Although the third week of August ended with a stellar earnings report from Nvidia, maker of the graphic chips driving current artificial intelligence networks, investors had plenty of less pleasant fare to chew over. This was especially true when it came to US and Chinese real estate. The former is under pressure from rising mortgage rates, which are now north of 7%, while China’s property sector is struggling with crushing debts and declining numbers of potential buyers.

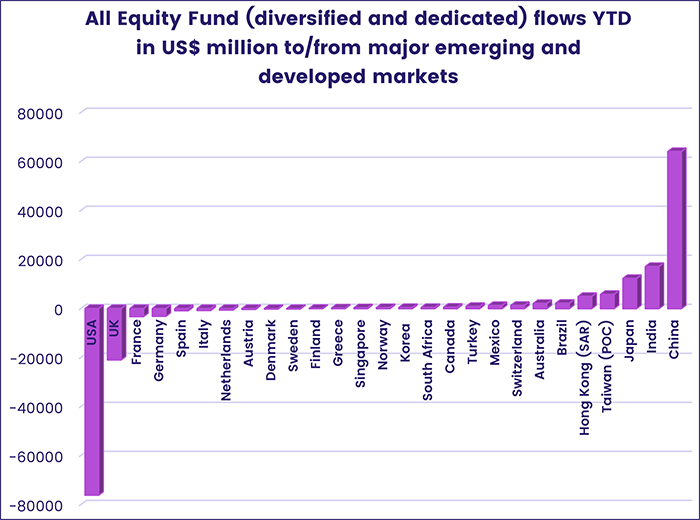

China’s well-chronicled economic woes did not stop EPFR-tracked China Equity Funds from absorbing another $3.1 billion. But those issues contributed to an increasingly pessimistic outlook for the global economy. Investors again pulled money out of Global and Global Emerging Markets (GEM) Equity Funds, extending their longest outflow streaks since 4Q22.

For the US, stress in real estate markets – especially commercial ones – raises the specter of further trouble for regional banks and the growth-sapping effects of tighter lending standards – the more so if the US Federal Reserve opts for another rate hike later this year. The week saw ratings agency Standard & Poor’s downgrade more US banks and US Equity Funds post their biggest outflow since mid-May.

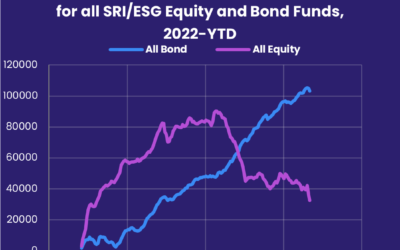

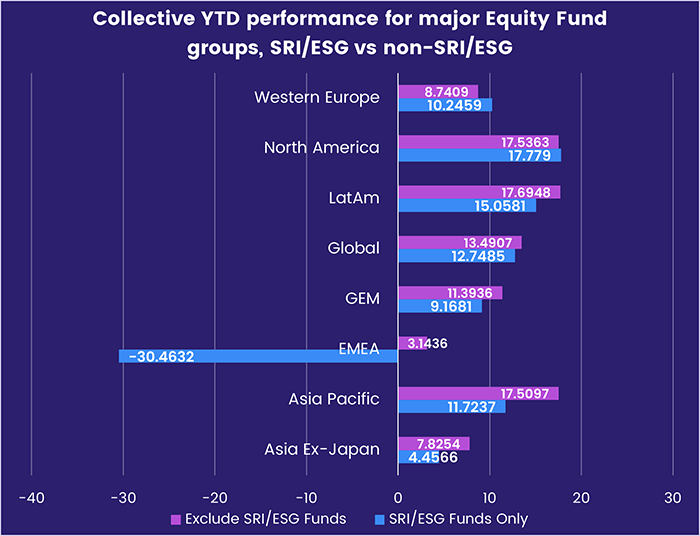

Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their third consecutive outflow, and fifth in the past six weeks, as underperformance relative to non-SRI/ESG funds and regulatory scrutiny sap previously voracious investor appetite.

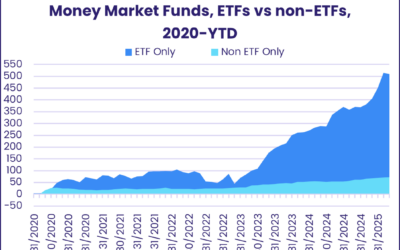

Overall, EPFR-tracked Equity Funds posted a collective outflow of $6.1 billion during the week ending August 23 while Bond Funds absorbed $609 million. Investors also pulled $1.7 billion out of Alternative Funds, Balanced Funds extended an outflow streak stretching back to early April and a net $122 million flowed out of Money Market Funds. At the asset class level, redemptions from Cryptocurrency Funds hit their highest level in over 13 months, Gold Funds extended their longest outflow streak since a 22-week run ended in mid-4Q22 and over $600 million was redeemed from Inflation Protected Bond Funds.

Emerging markets equity funds

The money kept rolling into China and India Equity Funds during the third week of August, helping EPFR-tracked Emerging Markets Equity Funds post their seventh straight collective inflow. Once again, this pivot to Emerging Asia offset redemptions from diversified Global Emerging Markets (GEM) Equity Funds which hit a 44-week high.

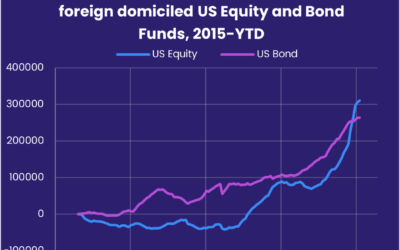

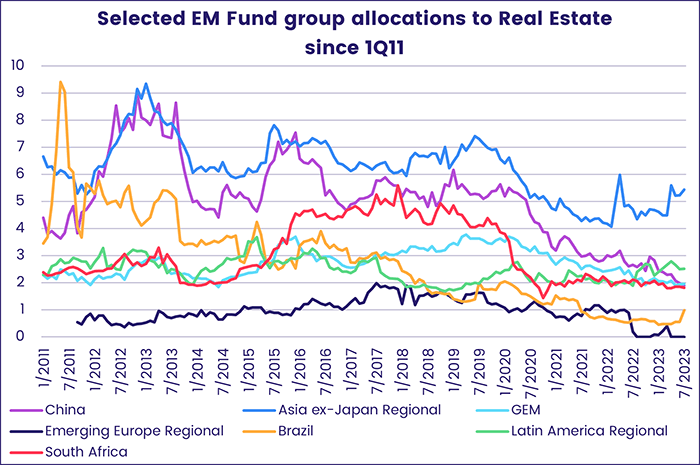

Domestically domiciled China Equity Funds again drove the headline number, with redemptions from foreign domiciled funds accelerating for the third straight week to their highest level since early 3Q15. While distress in China’s property market has yet to dent overall flows into China Equity Funds this year, managers of those funds are responding with allocations to real estate assets at a record low.

Flows to India Equity Funds, meanwhile, exceeded $300 million for the ninth time in the past 10 weeks as the group extended its longest inflow streak since 1H15. Although valuations for Indian equity are getting rich, investors continue buying into the country’s attractive demographics, an expanding economy on track to become the world’s third largest by the end of the decade and India’s growing technological prowess exemplified by the Chandrayaan-3 mission’s successful moon landing.

The enthusiasm for India stands in stark contrast to the lack of enthusiasm for most EMEA markets. During the latest week, redemptions from Poland Equity Funds hit a 38-week high while Turkey Equity Funds racked up their 11th outflow over the past 13 weeks. Turkey’s central bank, in its efforts to contain headline inflation still running at over 40%, hiked its key interest rate the day after the latest reporting period ended by 750 basis points to its highest level in nearly 20 years.

Latin America Equity Funds posted their 19th inflow since mid-April, with flows into Mexico Equity Funds the biggest contributor to the headline number. Funds dedicated to Peru, where the economy has been hit by political unrest, seen climate-related hits to agriculture and fishing, and uncertainty about future Chinese demand, posted their biggest outflow since late 2Q22.

Developed markets equity funds

Collective outflows from EPFR-tracked Developed Markets Equity Funds climbed to a three-month high during the third week of August as investors continue to shun Europe, question the outlook for global growth and fret about the nexus between US banks and the country’s real estate markets. Of the major groups, only Japan and Canada Equity Funds attracted fresh money while Europe Equity Funds recorded their 24th straight outflow, Global Equity Funds extended their longest redemption streak since 4Q22 and over $7 billion flowed out of US Equity Funds.

Despite the solid year-to-date performance that key US indexes have posted year-to-date, both dedicated and diversified Equity Fund groups have been net sellers to US stocks this year. The impact of tighter monetary policy on the commercial real estate portfolios of US banks, and renewed fears the US Federal Reserve has one more hike in store, are among factors testing the earlier consensus that the US economy is heading for a ‘soft landing’ going into 2024.

Japan Equity Funds continue to swim against the current tide, chalking up their 12th inflow in the 13 weeks since the beginning of June. The Bank of Japan is still running by far the most accommodative monetary policy of any major central bank and Japanese equity valuations are still well short, on a price-to-earnings basis, of those on offer in the US. While Japanese exchanges reported significant foreign selling during the latest week, foreign-domiciled Japan Equity Funds posted inflows for the 19th time in the past 21 weeks.

Interest in Japan did not spread to the broader universe of Asia Pacific markets. Singapore, New Zealand and Australia Equity Funds all posted outflows for the second week running and redemptions from Pacific Regional Funds jumped to a 14-week high.

With consumer confidence and business activity surveys adding to fears that European growth will stall going into the fourth quarter, investors continued pulling money out of Europe Equity Funds, although Europe Equity ETFs did post their first collective inflow since mid-July and their biggest since mid-April. At the country level, redemptions from UK Equity Funds accounted for half of the headline number for all Europe Equity Funds, investors pulled money out of Italy Equity Funds for the seventh time in the past eight weeks and Greece Equity Funds recorded their first outflow since the first week of April.

Global sector, industry and precious metals funds

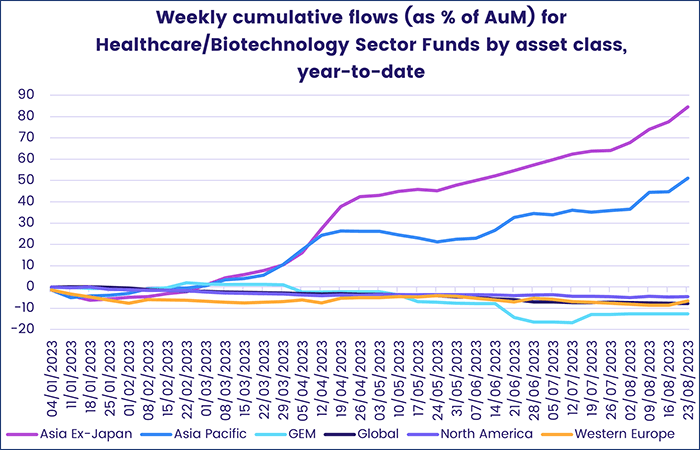

For the second straight week, only three of the 11 major EPFR-tracked Sector Fund groups reported inflows as investors reconsidered earlier assumptions about soft landings for the US and global economies. Technology Sector Funds absorbed a 10-week high of $2.3 billion, Telecoms Sector Funds recorded their sixth straight inflow and Healthcare/Biotechnology Sector Funds took in $833 million, roughly 2.5 times the size of the previous week’s outflow.

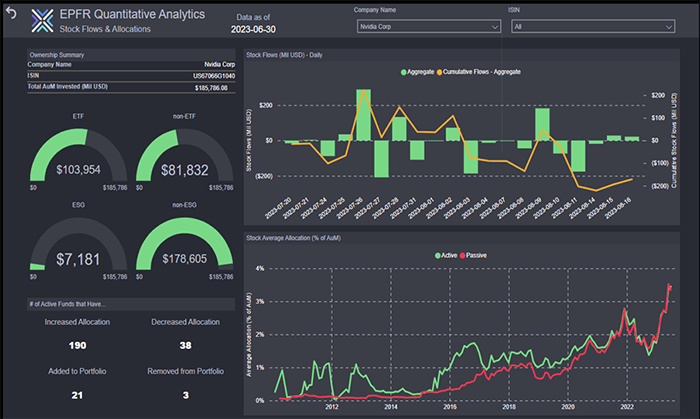

For Technology Sector Funds, the week ended on a high note as the chip designer and driving force behind many well-known artificial intelligence (AI) systems, Nvidia, crushed second quarter earnings estimates. But it was China-dedicated funds that, once again, accounted for the bulk of the headline number for all funds while around $200 million flowed into both US and Taiwan (POC) Technology Sector Funds.

EPFR’s Stock Flows & Allocations data shows nearly $186 billion currently invested in Nvidia Corp. For every five active funds that increased their allocation during the latest reporting period, one cut it, and for every seven adding Nvidia to their portfolio, one fund has shed the stock.

Having posted only six weekly inflows during the first half of 2023, Healthcare/Biotechnology Sector Funds are seeing significantly more interest as the third quarter progresses with a net $718 million flowing in over the past two months. Year-to-date, flows for this sector have been heavily biased towards groups dedicated to both developed and emerging Asian markets. During the latest week, flows into China Healthcare/Biotechnology Sector Funds topped $500 million while US-dedicated funds attracted nearly half that amount.

Energy Sector Funds saw the previous week’s inflow reversed as investors juggled questions about Chinese demand, the ability of oil producers to balance output with increasing supplies of renewable power and the enthusiasm of many governments for windfall taxes. Utilities Sector Funds are also struggling to attract interest from investors. The group extended their outflow streak to five weeks, the longest since another five-week run that started mid-1Q18.

Financials Sector Funds continued to experience redemptions as ratings agencies continue to take their shears to US bank ratings. The inflows recorded by Canada Financials Sector Funds were nowhere near enough to offset the $650 million that flowed out of US-dedicated funds.

Bond and other fixed income funds

EPFR-tracked Bond Funds ended the week of August 23 with another inflow, their 22nd in a row, but risk aversion among fixed income investors climbed another notch. Redemptions from Emerging Markets Bond Funds climbed to a 23-week high and High Yield Bond Funds posted their biggest outflow since the final week of May.

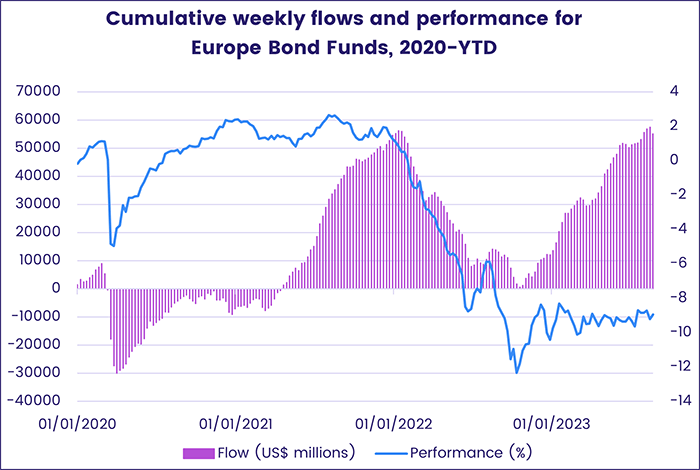

The latest week also saw Europe Bond Funds post their first outflow since late June and their biggest since the second week of 4Q22. The headline number included record-setting redemptions from Switzerland Bond Funds that were driven by redemptions from a single institutional fund. Spain and Italy Bond Funds recorded inflows for the 14th and 17th straight week, respectively while Belgium Bond Funds recorded their biggest outflow since mid-4Q20.

At the asset class level, Bank Loan Funds posted their eighth inflow of the past nine weeks, High Yield Bond Funds saw their current run of outflows hit five weeks and $5.6 billion, Municipal Bond Funds posted consecutive weekly outflows for the first time since late May and Mortgage-Backed Bond Funds absorbed fresh money for the 12th week running. Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates chalked up their fifth outflow of 2023.

US Bond Funds kept their year-to-date inflow streak intact as funds with sovereign mandates pulled in $2 for every dollar absorbed by US Corporate Bond Funds. Flows favored funds dedicated to short and intermediate-term debt.

Evergrande’s US bankruptcy filing and payments on bonds issued by two other major Chinese property developers in limbo did not stop dedicated China Bond Funds from posting only their eighth inflow since mid-1Q22. But redemptions from the diversified Global Emerging Markets (GEM) Bond Funds climbed to a 46-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.