Insights

Proprietary market data, research and analysis

Quant Insights

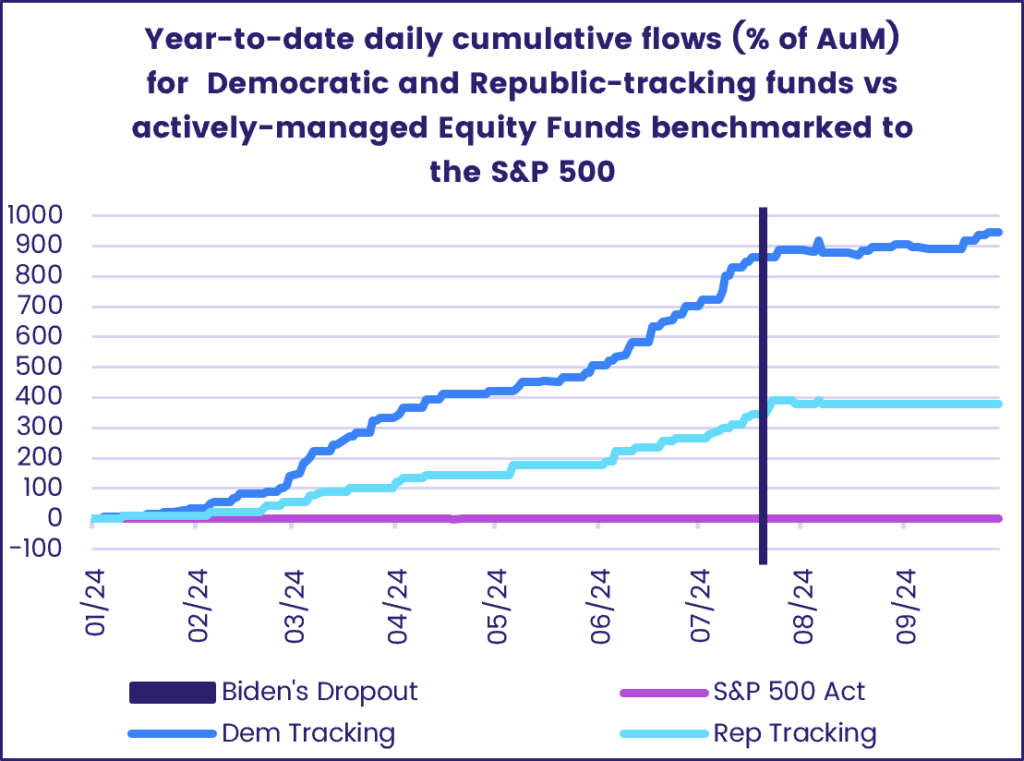

American politics: Where’s the information advantage?

The impending US Presidential election, which pits Democratic Vice President Kamala Harris against former Republican President Donald Trump, is...

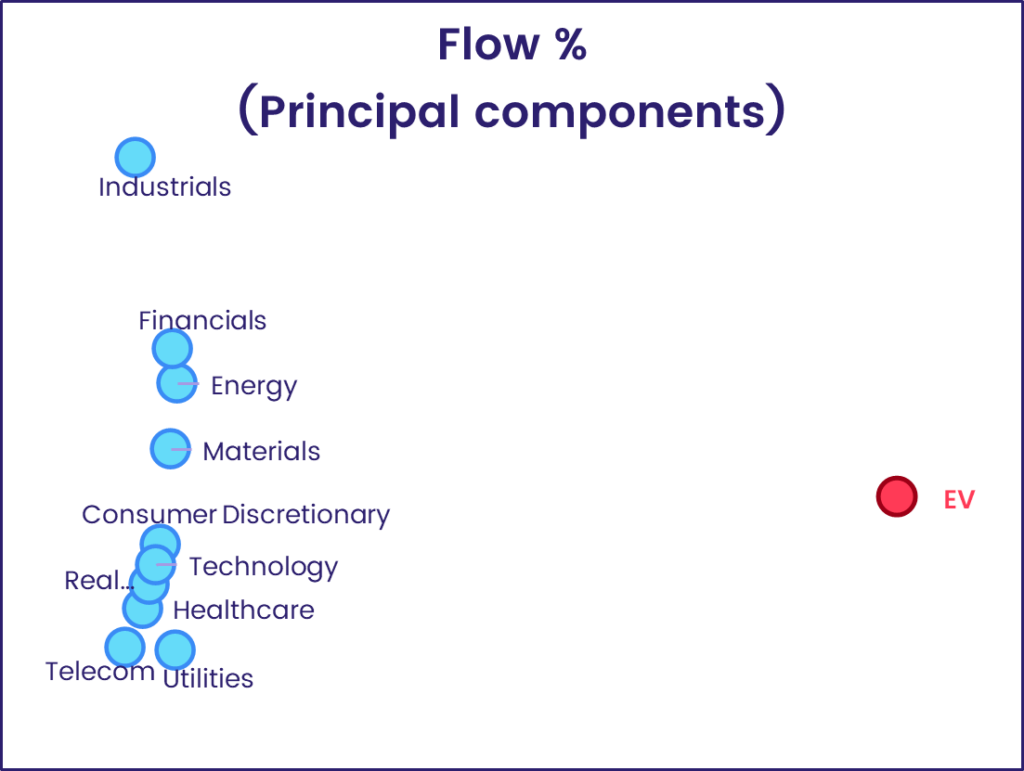

Electric Vehicles: Where to garage them?

We look at EV Funds within the universe of ETFs and mutual funds tracked by EPFR and their relationship to the Sector Fund groups they are most...

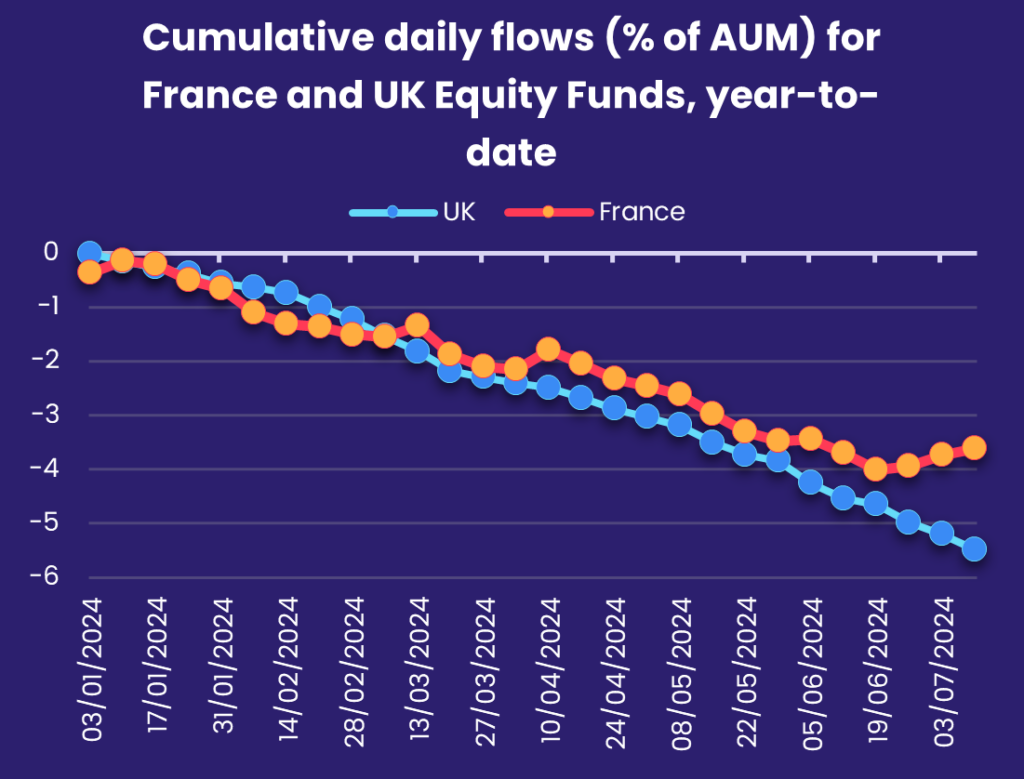

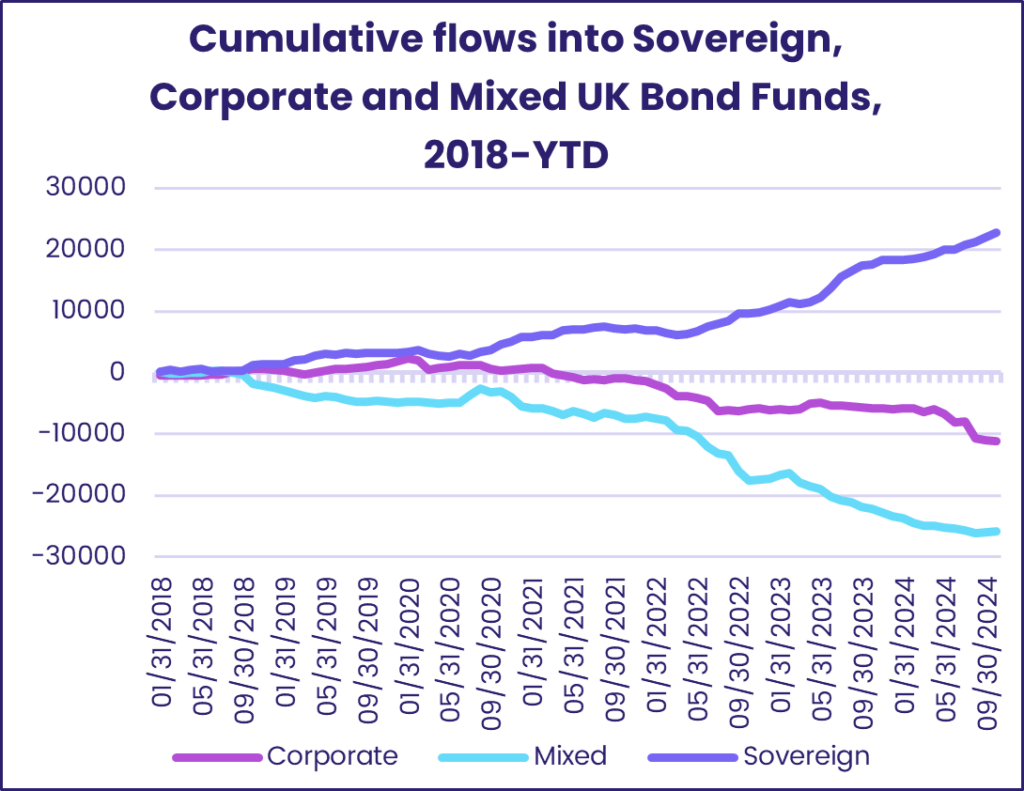

Another vote for divided government?

During the first week of July, the UK held, and France concluded, general elections that resulted in significant changes to both countries’...

Economist Insights

Flow pendulum swings to US stock funds

After a two-week influx of fresh money into China Equity Funds totaling $53 billion, the spotlight in mid-October shifted to US Equity Funds as a...

EM Equity Funds ride China rebound during record-setting week

The first week of October saw China’s benchmark stock index do a passable imitation of a roller coaster. It was a different story for flows into...

A rotation with Chinese characteristics

Investors anticipating that recent interest rate cuts in North America and Europe will drive a rotation from bonds to stocks, especially emerging...

Multimedia

Webinar: Central Banks in the Spotlight – The Fed and Bank of Japan Consider Momentous Policy Choices

As we head into September’s next round of central bank meetings, all eyes will be on the Federal Reserve and the Bank of Japan.

Market Insights: Searching for an anchor: Market sentiment towards China

The prospect of a slower-than-anticipated recovery for the Chinese economy puts investors at a crossroads. Following a market correction that...

Market Insights: Latest trends for ESG and Electric Vehicle Funds

This year, funds with SRI/ESG mandates are well off the pace seen in 2021 when the current full-year inflow record was set, despite taking in fresh...

Papers

EPFR Papers: Estimating asymmetric price impact

This paper studies the asymmetric price impacts mutual fund and ETF flows have on individual stocks in demand-based asset pricing.

A rising tide lifts some (Japanese) boats: The Bank of Japan’s ETF purchases and their impact on market signals for individual stocks

The Bank of Japan has been the pace-setter among central banks when it comes to purchasing non-government financial securities. It was the first...

Oil bonds still have fuel in the tank – but how long will it last?

Fixed income markets are abuzz about the spectacular demand for new green bonds. Flows into fixed income funds with socially responsible investing...