With drought and Houthi missiles constricting two of the world’s major transit points, the Panama and Suez Canals, the pre-Christmas narrative of waning inflation and lower US interest rates proved a harder sell during the week ending Jan. 17. Inflation Protected Bond Funds, which recorded only two inflows between September 2022 and the final month of 2023, chalked up their second of the New Year while US Equity Funds posted consecutive weekly outflows for the first time since mid-August.

Investors searching for points of light continue to gravitate towards Asia-mandated Equity Funds, US Sovereign Bond Funds and Technology Sector Funds.

It was a mixed week for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. SRI/ESG Bond Funds extended their longest inflow streak since mid-2Q23 as they posted their second-largest inflow over the past 11 months. But redemptions from SRI/ESG Equity Funds hit a 42-week high as eight funds saw over $100 million pulled out.

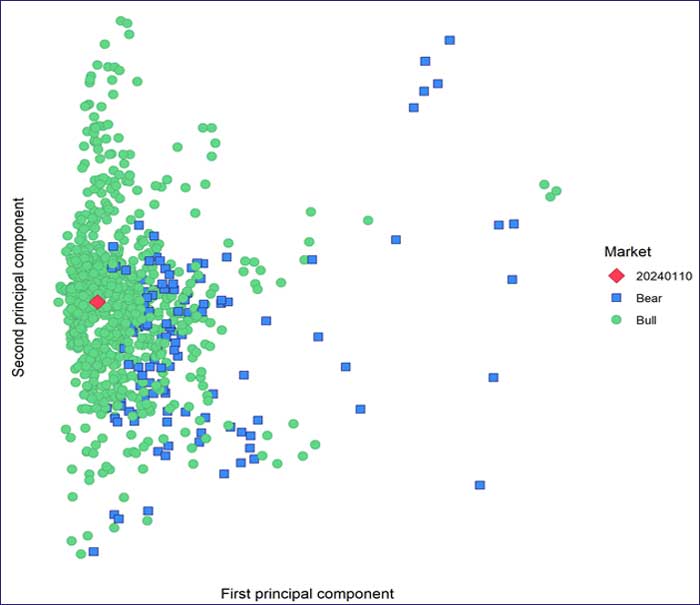

Investor sentiment, although cooling, is not yet signaling a major correction. The latest data point of EPFR’s Bear Detector, which uses principal component analysis of factors derived from the company’s databases, rests squarely in the bullish zone.

Overall, EPFR-tracked Bond Funds absorbed another $14.1 billion during the latest week while investors redeemed $32 million from Alternative Funds, $944 million from Equity Funds, $1.72 billion from Balanced Funds and $14.1 billion from Money Market Funds.

At the single country and asset class fund levels, Japan Money Market Funds posted their biggest inflow since mid-2Q15, flows into Finland and Greece Equity Funds hit 12 and 27-week highs, respectively, and Vietnam Bond Funds extended an inflow streak that began in late August. Cryptocurrency Funds attracted fresh money for the 16th straight week while Physical Gold Funds recorded their seventh outflow over the past eight weeks and Convertible Bond Funds their 29th since the first week of 3Q23.

Emerging markets equity funds

Flows into EPFR-tracked Emerging Markets Equity Funds retained their Asia-centric flavor going into the second half of January. China, India, Korea and Taiwan (POC) Equity Funds all pulled in over $400 million during the week ending Jan. 17 while the biggest inflow recorded by an EMEA or Latin America Country Fund group was the $11.4 million absorbed by Slovak Republic Equity Funds.

For the second week running, Emerging Markets Dividend Funds set a new inflow record as the weekly total broke the $1 billion mark for the first time. EM Collective Investment Trusts (CITs) posted their biggest inflow in over 13 months and Leveraged EM Equity Funds racked up their seventh inflow of the past eight weeks.

Despite the rumblings from China after Taiwanese voters gave the Democratic Progressive Party a third consecutive presidential term, flows into Taiwan (POC) Equity Funds hit an 11-week high. China views the DPP as hostile to its goal of reintegrating Taiwan, which it regards as a renegade province. The latest sector allocations data shows that technology stocks account for nearly two-thirds of the average Taiwan (POC) Equity Fund portfolio versus 14% of the average China Equity Fund.

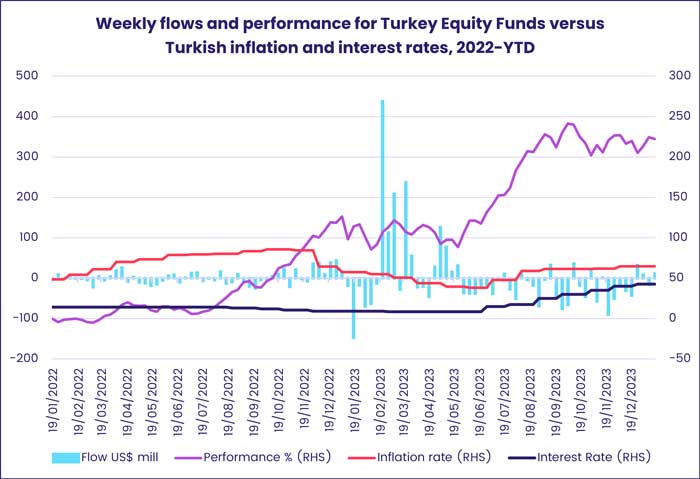

Elsewhere, EMEA Equity Funds posted their 12th outflow since the beginning of 4Q23 as investors weighed the outlook for Middle Eastern markets in light of the Israel-Hamas conflict and attacks on Suez Canal-bound shipping. The week did see Turkey Equity Funds record their third inflow over the past four weeks ahead of the central bank’s first policy meeting of the year on Jan. 25, with markets anticipating that an aggressive hiking cycle that has taken the country’s base rate up to 42.5% is close to peaking.

Latin America Equity Funds extended their longest outflow streak in over eight months as the increasingly cautious projects for the timing and scope of US interest rate cuts weigh on sentiment towards Mexico which – at least nominally – has supplanted China as America’s top trading partner. During the latest week, redemptions from Mexico Equity Funds hit a 34-week high.

Developed markets equity funds

With higher inflation readings for December behind them, a steady stream of earnings reports arriving daily and major central bank meetings ahead, investors maintained their cautious stance towards developed markets equity in mid-January. Japan was the exception, with flows into dedicated Japan Equity Funds hitting a 12-week high. But these were offset by redemptions from US and Europe Equity Funds, resulting in a second consecutive outflow for all EPFR-tracked Developed Markets Equity Funds.

US Equity Funds posted their first consecutive weekly outflows in over four months despite key indexes again testing record highs. Retail share classes continue to bleed money, having posted only five modest weekly inflows over the past 12 months, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest outflow since late 1Q23.

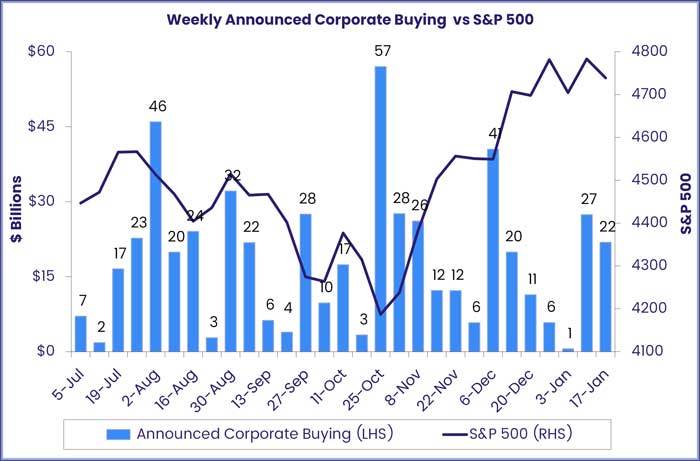

Research by EPFR’s senior liquidity analyst, Winston Chua, indicates that listed US companies are still retiring over $5 worth of existing equity for every $1 in new equity that they issue. There was also a marked jump in cash takeovers during the latest week relative to share buybacks. “Corporate buying has climbed to $50 billion so far this month, with 80% of the volume coming from new cash takeovers,” notes Chua. “Cash mergers are bullish for equity prices, but they can also signal market tops when buying activity becomes extreme.”

Europe Equity Funds posted their third straight outflow as hopes for interest rate cuts from the European Central Bank fade in the pace of rising wages and sticky price data. At the country level, Germany Equity Funds extended a redemption streak stretching back to mid-July, outflows from Italy Equity Funds hit an eight-week high and Spain Equity Funds posted their biggest inflow in just under a year.

The latest headline number for Japan Equity Funds, which came during a week when the benchmark Nikkei-225 index hit a 34-year high, was driven by the largest collective inflow recorded by foreign-domiciled funds since early 1Q18. Flows to overseas domiciled funds were broadly distributed, with 23 individual funds attracting between $20 billion and $293 billion. Japan’s central bank holds its first policy meeting of 2024 early next week.

Global sector, industry and precious metals funds

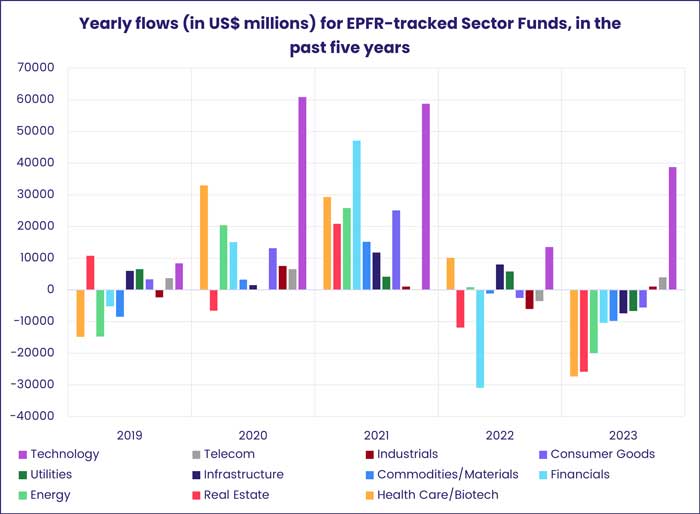

Last year, the week leading into the fourth quarter US corporate earnings season saw six of the 11 major EPFR-tracked Sector Fund groups post an inflow as investors positioned themselves for more positive news. This year, however, expectations of easier monetary conditions that seemed in sight coming into 2024 have faded fast, and only three of the groups – Technology, Industrials, and Healthcare/Biotechnology Sector Funds – attracted fresh money during the week ending Jan. 17.

After a strong 2023, Technology Sector Funds have overcome a rare outflow in the first week of 2024 and have pulled in $4 billion over the past two weeks. During the latest week, Semiconductor Funds snapped a three-week inflow streak while Artificial Intelligence Funds chalked up their 37th inflow of the past 40 weeks, Cybersecurity Funds their second of the past three weeks, and Digital Tech Funds recorded their biggest inflow in nearly four months.

Although Consumer Goods Sector Funds extended their current redemption streak to six weeks and $3.4 billion total, inflows on the final day of the reporting period – their first daily inflow since Dec. 27 – cut the size of this week’s outflow by more than half. Funds dedicated to the makers of these goods also had a better week. After hefty redemptions last week, Industrials Sector Funds posted a six-week high inflow boosted by the largest inflows for US-dedicated funds since early August.

A group that saw redemptions rocket to an all-time yearly high of $27.3 billion last year, Healthcare/Biotechnology Sector Funds, extended their latest inflow streak to three weeks and nearly $800 million. While last week’s inflow soared to a 20-week high on the back of US and China-dedicated funds, this week’s headline number was brought down by the first redemptions from US Healthcare/Biotechnology Sector Funds year-to-date.

Bond and other fixed income funds

Investors continued to steer significant sums into US, Europe and Global Bond Funds going into the second half of January against a backdrop of rising tensions in the Middle East, another government funding scramble in the US and several higher-than-expected inflation numbers. Collective flows to all EPFR-tracked Bond Funds exceeded $14 billion for the first time since the first week of 2Q23.

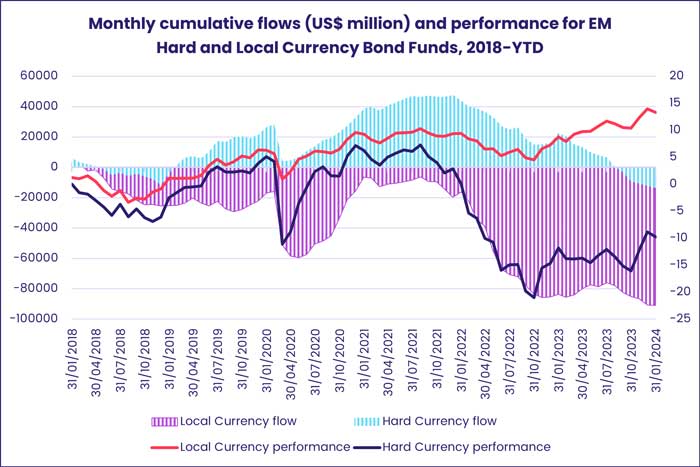

The week ending Jan. 17 did see Emerging Markets Bond Funds experience net redemptions for the 23rd time over the past 25 weeks and Asia Pacific Bond Funds post their fifth largest outflow during the past 12 months.

At the asset class level, Inflation Protected Bond Funds posted their biggest inflow in over four months, High Yield Bond Funds recorded their 10th inflow since the beginning of November, Mortgage Backed Bond Funds took in fresh money for the 11th inflow over the past 15 weeks and flows into Municipal Bond Funds climbed to a 26-week high.

A three-week run of inflows, their longest since mid-2Q23, ended for Emerging Markets Currency Bond Funds as rising tensions in the Middle East put further pressure on already stressed sovereign issuers such as Egypt and Lebanon. Redemptions from China Bond Funds hit a nine-week high as investors digest the bankruptcy of wealth manager Zhongzhi.

Europe Bond Funds recorded their biggest collective inflow since early May of last year as retail share classes pulled in fresh money for the 19th straight week. Funds with corporate mandates posted their largest inflow in over 13 months, with flows favoring investment grades over their high yield counterparts by a 10-to-1 margin. At the country level, redemptions from Italy Bond Funds hit a level last seen in 3Q22 while Spain Equity Funds recorded their biggest inflow since mid-2Q23.

For the third time during the past four weeks, funds with short term mandates were the preferred duration for investors looking to US Sovereign Bond Funds. Foreign domiciled US Bond Funds have started 2024 with three straight inflows, the latest of which was the biggest since late 3Q22.

Global Bond Funds, the largest of the diversified Developed Markets Bond Fund groups, saw inflows climb to their highest level in nearly a year. Funds with fully global mandates took in over 10 times the amount that found its way into Global ex-US Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.