The fourth week of September saw oil prices inch closer to the $100 a barrel mark, yields on US 10-year Treasuries hit a 15-year high and the clock wind down towards another US government shutdown. Investors, predictably, lost a lot of their risk appetite.

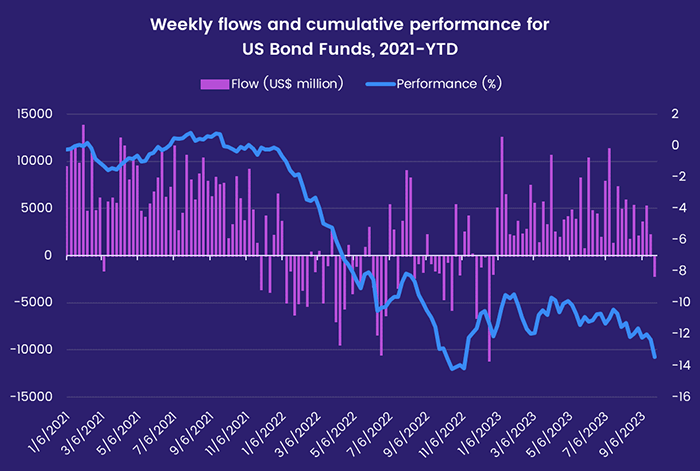

Among the week’s casualties was the 38-week inflow streak that US Bond Funds had compiled. Although US Sovereign Bond Funds continued to attract fresh money, big redemptions from junk and municipal funds resulted in the first outflow for the group overall since the final week of 2022.

Elsewhere, redemptions from Alternative Funds jumped to a 40-week high, High Yield Bond Funds posted their biggest outflow since the third week of February, money flowed out of Emerging Markets Bond Funds for the ninth straight week and Bank Loan Funds posted their first outflow since late July and biggest since mid-June.

Investors did keep faith with funds offering exposure to Asian equity, with China, India, Japan, Korea and Taiwan (POC) Equity Funds recording solid to above average inflows and flows into Pacific Regional Equity Funds hitting a 13-week high.

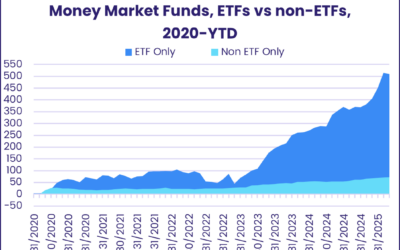

Overall, investors pulled a net $3.5 billion out of EPFR-tracked Bond Funds during the week ending Sept. 27 while Equity Funds collectively absorbed $11.6 billion. Redemptions from Alternative and Balanced Funds totaled $3.1 billion and $4 billion, respectively, while modest flows into US Money Market Funds were offset by the biggest outflow from Europe MM Funds in over eight months.

At the single country and asset class fund level, Hong Kong Bond Funds extended an outflow streak stretching back to the second week of the year, France Equity Funds posted their biggest inflow since late March and India Equity Funds absorbed fresh money for the 28th consecutive week. Gold Funds extended their current outflow streak to 18 weeks, with the latest redemptions the biggest in three months, while redemptions from Total Return Funds hit a year-to-date high.

Emerging markets equity funds

Once again, investors’ appetite for exposure to Emerging Asia kept the headline number for all EPFR-tracked Emerging Markets Equity Funds on the right side – barely – of zero. In contrast to earlier weeks, however, China Equity Funds were not the only Asia ex-Japan Country Fund group doing the heavy lifting.

During the fourth week of September, those flows into Asia ex-Japan Equity Funds offset net redemptions from the other three major regional groups. EMEA Equity Funds posted their third straight outflow, Latin America Equity Funds experienced net redemptions for the third time in the past four weeks and the diversified Global Emerging Markets (GEM) Equity Funds chalked up their biggest outflow since late 4Q21.

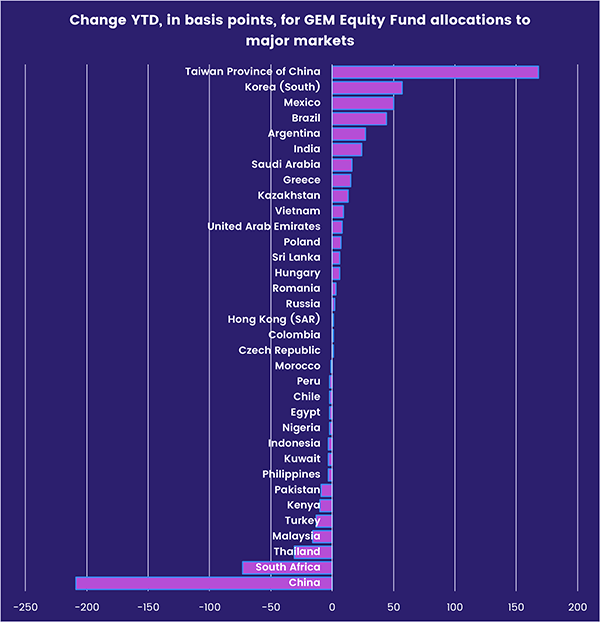

The latest country allocations data shows that GEM Fund managers have maintained the rotation this year from China and major EMEA markets to Taiwan (POC), Korea and a number of Latin American markets.

Among the Asia ex-Japan Country Fund groups, China Equity Funds absorbed another $1.5 billion during a week that was light on fresh macroeconomic datapoints and new policy measures. Flows into Korea Equity Funds were positive for the ninth consecutive week despite the headwinds for the Korean economy posed by higher energy prices and India Equity Funds moved closer to eclipsing the record inflow streak they compiled between 4Q03 and 2Q04.

The cautious optimism about Chinese growth, based on August data, did not move the needle for Brazil Equity Funds which posted their third outflow month-to-date. Enthusiasm for Mexico Equity Funds was also sapped by the prospect of US interest rates staying at current levels well into next year.

EMEA Equity Funds suffered from souring sentiment towards Turkey and the unwillingness of investors to buy into the oil stories of major producers. Saudi Arabia and UAE Equity Funds posted modest outflows while Nigeria, Kuwait and Qatar Equity Funds posted inflows measured in thousands rather than millions of dollars. For Turkey, higher oil prices complicate a struggle with inflation that is running at double the central bank’s current base interest rate.

Developed markets equity funds

Although the US Federal Reserve has emphatically paused rather than pivoted when it comes to interest rates and another US government shutdown looms, most of the major EPFR-tracked Developed Markets Equity Funds groups posted inflows during the week ending Sept. 27. These ranged from $68 million for Canada Equity Funds to $11.9 billion for US Equity Funds.

Investors took the opposite tack with Europe Equity Funds, which racked up their 39th consecutive outflow as sentiment towards the region continues to experience death by a thousand cuts that include the highest Eurozone interest rates at a record high, the war in Ukraine, the impact of drought on farm output, rising energy prices, the social and political pressures stemming from the steady stream of illegal immigrants and the fading momentum of the region’s dominant economy, Germany.

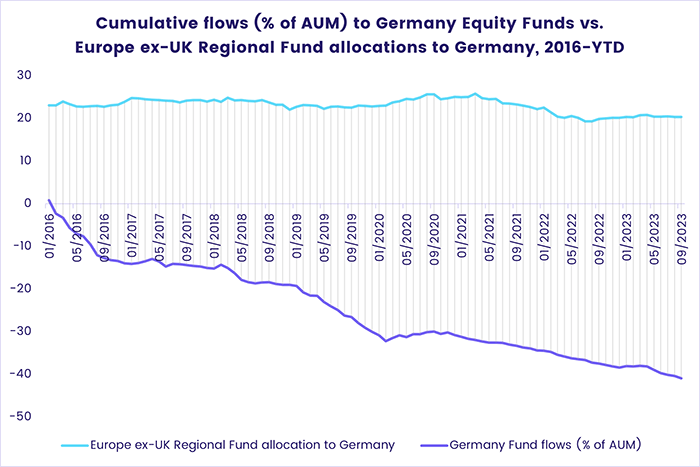

During the latest week redemptions from Germany Equity Funds hit a 14-week high as the group racked up their 30th outflow in the 39 weeks year-to-date. Sentiment among fund managers has proved more resilient, with Global and Global ex-US Equity Fund allocations off the 17-year lows seen in 2H22 and Europe Regional Fund exposure also up YTD.

Investors steered nearly $12 billion into US Equity Funds as retail share classes attracted fresh money for the first time since mid-June. The bulk of the week’s inflows went to Large Cap Blend, Small Cap Blend and Large Cap Growth Funds while redemptions from Large Cap Value Funds climbed to a 13-week high. Leveraged US Equity Funds took in fresh money for the third straight week.

Japan Equity Funds posted their biggest inflow since the first week of August, with retail flows hitting a one-year high. But foreign-domiciled funds experienced their heaviest redemptions since mid-1Q22. The latest sector allocations data shows that, coming into September, Japan Equity Fund managers cut their exposure to healthcare stocks to a 48-month low and kept their exposure to telecoms close to the previous month’s five-year low.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, took in fresh money for the fifth week running.

Global sector, industry and precious metals funds

With the third quarter winding down and the next corporate earnings season on the horizon, investors pulled significant sums from eight of the 11 EPFR-tracked Sector Fund groups during the week ending Sept. 27. Flows during the latest week ranged from an outflow of $1.2 billion for Healthcare/Biotechnology Sector Funds to an inflow of $1 billion for Technology Sector Funds. Most groups saw outflows hit multi-week highs.

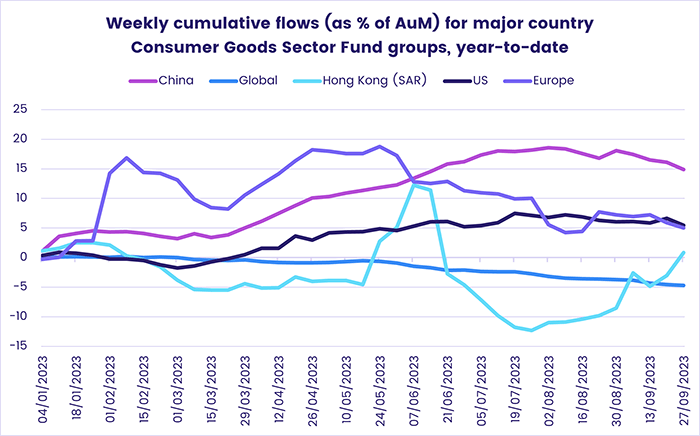

Consumer Goods Sector Funds were among those groups, with the latest outflow the biggest in nearly 18 months. Although retail investors have been running from Consumer Goods Sector Funds for the majority of the past two years, it was institutional flows that drove the headline number this week.

With the new higher-for-longer interest rate consensus hardening, US Consumer Goods Sector Funds were the hardest hit, seeing $728 million redeemed, while China-dedicated funds posted their largest outflow in almost a year and global-mandated funds stretched their current outflow streak to 12 weeks. Three of the 10 funds recording the biggest outflows for the week were consumer staples focused and all but two of them were ETFs.

Despite the healthy inflows absorbed by all US Equity Funds, the only dedicated US Sector Fund groups to see fresh money this week were US Energy, Real Estate and Infrastructure Sector Funds.

Although the list of central banks that are putting monetary tightening on hold – or even cutting interest rates – is growing, investors continued to exit Financials Sector Funds for the ninth straight week, a run that has seen $7.4 billion exit. Strong flows into another interest rate-sensitive group on the final day of the reporting period meant that Real Estate Sector Funds ended the week with a modest inflow. Going down another level, REIT Funds have seen inflows of 1.7% of assets so far this year and a custom group of four Commercial Real Estate Funds showed year-to-date inflows reaching over 9% of their assets.

Redemptions for Infrastructure and Utilities Sector Funds climbed to 14 and 16-week highs, respectively, and the last time Telecoms Sector Funds endured outflows for five straight weeks was the same period last year.

Bond and other fixed income funds

A sharp drop in overall risk appetite brought the latest inflow streak compiled by EPFR-tracked Bond Funds to an end in late September. The group posted its first collective outflow since mid-March and its biggest since late 4Q22 as investors weighed the impact of interest rates at current levels into next year on asset classes such as high yield debt and emerging markets bonds.

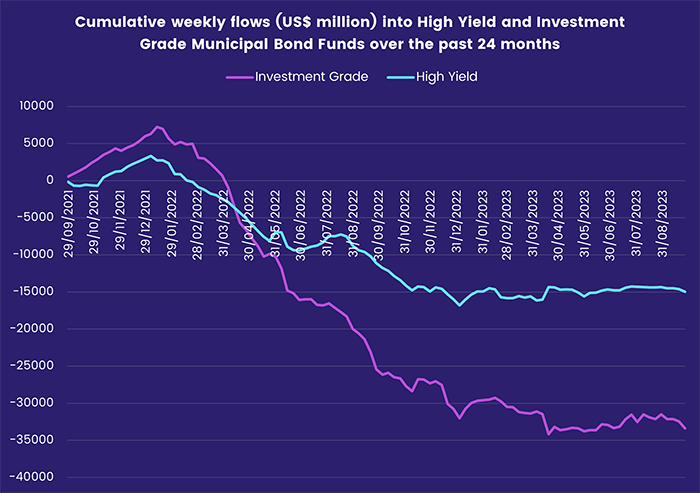

The latest week saw US Bond Funds post their first outflow so far this year, redemptions from High Yield Bond Funds hit a 31-week high, Emerging Markets Bond Funds match their longest outflow streak year-to-date and Municipal Bond Funds post their biggest outflow since late February.

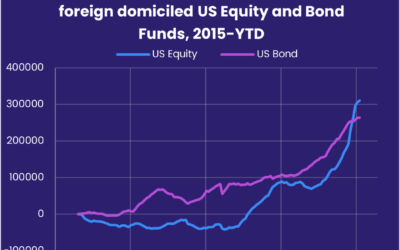

Redemptions from US Municipal and High Yield Bond Funds more than offset another week of positive flows for US Sovereign Bond Funds. Among the latter, short term was the preferred duration, although flows into Intermediate and Long Term Sovereign Funds hit five and eight-week highs, respectively. US Bond Funds domiciled overseas extended an inflow streak that started in early May.

Investors looking to Europe also showed a preference for sovereign over corporate debt, with flows into Europe Sovereign Bond Funds hitting a seven-week high as the group posted its 33rd consecutive inflow while Europe Corporate Bond Funds posted their biggest collective outflow since the third week of March. At the country level, flows favored funds dedicated to some of the bigger recipients of EU’s post-Covid recovery funds. Spain Bond Funds recorded their 20th consecutive inflow and Italy Bond Funds their 22nd.

Emerging Markets Hard Currency Bond Funds again accounted for the bulk of the headline number for all EM Bond Funds as redemptions from retail share classes hit their highest level since late 2Q22.

Both of the major multi-asset groups recorded their biggest weekly outflow year-to-date. Balanced Funds last posted an inflow in early April and, year-to-date, have seen over $110 billion flow out while Total Return Bond Funds have taken in over $40 billion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.