$46T+

93%

150K+

$7T+

25+

Latest Insights

Thought leadership and analysis that help you find a signal in the noise

Sell in May and go away until 2025?

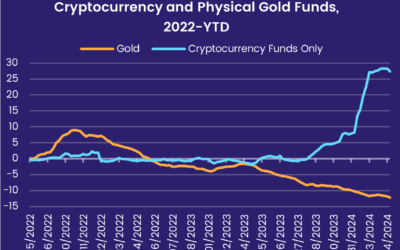

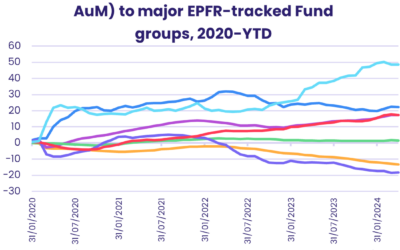

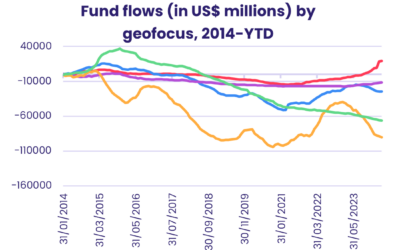

The final week of April ended with US markets closing the books on their worst month since September, the price of Bitcoin down some 17% from its mid-March high, Russia on the offensive in Ukraine and US interest rate cuts nowhere in sight. Against this backdrop, flows to most EPFR-tracked fund groups remained subdued for the second week running.

EPFR in the news – April 2024

Here is the March 2024 summary of where EPFR’s Fund Flows and Allocations data is cited in leading media outlets globally.

Hoped-for US rate cuts morph into fear of another hike

Investors took a cautious approach to most asset classes during the third week of April, with lackluster inflows or modest outflows being the norm for many EPFR-tracked fund groups. Japan Equity and Mortgage-Backed Bond Funds were notable exceptions.

Sell in May and go away until 2025?

The final week of April ended with US markets closing the books on their worst month since September, the price of Bitcoin down some 17% from its mid-March high, Russia on the offensive in Ukraine and US interest rate cuts nowhere in sight. Against this backdrop, flows to most EPFR-tracked fund groups remained subdued for the second week running.

EPFR in the news – April 2024

Here is the March 2024 summary of where EPFR’s Fund Flows and Allocations data is cited in leading media outlets globally.

Hoped-for US rate cuts morph into fear of another hike

Investors took a cautious approach to most asset classes during the third week of April, with lackluster inflows or modest outflows being the norm for many EPFR-tracked fund groups. Japan Equity and Mortgage-Backed Bond Funds were notable exceptions.

The cruelest month shows its colors

April is known for its showers, warming trends and sudden changes in climate. This April, it has been missiles and attack drones that made up the showers, prices that have stayed warm and the investment climate that has shifted abruptly.