With mud season keeping the conflict in Ukraine deadlocked and the next round of major central bank meetings still a fortnight away, investors turned their attention to taxes, corporate earnings and China’s economy during the third week of April.

EPFR-tracked China Equity Funds saw their three-week run of outflows come to an end as first-quarter GDP growth for the world’s second largest economy came in at 4.5% – the highest rate since 1Q22 – while US Money Market Funds posted their biggest outflow in 15 months during a week when millions of Americans scrambled to file, and pay, their 2022 taxes.

The week ending April 19 was a better one for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. Flows into all SRI/ESG Equity Funds hit their highest level since late July 2022 and EM SRI/ESG Equity Funds posted inflows for the 22nd straight week.

Overall, EPFR-tracked Equity Funds recorded a net outflow of $2.6 billion during the week ending April 19. Investors steered $1.2 billion into Alternative Funds and $4.5 billion into Bond Funds while $1.8 flowed out of Balanced Funds and $65 billion from Money Market Funds.

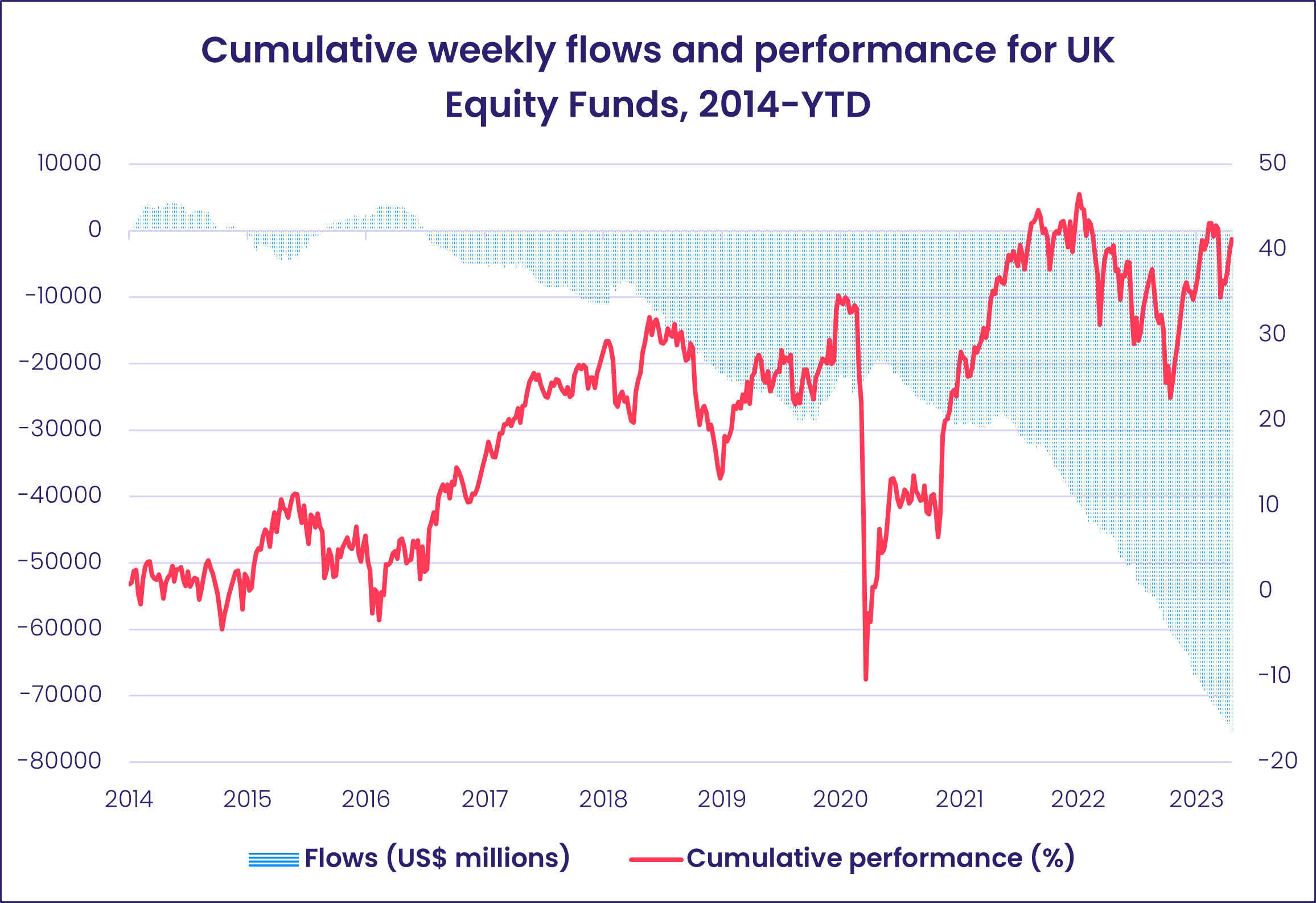

At the single country and asset class fund level, Italy Bond Funds posted their seventh inflow in the past eight weeks and Italy Equity Funds their 10th outflow in the past 14, redemptions from UK Equity Funds hit a 15-week high and China Bond Funds recorded their second inflow year-to-date and fourth since the beginning of 2Q22. Cryptocurrency Funds took in fresh money for the fifth straight week, Copper Funds posted their biggest outflow since late 2Q22 and High Yield Bond Funds chalked up their second biggest inflow YTD.

Emerging markets equity funds

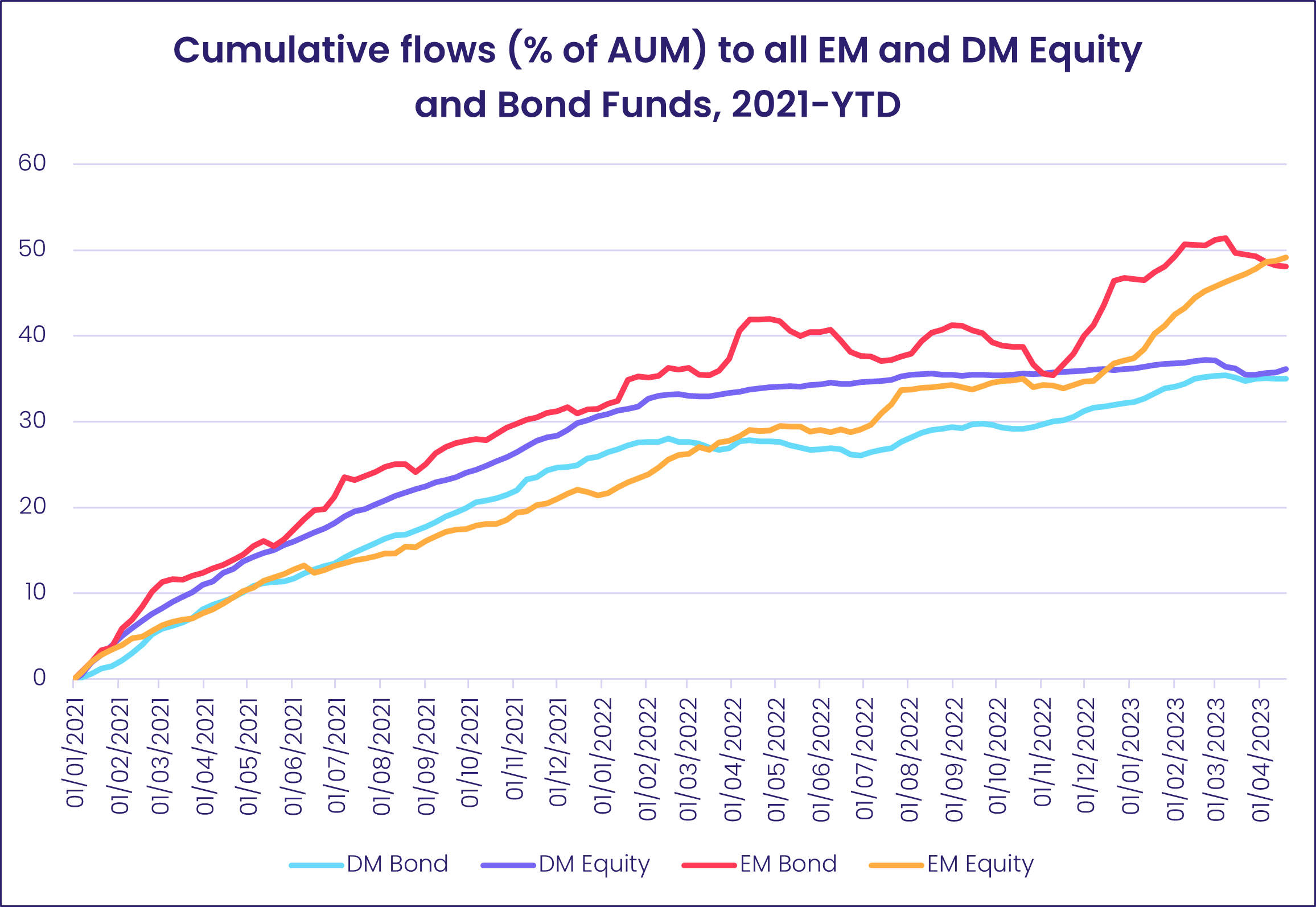

Renewed enthusiasm for China’s economic rebound story during the third week of April helped EPFR-tracked Emerging Markets Equity Funds record their 12th inflow of 2023 as three of the four major regional groups posted inflows ranging from $6 million to $1.79 billion.

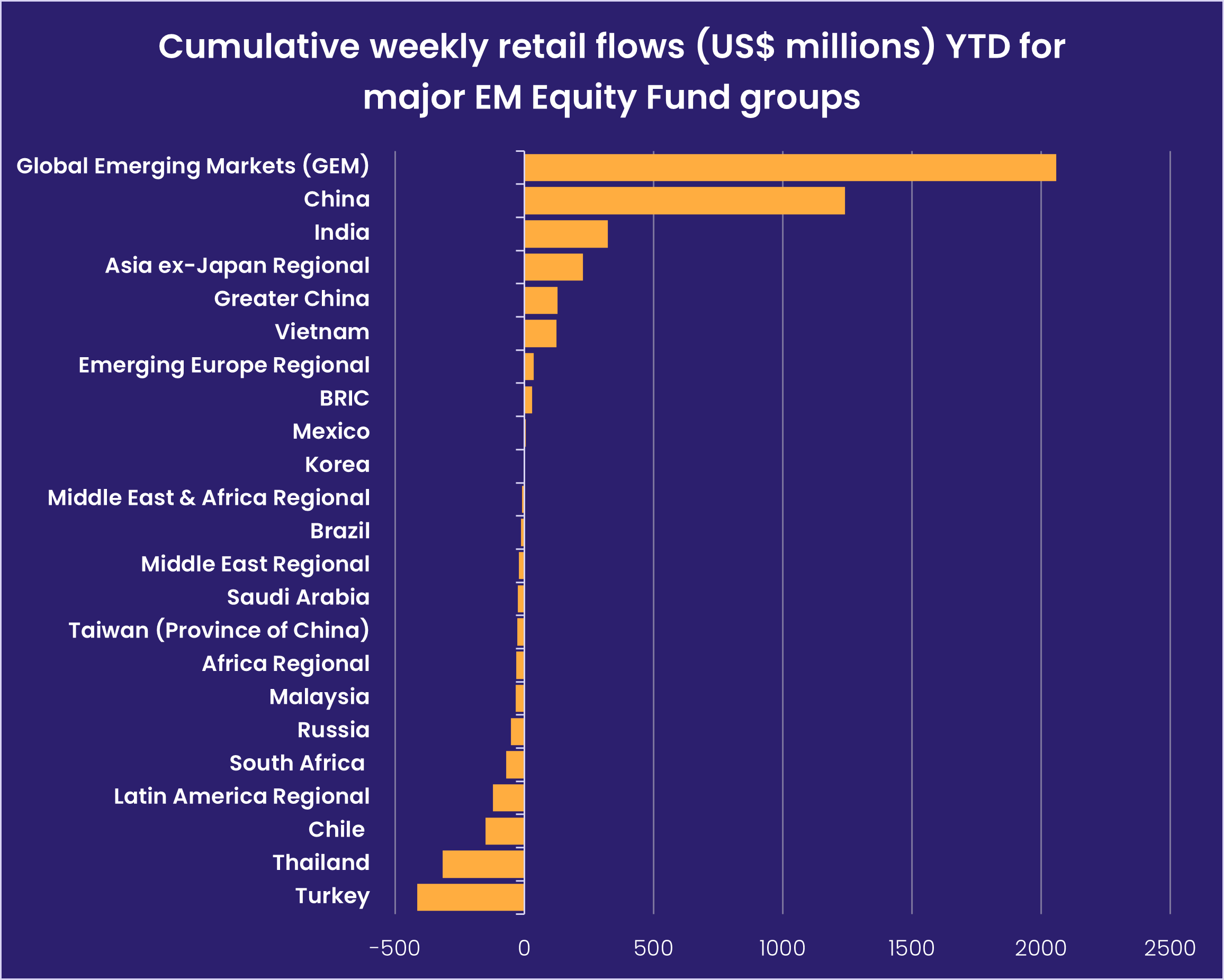

The latest data from China showed the economy growing 4.5% year-on-year in the first quarter on the back of pent-up demand from Chinese consumers. China Equity Funds pulled in over $2 billion for the fifth time so far this year, with flows into funds domiciled outside China hitting their highest level since the first week of February. Retail flows, meanwhile, climbed to a six-week high. Among the major EM groups, China Equity Funds have been the second most popular with retail investors YTD after the diversified Global Emerging Markets (GEM) Equity Funds.

While Chinese GDP growth is accelerating, it is India’s population growth that was in focus during the latest week as the UN predicted India’s population will surpass China’s by mid-year. India Equity Funds posted their fifth straight inflow, with the latest the biggest in nearly three months. Financial, technology and consumer staples plays remain the three biggest sector allocations for this group.

Among the Latin America Equity Fund groups, Brazil Equity Funds recorded their fifth straight outflow and Mexico Equity Funds their fifth in the past six weeks while flows into Latin America Regional Funds hit an eight-week high.

EMEA Equity Funds were the only major group to post an outflow as redemptions from Turkey and Poland Equity Funds hit 10 and 20-week highs, respectively, and South Africa Equity Funds racked up their 12th outflow in the past 14 weeks.

Developed markets equity funds

The week ending April 19 saw EPFR-tracked Developed Markets Equity Funds record their seventh outflow in the past 10 weeks as US, Global, Europe and Canada Equity Funds each surrendered over $900 million.

With core inflation above the headline number in both the US and Eurozone, the European Central Bank (ECB) and US Federal Reserve are now expected to hike interest rates again when they hold their respective policy meetings early next month. That raises the odds of a recession in the second half of the year and keeps the pressure on banks grappling with higher funding costs.

In addition to tighter credit, Europe faces the costs of a long-term drought that could hit the continent’s agriculture, tourism, transportation, manufacturing and energy sectors again this summer. Last August the Rhine River, a key artery for European trade, became impassable for larger ships and barges, and levels are already lower than normal after an exceptionally dry February. Europe Equity Funds have now posted outflows for six straight weeks.

At the country level, UK Equity Funds experienced the heaviest redemptions as inflation remains in double digits. The country is also wrestling with weak productivity growth and private investment, a struggling national health service and the loss of unfettered access to European markets.

US Equity Funds chalked up their fourth outflow in the past five weeks as Large Cap Blend and Value Funds both saw over $1 billion redeemed. At the fund level, the best performing fund is up just over 25% so far this year and the worst is down just under 25%. The range for the best and worst performing Europe Equity Funds is -18.1% to +16.9% and for Japan Equity Funds is -2.1% to 7.1%.

Those Japan Equity Funds saw another $488 million flow out during the week ending April 19 as redemptions from retail share classes hit their third highest weekly total since 4Q21.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, posted their biggest outflow since the second week of March. Global ex-US Funds recorded a modest inflow that was more than offset by redemptions from funds with fully global mandates.

Global sector, industry and precious metals funds

The 1Q23 corporate earnings season moved through the gears during the third week of April, churning out numbers, context and forecasts that kept money moving into and out of EPFR-tracked Sector Fund groups. For the third straight week, six of the 11 major groups recorded inflows that ranged from $120 million for Telecom Sector Funds to $1.7 billion for Healthcare/Biotechnology Sector Funds.

Some high-profile earnings reports from major banks, coming as they did on the heels of three US bank failures in March, kept investors focused on the financial sector in mid-April. Up until April 18, daily flows were indicating redemptions for Financial Sector Funds, but thanks to $733 million flowing in on the final day of the reporting period the group posted consecutive weekly inflows. US Financials Sector Funds backed the headline number with a 34-week high inflow of $1.1 billion while Europe and Canada-dedicated funds equally contributed to a $500 million redemption. For Canada Financial Sector Funds, it was the largest outflow since mid-3Q20.

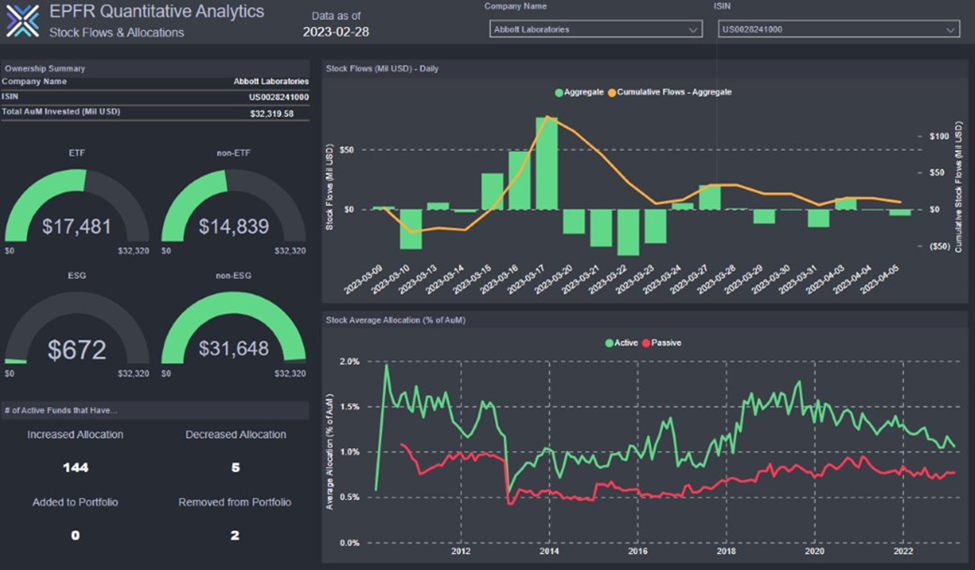

Besides banks, investors homed in on reports from big healthcare plays. The sales of covid tests and vaccines have slowed dramatically, a sign that the world has returned to “normalcy” but that caused a dent in profits for some healthcare companies and spurred them to look for alternative drivers. Abbott Laboratories was one of those, reporting first-quarter sales and earnings that exceeded expectations but were qualified by the headwinds created by inflation and policy changes for government-back health insurance plans. EPFR’s stock-level flows and allocations data suggests that investors and fund managers are factoring those headwinds into their outlook for this company.

Healthcare/Biotechnology Sector Funds, meanwhile, recorded their largest inflow since mid-4Q21. China-dedicated funds posted a second consecutive weekly inflow above $1 billion and US Healthcare/Biotechnology Sector Funds snapped an eight-week, $3.4 billion outflow streak.

Also pulling in over $1 billion were Consumer Goods Sector Funds. The last time this group saw an inflow of this magnitude was in late December of 2021. The latest headline number was mainly backed by US-dedicated funds, which saw their current inflow streak hit seven weeks and $3.5 billion.

Energy Sector Funds snapped a two-week stretch of inflows after electric vehicle bellwether Tesla delivered earnings that left most investors with questions about demand and strategy. A custom grouping of Electric Vehicle Funds highlighted the dropping sentiment with a five-week outflow streak and one of those weeks (April 5th) the largest outflow on record.

Bond and other fixed income funds

EPFR-tracked Bond Funds headed into the fourth week of April having chalked up their 14th inflow of the year. There were signs that risk appetite among fixed income investors is on the rise again, with over $3 billion flowing into High Yield Bond Funds, flows to Frontier Markets Bond Funds hitting a record high and Emerging Markets Bond Funds snapping a nine-week outflow streak.

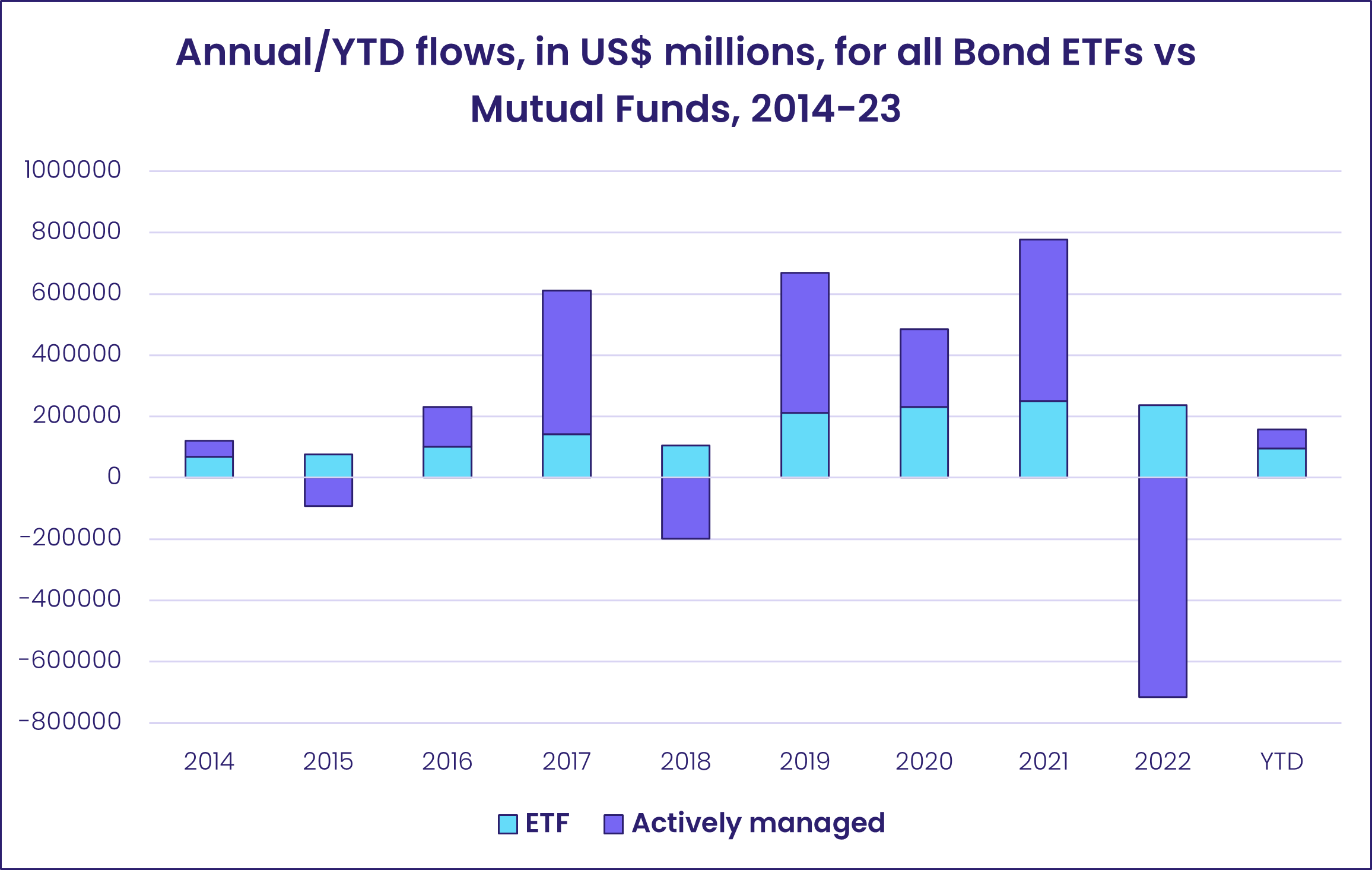

For the ninth week running, Bond ETFs attracted more fresh money than their actively managed counterparts. The disparity is not as stark as it was last year when collective redemptions from Bond Mutual Funds exceeded $700 billion.

At the asset class level, money left Inflation Protected Bond Funds for the 34th consecutive week, Bank Loan Funds posted their 13th straight outflow and 23rd in the past 24 weeks, redemptions from Municipal Bond Funds hit an eight-week high and Convertible Bond Funds experienced net outflows for the 14th time year-to-date.

“With headline inflation in the Eurozone dropping below 7% in March, flows into Europe Bond Funds climbed to an 11-week high, as funds dedicated to corporate debt outgained their sovereign counterparts by a more than 2-to-1 margin. The week saw significant moves at the country level. Flows into Spain and UK Bond Funds hit their highest levels since mid-4Q22 and late 3Q21, respectively, while Netherlands Bond Funds posted their biggest inflow in nine weeks and Italy Bond Funds chalked up their seventh inflow in the past eight weeks.

US Bond Funds recorded a modest collective inflow that largely bypassed fund groups with short duration mandates. Retail share classes saw money flow out for the seventh straight week.

Investors in the emerging markets space steered over $700 million into EM Local Currency Funds during the third week of April. Frontier Markets Bond Funds absorbed over $250 million while, at the country level, both Thailand and Korea Bond Funds posted significant inflows.

Among the Asia Pacific Bond Fund groups, flows into Australia Bond Funds climbed to a 10-week high while Japan Bond Funds recorded their sixth outflow in the past seven weeks. Japan’s central bank meets towards the end of next week, and investors are looking for signs that it will consider loosening its yield curve control policy. That policy has been tested by higher domestic inflation and yields on overseas debt, prompting Japanese investors to sell government bonds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.