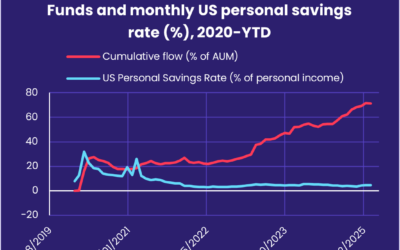

In the wake of the Federal Reserve’s first interest rate cut in over four years, US equity markets hit fresh record highs and collective flows into US-mandated Equity, Bond and Money Market Funds tracked by EPFR totaled over $160 billion. The bulk of that fresh money, however, was absorbed by US Money Market Funds.

The Fed’s shift to an easing bias opened the door for other central banks to cut their interest rates without triggering currency weakness versus the US dollar. China’s central bank took advantage of the opening, announcing a stimulus package that includes a 0.5% cut in the reserve requirement for Chinese banks, measures to support Chinese equity markets and lowering the interest rate on existing mortgages. China Equity Funds saw net inflows surge to a nine-week high of $8.1 billion.

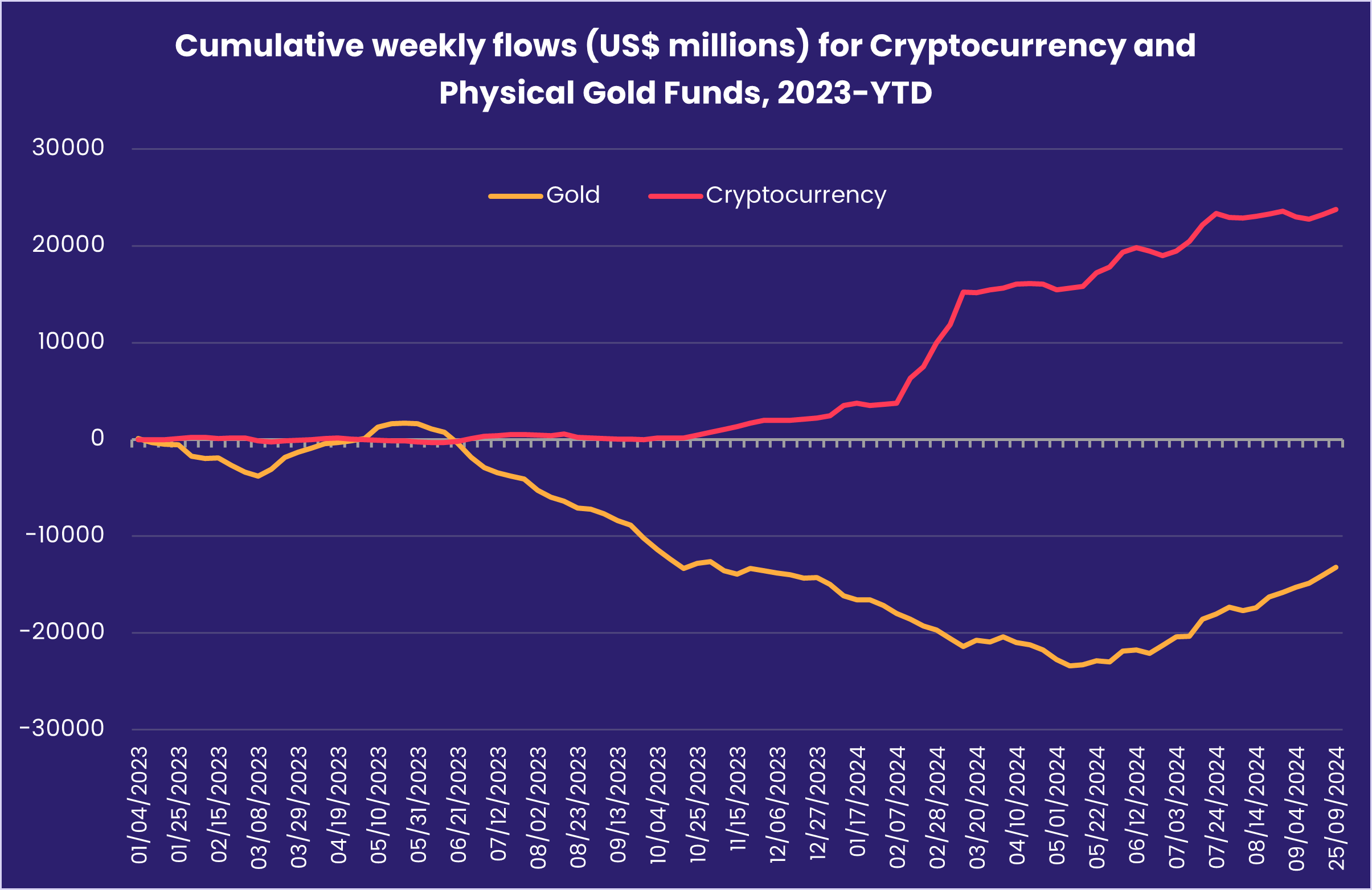

Overall, flows to fund groups associated with riskier asset classes during the week ending Sept. 25 were mixed. High Yield, Bank Loan and Emerging Markets Bond Funds all posted solid inflows, with the latter posting their biggest weekly inflow since the fourth week of 1Q23. But investors opted not to chase the latest burst of enthusiasm for the artificial intelligence story – Technology Sector Funds chalked up their third outflow over the past five weeks – and both Cryptocurrency and Physical Gold Funds attracted fresh money.

At the asset class and single country fund level, redemptions from China Bond and Money Market Funds hit 43 and 117-week highs, respectively, Indonesia Equity Funds recorded their biggest inflow since the third week of February and flows into Canada Equity Funds climbed to a year-to-date high. Convertible Bond Funds tallied their biggest inflow in three years, flows into Silver Funds hit a nine-week high and last week’s flows into Dividend Equity Funds were largely reversed.

Emerging Markets Equity Funds

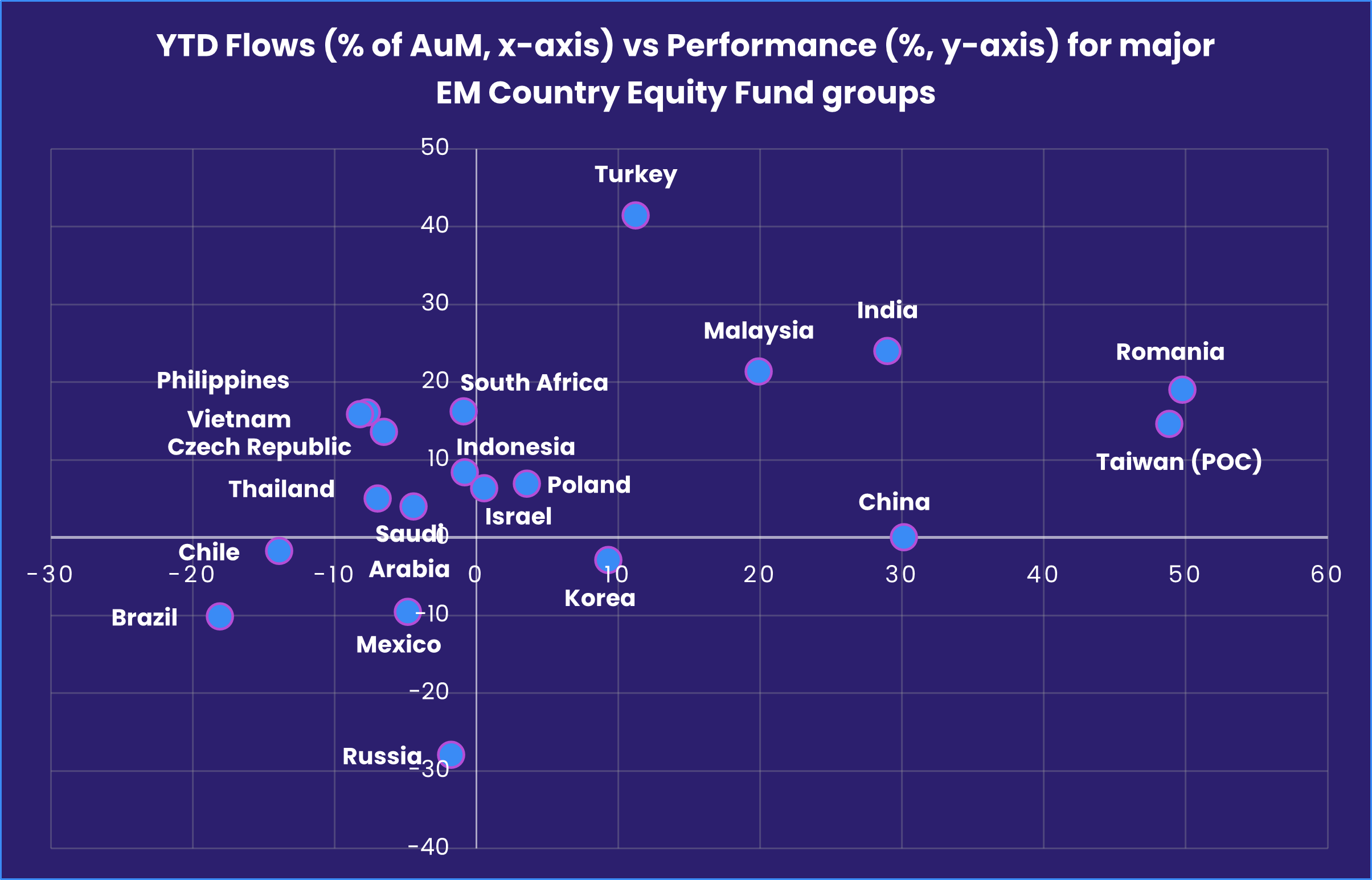

Flows into EPFR-tracked Emerging Markets Equity Funds picked up some strong tailwinds going into the final days of September as central bankers in the US and China moved to support economic growth. Net flows into all funds climbed to an eight-week high as the group extended their longest inflow streak since an 18-week run ended in mid-1Q19.

By far the biggest contributors to the headline number were China Equity Funds, which posted their fourth largest inflow of 2024 during a week when the People’s Bank of China announced a package of measures aimed at boosting lending, consumer confidence and the country’s battered property sector. Domestically domiciled ETFs absorbed much of the fresh money, with 33 posting inflows of over $50 million during the week ending Sept. 25, but flows into foreign domiciled funds hit a year-to-date high.

Coming into this month, the average exposure to China among the diversified Global Emerging Markets (GEM) Equity Funds had fallen to its lowest level since late 2Q16. India’s allocation, meanwhile, hit a new record high.

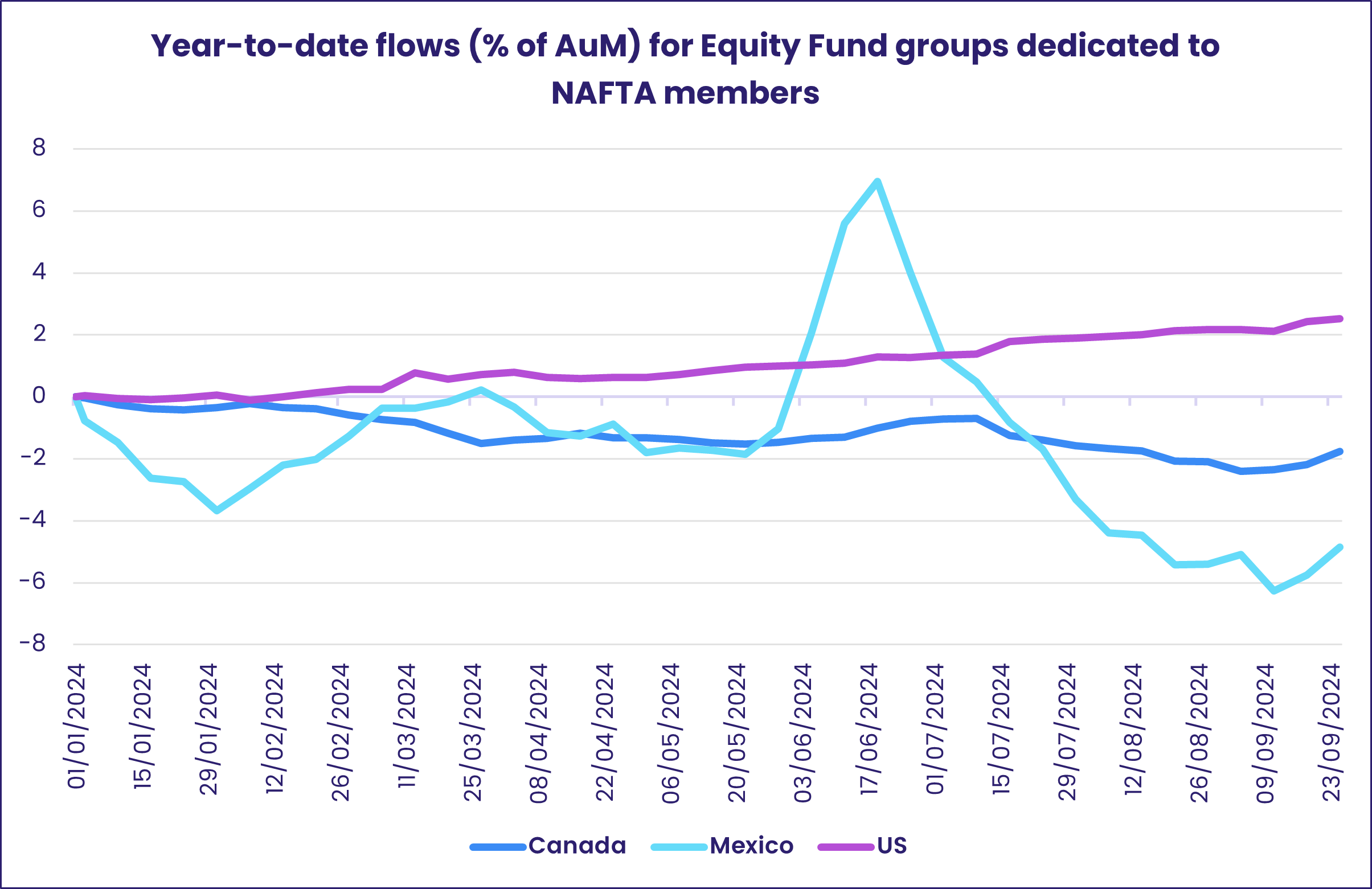

Chinese stimulus measures and the US Federal Reserve’s long-awaited pivot on interest rates boosted flows into Latin America Equity Funds, which recorded their biggest inflow since mid-June. Argentina’s reform and soybean export stories have drawn a fresh influx of new money into Argentina Equity Funds, and Mexico’s proximity to a US economy still on track for a ‘soft landing’ is reflected in recent flows to Mexico Equity Funds.

EMEA Equity Funds, whose fortunes owe more to global energy markets and the strength of the Eurozone, extended their current outflow streak despite flows into South Africa and Saudi Arabia Equity Funds hitting six and nine-week highs, respectively.

Investors, who hit Frontier Markets Equity Funds with net redemptions 10 of the second quarter’s 13 weeks, committed fresh money to the group for the fourth time during the past six weeks. Vietnam remains by far the biggest single country allocation for this group.

Developed Markets Equity Funds

The week ending Sept. 25 saw EPFR-tracked Developed Markets Equity Funds post their second straight inflow and 32nd year-to-date as investors and markets responded to the first cut in US interest rates since 1Q20. Of the major groups by geographic focus, only Pacific Regional Equity Funds posted an outflow while investors steered between $47 million and $10.8 billion into Japan, Global, Canada, US and Europe Equity Funds.

With the latest reporting period straddling the quarterly expiration of four option classes – the so-called quadruple witching – daily flows to US Equity Funds swung between an inflow of $18.9 billion on Sept. 19 to an outflow of $32.5 billion on Sept. 23. The net result was a weekly inflow of under $11 billion that bypassed funds with mid- and small-cap mandates. Redemptions from all US Small Cap Equity Funds hit a 28-week high. It was the same story for US Dividend Funds.

In relative terms, Canada Equity Funds fared better, with inflows equaling 0.4% of AUM versus 0.09% for US Equity Funds. The prospect of US and Chinese demand for Canadian exports picking up in response to monetary easing in both countries helped Canada Equity Funds record their biggest inflow since late December. Investors are also anticipating further rate cuts by Canada’s central bank during the fourth quarter.

Europe Equity Funds chalked up their third inflow of the third quarter, and their biggest since mid-May, despite multiple headwinds that include France’s political drift and the struggles of German manufacturers. Dedicated Switzerland and Sweden Equity Funds both recorded solid inflows ahead of rate cuts by their respective central banks.

With the Bank of Japan signaling that it will move cautiously when it comes to further interest rate hikes, Japan Equity Funds posted their third inflow over the past month. Redemptions from retail share classes hit an 11-week high and Leveraged Japan Equity Funds also suffered outflows.

Among the major diversified groups, Global ex-US Equity Funds, whose allocation to Japan currently stands at 16.8% of the average portfolio, posted their 11th inflow of the current quarter. But Pacific Regional Equity Funds, which have a 37% weighting for Japan, recorded their biggest outflow in over nine months.

Global sector, Industry and Precious Metals Funds

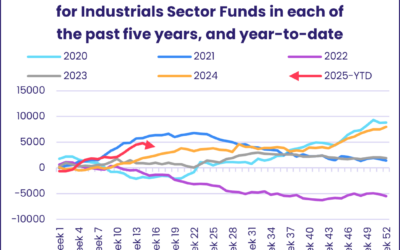

Approaching the end of September, sector-oriented investors took a red pen to their portfolios and, for the first time in roughly three months, exited nine of the 11 major EPFR-tracked Sector Fund groups. The only groups to see a second consecutive week of inflows were Commodities/Materials and Healthcare/Biotechnology Sector Funds.

Consumer Goods Sector Funds posted their second-largest outflow on record since EPFR started tracking these funds in late 2000. This week last year saw a similar outflow, and investors have shown a tendency over the years to pull out of this fund group at the tail end of the third quarter. During the latest week, redemptions from a single US-dedicated ETF benchmarked to an S&P Consumer Staples index accounted for about 60% of the headline number.

Flows into Technology Sector ETFs remained steady for a third consecutive week, their 12th inflow of the past 13 weeks, while mutual funds dragged the overall headline number down into negative territory for the third time over the past four weeks.

Drilling down, EPFR’s Industry Flows & Allocations data shows only one industry group – Real Estate – experiencing net redemptions year-to-date. Software & Services ($50.7 bn) have attracted the biggest inflow followed by Capital Goods ($28.5 bn) and Semiconductors & Equipment ($27.7 bn). From 2008-2020, flows for Software & Services were consistently down, attracting just three years of inflows in that span. In 2021, the group saw a record $85 billion flow in and has continued to attract fresh money.

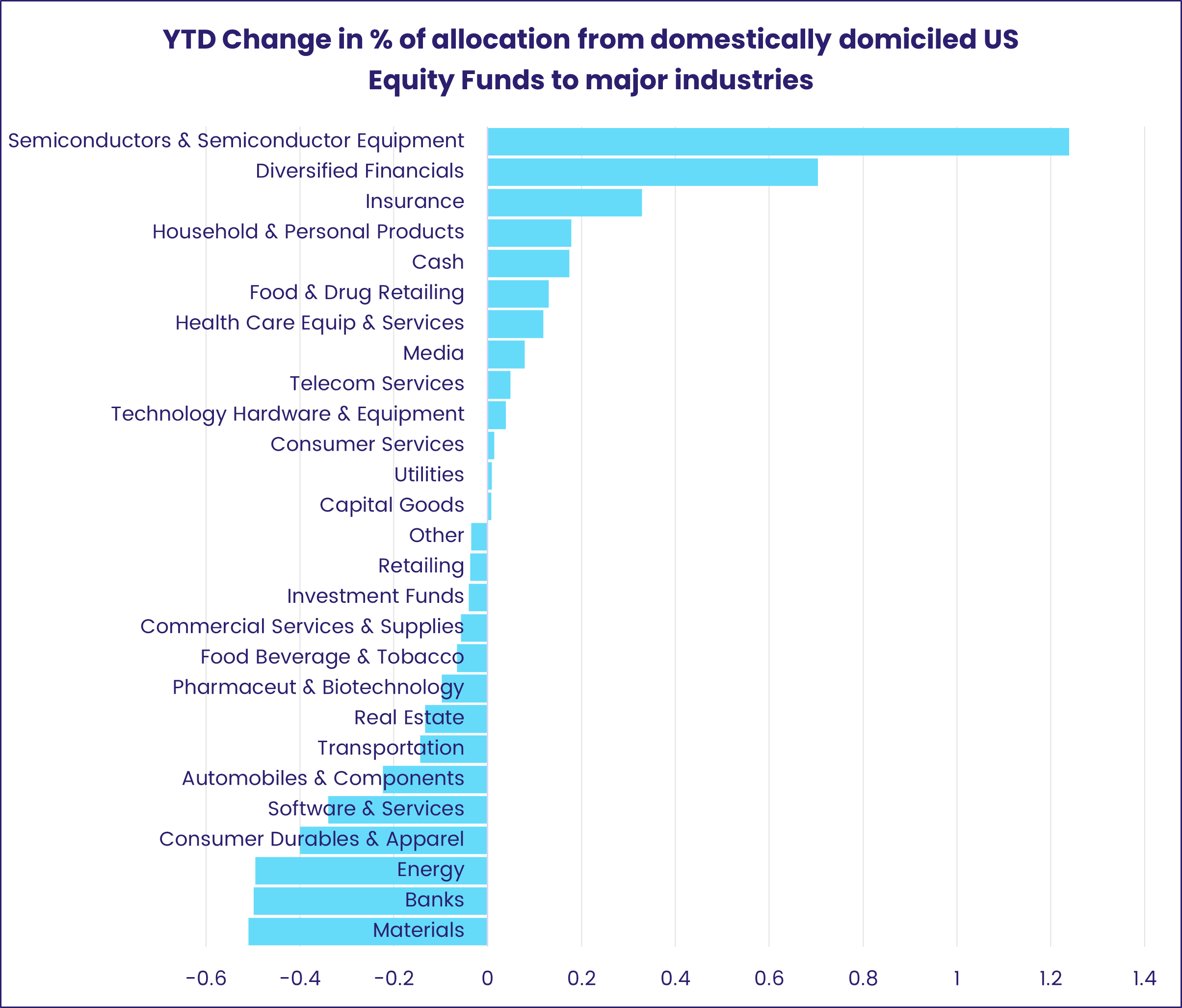

When it comes to allocations at the industry level, Global, US and Europe Regional Equity Fund managers are following slightly different paths so far this year. US Equity Fund managers have shifted their focus to Semiconductors & Equipment (up 1.50%), but behind this overall number is a difference in the tacks taken by domestically and overseas domiciled funds.

Foreign-domiciled US Equity Fund managers are strongly focused on technology-related industries, with three among the top five industries that have seen biggest increases in their average allocation YTD. Domestically domiciled managers have been leaning more into Diversified Financials and Insurance, while reducing their exposure to Software & Services.

Global Equity Fund managers are putting an increased emphasis on Capital Goods (up 1.52% year-to-date), while rotating away from Banks (down 1.07%). Although Europe Regional Equity Fund managers also increased allocations to capital goods, Pharmaceutical & Biotechnology industry has been the main attraction for this fund group – an area US and Global shied away from.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds maintained their current inflow streak during the week ending Sept. 25, pulling in another $12.6 billion that lifted their year-to-date total over $600 billion. Yields on sovereign debt remain attractive, especially when compared to the returns on offer between 2010 and 2020, and falling interest rates should deliver capital gains as bond prices climb.

Behind the latest headline were the 40th consecutive inflow for US Bond Funds, the biggest inflow recorded by Emerging Markets Bond Funds in over 20 months and the 37th inflow recorded by Global Bond Funds so far this year.

At the asset class level, Convertible Bond Funds recorded their biggest inflow since 3Q21 and High Yield Bond Funds extended their current inflow streak to six weeks and $9.5 billion. Investors pulled money out of Catastrophe Bond Funds for the second time in the past three weeks and from Green Bond Funds for the 11th time over the past 15 weeks while redemptions from CoCo Bond Funds hit their highest level since mid-April.

Among the major groups by geographic focus, only Asia Pacific Bond Funds chalked up an outflow. Redemptions from Japan Bond Funds underpinned the headline number as investors recalibrated their expectations for higher interest rates pulling more money – both domestic and foreign – from Japanese debt.

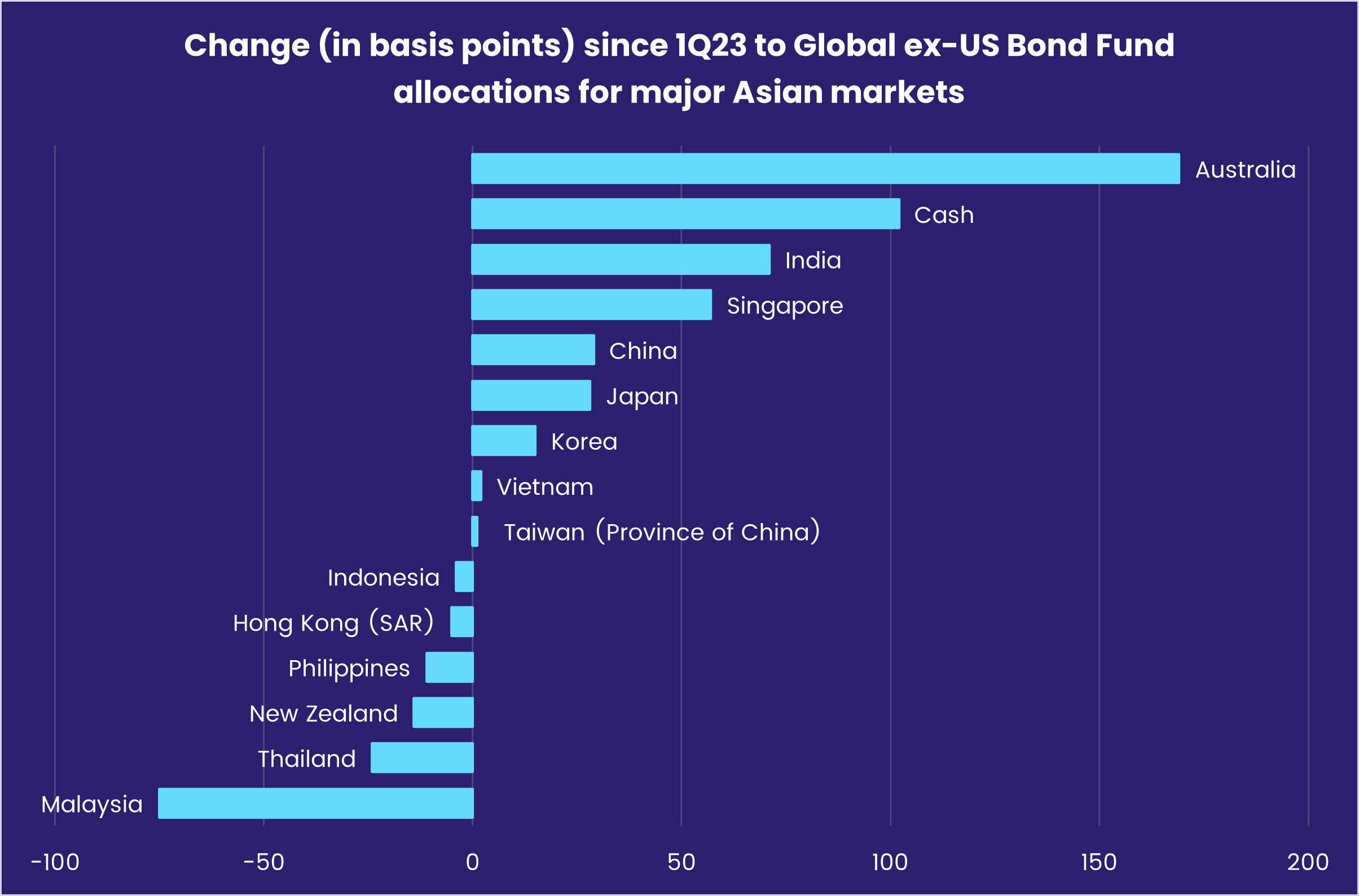

Managers of Global ex-US Bond Funds, which have pulled in over $21 billion so far this year, have increased their exposure to Japan over the past eight months. But they have been more aggressive in boosting their allocations to Australia, India and Singapore.

Europe Bond Funds enjoyed another solid week with funds dedicated to corporate debt attracting more money than their sovereign counterparts for the sixth straight week. At the country level, flows into France Bond Funds hit a 13-week high and redemptions from Spain Bond Funds a 14-week high as the country’s 10-year borrowing costs climbed above those of Spain for the first time since 2006.

Diversified Global Emerging Markets (GEM) Bond Funds were the biggest beneficiaries of the improving sentiment towards EM debt, pulling in over $1 billion during the latest week. It was only the fourth time since the beginning of 2023 that the group broke this mark.

Flows to US Bond Funds favored Intermediate Term Funds in US$ terms and mixed duration funds in % of AUM terms. Retail share classes enjoyed solid inflows for the eighth week running and collective flows into overseas domiciled US Bond Funds climbed to their highest level since mid-3Q19.

Did you find this useful? Get our EPFR Insights delivered to your inbox.