Two weeks after global markets corrected sharply, fund flows have regained much of their previous shape.

With inflation and retail spending data keeping hopes of both September rate cuts and a soft landing in play, combined flows into US Equity, Bond and Money Market Funds during the second week of August totaled over $40 billion. Also seeing fresh money were China and India Equity Funds, Cryptocurrency Funds, Japan Equity Funds and Technology Sector Funds.

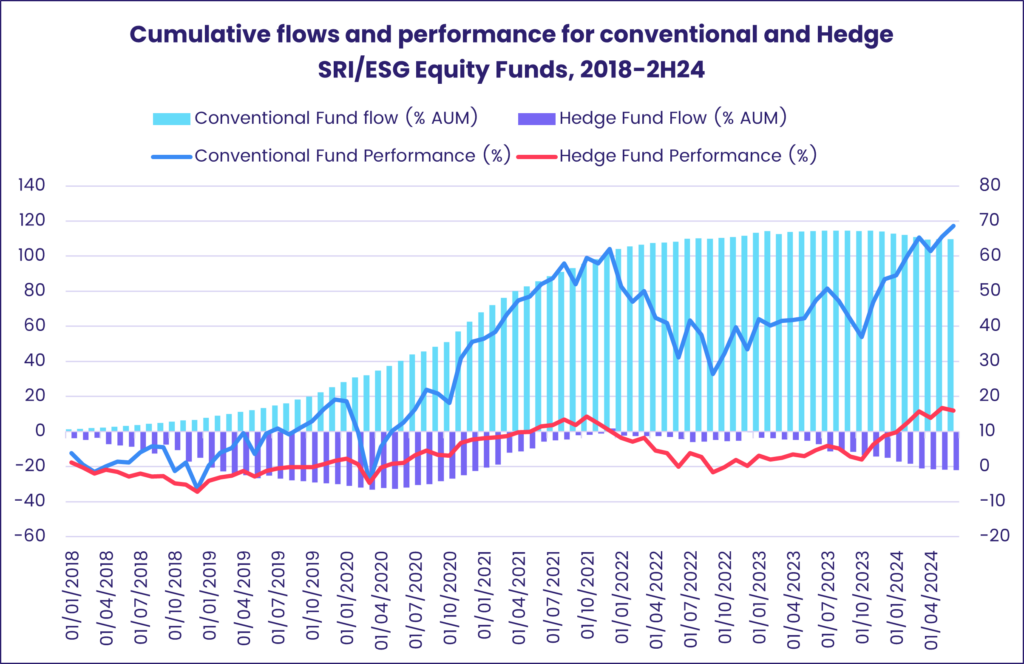

Risk appetite among fixed income investors continued to lag their equity counterparts, and it was also another tough week for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. SRI/ESG Equity Funds posted their biggest collective outflow since late April while redemptions from SRI/ESG Bond Funds hit their highest level since late 1Q20. In the case of the latter, however, the headline number reflects the liquidation of three of a UK Corporate Bond Fund’s share classes.

Overall, the week ending August 14 saw EPFR-tracked Equity Funds absorb a net $11.5 billion as Dividend Equity Funds extended their longest inflow streak since 2H22. Bond Funds pulled in $6.3 billion and Money Market Funds $27.5 billion. Investors pulled a net $52 million from Alternative Funds and $1 billion from Balanced Funds.

At the asset class and single country fund level, France Equity Funds took in fresh money for the eighth straight week, France Bond Funds posted their biggest outflow since mid-4Q23, redemptions from Brazil Bond Funds hit a 19-week high and Turkey Money Market Funds posted their 17th consecutive inflow. Convertible Bond Funds experienced their biggest outflow in three months, Bank Loan Funds posted a third consecutive outflow for the first time since mid-2Q23 and flows out of Mortgage Backed Bond Funds climbed to a 33-week high.

Emerging Markets Equity Funds

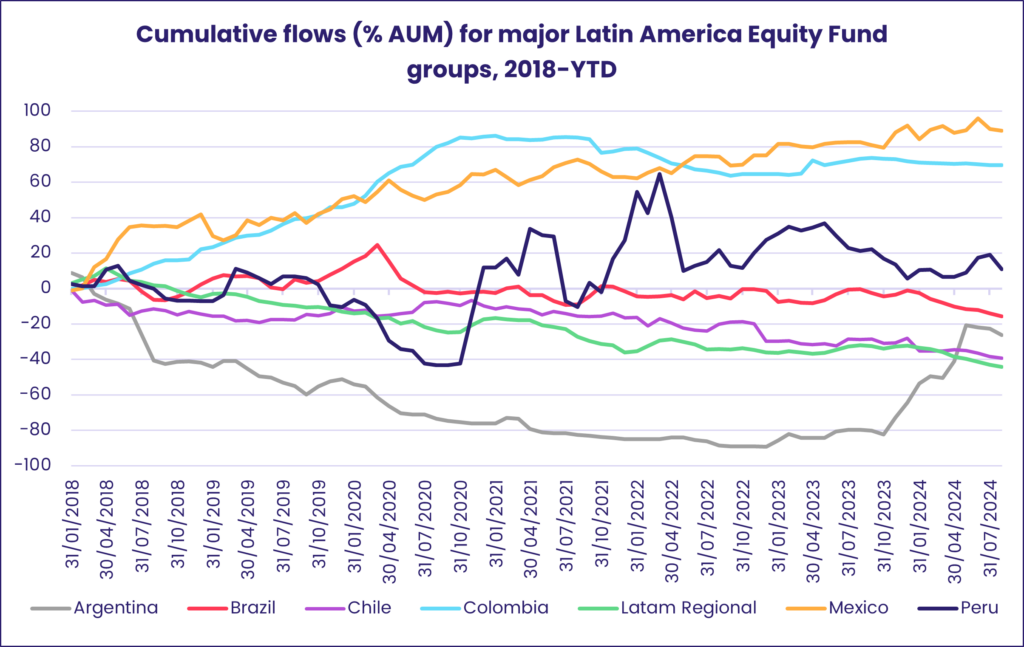

The week ending August 14 saw EPFR-tracked Emerging Markets Equity Funds record their 11th straight inflow. Once again, flows into China, India and Taiwan (POC) Equity Funds underpinned the headline number, which stayed in positive territory despite further outflows from Latin America, Frontier Markets and Global Emerging Markets (GEM) Equity Funds and the heaviest redemptions from retail share classes in over four months.

EM Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest run of inflows since mid-3Q23 while Leveraged EM Funds and EM Dividend Funds chalked up their ninth and 11th consecutive inflows.

Also seeing inflows were EMEA Equity Funds as investors rebuilt the South African positions that they cut in the run up to that country’s general election in late May. The coalition government that emerged from that election, which ended the African National Congress’s legislative majority, has so far exceeded admittedly modest expectations. The latest flows into South Africa Equity Funds were the largest since EPFR started tracking the group weekly in 2000.

Latin America Equity Funds, meanwhile, posted their ninth consecutive outflow as concerns about Chinese demand, US interest rates and regional policy making continue to weigh on investor sentiment towards the region. In the case of Brazil, inflation shows signs of regaining momentum and pushing the central bank to hike interest rates.

China Equity Funds pulled in nearly $700 million during the latest week against a challenging economic backdrop for the world’s second-largest economy. Chinese policymakers are wrestling with a range of issues that include trade tensions, a struggling property sector and caution on the part of domestic consumers.

Among Asia ex-Japan Country Fund groups dedicated to the region’s smaller markets, Vietnam Equity Funds posted their 28th outflow so far this year and Thailand Equity Funds extended a redemption streak stretching back to the second week of January. Shake-ups in the governments of both countries have prompted investors to pull back until the direction of travel becomes clearer.

Developed Markets Equity Funds

Global and Europe Equity Funds joined the post-correction rebound party during the second week of August, helping US and Japan Equity Funds propel EPFR-tracked Developed Markets Equity Funds to their 17th straight collective inflow.

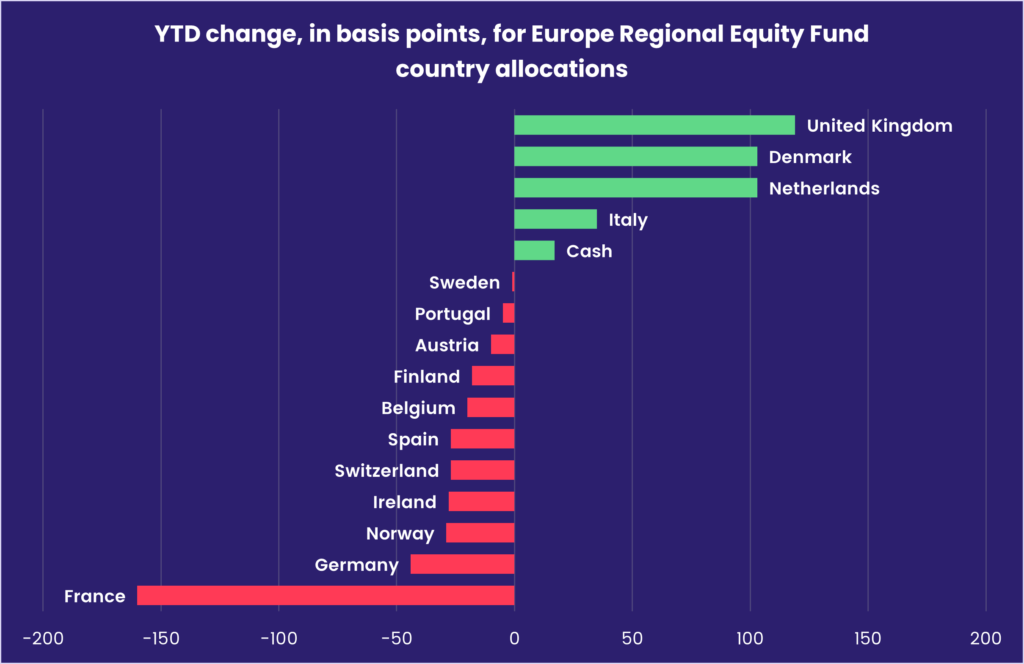

The inflow recorded by Europe Equity Funds was the first since the second week of May and only the 10th over the past 24 months. Europe ex-UK Regional and dedicated Switzerland Equity Funds were the biggest contributors to the headline number during a week when fears of slowing growth in key export markets, the US and Japan, ebbed.

At the country level, France Equity Funds recorded another weekly inflow as the Paris Olympics wound down and the question of forming a new government moved back into the spotlight. UK Equity Funds, meanwhile, experienced further redemptions despite decent growth and inflation data. Investors are taking a different cross-channel tack from Europe Regional Equity Fund managers, who have been rotating exposure from France to the UK.

While investors looking to Europe are willing to take on some diversified exposure, those focused on Asia again showed a preference for dedicated Australia and Japan Equity Funds while Asia Pacific Regional Funds chalked up their sixth outflow since early July and their biggest since early March.

Japan Equity Funds picked up tailwinds from the Bank of Japan’s dovish comments, better-than-expected second quarter GDP growth and unpopular Prime Minister Fumio Kishida’s decision to step down. Foreign domiciled funds racked up their biggest inflow since early April.

Flows into US Equity Funds favored ETFs over actively managed funds and Large Cap Blend Funds over other combinations of capitalization and investment style. Flows into Leveraged US Equity Funds faltered, US Dividend Equity Funds added to their longest inflow streak since 3Q22 and US Equity Collective Investment Trusts (CITs) snapped a three-week run of outflows.

Global sector, Industry and Precious Metals Funds

During the week ending August 14, six of the 11 EPFR-tracked Sector Fund groups attracted fresh money ranging from $131 million for Real Estate Sector Funds to $2.98 billion for Technology Sector Funds. Flows were consistent with the previous week for all but three groups – Financials, Healthcare/Biotech and Industrials Sector Funds – as they moved into positive territory. For the second time in the past four weeks, redemptions for Energy Sector Funds were the heaviest of all groups.

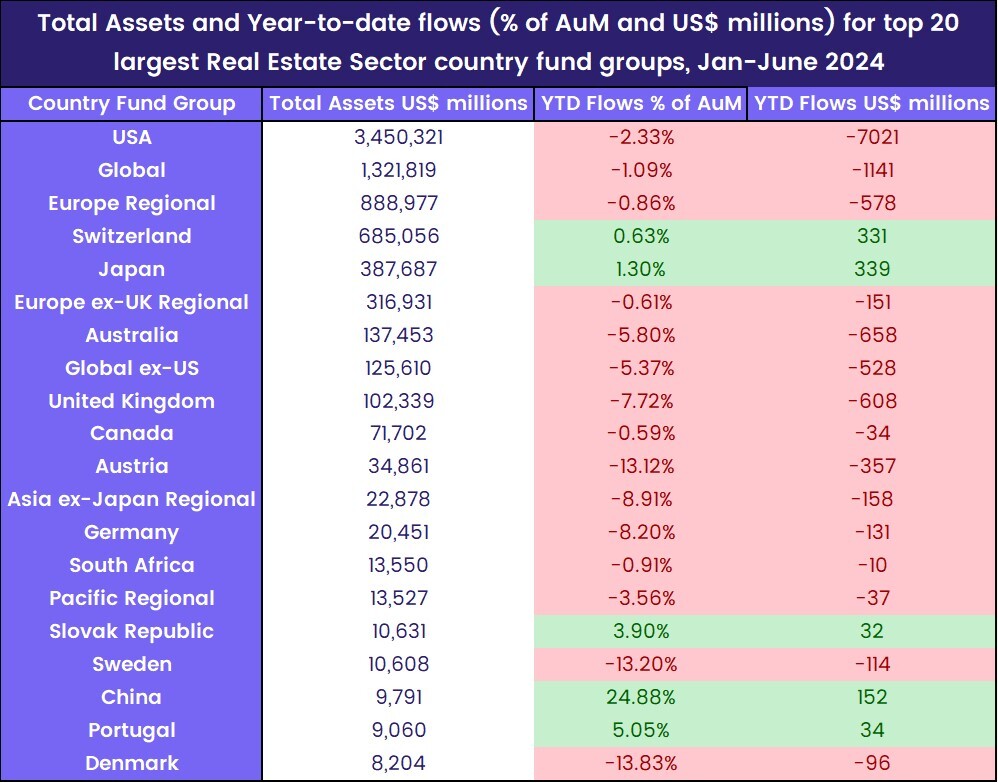

Real Estate Sector Funds remained in positive territory for a third straight week, making up for the previous heavy week of outflows. EPFR’s Head of Analytics and Quant Strategies, Steven Shen, reflected in the latest webinar how “China Real Estate Sector Funds have experienced a resurgence in investment supported by recent policy measures aimed at stabilizing the market and addressing the liquidity issues faced by the major developers. The Chinese government’s efforts to boost the housing market has renewed investor confidence and have driven significant inflows into real estate funds.” China Real Estate Sector Funds have posted four consecutive months of inflows, attracting $152 million (or nearly 25% of assets) year-to-date – one of the few groups to receive inflows.

Flows into Financials Sector Funds hit a four-week high with the help of a single SPDR ETF that pulled in over $870 million (2.2% of the fund’s assets). In terms of relative flows, a single US Preferred Stock and Hybrid Security ETF added 193% of assets, or $57 million.

Industrial Sector Funds snapped a three-week redemption streak that cost the group $853 million, bringing in just their second inflow of the past eight weeks. Flows for Aerospace & Defense Funds climbed to an eight-week high, and Construction Funds extended their inflow streak to four weeks, the longest run in over two months.

After a 19-week run where Healthcare/Biotechnology Sector Funds suffered outflows during 17 of those weeks, the group has seen two inflows in the past three weeks. Dedicated Biotechnology Funds accounted for nearly 65% of the overall headline number this week. While looking at a more granular level, the custom groupings of Medicine and Pharma Funds have been getting more attention this year, with inflows north of $150 and $435 million year-to-date.

Utilities Sector Funds extended their longest streak of inflows since late 3Q22, absorbing $1.84 billion in just five weeks. A single passively-managed US ETF attracted a lion share of the headline number this week, while four of the bottom six funds with the heaviest outflows were water-related.

Bond and other Fixed Income Funds

Year-to-date flows into EPFR-tracked Bond Funds climbed within striking distance of the $500 billion mark during the second week of August. But, in contrast to previous weeks, US Bond Funds were the only major geographic group to attract meaningful inflows. Global, Asia Pacific Emerging Markets and Europe Bond Funds all posted collective outflows that, in the case of the latter two groups, were the biggest in 11 and 97 weeks, respectively.

At the asset class level, investors again kept their distance from riskier groups. Another $481 million flowed out of Bank Loan Funds while High Yield Bond Funds posted consecutive weekly outflows for only the third time in the past eight months. Redemptions from all Mortgage Backed Bond Funds climbed to a 33-week high, although Collateralized Debt Obligation Funds bounced back from their first outflow in well over a year, and Convertible Contingent (CoCo) Bond Funds recorded their biggest outflow since mid-April.

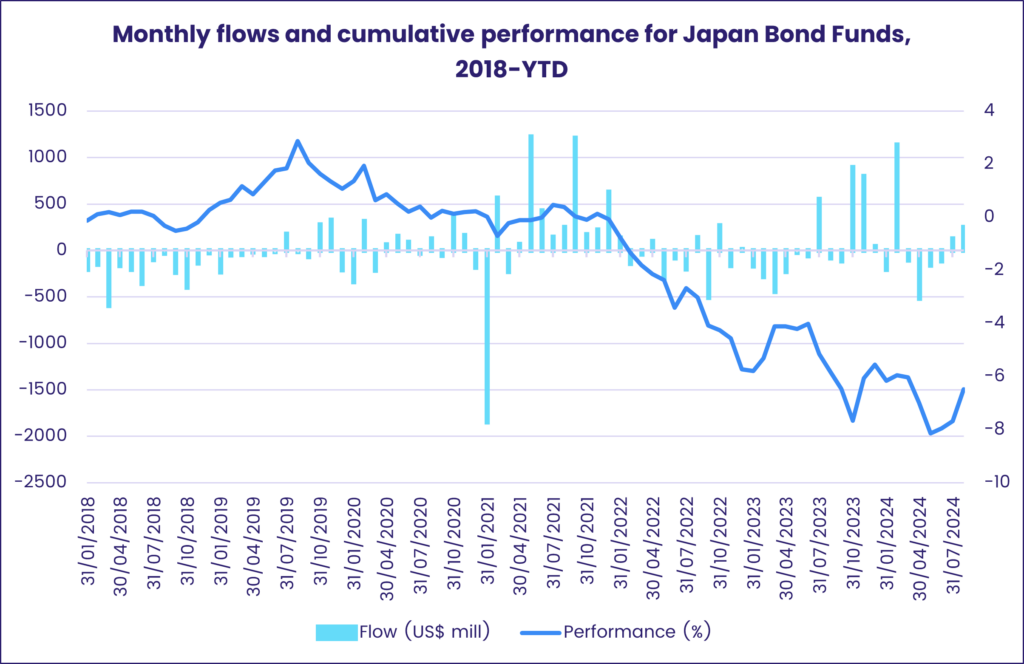

Japan Bond Funds, which posted their biggest inflow in over six months on the heels of the Bank of Japan’s latest rate hike, saw two thirds of that money flow out during the latest week as the BOJ soft-pedalled the pace of future hikes. Australia Bond Funds, meanwhile, extended an inflow streak stretching back to early April.

The headline number for Europe Bond Funds was colored by the liquidation of several share classes previously offered by a UK Corporate Bond Fund with a socially responsible mandate which accounted for the bulk of the headline number. Switzerland Bond Funds also contributed, recording their biggest outflow in 10 weeks. Retail share classes swam against the tide, recording their 32nd inflow of the year so far.

Both Hard and Local Currency Emerging Markets Bond Funds tallied outflows during the latest week while, at the asset class level, redemptions from EM High Yield Bond Funds hit their highest level since mid-December. China Bond Funds did extend their current inflow streak.

US Sovereign Bond Funds took in $3 for every $1 steered into funds with corporate mandates, Long term was the preferred duration, with flows into Long Term US Bond Funds hitting a level last seen in early January.

Did you find this useful? Get our EPFR Insights delivered to your inbox.