After a quarter when both the US Federal Reserve and European Central Bank reversed course on the normalization of their monetary policies, the focus during the first week of October shifted from central bankers to the Sino-Chinese trade war, the latest corporate earnings season, and impending elections in Spain, Canada, and Argentina.

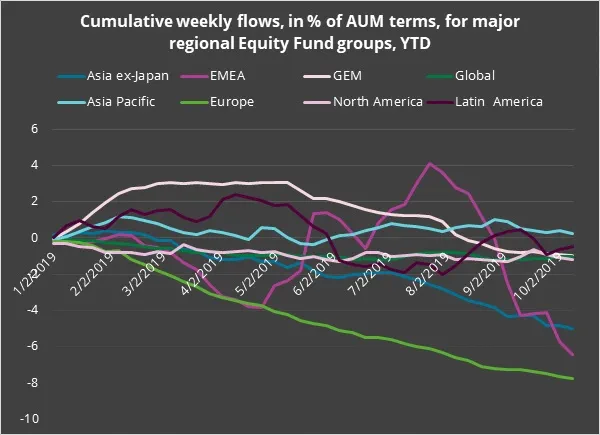

This shift in focus did not, for the most part, breed investor optimism. On the fixed income side flows remained heavily biased towards Bond Funds with investment grade mandates during the week ending Oct. 9. Among Equity Fund groups, both China and US Equity Funds posted outflows in the run-up to the latest round of trade talks between the new nations, and redemptions from Spain Equity and Bond Funds climbed to eight and 13-week high as the country prepares for its fourth general election in as many years and Alternative Funds posted their biggest collective outflow since the first week of August.

Did you find this useful? Get our EPFR Insights delivered to your inbox.