Latest Insights

Thought leadership to easily identify trends and make confident decisions

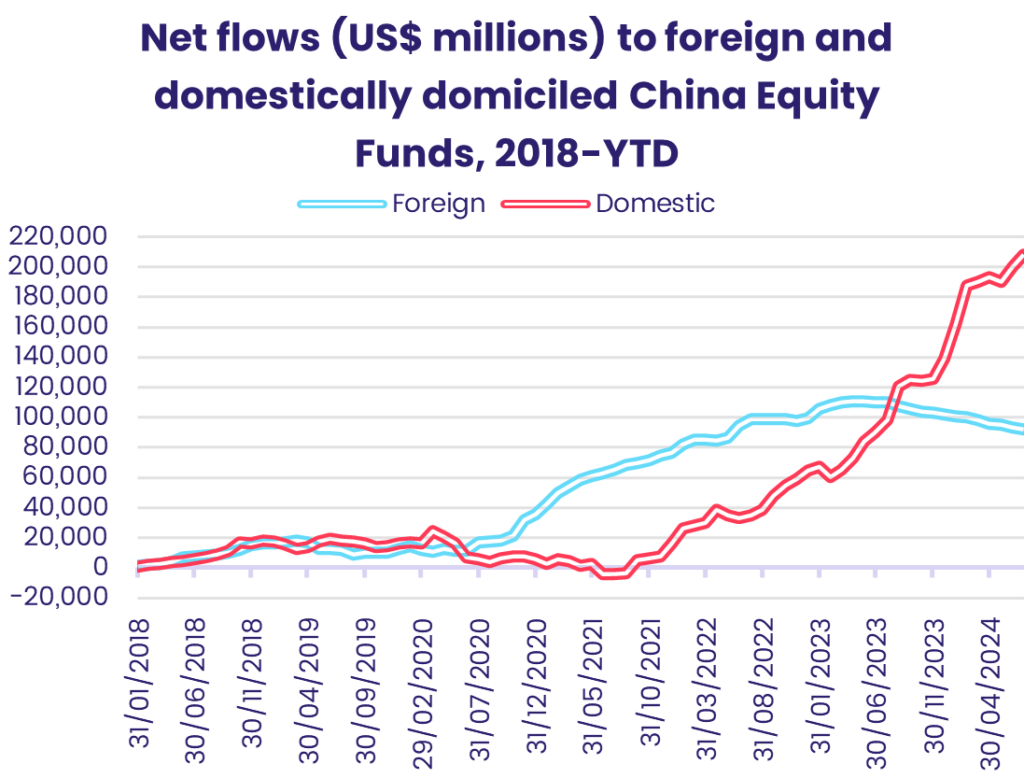

Market Insights: Searching for an anchor: Market sentiment towards China

Among the shifts evident in EPFR’s data coming into the third quarter was a recovery in sentiment towards, and flows into, China-mandated...

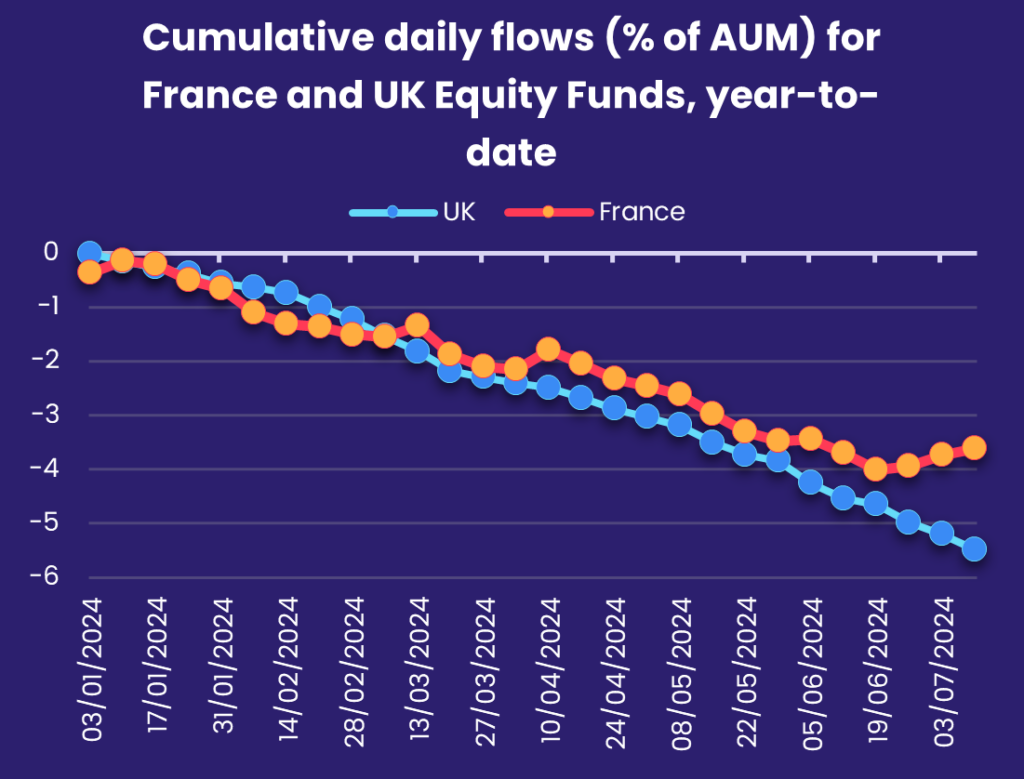

Another vote for divided government?

During the first week of July, the UK held, and France concluded, general elections that resulted in significant changes to both countries’...

Fund flows prove resilient as noise levels rise

During WWII, civilians were constantly reminded that “loose lips sink ships.” In early 3Q24, it appeared that loose lips can also sink chips as...