Going into the second half of March, Russia’s invasion of the Ukraine – now in its fourth week – and the run-up to the US Federal Reserve’s first post-Covid interest rate hike continued to roil global markets. But the pandemic, pushed down the list of concerns as the Omicron variant’s grip on key markets ebbed, reinserted itself in the debate over supply chains and inflation by triggering major lockdowns in China.

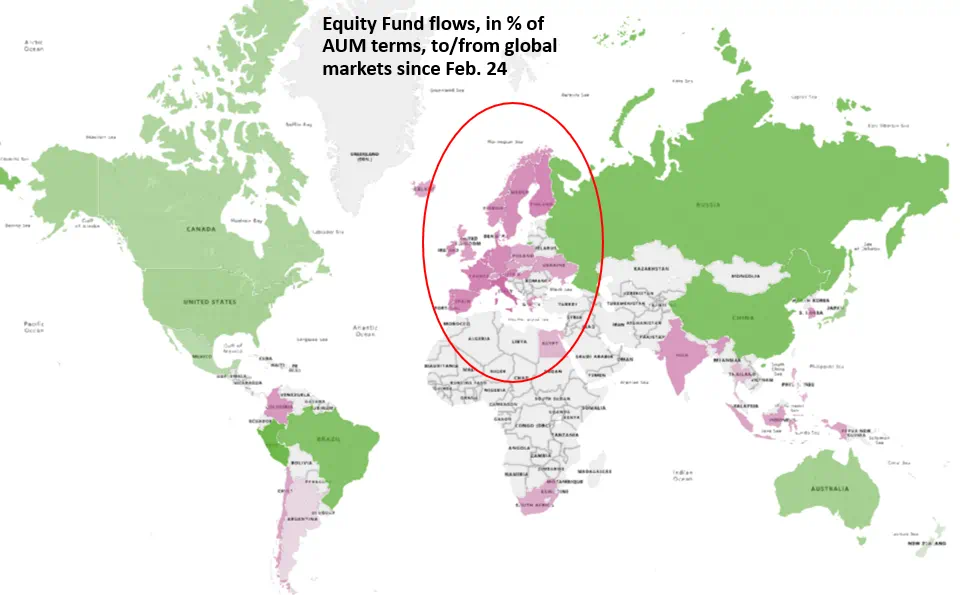

Fund flows during the week ending March 16 responded, sometimes with wild swings, to these narratives. In the case of China, and the steps it has taken in defense of its zero-Covid policy, investors responded by snapping China Equity Funds 13-week inflow streak and extending the longest run of outflows for China Bond Funds since 4Q17. The conflict in the Ukraine, meanwhile, continues to be viewed as a largely European problem although funds dedicated to some emerging markets resource plays such as Brazil and Saudi Arabia are attracting bigger inflows.

The Fed’s much anticipated 0.25% rate hike added to the headwinds facing most Bond Fund groups. But flows for US Equity Funds jumped sharply after the conclusion of a policy meeting that did not, as some feared, deliver a 50 basis point hike.

Overall, the second week of March saw EPFR-tracked Equity Funds post a collective inflow of $25.4 billion while Bond Funds surrendered a net $14.8 billion and Money Market Funds $35.9 billion. Investors also pulled over $900 million from Balanced Funds but extended the current inflow streak for Alternative Funds to nine weeks and $18 billion.

At the single country and asset class fund levels, Convertible and Mortgage-Backed Bond Funds both posted their 17th straight outflow, Municipal Bond Funds extended their longest redemption streak since 1Q20 and outflows from Cryptocurrency Funds jumped to a nine-week high. Redemptions from Spain and Belgium Equity Funds hit 18 and 34-week highs respectively, flows into Denmark Bond Funds set a new weekly record and Hong Kong Equity Funds took in over $100 million for the fourth straight week.

Did you find this useful? Get our EPFR Insights delivered to your inbox.