Investors continued to give thanks for US assets during the third week of November. Combined flows into US Equity, Bond and Money Market Funds hit $41 billion, taking the month-to-date total for these three groups to $156 billion.

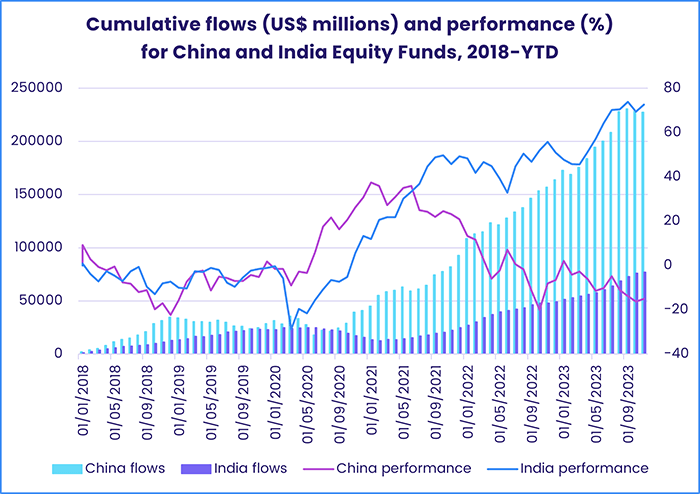

While US-dedicated fund groups are currently in the money, previously favored Asia-dedicated groups are feeling a chill. China Equity Funds, which absorbed $30 billion during the third quarter, posted their fifth outflow of the current quarter while redemptions from Japan Equity Funds jumped to a 37-week high.

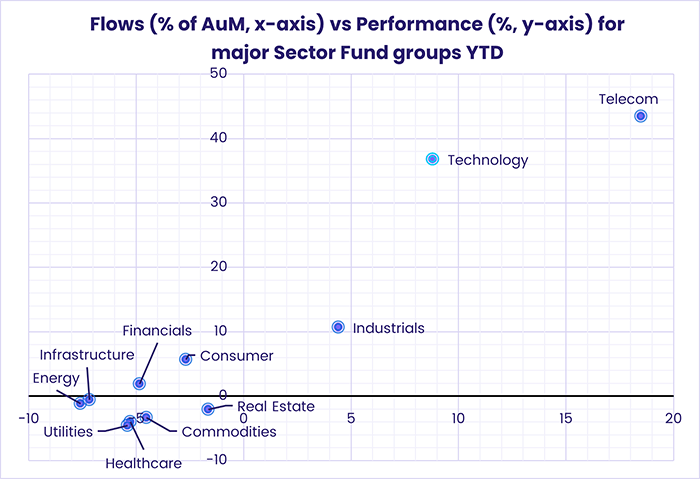

Investor appetite for sector-level exposure is also at a low ebb. Over the past four weeks, the number of major Sector Fund groups (out of 11) recording inflows is 0, 4, 5 and 3, respectively.

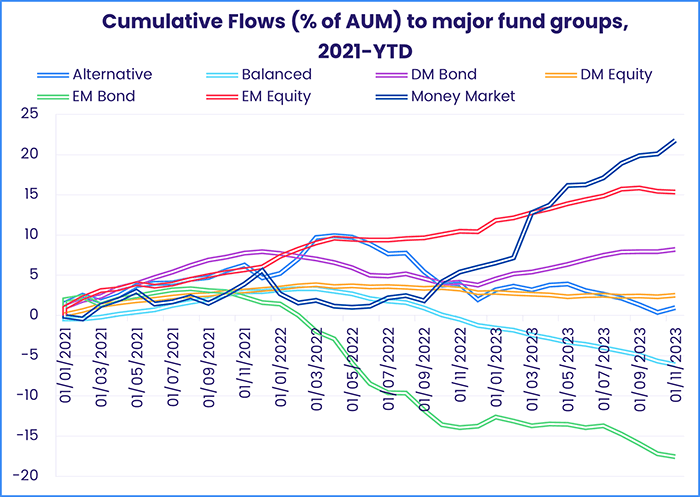

Overall, the week ending Nov. 22 saw a net $13.5 billion flow into all EPFR-tracked Equity Funds while Alternative Funds attracted $3.1 billion – an 87-week high – and Bond Funds $6.6 billion. Over $30 billion flowed into Money Market Funds, with Japan MM Funds recording their biggest inflow since mid-June, while Balanced Funds extended a redemption streak that now stands at 46 weeks and $112 billion.

At the asset class and single country fund levels, High Yield Bond Funds extended their longest run of inflows in over 14 months, flows into Gold Funds hit a 27-week high and inflows for Cryptocurrency Funds climbed to a level last seen in early 4Q21. Both India and Taiwan (POC) Equity Funds attracted over $400 million, Italy Bond Funds posted their biggest inflow since late July and UK Equity Funds posted their fifth inflow of 2023.

Emerging markets equity funds

EPFR-tracked Emerging Markets Equity Funds added to their longest outflow streak since 1H20 during the week ending Nov. 22. Of the major regional groups, EMEA Equity Funds experienced net redemptions for the 11th time in the past 14 weeks and Asia ex-Japan Equity Funds extended their longest run of outflows since early 2Q21. The diversified Global Emerging Markets (GEM) Equity Funds posted consecutive weekly inflows for the first time in over three months and Latin America Equity Funds absorbed over $250 million for the second week running.

Year-to-date, however, flows into all EM Equity Funds stand at $90 billion versus a collective outflow of $76 billion for all Developed Markets Equity Funds. This is similar to the full-year totals last year when EM funds absorbed $88 billion and DM funds surrendered $78 billion.

The latest week saw China Equity Funds chalk up their fifth outflow over the past seven weeks as investors wait for tangible evidence that a disappointing post-Covid rebound is on a more solid footing. The country’s average allocation among GEM Equity Funds has been rangebound, coming in between 23.7% and 23.9% four of the past five months, and China Hedge Funds have posted outflows 16 of the past 18 months.

GEM Fund managers remain bullish about India, which has supplanted Taiwan (POC) as their second-biggest single country allocation. Dedicated India Equity Funds have now taken in fresh money for 36 consecutive weeks, their longest inflow streak since EPFR started tracking them, as the country’s benchmark equity index – the Sensex – has hit record highs.

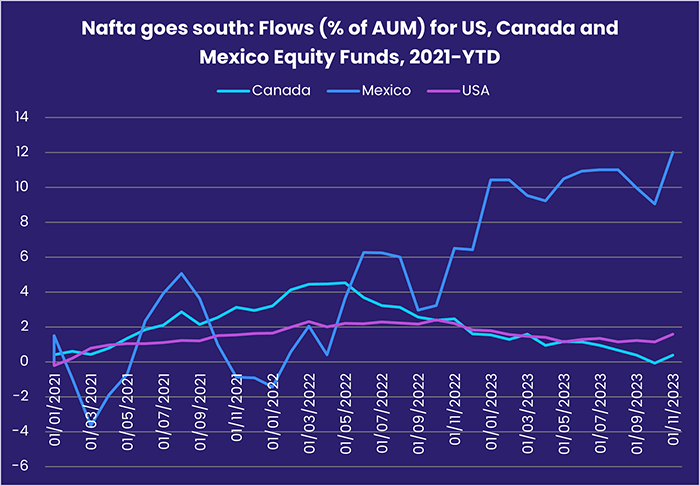

Latin America Equity Funds enjoyed another week of solid inflows as Argentina elected a populist president promising economic ‘shock therapy’ and Mexico’s proximity to a fast-growing US economy boosts its own GDP growth. Argentina Equity Funds posted their biggest inflow since 1Q18 as self-described libertarian Javier Milei, who has promised to shrink the country’s public sector and dollarize its economy, won the presidency.

Concerns about the cost of containing Turkish inflation hit Turkish Equity Funds, which posted their biggest outflow since January ahead of a 500 basis point rate hike by Turkey’s central bank. Other EMEA Country Fund groups fared better, with Israel Equity Funds recording their biggest inflow since the current conflict with Hamas began on Oct. 7.

Developed markets equity funds

Optimism about the trajectory of US inflation and interest rates continued to shape flows to EPFR-tracked Developed Markets Equity Funds going into the Thanksgiving holiday. US Equity Funds took in another $12.3 billion, taking their three-week total to $49 billion, while Global Equity Funds with mandates encompassing the US posted their biggest inflow since early September.

Japan, Global ex-US and Europe Equity Funds recorded the biggest outflows among the major DM Equity Fund groups during the week ending Nov. 22.

The latest redemptions from Japan Equity Funds were the biggest in over eight months as investors continued to digest the Japanese economy’s loss of momentum in the third quarter and look ahead to the Bank of Japan’s December policy meeting. The latest data showed Japanese inflation holding above the BOJ’s 2% target for the 19th straight month, adding fresh fuel to the debate about when – or if – the central bank will end its negative interest rate policies.

US Equity Funds recorded solid inflows despite another week of net outflows from actively managed funds, their 44th in a row. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates followed up the previous week’s record inflow by posting their second-biggest inflow year-to-date.

Europe Equity Funds racked up their 37th consecutive outflow as the victory of Euroskeptic Geert Wilders and his Freedom Party in the Netherlands’ general election promises more headaches for European policymakers. Redemptions from Netherlands Equity Funds hit a six-week high as they recorded their 10th outflow in the past 11 weeks.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, saw a six-week run of outflows come to an end as commitments to funds with fully global mandates offset the fifth straight week of outflows from Global ex-US Equity Funds.

Global sector, industry and precious metals funds

Flows to Sector Fund groups ebbed during the third week of November as the third quarter earnings season wound down and investors looked ahead to a new year. Only three of the 11 major EPFR-tracked groups attracted fresh money while eight experienced net redemptions ranging from $14 million for Telecom Sector Funds to $751 million for Healthcare/Biotechnology Funds.

The outflows from Telecom Sector Funds were only the second in the past week from what has, in relative terms, been the year’s most popular group and the best performer. Part of this enthusiasm stems from perceptions of the role telecom companies will play in delivering new Artificial Intelligence applications and improvements.

The AI story helped Technology Sector Funds post their third straight inflow in excess of $1.5 billion, with US-mandated funds the biggest contributors to the headline number ahead of another strong earnings report from AI chipmaker Nvidia. Meanwhile, year-to-date flows into China Technology Sector Funds, which peaked at over $22 billion in late September, have moved sideways.

Among the groups experiencing net redemptions, Real Estate Sector Funds posted their fourth consecutive outflow as the US housing market continues to lose momentum and the European Central Bank highlighted the connection between struggling commercial real estate and tighter bank lending in its latest stability report.

Infrastructure Sector Funds remain out of favor against a backdrop of rising interest rates and stretched public finances. The group, which posted a record-setting inflow in 2021, chalked up their 27th outflow since the beginning of March.

Bond and other fixed income funds

Flows to EPFR-tracked Bond Funds ticked higher during the third week of November as hopes for a shift in US monetary policy during 1H24 sustained a moderate jump in risk appetite. The week saw Emerging Markets Hard Currency Bond Funds post their first inflow since late July, High Yield Bond Funds extend their longest inflow streak since late 4Q21 and flows into Europe Bond Funds hit a 16-week high.

Year-to-date flows into all Bond Funds now stand at $356 billion versus an outflow of $450 billion for the comparable period last year. Over 70% of the money committed to Bond Funds this year has gone into ETFs. In 2021 actively managed funds took in twice the amount of fresh money absorbed by ETFs.

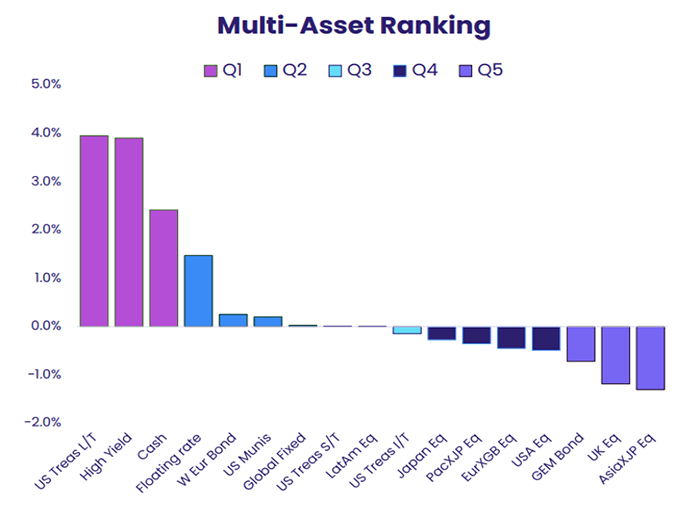

US Sovereign Bond Funds posted consecutive weekly outflows for the first time since mid-1Q21, although Long Term Sovereign Funds attracted fresh money for the 15th straight week. US long term Treasuries currently sit atop EPFR’s weekly multi-asset rankings, with junk bonds and cash also in the top quintile. At the beginning of the quarter, the top three were short, long and intermediate term treasuries, respectively, while high yield debt was in the bottom quintile.

Investors committed fresh money to Europe Bond Funds for the 17th time in the 21 weeks since the beginning of July, with Europe Corporate Bond Funds posting their biggest collective inflow since mid-April. However, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their third outflow over the past four weeks.

At the country level Italy, Switzerland and UK Bond Funds all took in over $100 million. The latest country allocations data shows Europe ex-UK Bond Fund exposure to Austria and France at 58 and 59-month highs, respectively, while Europe Regional Bond Fund allocations to the UK remain just shy of the record high set in September.

Emerging Markets Bond Funds came close to snapping their 17-week outflow streak as flows into the diversified Global Emerging Markets (GEM) Bond Funds hit their highest level in nearly four months and Frontier Markets Bond Funds recorded their biggest inflow since early July.

Did you find this useful? Get our EPFR Insights delivered to your inbox.