Investors were expecting quarter-point interest rate hikes from the US Federal Reserve and European Central Bank (ECB) in early May. They got them, along with the collapse of another American regional bank, a warning from Treasury Secretary Janet Yellen that the US may not be able to pay its bills in June if the debt ceiling standoff persists and more violent protests against pension reform in France.

By and large, those investors stuck to the previous week’s script, cutting their exposure to developed markets equity, seeking instead the relative safety of Money Market and Investment Grade Bond Funds and buying into China’s economic rebound story.

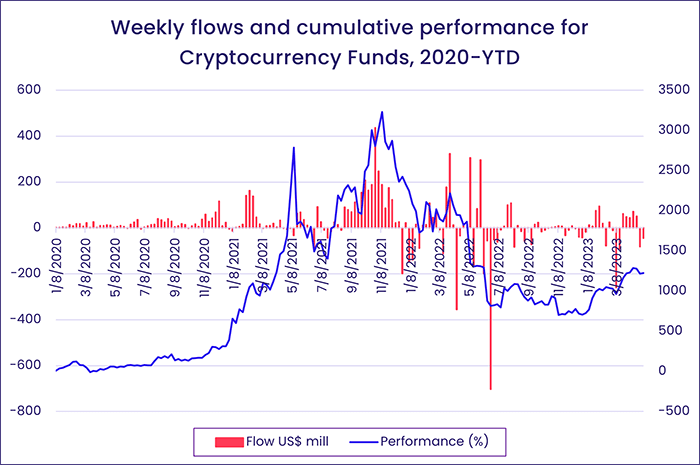

Risk appetite perked up in the fixed income fund universe, with High Yield Bond Funds pulling in over $1 billion and Emerging Markets Bond Funds posting only their third inflow since the beginning of February, but flows to Sector Funds favored groups with defensive reputations and Cryptocurrency Funds posted consecutive outflows for the first time since mid-March.

Overall, investors pulled a net $6.5 billion – a nine-week high – from all EPFR-tracked Equity Funds during the week ending May 3. Balanced Funds surrendered $1.7 billion while Alternative Funds absorbed $1.1 billion, Bond Funds $10.9 billion and Money Market Funds $59.4 billion. In the case of the latter, the bulk of the inflows accrued in US Money Market Funds while Europe Money Market Funds recorded their biggest outflow since late February.

At the single country and asset class fund level, Switzerland Equity Funds recorded their biggest outflow in exactly four years while over $500 million flowed into Switzerland Bond Funds. Investors pulled money out of Convertible Bond Funds for the 19th time in the past 21 weeks and out of Municipal Bond Funds for the ninth time in the past 11 weeks.

Emerging markets equity funds

Another week of strong flows into China and Greater China-dedicated funds allowed EPFR-tracked Emerging Markets Equity Funds to kick off the month of May with their 14th inflow year-to-date. The latest inflow came despite the sixth week of retail redemptions in the past eight and another US interest rate hike.

Commitments to Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds underpinned the headline number. Both EMEA and Latin America Equity Funds posted modest outflows and redemptions from Frontier Markets Equity Funds hit a 46-week high.

Flows into China Equity Funds were front-loaded, with daily data showing them tapering sharply as the week progressed and attention shifted from the first quarter’s better-than-expected GDP growth to recurring questions about the durability of the rebound. High youth unemployment and local government debt levels, cautious earning guidance from some Chinese companies, a struggling property sector and the weak 1Q22 number that the latest GDP data compares to are all giving investors pause for thought.

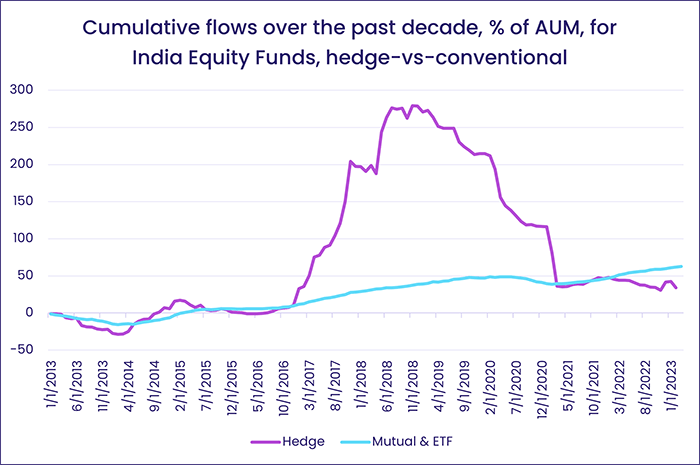

There was more interest in some of the other Emerging Asian markets. Indonesia Equity Funds extended their longest inflow streak since mid-4Q22, flows into Thailand Equity Funds hit a 60-week high and India Equity Funds took in fresh money for the seventh straight week and 10th time in the past 12 weeks ahead of the annual monsoon rains. While flows into conventional India Funds and ETFs have marched steadily higher over the past decade, those to India Hedge Funds have – in relative terms – converged sharply after peaking in 1Q19.

EMEA Equity Funds chalked up their sixth straight outflow despite the more than $100 million committed to Turkey Equity Funds as the countdown to the mid-May general election heads into its final days. Emerging Europe Regional Funds, however, recorded their biggest outflow since February of last year.

Among the Latin America Country Fund groups, flows into Colombia Equity Funds climbed to their highest level in over three years. But Chile Equity Funds experienced net redemptions for the 11th straight week as investors digested the left-of-center government’s plans to nationalize the country’s lithium mines.

Developed markets equity funds

With the first week of May seeing additional interest rate hikes on both sides of the Atlantic, investors responded by pulling a combined $10 billion out of US and Europe Equity Funds. Those redemptions, and the biggest outflows from Pacific Regional Equity Funds since late 4Q18, more than offset flows into Global and Canada Equity Funds, resulting in a third straight outflow for all EPFR-tracked Developed Markets Equity Funds.

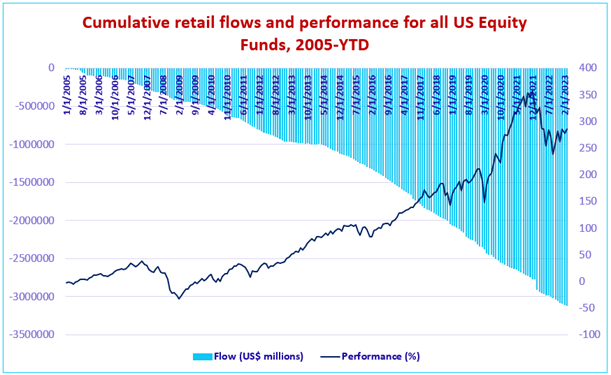

US Equity Funds saw money flow out of retail share classes for the 12th time in the past 13 weeks. Over the past 20 years, retail redemptions have totaled over $3 trillion as investors nearing retirement responded to the shocks of the ‘dot-com’ bubble bursting and the great financial crisis.

The US companies that issued this equity continue to aggressively support its price by squeezing supply. The latest research by EPFR Liquidity Analyst Winston Chua notes that, since the beginning of April, US corporations are spending nearly $9 repurchasing shares for every dollar’s worth they issue. The 12-month buy/sell ratio, meanwhile, is 13-to-1.

Europe Equity Funds saw significant sums flow out of UK and Switzerland Equity Funds and both of the major regional groups. Europe Dividend Funds experienced net redemptions for the fourth time in the past five weeks and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates expended their longest outflow streak since 1Q22. But investors did see some value in some of the major Mediterranean markets. Greece Equity Funds posted their biggest inflow since 2Q21, flows into Spain Equity Funds climbed to a 14-week high as they snapped a six-week run of outflows and Italy Equity Funds also attracted some fresh money.

Money flowed out of Japan Equity Funds for the fifth week running despite a fifth straight inflow for funds domiciled overseas and a 12th straight inflow for Japan SRI/ESG Equity Funds.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, took in over $2 billion with flows favoring fully global funds 4-to-1 over Global ex-US Funds.

Global sector, industry and precious metals funds

Flows to EPFR-tracked Sector Fund groups mirrored the uncertainty surrounding key market drivers coming into May. Have US interest rates peaked? Will China’s economic rebound fade in the second half of the year? Are sovereign and corporate debt dynamics sustainable? During the latest week, five of the 11 major groups tracked by EPFR absorbed fresh money, ranging from $183 million for Telecoms Sector Funds to $729 million for both Consumer Goods and Technology Sector Funds. For the first time in three weeks, no group reported an inflow that breached the $1 billion mark.

Technology Sector Funds were one of the groups to see inflows. But, once again, it was funds dedicated to China that drove the headline number while US Technology Sector Funds racked up their third outflow in the past four weeks. Among the top dozen funds ranked by inflows for the week, the second, fourth and sixth have semiconductor mandates. All of the top 12 were ETFs.

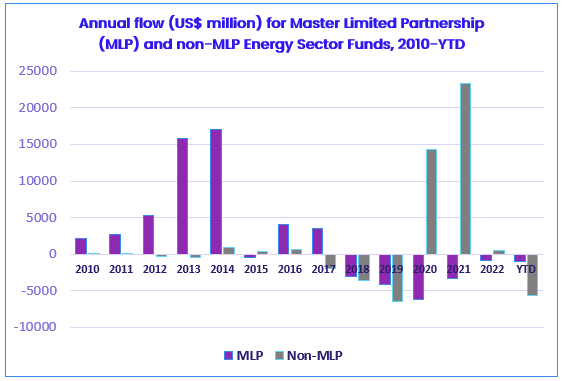

Energy Sector Funds remain out of favor as investors pulled over $500 million out of the group for the third straight week. Funds dedicated to Master Limited Partnerships (MLPs), a tax advantaged vehicle for investing in US mid-stream assets such as pipelines and storage facilities, posted their 18th outflow in the past 20 weeks. Energy MLP Funds were wildly popular in 2013 and 2014 thanks to their combination of liquidity, tradability and tax advantages. But resistance to building these kinds of assets, closer scrutiny from tax authorities and their complexity have curbed investor enthusiasm for exposure to these vehicles.

With First Republic joining the list of US banks that have failed since March, Financial Sector Funds also recorded an outflow and Real Estate Sector Funds chalked up their third outflow since the beginning of April. But the sub-group dedicated to regional banks recorded their sixth inflow in the past nine weeks

Gold Funds have seen $3.8 billion committed over the past eight weeks. That’s the longest inflow streak since a 14-week run starting mid-1Q22 that pulled in $20.8 billion as investors fretted about inflation and the Russian assault of Ukraine.

Bond and other fixed income funds

Year-to-date flows into EPFR-tracked Bond Funds climbed past the $150 billion mark during the week ending May 3 as investors continue to discount the risks of the current US debt ceiling standoff and the risks of a recession in the second half of the year. At this point last year, some $160 billion had been redeemed from these funds.

The latest week saw all of the major groups by geographic focus record an inflow. Asia Pacific Bond Funds recorded their biggest inflow since mid-October, flows into Europe Bond Funds hit a 94-week high, Canada Bond Funds absorbed fresh money for the 14th time in the past 16 weeks and US Bond Funds racked up their 18th consecutive inflow.

At the asset class level, Inflation Protected Bond Funds moved within a week of matching the longest-ever outflow streak, Mortgage-Backed Bond Funds posted their fourth outflow YTD and biggest since the first week of January, investors pulled money out of Bank Loan Funds for the 25th time in the past 26 weeks and flows into Total Return Funds exceeded $2 billion for the first time in nearly three months.

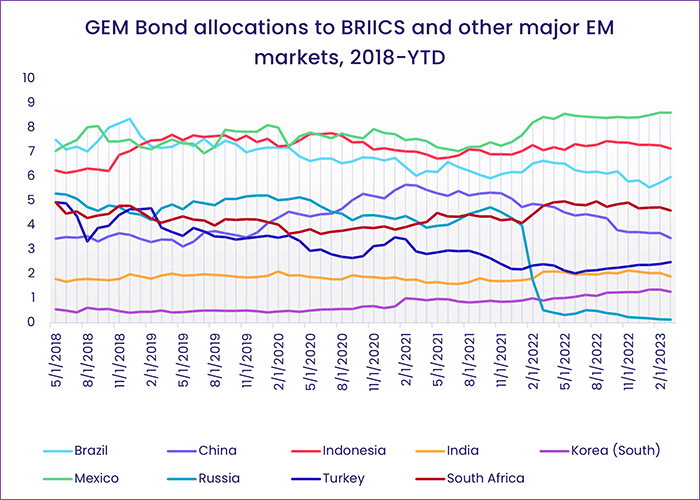

Local Currency Emerging Markets Bond Funds posted their eighth inflow of the year, lifting the headline number for the overall group into positive territory. Funds with hard currency mandates have not posted an inflow since the first week of February. The latest country allocations data shows that managers of diversified Global Emerging Markets (GEM) Bond Funds have lifted their average weighting for Turkey to a 17-month high while cutting their exposure to South Africa and China to 13 and 45-month lows, respectively.

US Bond Funds with sovereign mandates attracted more fresh money than their corporate peers for the 10th time in the past 12 weeks. Intermediate term (5-10 years) with the preferred duration.

Flows into Europe Bond Funds, which were the largest in nearly two years, were broadly based with 35 funds attracting over $50 million and 19 of those funds taking over $100 million. At the country level, France Bond Funds posted their biggest inflow YTD and Sweden Bond Funds since early December.

On the heels of the Bank of Japan’s decision to leave policy unchanged after the first meeting in a decade not chaired by Haruhiko Kuroda, Japan Bond Funds posted their biggest inflow since the final week of February.

Did you find this useful? Get our EPFR Insights delivered to your inbox.