Investors spent the week leading into the Easter holidays digesting the latest round of central bank policy meetings. Their conclusions seem to have eased their minds and increased their risk appetite.

With the US Federal Reserve, European Central Bank, Sweden’s Riksbank and the Bank of England keeping interest rates on hold but talking about easing, the Swiss National Bank actually cutting rates and the Bank of Japan reiterating its continued commitment to accommodative monetary conditions despite ending its negative interest rate regime, the pressure on developed economies from higher borrowing costs looks certain to ease in the coming quarters.

Against this backdrop, EPFR-tracked US Bond and Equity Funds posted the fifth and second-highest weekly inflows year-to-date, respectively, flows into Japan Equity Funds hit their highest level since early 4Q21, and both High Yield Bond and Bank Loan Funds posted their biggest inflows in over four months.

Investors remain leery of Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which racked up their 15th consecutive outflow. But SRI/ESG Bond Funds absorbed fresh money for the 12th time so far this year, with the latest inflow a 102-week high.

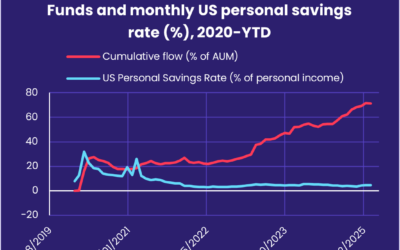

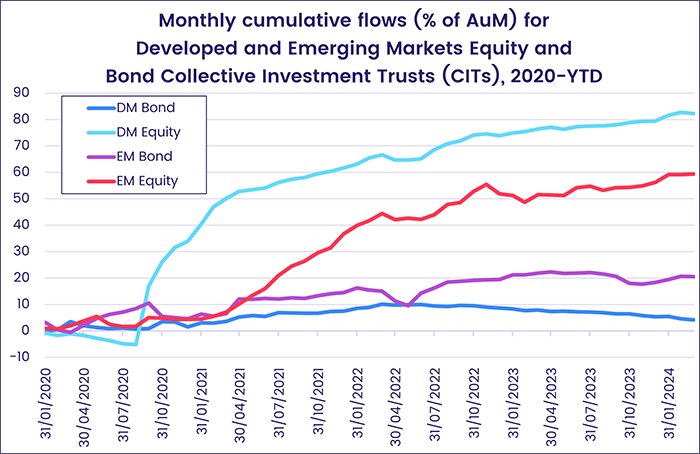

Both Equity and Bond Collective Investment Trusts (CITs) saw a spike in redemptions with outflows from Bond and Equity CITs hitting an eight and 35-week highs, respectively. The collective AUM of these vehicles climbed past the $1 trillion mark last month.

At the single country and asset class fund levels, both Physical Gold and Silver Funds posted outflows, Convertible Bond Funds attracted fresh money for the first time in nearly three months and Inflation Protected Bond Funds chalked up their seventh outflow since the beginning of February. Redemptions from Switzerland Equity Funds climbed to a 26-week high and Vietnam Equity Funds recorded their biggest outflow since mid-3Q23.

Emerging markets equity funds

All four of the major EPFR-tracked Emerging Markets Equity Fund groups by geographic focus posted modest outflows during the fourth week of March as optimism about monetary policy in key developed markets was offset by doubts about the capacity – and willingness – of China and Europe to absorb EM exports.

Europe-domiciled EM Equity Funds experienced their 33rd straight outflow, with the latest redemptions offsetting the biggest flows into US-based funds in over eight months. Japan-domiciled funds, meanwhile, extended an inflow streak stretching back to the beginning of last year.

It was a mixed week for funds dedicated to the major Asian markets. China Equity Funds, despite better macroeconomic data, cheap valuations and the CSI 300’s 15% jump off February’s low, posted a third straight outflow for the first time since early 2Q23 while redemptions from Taiwan (POC) Equity Funds climbed to a 35-week high. But India Equity Funds posted their 54th consecutive inflow and Korea Equity Funds snapped a five-week run of outflows.

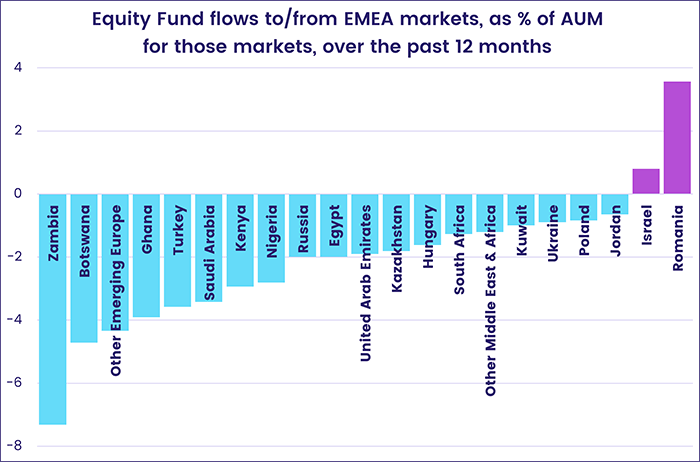

EMEA Equity Funds posted their fourth straight outflow as the markets within the universe continue to navigate a range of headwinds from the conflicts in Ukraine and Gaza to the weakness of the Eurozone economies. Support from diversified fund groups has also faded. Since mid-2019, the average allocation among the diversified Global Emerging Markets (GEM) Equity Funds for EMEA markets has fallen by over a third.

Money flowed out of Latin America Equity Funds for the 111th time so far this year as Brazil Equity Funds chalked up their second biggest outflow of 2024. When it comes to taking on sector exposure, the latest allocations data shows that Latin America Regional Fund managers lifted their average weightings for the financial and utilities sectors to 14 and 43-month highs, respectively, coming into March while the share of commodities stocks fell to a level last seen in June 2020.

Frontier Markets Equity Funds posted their biggest outflow of the year as the keystone market for the group, Vietnam, struggles with the uncertainty generated by the departure of two presidents in less than a year.

Developed markets equity funds

Going into the final days of March, EPFR-tracked Developed Markets Equity Funds took in fresh money for the seventh time during the past two months on the back of strong flows into US and Japan Equity Funds. The latest inflows came as benign interpretations of recent decisions by monetary policymakers helped benchmark equity indexes in both countries climb to fresh record highs.

US Equity Funds recorded a net inflow of over $15 billion despite the first outflows from overseas domiciled funds since mid-December and the 26th straight week of net redemptions from retail share classes. Technology remains by far the biggest single sector allocation for this fund group, with the current weighting more than double that of second-placed financials.

Among Japan Equity Funds, industrial plays have the biggest share of the average portfolio but are being challenged by the consumer discretionary and technology sectors. The latest week’s flows into Japan Equity Funds were the biggest in over 28 months and were broadly distributed, with 30 funds absorbing over $30 million and 14 of those pulling in more than $100 million.

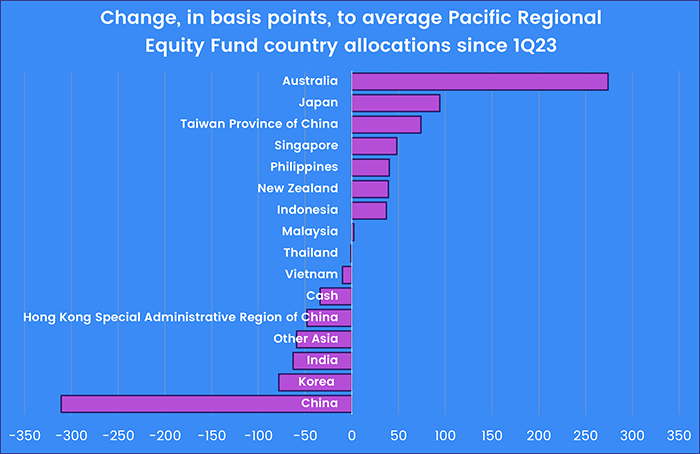

Japan’s weighting among Pacific Regional Equity Funds has climbed by nearly 100 basis points over the past 14 months. But investors looking to the region have been showing a preference for single country exposure, with this group posting outflows during 16 of the past 18 weeks.

In Europe, the benchmark indexes for France and Germany have also hit new record highs this quarter. But that is not translating into increased appetite from investors. During the latest week, Germany Equity Funds racked up their 37th consecutive outflow while money flowed out of France Equity Funds for the ninth time during the past 10 weeks. Fears of Chinese mercantilism, Russian aggression and US isolationism are all weighing on sentiment towards Europe.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, recorded their biggest outflow of the year so far. This group has lost its allure for retail investors. Having posted inflows nine out every 10 weeks between 1Q20 and 2Q22, retail share classes have seen nearly $90 billion flow out since.

Global sector, industry and precious metals funds

With earnings reports slowing to a trickle and the Easter holidays looming, flows to EPFR-tracked Sector Fund groups were a mixed bag that erred on the side of redemptions. Only four out of the 11 major groups recorded inflows during the week ending March 27. Flows into those four ranged from $152 million for Telecoms Sector Funds to $1.56 billion for Technology Sector Funds. But the more interesting narratives belonged to the groups and sub-groups posting outflows.

Redemptions from Healthcare/Biotechnology Sector Funds continued for a second straight week, hitting a 13-week high that was nearly three times bigger than last week’s figure. Dedicated Biotechnology Funds accounted for more than half of the headline number. Other smaller subgroups, like Pharma and Genomics Funds, saw outflows this week, while Medicine and Drug Industry Funds both recorded a second straight week of inflows.

Funds that aim to capitalize on the theme of “ageing population” have not been popular this year. These include funds with aging, longevity, long-term care, and silver age in their name that look to capitalize on the growing cohort of retirees and their needs. The group experienced solid yearly inflows from 2012 to 2021 – except for 2016 – which included a record $650 million in 2015. But for the past three years – as more and more baby boomers exit the work force and head closer towards retirement – Aging/Longevity Funds have suffered consistent outflows.

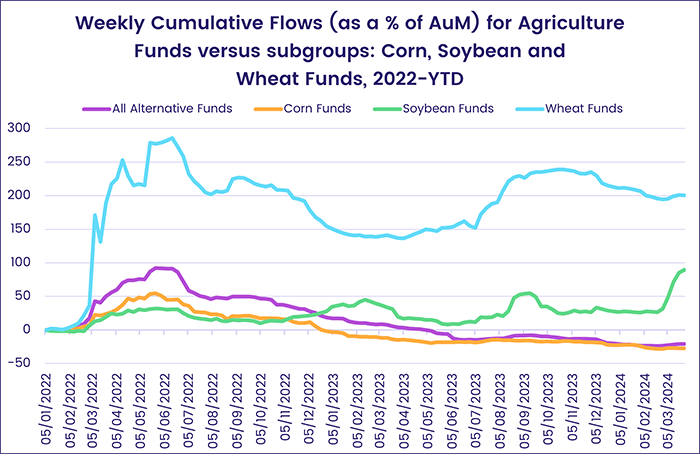

Although Commodities/Materials Sector Funds racked up another outflow, one subgroup has been gaining momentum. Agriculture Funds, which have a presence in both the Equity and Alternative Fund universes, are seeing those under the latter umbrella gain traction. These funds, which invest in specific crops – wheat, corn, soybeans, etc. – rather than diversified agricultural businesses and their output, were boosted by Russia’s invasion of Ukraine and the effect that had on the price of several major crops. Investors pumped over $360 million (roughly 160% of assets) into Wheat Funds in the month post February 2022, boosting the overall assets managed by Agriculture Funds by 42% of assets, and added another $250 million up until mid-June.

Recently, Soybean Funds have seen four straight weeks of above average inflows, after much of the past 20 weeks in negative territory, and Wheat Funds have seen three straight weeks of inflows.

After eight straight weeks of outflows costing the group $4 billion, Financials Sector Funds posted an inflow during the final week of March. Contributing to this week’s headline number were US-dedicated funds, and the biggest inflows for Europe Regional and China Financials Sector Funds since late January 2023 and late December, respectively.

Bond and other fixed income funds

With current yields on better quality debt expected to start drifting lower in the second half of the year, investors have continued to steer large sums into EPFR-tracked Bond Funds while those yields are still on offer. Going into the second quarter, year-to-date flows climbed past the $200 billion mark.

The latest week saw risk appetite increase when it came to developed markets assets while Emerging Markets Bond Funds posted their biggest outflow since the first week of 4Q23. Investors steered over $3 billion into Global Bond Funds for only the second time during the past 28 months, committed fresh money to US and Europe Bond Funds for the 14th and 21st consecutive week, respectively, and snapped Asia Pacific Bond Funds latest outflow streak.

At the asset class level, flows into High Yield and Bank Loan Funds during the fourth week of March hit 20-week highs, Mortgage-Backed Bond Funds posted their biggest weekly inflow in over five months, Convertible Bond Funds chalked up their biggest inflow since mid-4Q22 and Municipal Bond Funds enjoyed their largest influx of fresh money in eight months.

A fifth of the headline number for all Europe Bond Funds was attributable to a single country fund group, Denmark Bond Funds, which absorbed over $500 million for the second time in the past six weeks. Retail share classes recorded net inflows for the 29th week running and Europe Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest inflow since mid-3Q23.

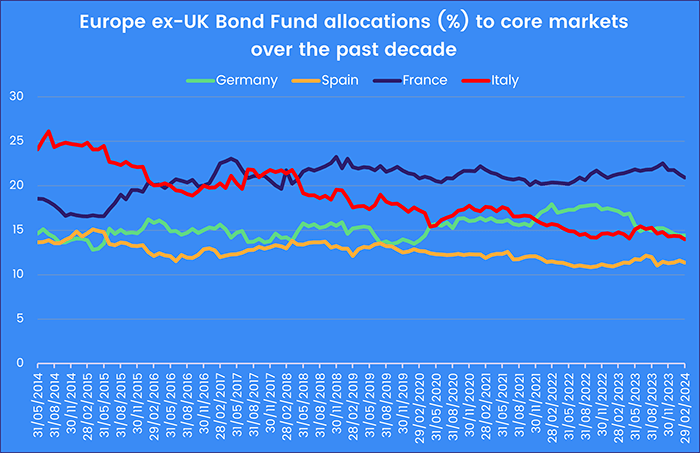

When it comes to country exposure, managers of Europe ex-UK Regional Bond Funds have cut their allocations for core markets and cash while boosting them for the Netherlands, Switzerland and Ireland. The 300 basis point difference between allocations for Germany and Italy in early 4Q22 has shrunk to 54 basis points.

US Bond Funds enjoyed solid inflows, with investment grade funds taking in $2 for every $1 committed to US High Yield Bond Funds. Funds with corporate mandates fared better, in flow terms, than their sovereign counterparts for the third time since the beginning of the month. Leveraged US Bond Funds posted their first inflow since the third week of February and their biggest since the second week of the quarter.

Diversified Emerging Markets Local Currency Bond Funds made the biggest contribution to the overall group’s headline number. At the country level, redemptions from China and Thailand Bond Funds hit 10 and 11-week highs, respectively.

Did you find this useful? Get our EPFR Insights delivered to your inbox.