Insights

Proprietary market data, research and analysis

Quant Insights

Playing with dynamite

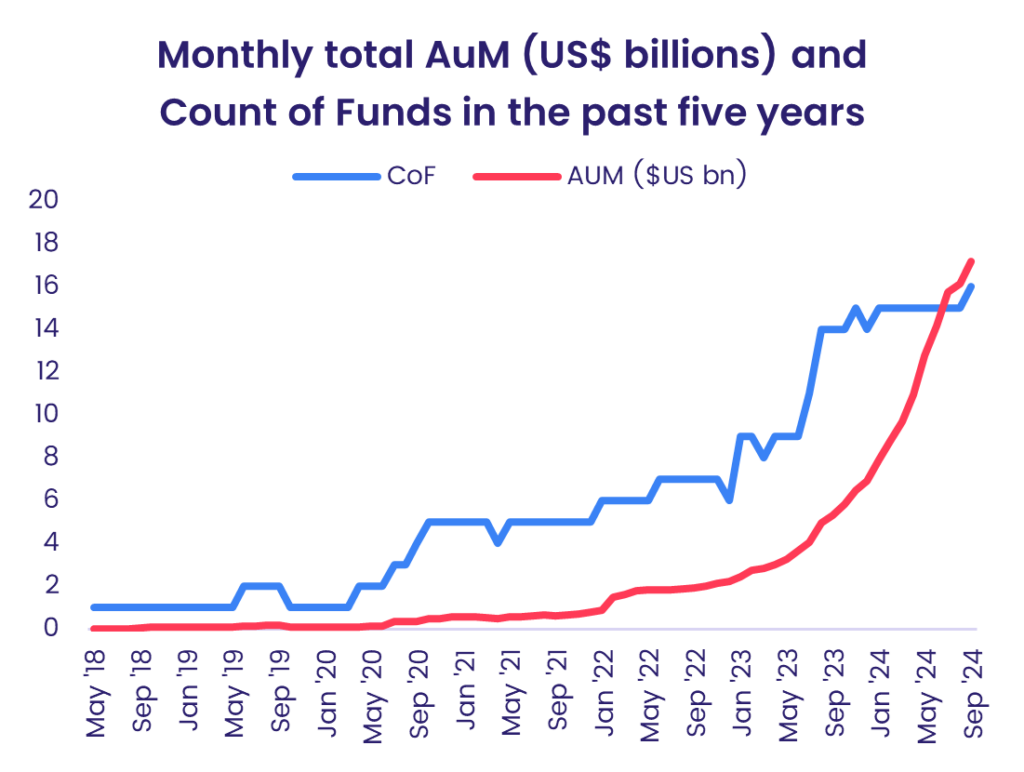

In this Quant’s Corner, we will look at the growing number of single-security Leveraged Funds in EPFR’s database and explore ways to generate...

CLOs emerging from the CDO shadow

Modern CLOs and CDOs are regarded as much safer than their pre-crisis versions. But where, in the spectrum of major fixed income asset classes do...

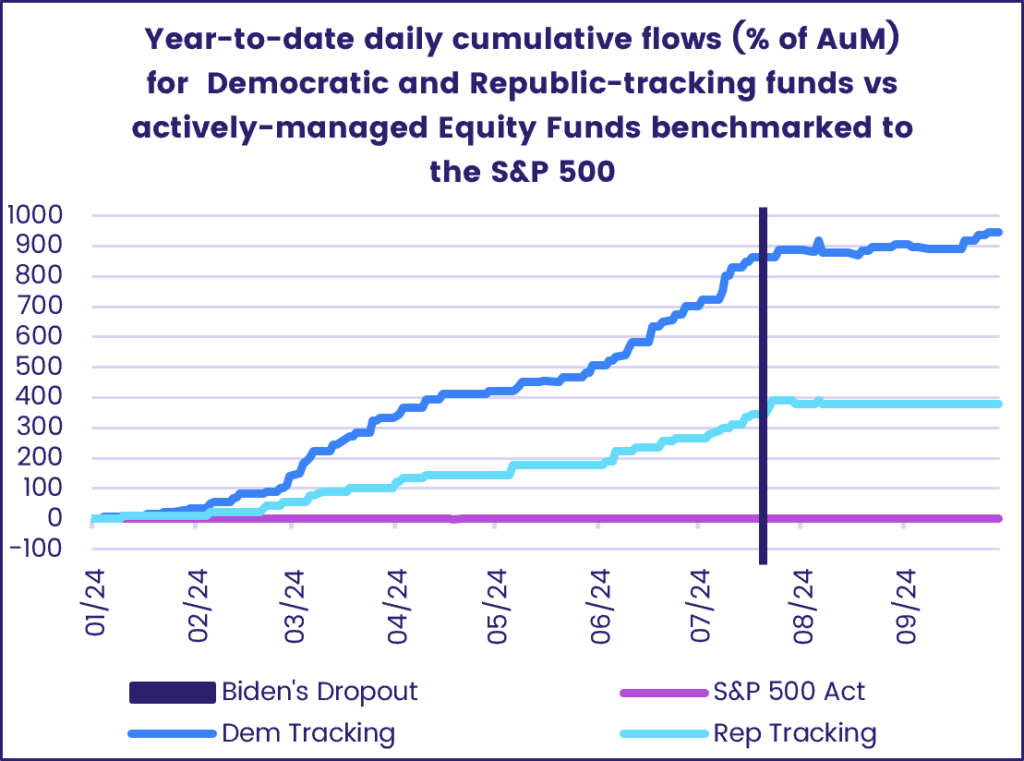

American politics: Where’s the information advantage?

The impending US Presidential election, which pits Democratic Vice President Kamala Harris against former Republican President Donald Trump, is...

Economist Insights

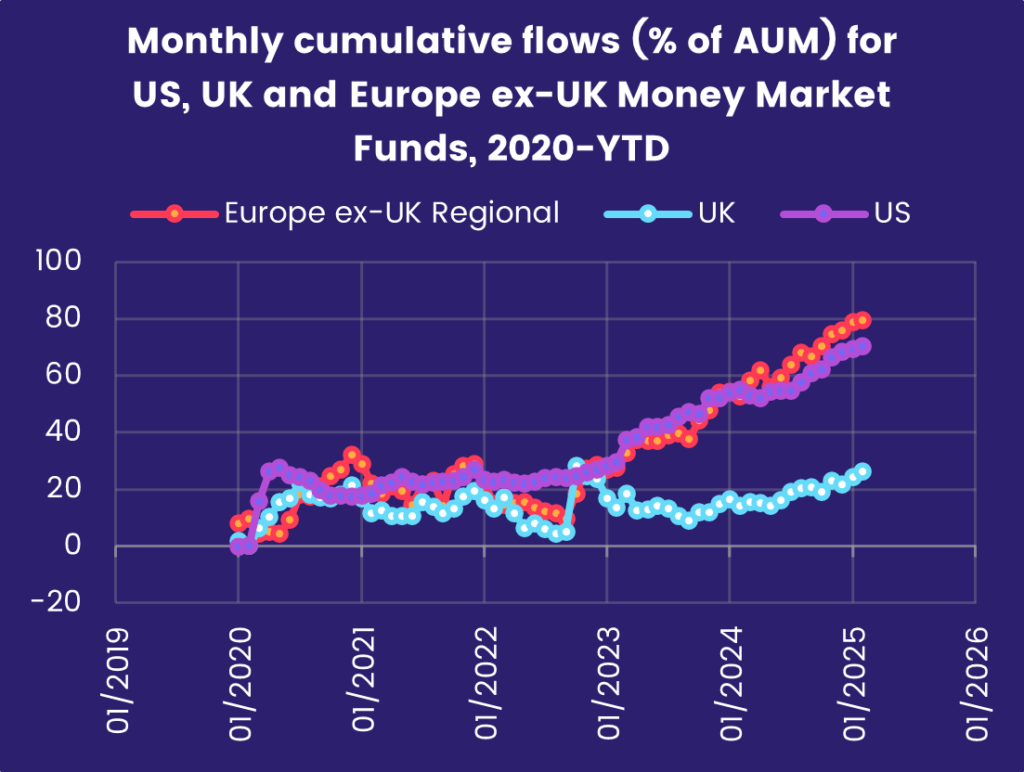

Back to the future for fund flows in 1Q25

Five weeks into President Donald Trump’s first term, flows to EPFR-tracked Europe Equity Funds were coming out of a long slump, investors were...

Making the case for Europe is getting easier

Funds dedicated to the old world and conventional asset classes enjoyed a rare moment in the sun during the second week of February, which ended...

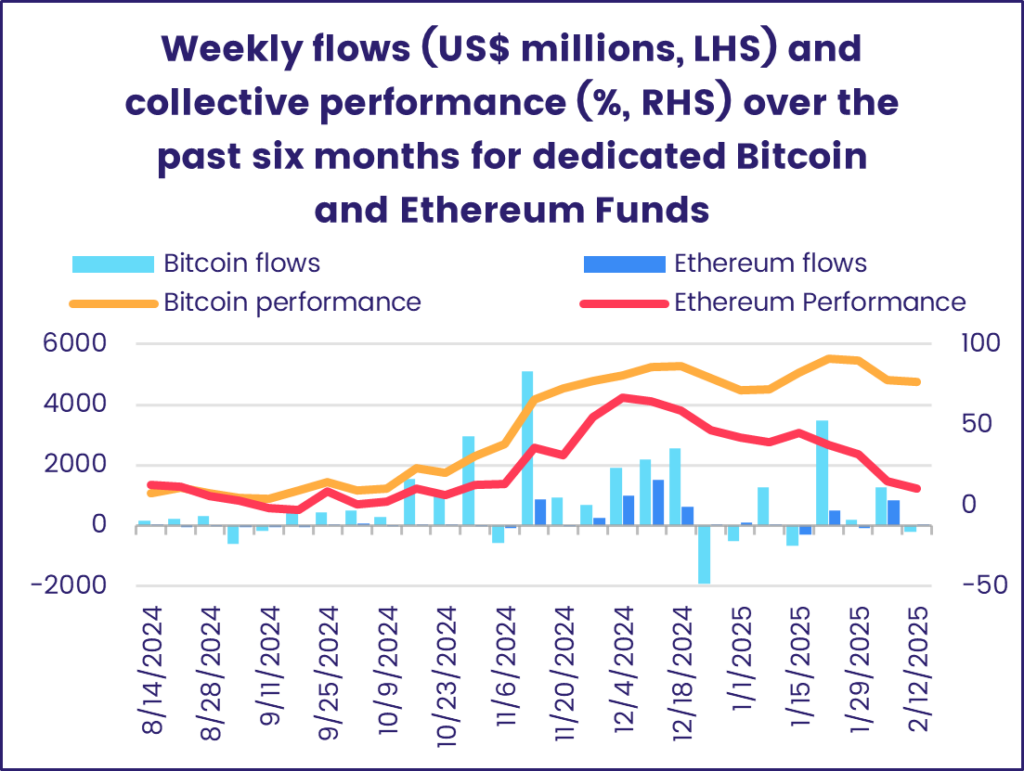

Rotating from new to old in mid-February

Funds dedicated to the old world and conventional asset classes enjoyed a rare moment in the sun during the second week of February, which ended...

Multimedia

From Macro to Micro: 2025 Global Markets Outlook Post-US Election – Chart Pack & Webinar

As we head into September’s next round of central bank meetings, all eyes will be on the Federal Reserve and the Bank of Japan.

Webinar: Central Banks in the Spotlight – The Fed and Bank of Japan Consider Momentous Policy Choices

As we head into September’s next round of central bank meetings, all eyes will be on the Federal Reserve and the Bank of Japan.

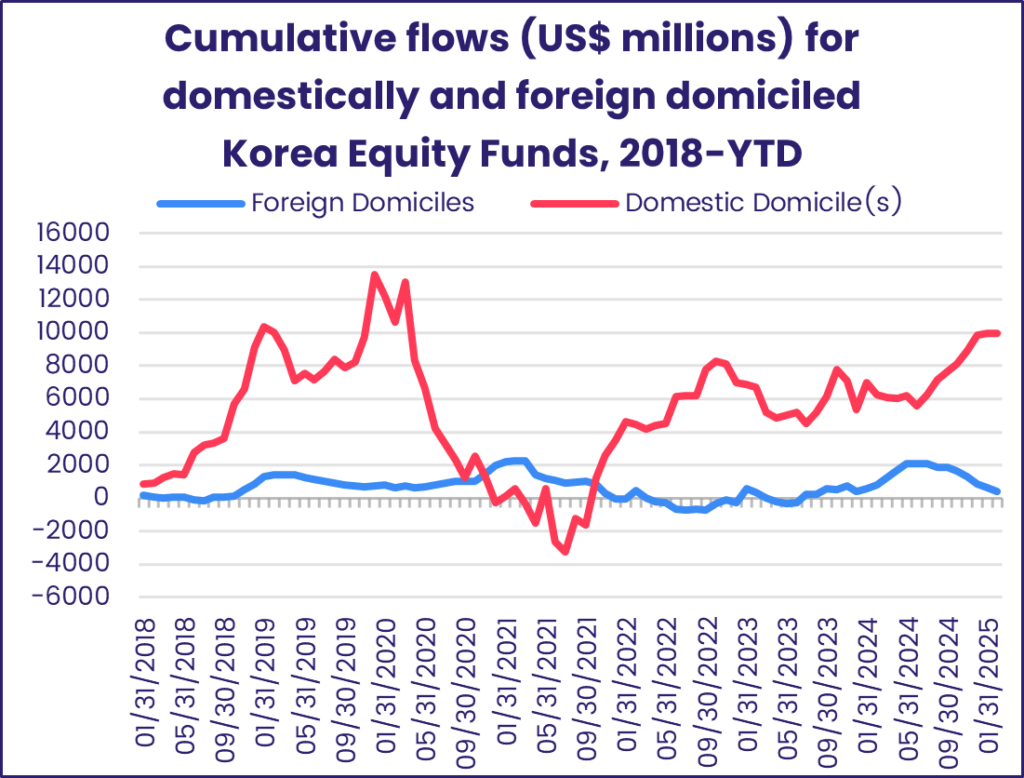

Market Insights: Searching for an anchor: Market sentiment towards China

The prospect of a slower-than-anticipated recovery for the Chinese economy puts investors at a crossroads. Following a market correction that...

Papers

EPFR Papers: Estimating asymmetric price impact

This paper studies the asymmetric price impacts mutual fund and ETF flows have on individual stocks in demand-based asset pricing.

A rising tide lifts some (Japanese) boats: The Bank of Japan’s ETF purchases and their impact on market signals for individual stocks

The Bank of Japan has been the pace-setter among central banks when it comes to purchasing non-government financial securities. It was the first...

Oil bonds still have fuel in the tank – but how long will it last?

Fixed income markets are abuzz about the spectacular demand for new green bonds. Flows into fixed income funds with socially responsible investing...