August started with a major market correction triggered by shifting dynamics in the yen carry trade and some mediocre US labor market data. On August 5, Japan’s benchmark Nikkei-225 stock index recorded its biggest one-day drop since 1987. Major US indexes, meanwhile, found themselves 6-11% off their mid-July highs.

Flows to and from EPFR-tracked funds during the first week of August indicated a willingness on the part of equity investors to buy into these dips. Collectively, Equity Funds absorbed a net $9.7 billion with US, Japan, China, Taiwan (POC) and Global Equity Funds the biggest contributors to the headline number. The money also continued to roll into Technology Sector Funds, which attracted over $3 billion.

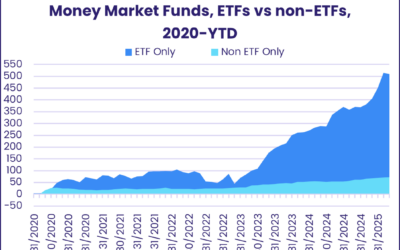

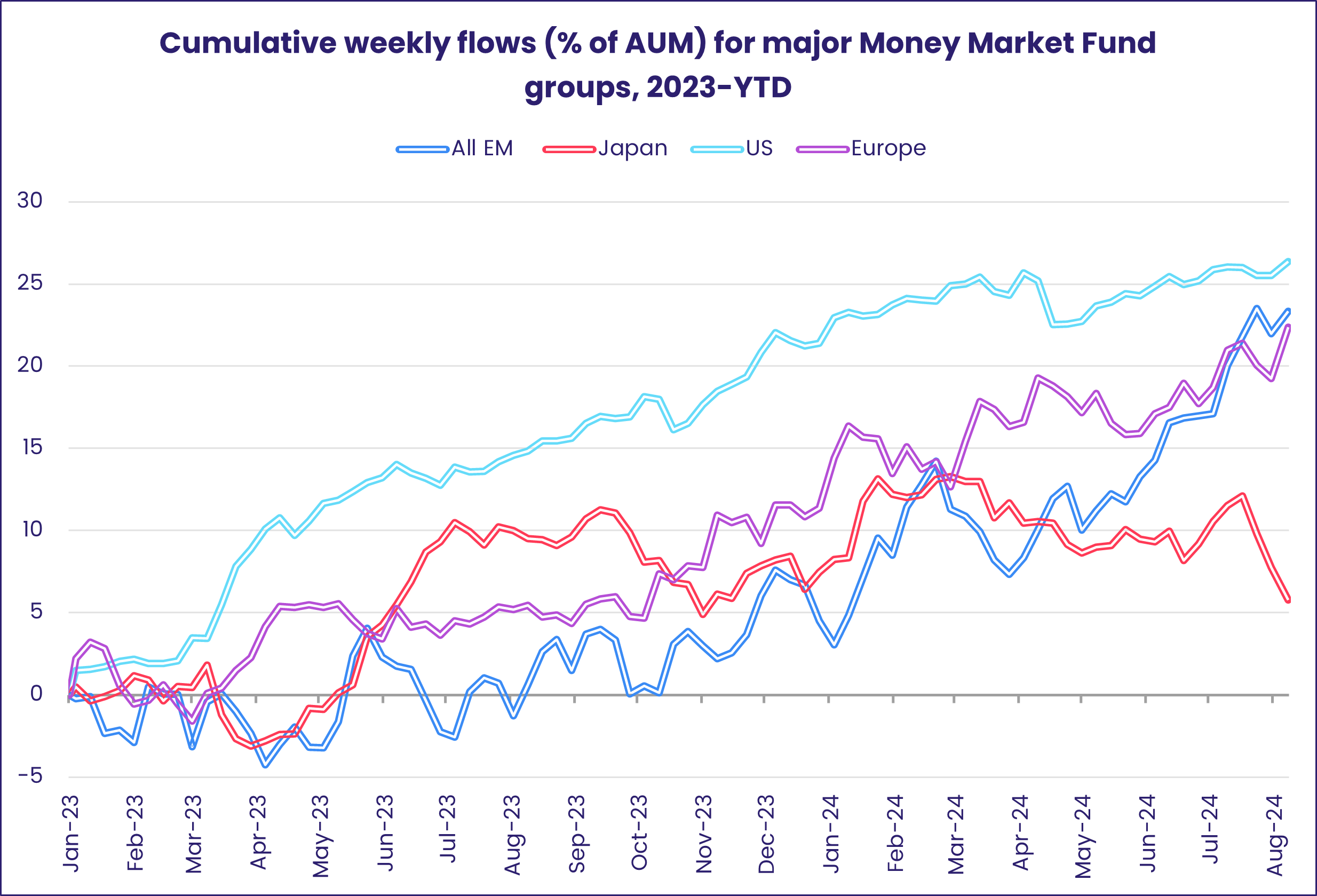

Total flows into Bond Funds were comparable – $10.1 billion – but included the biggest outflows from High Yield and Bank Loan Funds since early 4Q23 and late 1Q20, respectively. The week was also marked by a move to cash with Money Market Funds posting their biggest collective inflow since early April.

At the single country and asset class fund level, Physical Gold Funds saw their longest inflow streak since mid-2Q23 come to an end, Mortgage-Backed Bond Funds chalked up their first outflow year-to-date and flows into Municipal Bond Funds climbed to an 82-week high. Japan Money Market Funds posted a third consecutive outflow for the first time since mid-4Q23, Japan Bond Funds saw their biggest inflow in over four months, redemptions from New Zealand Equity Funds hit a 20-week high and South Africa Money Market Funds set a new inflow record.

Emerging Markets Equity Funds

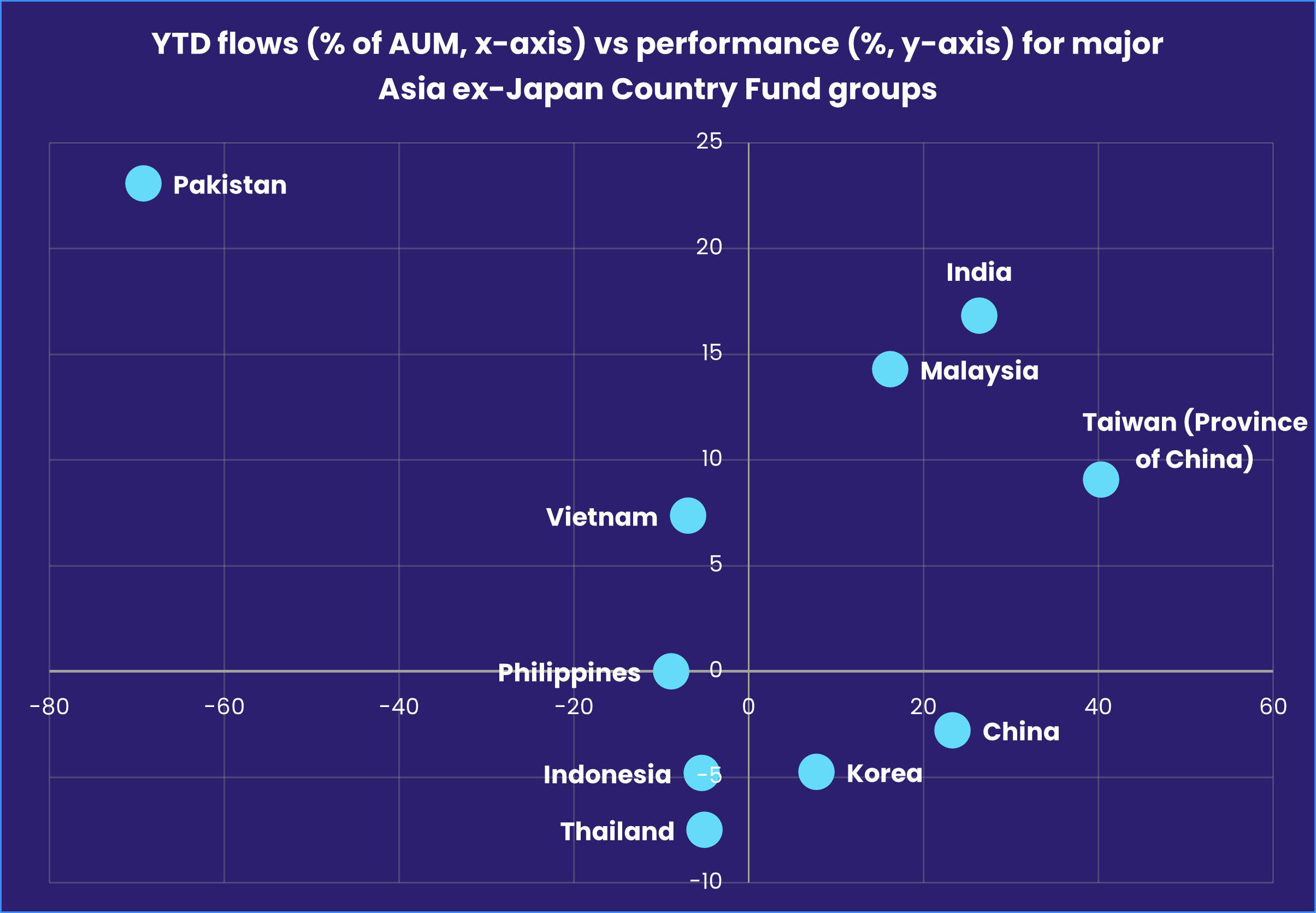

China and Taiwan (POC) Equity Funds drove EPFR-tracked Emerging Markets Equity Funds to another inflow – their 10th in a row – during the first week of August. The flows into these and other major Asia ex-Japan Country Fund groups offset outflows from Global Emerging Markets (GEM), Latin America and EMEA Equity Funds that hit 16, 17 and 42-week highs, respectively.

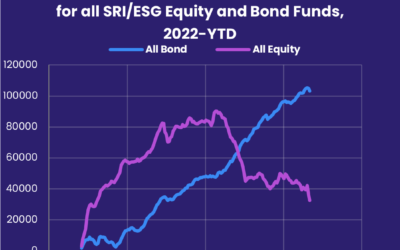

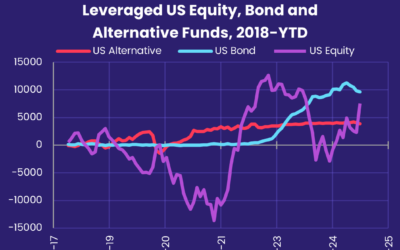

The market turmoil did not stop flows into Leveraged EM Funds from climbing for the fourth week running to their highest level since late 1Q19, and flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates hit a one-year high.

The latest flows into China Equity Funds took their year-to-date total over the $75 billion mark. During the same period last year, they had absorbed a net $50 billion. With property prices still under pressure and banks trimming the interest rates they pay on retail deposits, China’s equity markets are the best available option for many domestic investors.

Taiwan (POC) Equity Funds, meanwhile, continue to enjoy a strong tailwind from the island’s position in the global artificial intelligence supply chain. The group has now posted inflows 17 of the past 18 weeks and Taiwan’s average allocation among GEM and Global ex-US Equity Funds is currently at record highs.

Although India Equity Funds extended their current inflow streak, the total was the lowest since the week ending May 3, 2023. The recent 2024-25 budget introduced a number of changes to the taxation of mutual funds and ETFs that included higher taxes on both short and long-term gains.

Flows into EMEA Equity Funds stalled in early August as concerns about US, Chinese and European growth hit oil prices and the outlook for European convergence plays. Saudi Arabia Equity Funds posted their first outflow since late June, Romania Equity Funds saw their 39-week inflow streak come to an end as they chalked up their biggest outflow in over two years and redemptions from Turkey Equity Funds climbed to a 36-week high.

Latin America Equity Funds posted another collective outflow as high US interest rates continue to limit the scope for regional central banks to cut their own rates.

Developed Markets Equity Funds

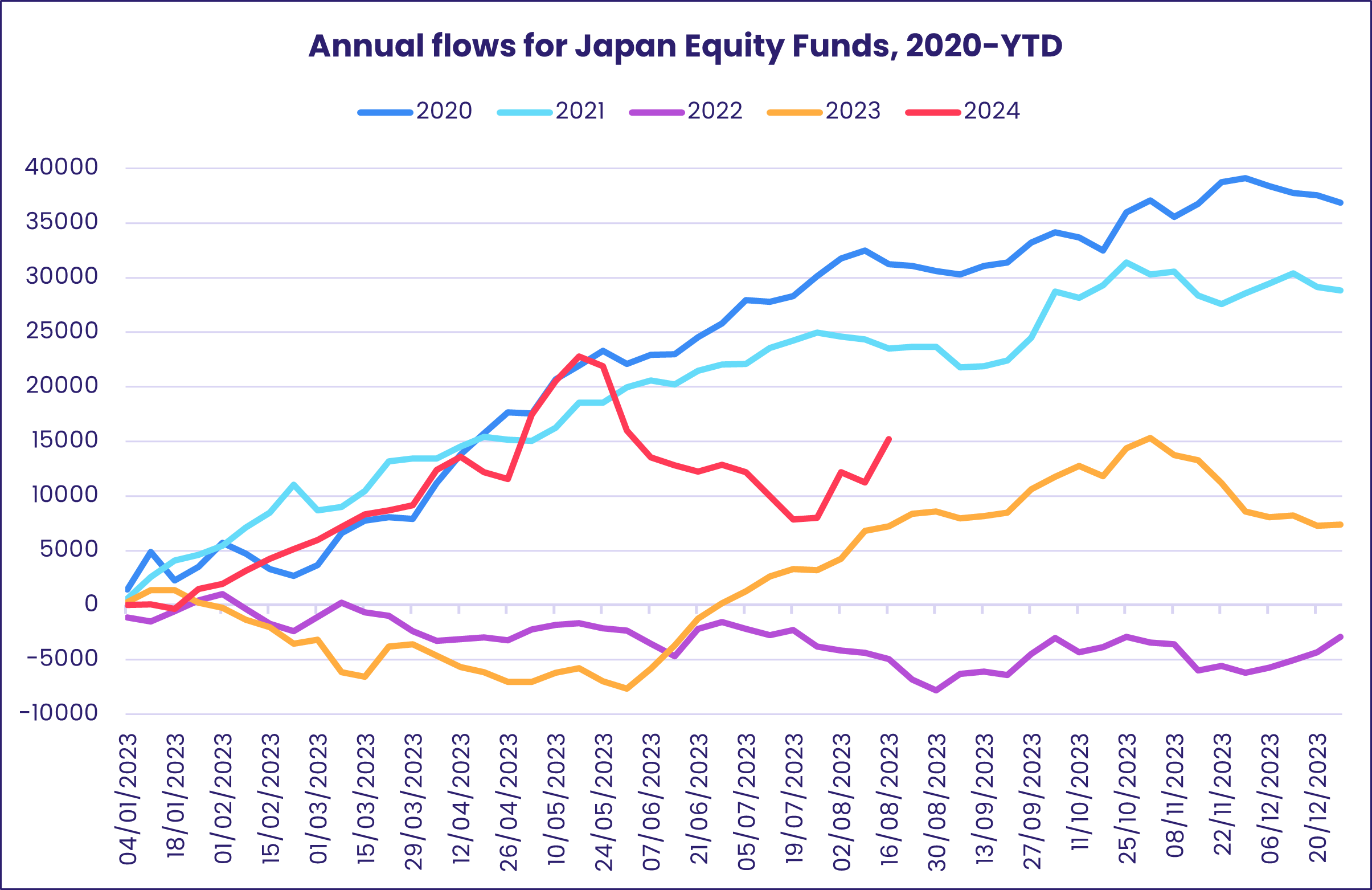

EPFR-tracked Developed Markets Equity Funds started August by posting their 16th consecutive inflow as investors – in the case of the US and Japan – looked past the sharp correction experienced by global stock markets. Combined flows into US and Japan Equity Funds totaled $10 billion while Europe, Global and Canada Equity Funds surrendered $2.8 billion between them.

Japan Equity Funds posted their third largest inflow so far this year, with domestically-domiciled ETFs absorbing the lion’s share of the latest inflows during a week when the country’s benchmark stock index recorded its biggest one-day decline since 1989. Flows into retail share classes hit their highest level since the third week of 4Q18, when domestic investors turned for home amidst a technology sector, populist politics and tariff-fueled market sell-off around the globe.

US Equity Funds added to their current inflow streak as market expectations for US interest rate cuts from September to the end of the year ballooned from 25 basis points to 125 basis points. Funds with large cap mandates absorbed the bulk of the latest inflows while Small Cap US Equity Funds, which carried their longest inflow streak since early 1Q24 into August, posted their biggest collective outflow in over four months. Investors remain willing to stretch for additional performance, with Leveraged 3X Funds attracting over $2 billion for the second week running.

Although the central banks of Sweden, Norway, Switzerland, the UK and the Eurozone are already at least one rate cut into their easing cycles, Europe Equity Funds chalked up their 29th outflow of 2024. Net redemptions hit their highest level since late 3Q23 as Germany flirts with recession, French lawmakers remain unable to cobble together a new government and the risks of a trade war with China over electric vehicles continue to mount.

At the country level, France Equity Funds took in fresh money for the seventh straight week while redemptions from UK Equity Funds climbed to a four-week high. Greece Equity Funds chalked up their ninth consecutive outflow and redemptions from Spain Equity Funds hit their highest level in over three months.

The major diversified Developed Markets Equity Fund groups struggled in early August, with investors pulling money out of Global, Pacic Regional, Europe Regional and Europe ex-UK Equity Funds. Only Global ex-US Funds attracted meaningful inflows.

Global sector, Industry and Precious Metals Funds

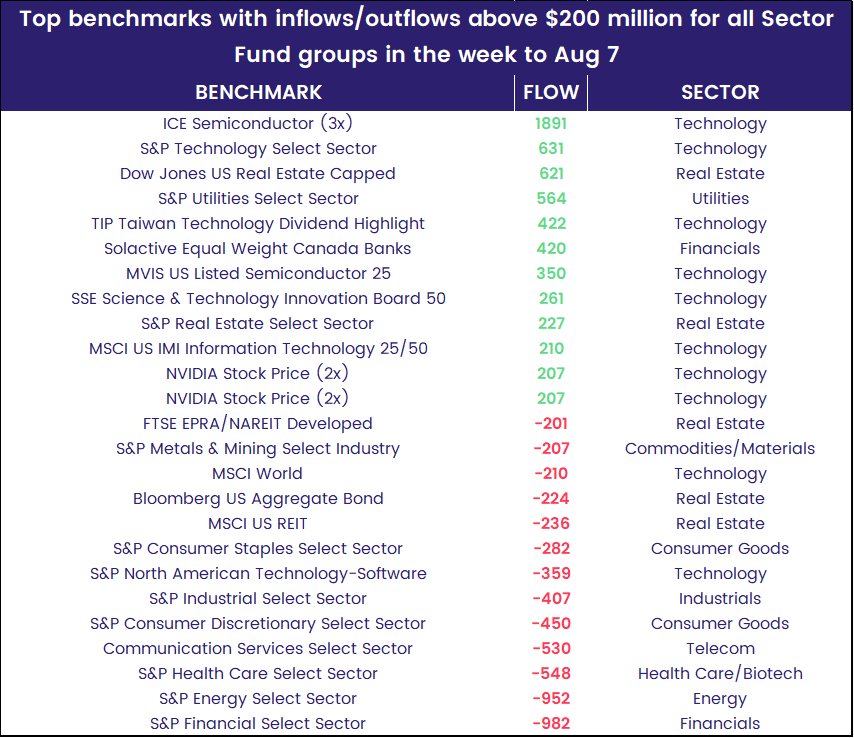

Sector-oriented investors were drawing a red line through their portfolios in the first week of August, with redemptions for three EPFR-tracked Sector Fund groups exceeding $1 billion. Consumer Goods and Financials Sector Funds posted their biggest outflows in 25 and 40 weeks, respectively, while redemptions for Energy Sector Funds exceeded $1 billion for the fourth time during the past two months.

Five more groups posted outflows, leaving Technology, Utilities and Real Estate Sector Funds as the only groups to tally an inflow. Flows into Real Estate Sector Funds climbed to a 20-week high. Of the top 10 benchmarks carrying the most weight among this group, three tied to Dow Jones absorbed over $700 million and another $200 million was committed to an S&P index, while redemptions over $200 million each from those with ties to MSCI, Bloomberg and FTSE brought the headline number down.

Looking at the top 20 benchmarks with the biggest inflows or outflows across all sector groups for the week ending August 7, which was a tumultuous one for global markets, S&P appeared 10 times for those with redemptions but just five times for those in positive territory. The chart below shows aggregate flows for the most influential benchmarks during the latest week.

Investors poured more money into Utilities Sector Funds as the group extended their longest inflow streak since mid-2Q23. The group has seen inflows during 11 of the past 15 weeks, a reverse of the prior 15 consecutive weeks that were marked by consistent outflows.

Healthcare/Biotechnology Sector Funds were in a favorable position as of Monday’s figures but combined redemptions on the final two reporting days of over $1 billion sent the headline number into negative territory. That included their heaviest daily outflow since mid-March. Biotechnology Only Funds snapped a two-week inflow streak.

Bond and other Fixed Income Funds

Flows into EPFR-tracked Bond Funds remain on track to challenge the full-year record set in 2021 as investors steered another $10 billion into the overall group during the first week of August. But those investors showed a marked preference for exposure to sovereign, investment grade and developed markets debt classes over funds with high yield, corporate and emerging markets mandates.

Among the major geographic groups, US Bond Funds racked up their 55th straight inflow, Europe Bond Funds’ year-to-date total climbed by another $2.5 billion to 82% of the full-year record, flows into Asia Pacific Bond Funds climbed to a 23-week high and Global Bond Funds extended an inflow streak stretching back to the third week of March.

At the asset class level, Bank Loan Funds racked up their biggest outflow in over four years, redemptions from High Yield Bond Funds climbed to a 44-week high and Mortgage-Backed Bond Funds recorded their only outflow of 2024 while Municipal Bond Funds posted their biggest inflow in over 18 months.

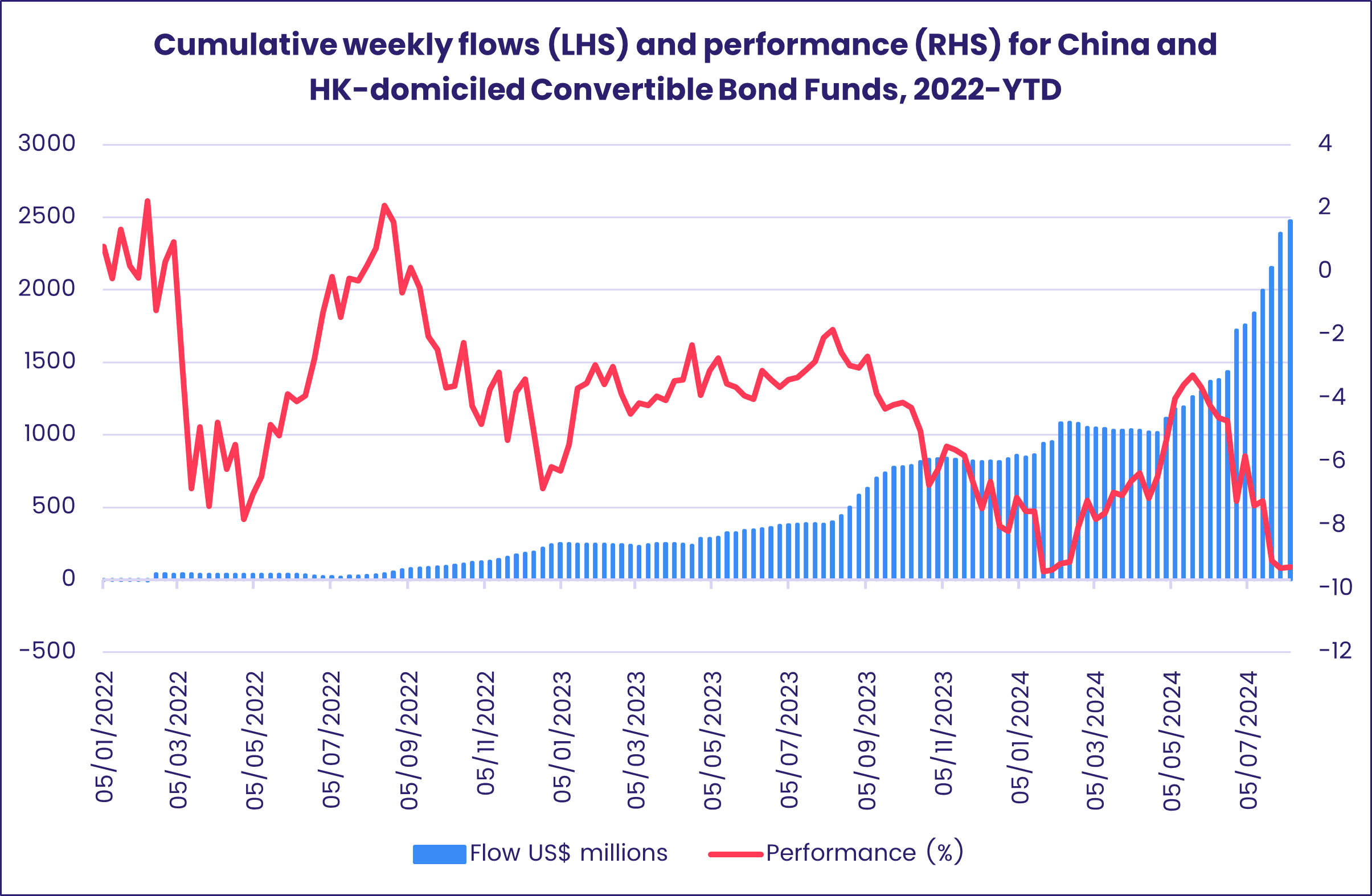

Once again, outflows from Emerging Markets Hard Currency Funds offset flows into ones with local currency mandates. In the case of the latter, strengthening appetite for exposure to Chinese debt has been a key driver. The latest inflows to China Bond Funds were the largest since mid-1Q22. There has also been a marked increase in demand for Chinese convertible bonds.

Japan Bond Funds absorbed fresh money for the seventh week running, with the latest inflow the biggest since late February, as markets and investors digest the Bank of Japan’s latest interest rate hike.

Flows into Europe Bond Funds favored Germany frugality over the new British government’s plans for additional spending. Flows into Germany Bond Funds hit their highest level in nearly a year while UK Bond Funds posted their biggest outflow since mid-June. Europe Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates remain popular, posting their 31st inflow year-to-date.

Flows into US Bond Fund retail share classes hit their highest level since early February as investors of all stripes gravitated towards funds with sovereign rather than corporate mandates. US Long Term Bond Funds took in fresh money for the 19th week running, but the net inflow was the smallest since that run began.

Did you find this useful? Get our EPFR Insights delivered to your inbox.