About EPFR’s Fund Flows and Allocations Data and Insights

Unparalleled understanding of how money is moving and why

Our best-in-class Fund Flows and Allocations Data helps you reveal the investible truth by looking at market trends, investor sentiment, liquidity, risk signals and corporate actions, and can be tailored to your specific use case.

$55T+

93%

151K+

$7T+

25+

Primary benefits

Industry-leading timeliness and granularity

Supports both bottom-up and top-down asset allocation strategies

Illustrated analysis of key factors driving current flow trends

Critical insights at macro and stock levels

Unique views on fund manager and investor sentiment

Insight into the fixed Income fund market at a bond ownership and security level

Connecting the dots with EPFR’s Fund Flows

Dating back to 1995, our fund flow data provides as-reported coverage of the net flows into and out of a universe of over 151,000 share classes and more than $55 trillion in assets tracked (AUM), helping our clients reveal the investible truth from:

- Equity Fund Flows

- Bond Fund Flows

- All other major asset classes, including: Money Market Flows, Alternative Fund Flows, and Multi-Asset Flows

Trusted by:

%

of the Bulge Bracket (the world’s largest investment banks)

%

of the “top 20” global asset management firms (by AUM)

%

of the Bulge Bracket (the world’s largest central banks)

%

of the “top 20” global asset mgmt firms (by AUM)

Latest Insights

Thought leadership and analysis that help you find a signal in the noise

‘Safe haven’ flows bypassing US Bond Funds in mid-April

Given the choice between two historic ports in economic storms, gold or US bonds, investors have overwhelmingly opted for the former during the first two weeks of the second quarter as the new US administration’s ad hoc, tariff-driven policymaking continues to roil global asset markets.

EPFR unveils its enhanced API: Unlocking 25+ Years of Fund, Country and Industry Flow & Allocation data

London, 16 April, 2025 – EPFR, the global leader in fund, country and industry flows and asset allocation intelligence, is transforming data access for investment professionals with the release of its enhanced REST API that supports Python, R, JavaScript and PHP, offering deep insight into institutional and retail investor flows and fund manager allocations covering over $60+ trillion in assets.

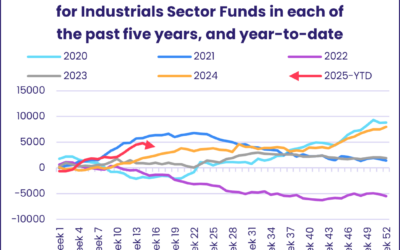

“Liberation Day” and after: A remarkable period of volatility for global fund flows

The Trump administration’s tariff announcements in the first week of April triggered the worst turmoil in global markets since the pandemic.

‘Safe haven’ flows bypassing US Bond Funds in mid-April

Given the choice between two historic ports in economic storms, gold or US bonds, investors have overwhelmingly opted for the former during the first two weeks of the second quarter as the new US administration’s ad hoc, tariff-driven policymaking continues to roil global asset markets.

EPFR unveils its enhanced API: Unlocking 25+ Years of Fund, Country and Industry Flow & Allocation data

London, 16 April, 2025 – EPFR, the global leader in fund, country and industry flows and asset allocation intelligence, is transforming data access for investment professionals with the release of its enhanced REST API that supports Python, R, JavaScript and PHP, offering deep insight into institutional and retail investor flows and fund manager allocations covering over $60+ trillion in assets.

“Liberation Day” and after: A remarkable period of volatility for global fund flows

The Trump administration’s tariff announcements in the first week of April triggered the worst turmoil in global markets since the pandemic.

China dodges the tariff bullet, catches the inflows

A week that was turbulent even by the standards of US President Donald Trump’s time in office saw funds dedicated to the primary target of his tariff strategy, China, enjoy a banner week. Between them, EPFR-tracked China Equity, Money Market and Bond Funds absorbed a net $28 billion.