Flows to and from EPFR-tracked fund groups during the final week of March continued to paint a picture of risk aversion and fear among investors. For the third week running liquidity funds recorded above average inflows while High Yield, Bank Loan, Emerging Markets Bond and Alternative Funds extended their current outflow streaks.

Those investors have much to fear, from still high inflation and a major European conflict now in its 14th month to the latest strain on Sino-US relations – Taiwan President Tsai Ing-wen’s visit to the US – and the aftershocks from recent US and European bank failures. But hope that bad economic news will translate into forbearance by interest rate setters remains resilient, with US markets on the rise heading into the second quarter and investors steering money into interest-rate sensitive Sector Fund groups and diversified Emerging Markets Equity Funds in anticipation of an early pivot by the US Federal Reserve.

Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did see their three-week run of outflows come to an end, and SRI/ESG Bond Funds also posted inflows.

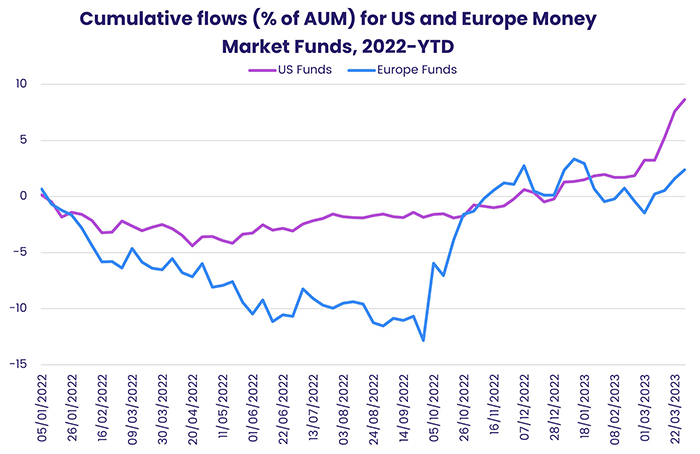

Overall, the week ending March 29 saw all EPFR-tracked Bond Funds absorb a net $2.4 billion. Investors pulled $5.1 billion out of Equity Funds, with Alternative Funds surrendering $1.2 billion and Balanced Funds $2.3 billion. Money Market Funds took in $60 billion, US MM Funds extended their current three-week, $311 billion inflow streak and Europe MM Funds took in fresh money for the fourth week running.

At the asset class and single country fund level, Convertible Bond Funds posted their 15th outflow in the past 16 weeks, Mortgage-Backed Bond Funds experienced net redemptions for the first time since late January and Municipal Bond Funds snapped a five-week run of outflows. Korea Bond Funds recorded their 12th inflow year-to-date, China Bond Funds recorded their first inflow of 2023 and investors steered money into Switzerland Equity Funds for the third time month-to-date.

Emerging markets equity funds

EPFR-tracked Emerging Markets Equity Funds closed out the first quarter with their 11th inflow year-to-date. They did so without the usual boost from China Equity Funds, which recorded their first outflow since the third week of February. Investors opted instead for the diversified exposure offered by Global Emerging Markets (GEM) Equity Funds. Retail share classes saw money flow out for the third straight week, actively managed funds took in more money than EM Equity ETFs for the fifth time year-to-date and EM Dividend Funds chalked up their 16th consecutive inflow.

While flows into GEM Equity Funds climbed to a six-week high, Asia ex-Japan Equity Funds posted their first outflow since mid-February and Latin America Equity Funds their fourth in a row.

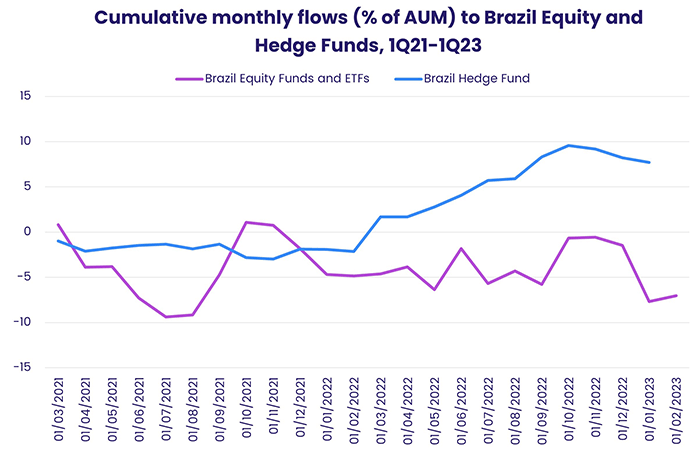

The latest outflows from Latin America Equity Funds were broadly distributed, with Colombia Equity Funds the only group to post a modest inflow. Chile Equity Funds recorded their biggest outflow since the first week of the year, money flowed out of Brazil Equity Funds for the third time in the past four weeks and Mexico Equity Funds extended their longest run of outflows since late 3Q22.

The latest Hedge Fund Flows data indicated that investors utilizing those vehicles have been more bullish about Brazil’s prospects over the past year than those channeling their investments through mutual funds and ETFs.

China Equity Funds posted a modest outflow during a week when Sino-US tensions were on display in several areas and investors questioned the willingness of Chinese consumers to spend when youth unemployment stands at 18% and the overall population is aging and shrinking.

The small collective inflow recorded by EMEA Equity Funds was again underpinned by flows into Turkey Equity Funds. While official efforts to support the country’s equity markets remain the key driver of those flows, some investors are positioning themselves for the outcome of May’s general election. Current polls suggest that current President Recep Tayyip Erdogan, who has overseen a dramatic drop in living standards and purchasing power thanks to his administration’s unorthodox economic policymaking, could be voted out of office.

Developed markets equity funds

Although benchmark US equity indexes regained some momentum going into the final days of March, US Equity Funds posted their seventh outflow in the past eight weeks. That, and redemptions from Europe and Pacific Regional Equity Funds, was enough to offset modest flows into Japan and Global Equity Funds. That left all EPFR-tracked Developed Markets Equity Funds contemplating their fifth collective outflow since mid-February.

The latest outflows from US Equity Funds hit Large Cap Funds the hardest in dollar terms and Small Cap Funds in % of AUM terms. US Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates were hit with redemptions for the sixth week running. That is their longest outflow streak since 1Q18.

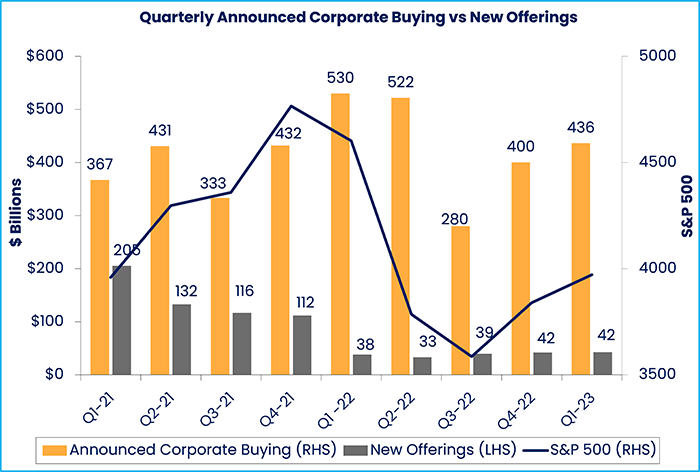

US companies continue to aggressively shrink their free float. “Announced corporate buying (new cash takeovers + new stock buybacks) during the first quarter rose to its highest level since it hit $530 billion in 1Q22,” noted EPFR Analyst Winston Chua. “On the other side of the ledger, new offerings remained flat at $42 billion, falling below $50 billion for the fifth consecutive quarter. So far this year, corporate actions have yielded a buy-sell ratio of 10.3-to-1. That’s well above the ratio of 3.7-to-1 in 2019, the last full year before the pandemic began.”

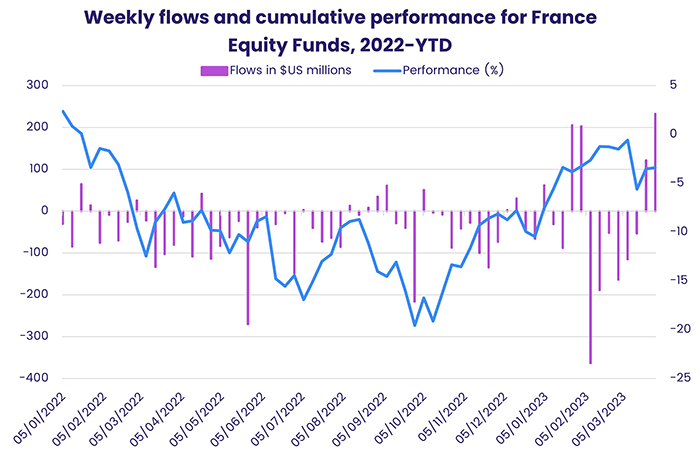

Europe Equity Funds chalked up their fifth outflow in the past six weeks as investors fretted over the region’s sticky inflation and hawkish sounding central banks. But, at the country level, France’s reform story and the reopening of a key export market – China – saw flows into dedicated France Equity Funds hit a level last seen in late 1Q20.

It was a rough week for Pacific Regional Funds, which recorded their biggest outflow in just over a year, but Japan Equity Funds posted consecutive weekly inflows for the first time since mid-January. Appetite for Japan Dividend Equity Funds remains strong, with that group extending its longest inflow streak since late 3Q22. The latest sector allocations data shows that managers of Japan Equity Funds kept their exposure to financial and industrial plays close to the 41 and 52-month highs, respectively, they touched earlier in the quarter.

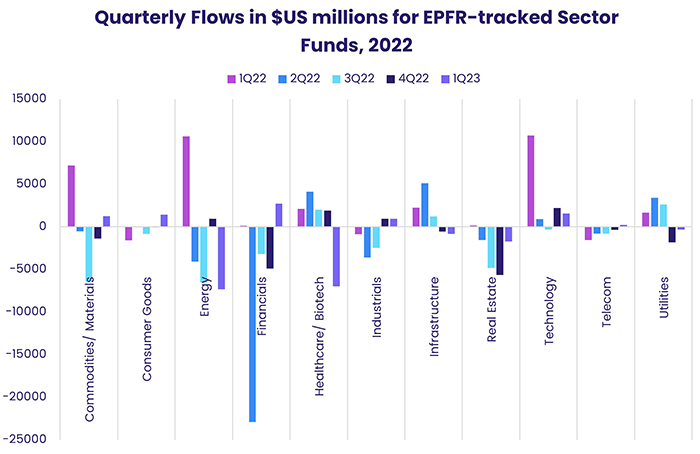

Global sector, industry and precious metals funds

A relatively calm week on the banking front allowed sector-oriented investors to look ahead during the final days of March. For some, that involved positioning for the next quarterly earnings season. For others, it involved positioning for weaker US growth and a pivot on interest rates by the US Federal Reserve in the second half of the year. Six of the 11 major EPFR-tracked Sector Fund groups posted inflows during the week ending March 29 that ranged from $71 million for Utilities Sector Funds to $711 million for Consumer Goods Sector Funds.

Flows into Consumer Goods Sector Funds climbed to an 11-week high on the back of commitments to US and China-dedicated funds, which absorbed $385 million and $185 million, respectively. For US consumers, the pinch from higher interest rates is being buffered by a tight labor market and rising wages while Chinese consumers are sitting on ‘excess’ savings accumulated during the zero-Covid lockdowns that are believed to total at least $1 trillion.

The latest flows helped Consumer Goods Sector Funds post their biggest quarterly inflow since 4Q21.

Despite the recent collapse of three regional US banks, Financial Sector Funds look set to end the first quarter at the top of the flow rankings. The group did end the quarter with a whimper, posting their biggest outflow in over two months.

Real Estate Sector Funds have struggled in recent weeks to attract fresh money. But the latest inflow was the biggest in 27 weeks. Investors committed $333 million, snapping a two-week run of outflows. Japan Real Estate Sector Funds posted their third consecutive inflow and 28th in the past 29 weeks while US and Switzerland-dedicated funds’ inflows touched eight and nine-week highs.

Bond and other fixed income funds

With the latest round of interest rate hikes and, they hope, the worst of the latest banking crisis behind them, fixed income investors thawed a little during the fourth week of March. EPFR-tracked Bond Funds recorded their 11th inflow in the 13 weeks year-to-date.

This thaw did not extend to High Yield Bond Funds, which saw over $3 billion flow out for the third straight week, and it was not enough to snap the current outflow streaks for Emerging Markets Bond and Bank Loan Funds. But redemptions from EM Bond and Bank Loan Funds were half and a third, respectively, of the previous week’s totals.

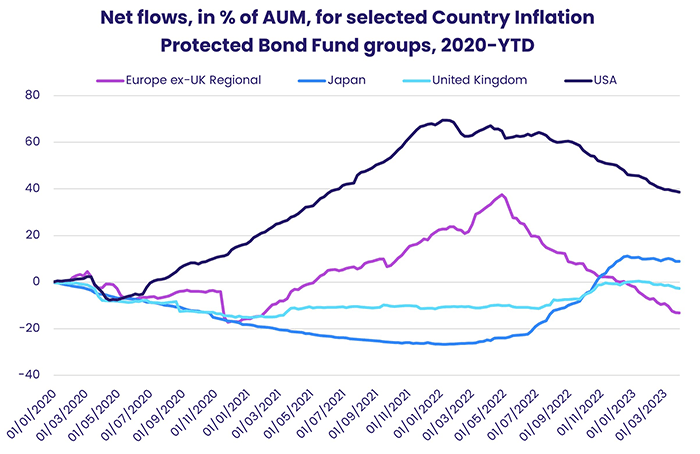

Elsewhere, Mortgage-Backed Bond Funds chalked up only their third outflow so far this year, Convertible Bond Funds posted up their 30th outflow in the past 34 weeks and Inflation Protected Bond Funds extended their longest outflow streak since a 37-week run ended in 2013.

Emerging Markets Bond Funds saw significant activity at the country level, especially among groups dedicated to Asian markets, as some $450 million left both Hard and Local Currency Funds. While Korea Bond Funds took in another $373 million and China Bond Funds posted their biggest inflow in over 13 months, redemptions from Thailand Bond Funds hit a 21-week high and Malaysia Bond Funds racked up their biggest outflow on record.

Among US Bond Fund groups, funds with sovereign mandates and/or intermediate-term durations were the most consistent money magnets. Long Term Sovereign Bond Funds ended the week with their biggest inflow since the second week of 3Q22. For the quarter as a whole, Short Term Sovereign and Intermediate Mixed Funds have seen the biggest inflows.

Europe Bond Funds eked out a modest inflow with muted flows to most country fund groups. Switzerland Bond Funds did pull in over $300 million and Italy Bond Funds extended their longest run of inflows this year while UK Bond Funds posted their fourth straight outflow.

Did you find this useful? Get our EPFR Insights delivered to your inbox.