The Paris Summer Olympics ended with the US and China occupying first and second position in the medal standings. They occupied the same positions when the latest week’s fund flows were tallied, with EPFR-tracked China Equity Funds pulling in over $6 billion for the fifth time so far this year and combined flows into US Equity, Bond and Money Market Funds exceeding $40 billion for the third week running.

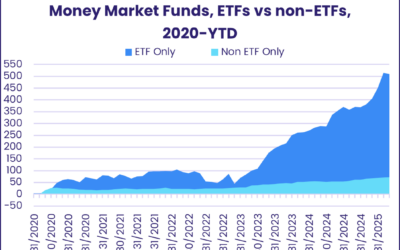

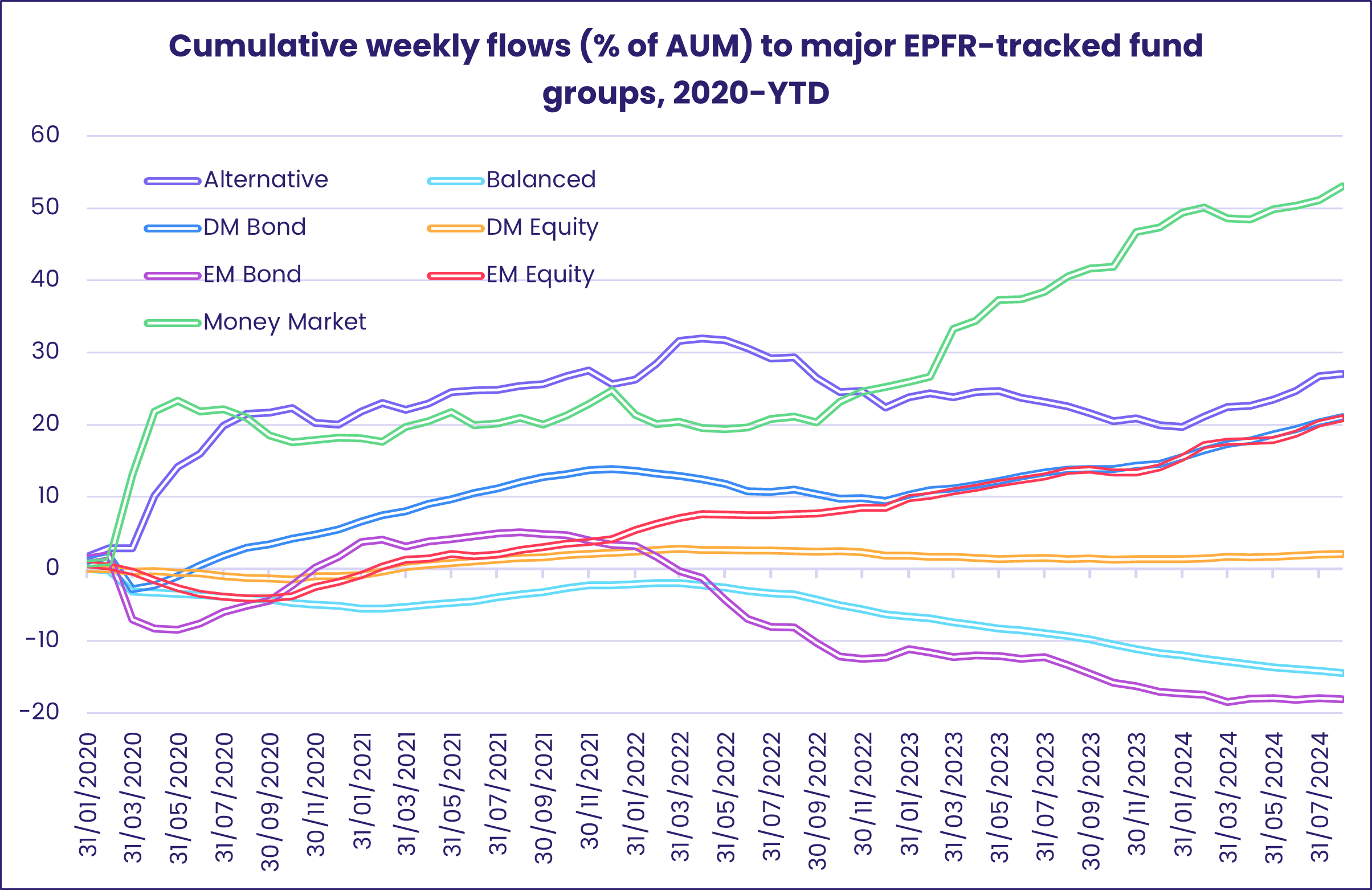

After the global market correction at the beginning of the month, investors have resumed the happier business of pricing in lower US interest rates and the ‘soft landing’ they expect for the world’s largest economy. Over the past four weeks, US Equity, Bond and Money Market Funds have taken in $30 billion, $42 billion and $131 billion, respectively.

Meanwhile, a host of current and potential issues – ranging from the fighting in Ukraine, the Middle East and Horn of Africa through rising trade tensions to the possibility of the US presidential election in November producing a disputed outcome – are being discounted or pinned on the European and EMEA universes.

Overall, the week ending August 28 saw EPFR-tracked Equity Funds post a collective inflow of $13.6 billion while Alternative Funds absorbed $535 million, Bond Funds $20.7 billion and Money Market Funds $24.5 billion.

At the asset class and single country fund level, Austria Equity Funds posted their 13th consecutive outflow and their biggest since late April, flows into UK Bond Funds climbed to a one-year high and Thailand Equity Funds experienced net redemptions for the 34th week running. Flows into Total Return Funds hit their highest level since January, High Yield Bond Funds pulled in another $1.8 billion and flows into Cryptocurrency Funds climbed to a five-week high.

Emerging Markets Equity Funds

Paced by another week of strong flows into dedicated China Equity Funds, EPFR-tracked Emerging Markets Equity Funds ended the fourth week of August with their 13th straight collective inflow. Although investors remain leery of Latin American, EMEA and frontier markets, their appetite for exposure to emerging Asia remains strong – Asia ex-Japan Equity Funds have only posted six collective outflows so far this year – and diversified Global Emerging Markets (GEM) Equity Funds chalked up consecutive weekly inflows for the first time since early February.

The latest country allocations data for GEM Equity Funds shows exposure to India at a fresh record high while China’s average weighting is just off the 84-month low touched in January. Actively managed GEM Funds have been underweight China since late 1Q23, but the current gap between active and passive exposure is the lowest in 16 months.

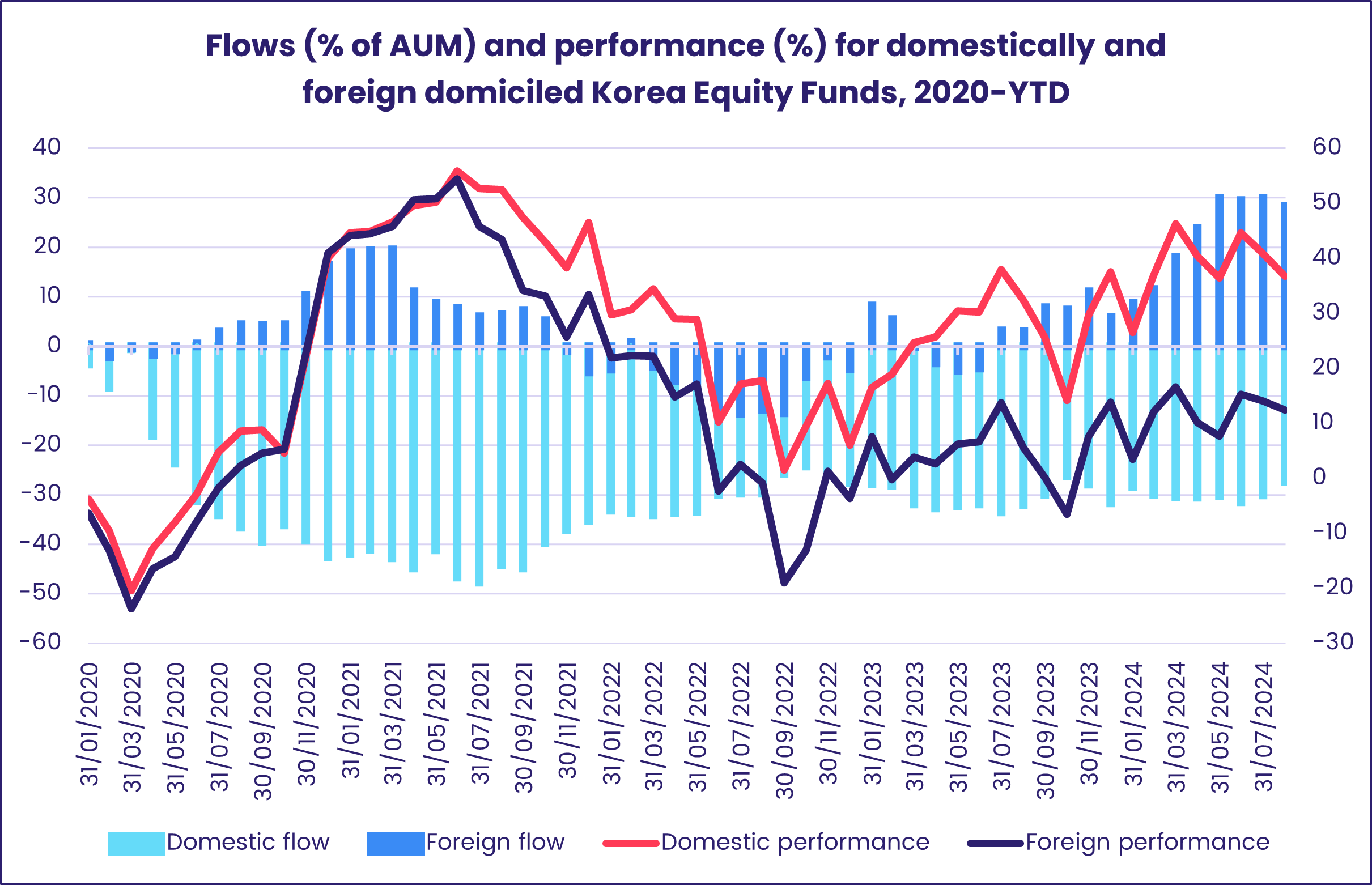

While India Equity Funds extended their record setting inflow streak, the sheer volume of domestic support for China Equity Funds and the AI tailwind being enjoyed by Taiwan (POC) Equity Funds have dominated the flows narrative for the Asia ex-Japan universe. Korea Equity Funds have posted inflows for six straight weeks and 15 of the past 20 weeks. Although domestically domiciled funds are turning in the stronger overall performance, foreign domiciled Korea Equity Funds have fared better in flow terms since the Covid pandemic started in 2020.

With Poland, South Africa, Saudi Arabia and Turkey Equity Funds all posting outflows, EMEA Equity Funds overall chalked up their fourth outflow over the past five weeks. Proximity to conflicts, doubts about short-term Chinese demand for oil, reservations about economic policymaking and waning support from diversified funds – the average GEM Fund allocation to EMEA markets has dropped by 6.7% over the past five years – have all sapped investor appetite for this group.

Investors interest in Latin America is also at a low ebb, with sentiment towards Brazil hit by the resurgence of inflation. But the strengthening consensus that the US will avoid recession and lower interest rates foreseeably only a month away gave Mexico Equity Funds a lift that carried them to their first collective inflow since mid-June.

Developed Markets Equity Funds

With AI bellwether Nvidia’s second quarter earnings and the latest reading from the US Federal Reserve’s preferred inflation guide on the horizon, flows to EPFR-tracked Developed Markets Equity Funds throttled back during the fourth week of August. But they were positive overall for the 19th straight week as investors added to positions based on benign expectations for US monetary policy and the trajectory of US economic growth.

Flows retained their US-centric flavor, with US Equity Funds accounting for the bulk of the week’s headline number and Global Equity Funds trounced their global ex-US counterparts when it came to attracting fresh money. Canada, Pacific Regional, Europe and Japan Equity Funds all posted outflows that ranged from $20 million to $1.1 billion.

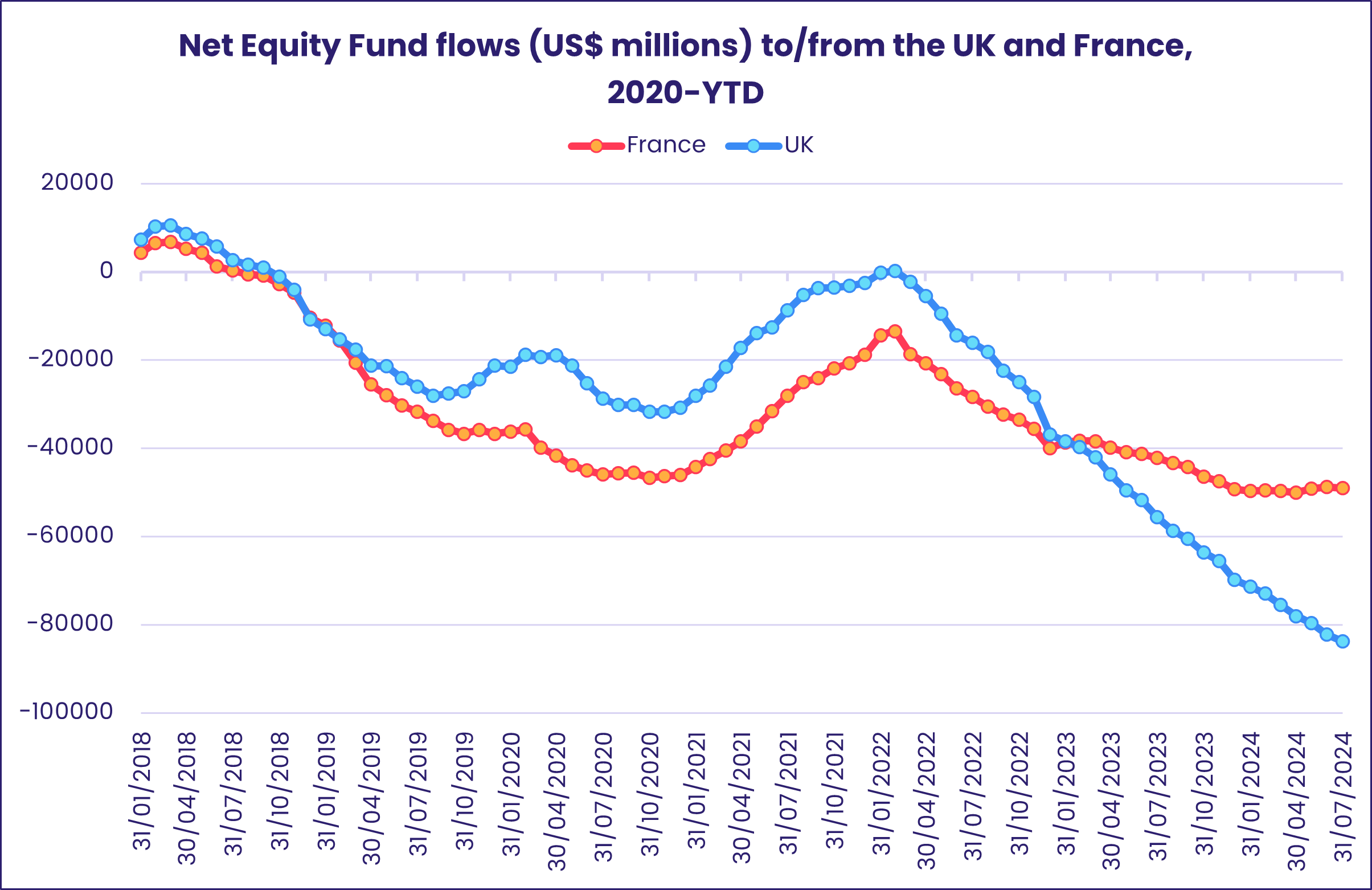

Europe Equity Funds saw their two-week inflow streak come to an end as France Equity Funds posted their first outflow since mid-June and UK Equity Funds their 35th year-to-date. In the eight weeks since the UK’s general election, which gave the left-of-center Labour Party a commanding majority, outflows from UK Equity Funds have averaged $358 million. In the eight weeks leading into the election, the average outflow was $794 million.

While dedicated UK Equity Funds have seen nearly $120 billion redeemed over the past six and a half years, the net impact on British stocks has been blunted by over $70 billion worth of purchases by Global and Global ex-US Equity Funds over the same period. Global mandate funds have steered over $45 billion into French equities, partially offsetting the selling by Europe Regional and dedicated France Equity Funds.

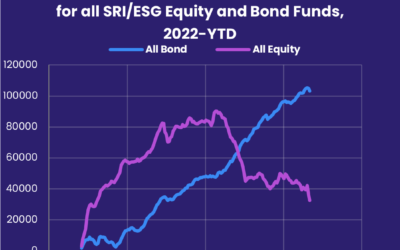

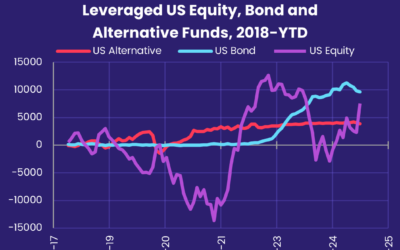

Flows into US Equity Funds during the latest week went primarily to Large Cap Exchange Traded Funds (ETFs). Redemptions from leveraged funds climbed to a seven-week high and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest outflow since late 1Q23.

The headline number for Japan Equity Funds fell for the third straight week although fresh money flowed into retail share classes for the sixth time in the past seven weeks. The country’s ruling Liberal Democratic Party is currently focused on politics rather than policy as it prepares to select a new leader after incumbent Prime Minister Junichiro Koizumi announced he will step down in September.

Global sector, Industry and Precious Metals Funds

For the third straight week, the number of EPFR-tracked Sector Fund groups reporting inflows outweighed those with redemptions as all eyes turned to the high-rated semiconductor company, Nvidia, for clues on whether the stock – and the artificial intelligence theme it exemplifies – has more room to run. In the week to August 28, inflows ranged from $50 million for Infrastructure Sector Funds to just shy of $1 billion for Financial Sector Funds.

Although stellar, Nvidia’s earnings report generated very mixed reviews. But that did not stop Technology Sector Funds from racking up a ninth consecutive inflow, their longest streak in a year. The group has seen over $19.4 billion flow in, compared to $18 billion during the 10-week run leading up to the end of August 2023.

At a granular level, flows for Technology Sector Funds pulled in opposite directions, with the top money magnet a semiconductor ETF and the fund with the heaviest redemption a leveraged 3x semiconductor ETF. During a week which saw the launch of the first ever AAA game in China, Black Myth: Wukong, tech-oriented investors also turned to gaming funds. A custom grouping of Anime, Comic and Gaming Funds brought an end to their six-week streak of outflows with their biggest inflow since early June.

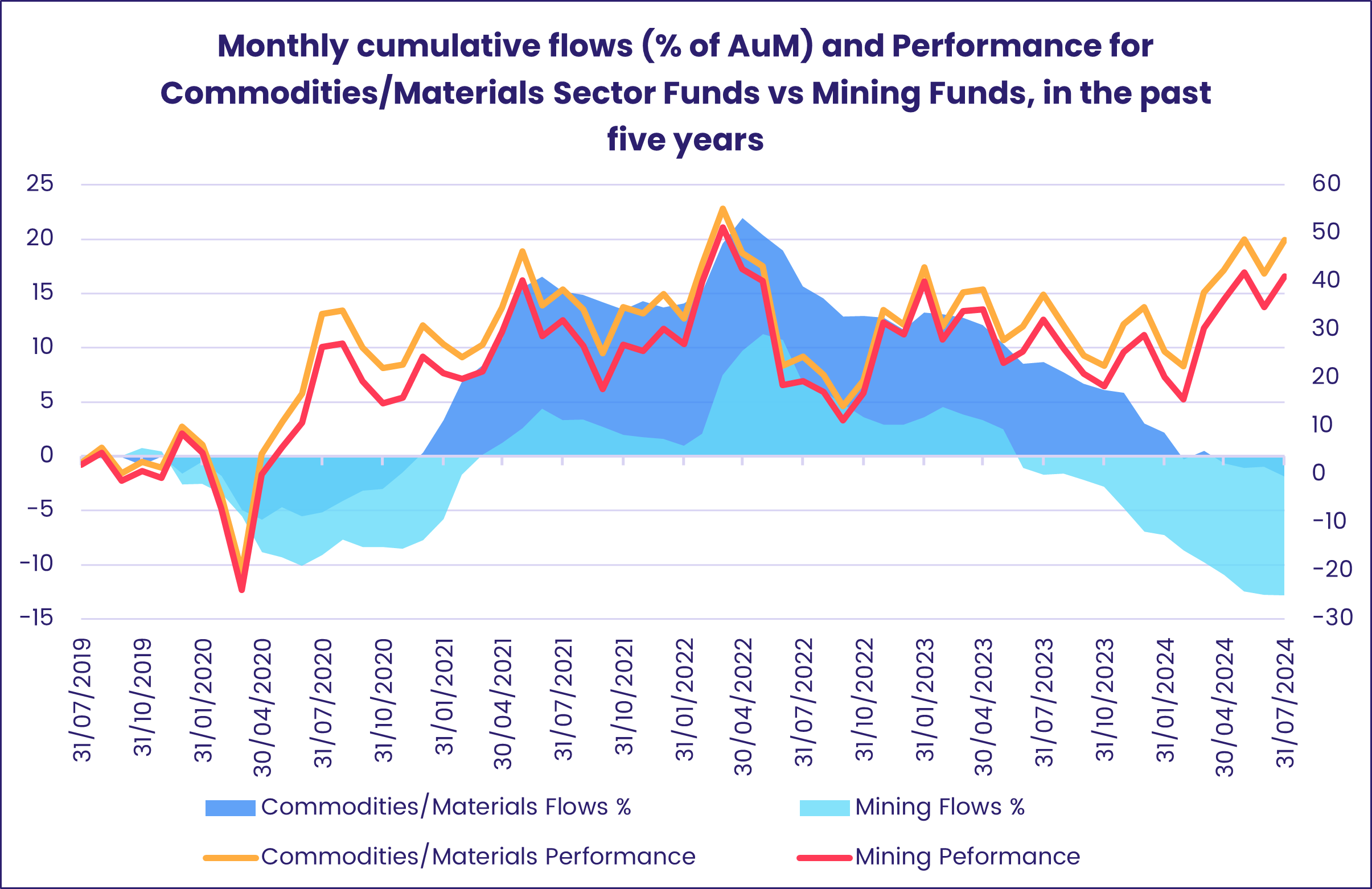

While tech funds added to their year-to-date total, Commodities/Materials Sector Funds extended their six-week, $2.3 billion redemption streak. At the individual fund level, those with the heaviest outflows included three with gold in their name, another two with mining mandates and one upstream natural resource ETF. A custom group of 100 funds with mining, miners, or mines (regardless of the metal) in their fund or benchmark name suffered their heaviest outflow year-to-date at $274 million. Mining Funds have pulled in just five weekly inflows this year and 10 inflows since late 1Q23.

Flows for Financials Sector Funds climbed to a six-week high, boosted by a third consecutive weekly inflow for US Financial Sector Funds, a run that has seen $2.4 billion flow in. US Bank Funds also attracted fresh money for the third time in the past six weeks, while Regional Banks saw significant inflows for the first time in three weeks.

With evidence of a housing market recovery in the US and drops in borrowing costs for British and Swedish buyers, Real Estate Sector Funds enjoyed their biggest inflows since early March. A subgroup of REIT Funds posted their heaviest outflow in three weeks, also the 10th redemption of the past 12 weeks. Europe Regional-dedicated REITs, however, brought home a 19-week high inflow.

Bond and other Fixed Income Funds

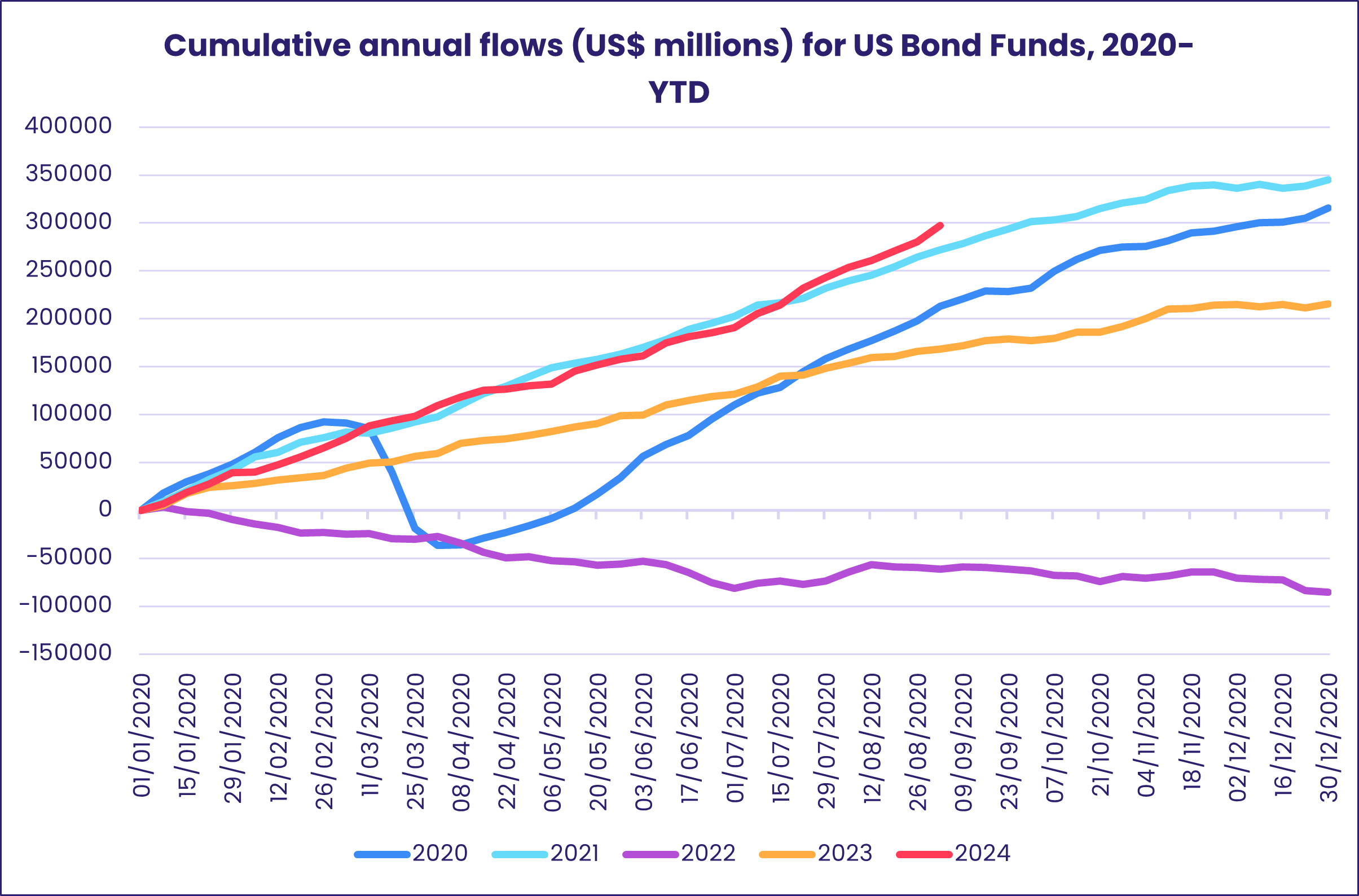

The money kept rolling in to EPFR-tracked Bond Funds – especially those with US mandates – during the fourth week of August as year-to-date inflows hit 148% of the total for 2023 and 69% of the full-year record set in 2021. All of the major groups by geographic focus except for Asia ex-Japan and EMEA Bond Funds recorded inflows.

At the asset class level, Municipal Bond Funds extended their current inflow streak to nine weeks and $10.5 billion, flows into Total Return Funds climbed to a 31-week high and High Yield Bond Funds took in over $1 billion for the 19th time so far this year. Mortgage Backed Bond Funds posted their 33rd inflow year-to-date and Collateralized Loan Obligation (CLO) Funds their 34th.

Overall flows into US Bond Funds posted their second-largest weekly inflow of 2024 as they remain on track to surpass their full-year record. While less than half of the record setting total in 2021 went into US Bond ETFs, those vehicles look set to absorb more money than their mutual fund counterparts for the third year running.

Foreign domiciled US Bond Funds fared well during the latest week, posting their biggest collective inflow since the third week of February.

For the seventh time during the past eight weeks, flows to Europe Bond Funds favored those with corporate mandates over those dedicated to sovereign debt. At the country level, flows into UK Bond Funds hit a 52-week high while Sweden Bond Funds posted their biggest outflow in over 33 months on the heels of another 25 basis point rate cut by the Swedish Central Bank.

Among Emerging Markets Bond Funds, redemptions from funds with local currency mandates narrowly eclipsed flows into hard currency funds. China Bond Funds experienced their heaviest redemptions since mid-January.

Did you find this useful? Get our EPFR Insights delivered to your inbox.