EPFR Hedge Fund Flow Data

Enhance research, improve directional calls & mitigate risk with accurate, reliable Hedge Fund Flow data

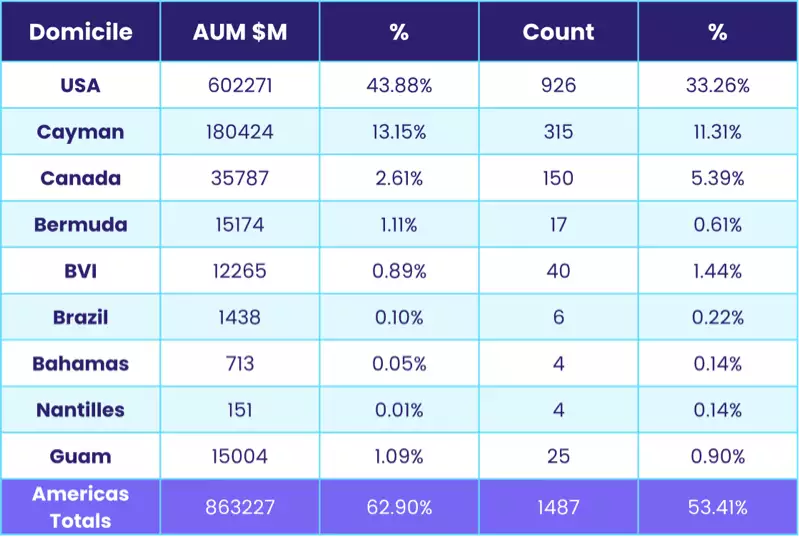

Hedge Fund Flows data from EPFR tracks nearly 2,800 individual hedge funds and Commodity Trading Advisors managing over $1.37 trillium in AuM at the fund level.

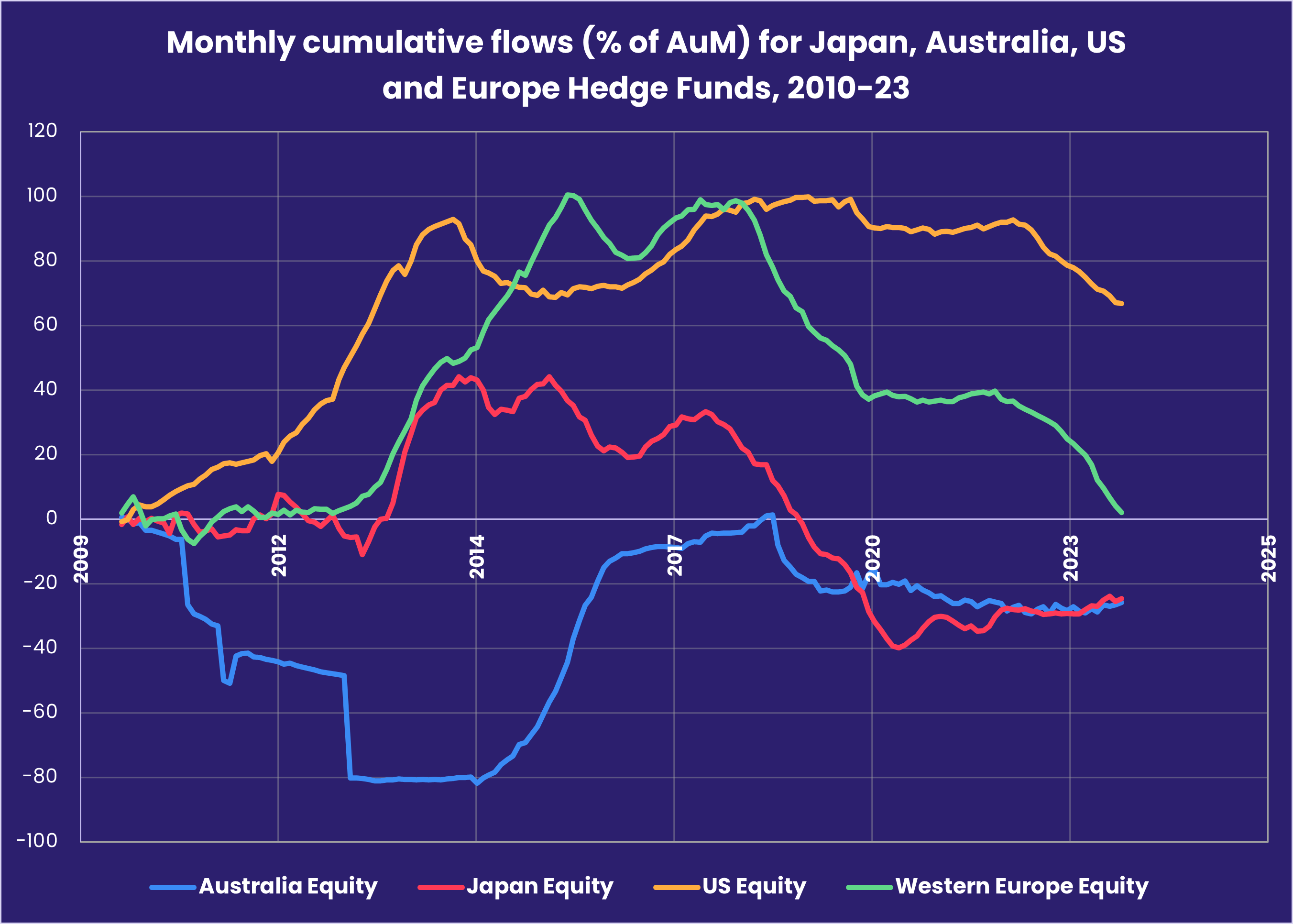

History goes back to 2010, allowing our clients to extract insights into a notoriously discrete investor type and unlock a more holistic view of global capital flows.

EPFR Hedge Fund Flows dataset

Data is available the month after the following, on the first weekday after the sixth NYSE working day.

With EPFR Hedge Fund Flows dataset, you can:

- Gain an exclusive insight on hedge funds, with data directly sourced from fund managers

- Develop trading ideas by monitoring how hedge funds impact markets

- Provide market insights by offering a distinct perspective on capital flows

- Generate Alpha and create new investment factors

Backstop Barclayhedge partnership

EPFR’s Hedge Fund Flows dataset applies our core competency in a combined database with our partner, Backstop Barclayhedge. With this partnership, EPFR is able to add hundreds of global hedge funds, including the biggest players, to our flows reports.

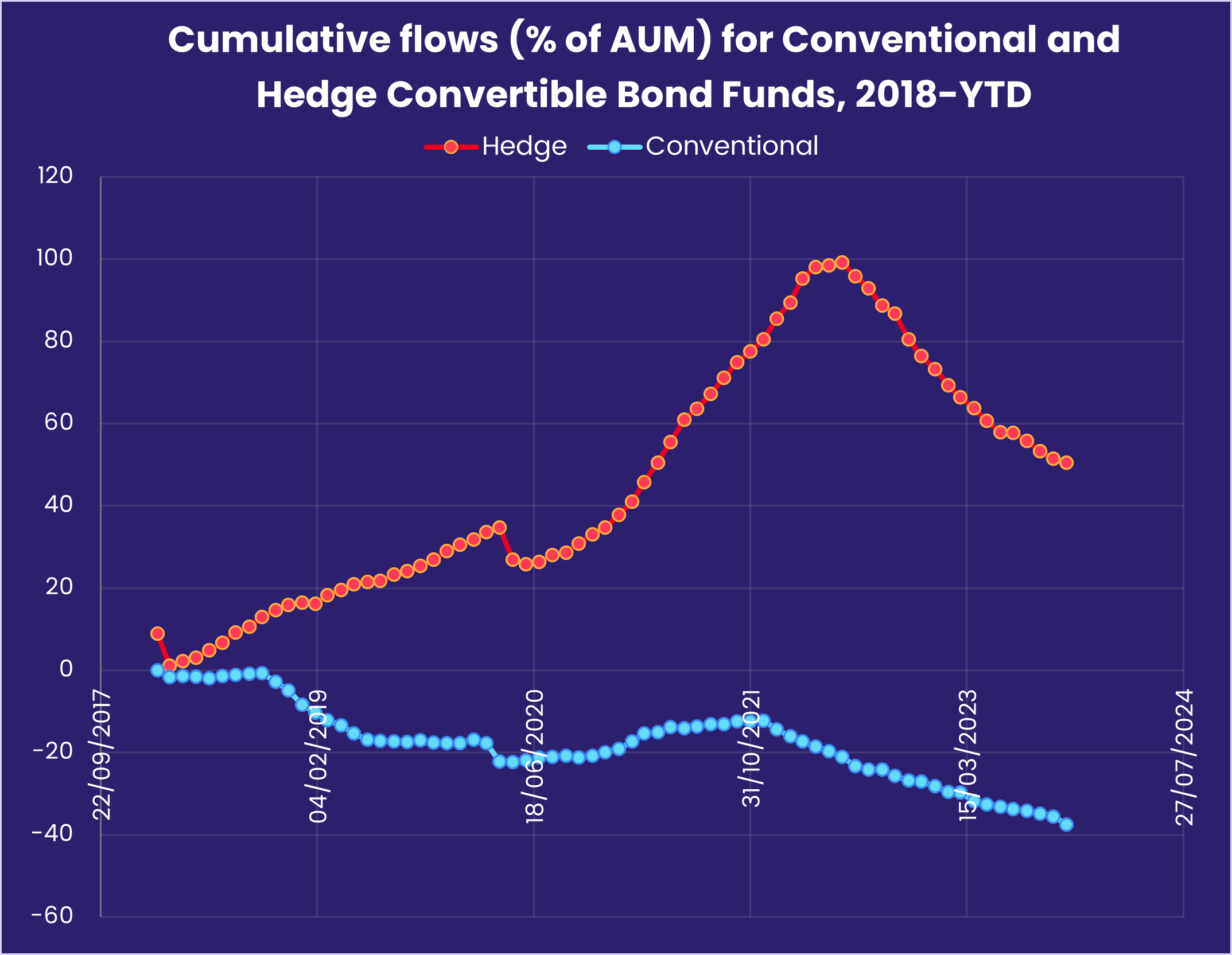

This dataset provides precise fund flow calculations at the fund level, offering a precise proxy of investor sentiment, hedge fund activity, and granularity to provide better insights.

When viewed alongside EPFR’s mutual fund and ETF data that tracks $52 trillion in global capital flows, Hedge Fund Flows offers investors a more complete view of market drivers supporting investment and risk management decisions.

Enhance Performance with Hedge Fund Investment Decisions

EPFR Hedge Fund Flows dataset in more detail:

- Tracks of 2,784 hedge funds and Commodity Trading Advisors at fund level

- Consistency (92% of funds repeat reporting each month)

- Historical data back to 2010

- Data sourced directly from fund managers

- Global domiciles

- Timeliness (monthly delivery published on first weekday after the sixth NYSE workday the following month)

- Data points include: flow$, flow%, AUM, change in NAV, FX, and change in FX

- Multiple filtering options, including: benchmark, domicile, strategy, geo focus, SRI, leverage, lockup, and more

- Delivery via FTP and email

Want to see it in action? Request your complimentary demo today: