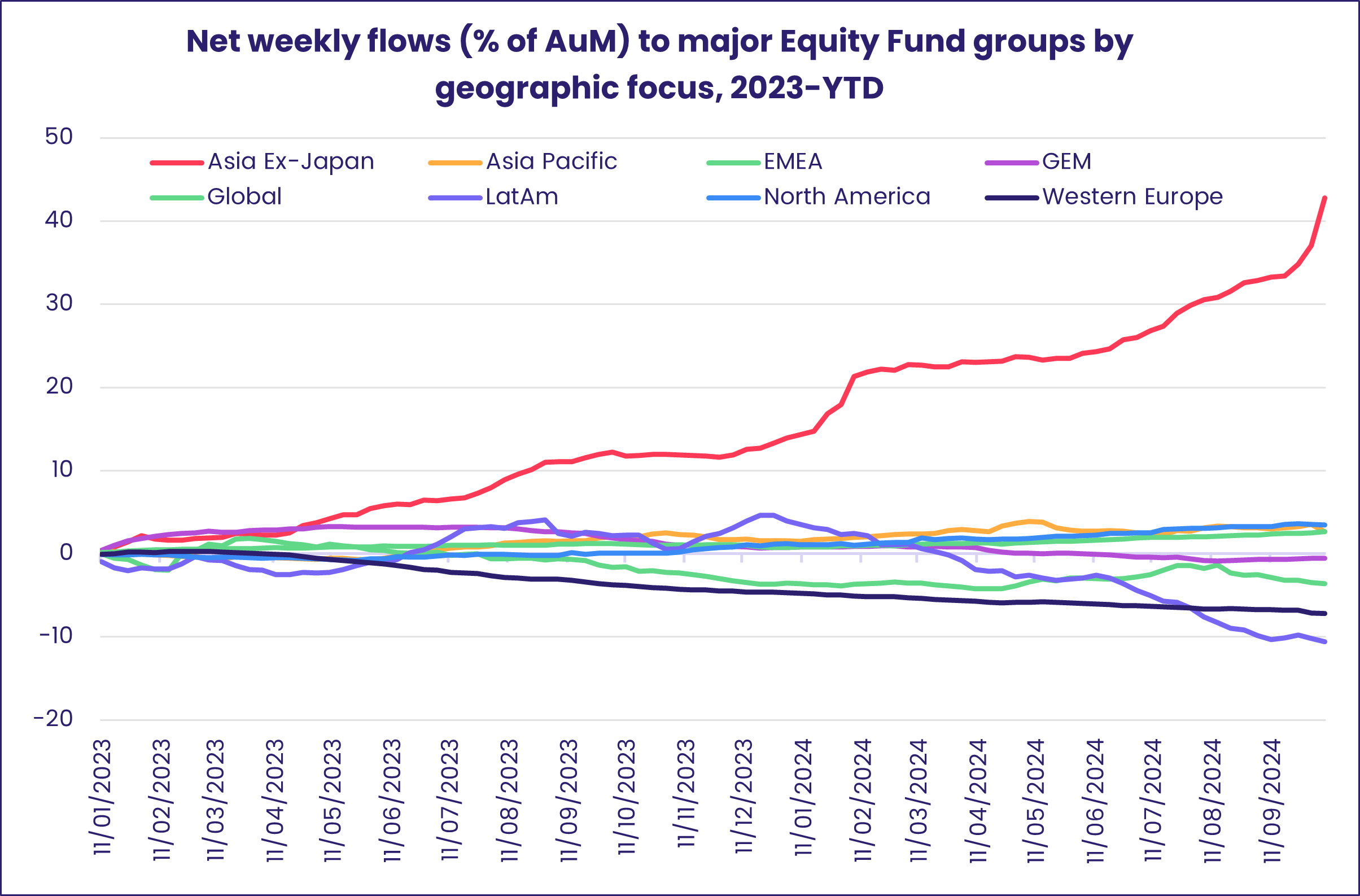

The first week of October saw China’s benchmark stock index do a passable imitation of a roller coaster. It was a different story for flows into dedicated China Equity Funds whose rocket-like trajectory carried these funds and the broader Emerging Markets Equity Fund group into record territory.

While a net $40.9 billion flowed into all EPFR-tracked Emerging Markets Equity Funds during the week ending Oct. 9, DM Equity Funds posted consecutive outflows for the first time since mid-April as flows into US Equity Funds lost momentum and Japan Equity Funds experienced record redemptions.

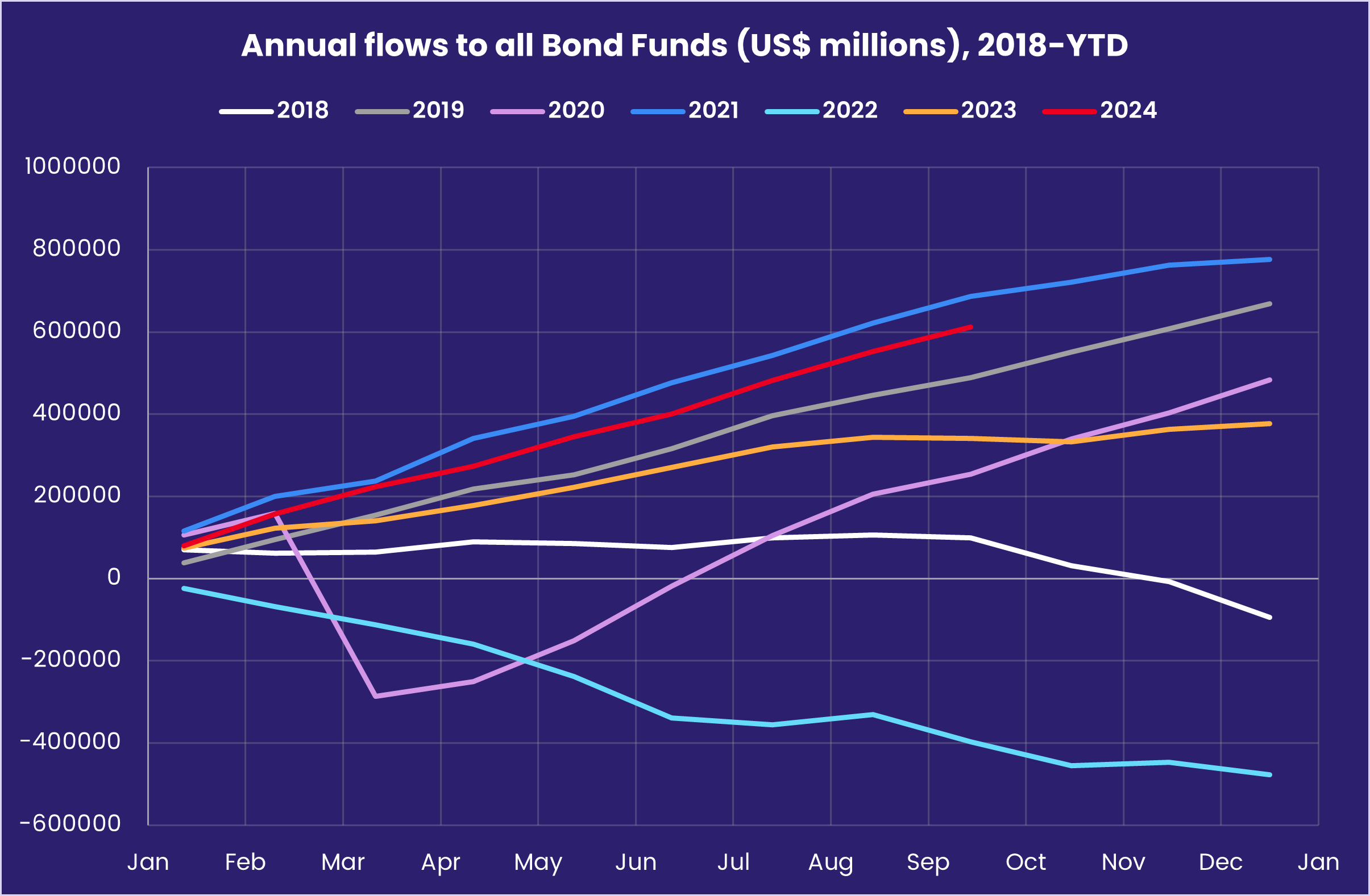

Flows to most fixed income groups remained strong, with Emerging Markets Bond Funds extending their longest inflow streak since the first half of 1Q23, Europe Bond Funds absorbing over $3 billion for the second week running and year-to-date flows into US Bond Funds surpassing $450 billion.

At the asset class and single country fund level, Japan Bond and Money Market Funds saw inflows climb to 33 and 39-week highs, respectively, while Greece Equity Funds extended their longest outflow streak since a 38-week run ended in early 1Q23. Flows into Physical Silver Funds hit an 11-week high, Convertible Bond Funds recorded their biggest inflow in over three years and Inflation Protected Bond Funds chalked up their biggest outflow of 2024.

Emerging Markets Equity Funds

Soaring appetite for exposure to the stimulus-driven Chinese equity market rally during the week ending Oct. 9 pumped nearly $40 billion into China Equity Funds. That influx of fresh money, which more than doubled the previous weekly record, also lifted the headline number for all EPFR-tracked Emerging Markets Equity Funds to a new record high.

Despite the eye-popping top level numbers, retail share classes for EM Equity Funds posted a collective outflow for the 12th week running and EM Dividend Funds saw over $300 million flow out. But flows into Leveraged EM Equity Funds joined the ranks of record-setting fund groups and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow in 14 months.

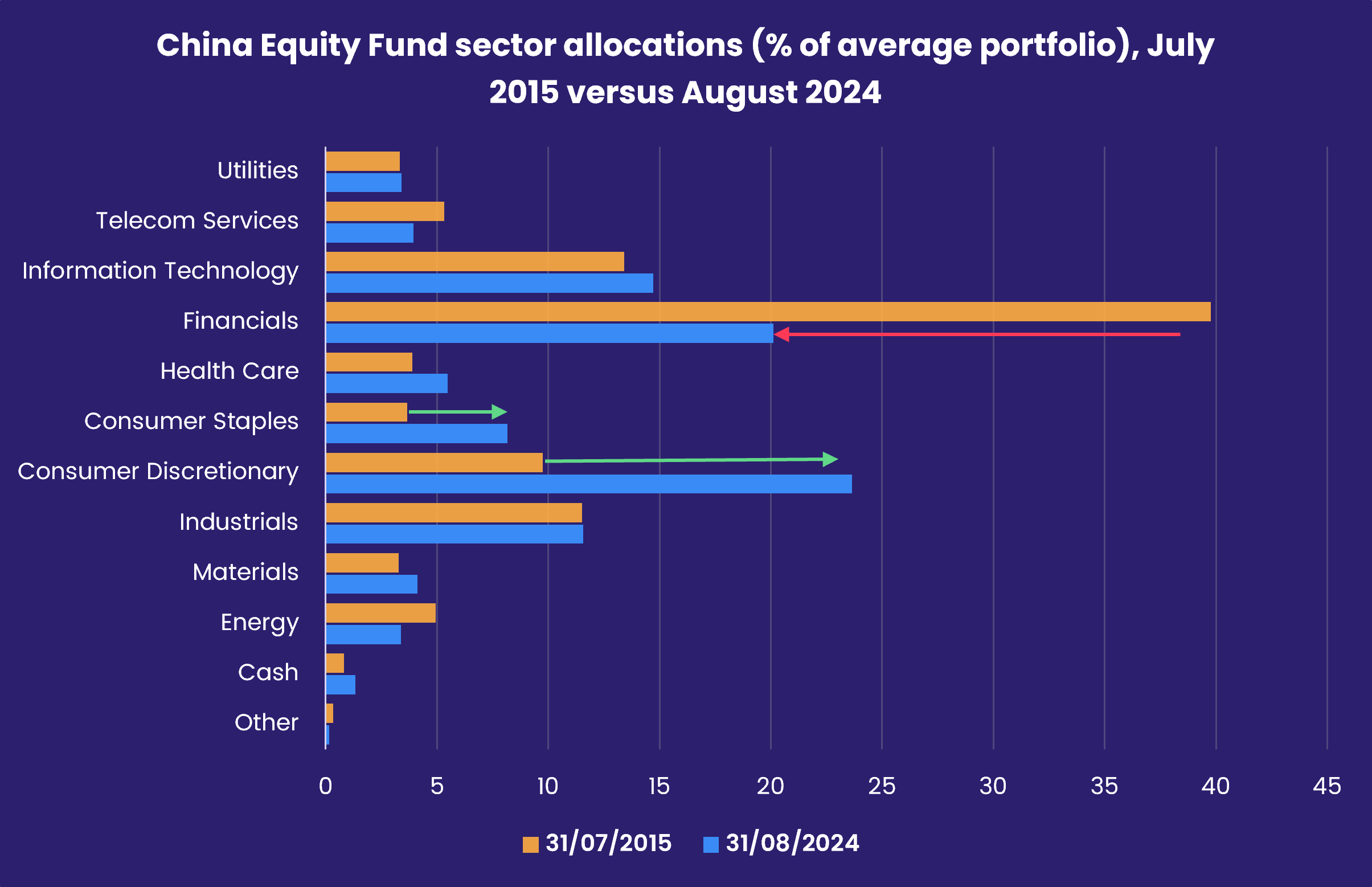

Among China-mandated funds, eight took in over $1 billion during the latest week and another 16 between $300 million and $990 million. For the second week running, overseas domiciled funds set a new inflow record as renewed enthusiasm for Chinese stocks drew comparisons with the events that triggered a major correction in mid-2015. Compared to that period, the China Equity Funds tracked by EPFR have much less exposure to financial stocks and much greater exposure to consumer plays.

With the focus firmly on China, an inflow streak for India Equity Funds that began in late 1Q23 ended abruptly as the group posted its biggest outflow since 2Q22. In relative terms, funds with mid-cap mandates saw the biggest outflows while Small Cap India Equity Funds eked out a modest collective inflow.

Elsewhere, the diversified Global Emerging Markets (GEM) Equity Funds extended their longest inflow streak since 1Q23, Frontier Markets Equity Funds posted inflows for the fifth time since the beginning of September, Latin America Equity Funds recorded only their third inflow over the past four months and EMEA Equity Funds saw another $93 million flow out.

The headline number for Latin America Equity Funds was driven by renewed enthusiasm for Brazil-mandated funds which posted their biggest inflow so far this year. Having sold into the Brazilian stock market’s surge during August, investors utilizing Brazil Equity Funds appear to be buying on the dip triggered by last month’s interest rate hike.

Developed Markets Equity Funds

Having celebrated the US Federal Reserve’s 50 basis point rate cut last month, investors with a developed markets focus slipped into what-have-you-done-for-me-lately mode in early October. EPFR-tracked Developed Markets Equity Funds ended the latest week by posting consecutive outflows for the first time since mid-April as those investors waited for confirmation that corporate earnings are on the upswing and that the Fed will put something more in the punch bowl when it meets next month.

Investors do expect another interest rate cut when European Central Bank policymakers meet on Oct. 17. But how much any rate cut will do for Europe’s economic fortunes in the face of multiple headwinds remains an open question. Those headwinds include fears of another energy shock if fighting in the Middle East escalates further, the growing prospect of a trade war with China centered around the continent’s automotive industry and deteriorating public finances in France, the UK and Italy.

Europe Equity Funds chalked up their 35th outflow year-to-date during the week ending Oct. 9 while, at the country level, most single market fund groups experienced outflows. Redemptions from Greece, Italy, Finland and Sweden Equity Funds hit eight, 16, 33 and 74-week highs respectively while Belgium Equity Funds posted their biggest outflow since 1Q23.

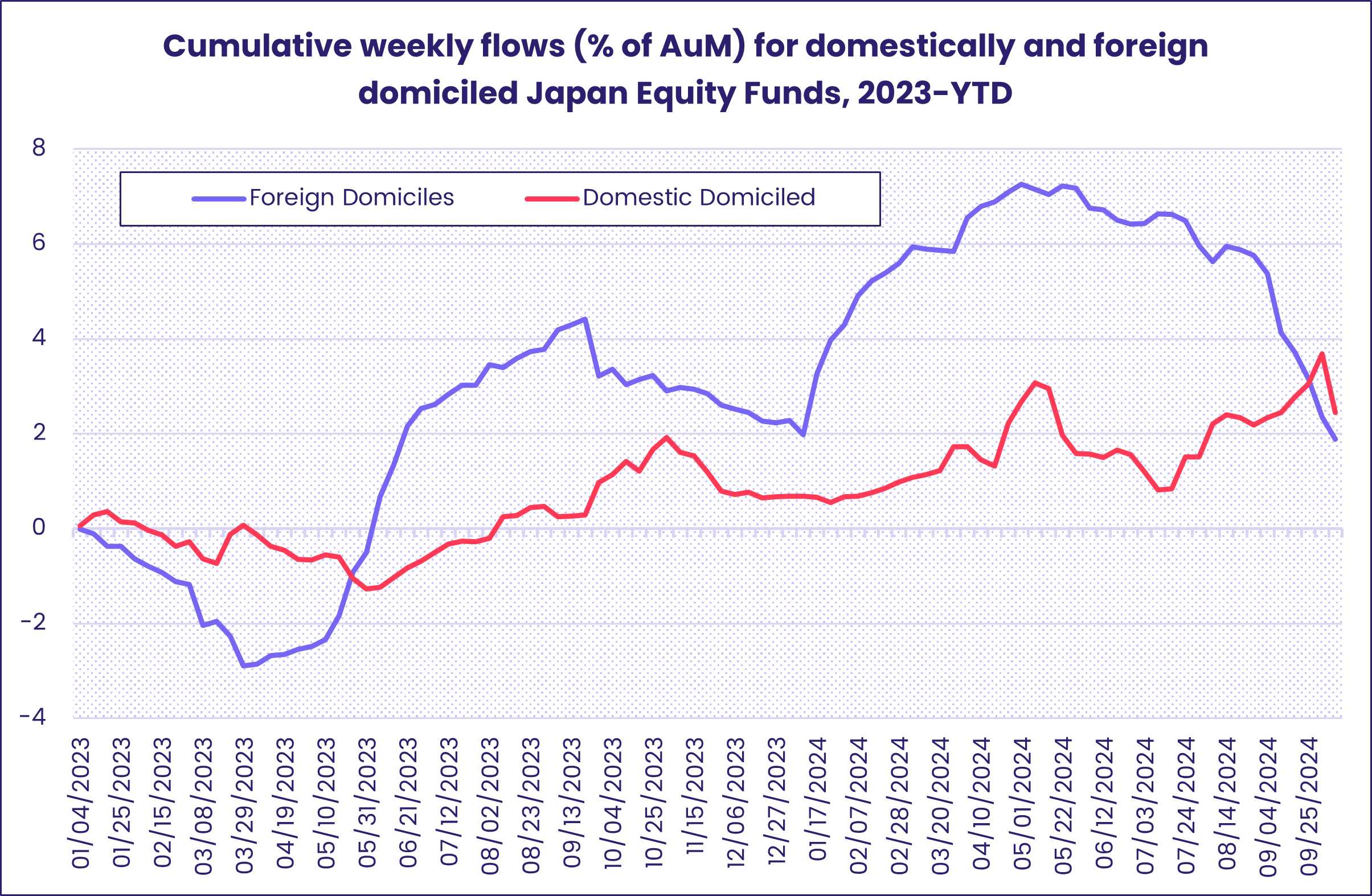

With another earnings season, a snap election and further Bank of Japan policy meetings on the horizon, both foreign and domestic investors took money off the table during the latest week. Japan Equity Funds posted their biggest outflow since EPFR started tracking them weekly in 4Q21. Pacific Regional Equity Funds, which on average allocate over 37% of their portfolios to Japan, posted their third-largest outflow YTD.

Despite the biggest retail redemptions since late 4Q23, US Equity Funds posted modest inflows as investors digested stronger-than-expected labor market data that raises questions about the trajectory of interest rate cuts over the next two quarters. There was more enthusiasm for America’s northern neighbor, with Canada Equity Funds pulling in over $600 million for only the second time so far this year.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, recorded their biggest inflow since the beginning of July. It was a particularly good week for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, with flows to these funds hitting their highest level in over 17 months.

Global sector, Industry and Precious Metals Funds

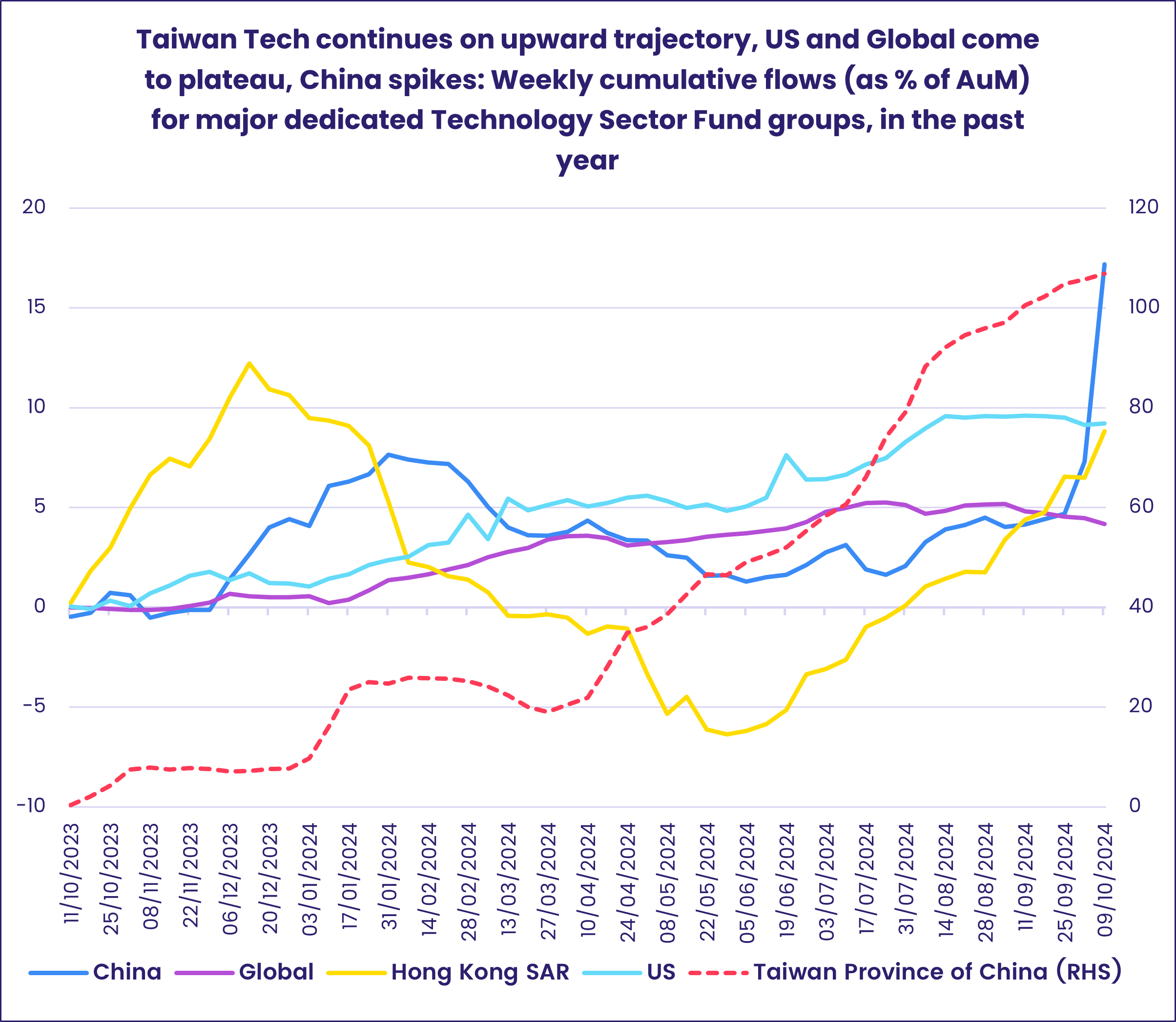

Total trading volume (the absolute value of outflows + inflows) during the week ending Oct. 9 hit nearly $11 billion for the 11 EPFR-tracked Sector Fund groups, the most in 16 weeks. Technology Sector Funds accounted for over 65% of the total, and Financials, Consumer Goods and Real Estate Sector Funds brought in roughly 7-9.5% each. Just two groups posted outflows.

China-dedicated funds accounted for a large share of the week’s headline number for Technology Sector Funds as investors chased the gains served up by China’s surging equity markets. Funds tied to an index representing the 30 largest tech companies listed in Hong Kong, which rose roughly 45% in nine days to Oct. 9, pulled in nearly $1 billion while those tracking the SSE Science & Tech Innovation Board 50 & 100 indexes – which consist of large cap and mid cap securities respectively – attracted a combined $5.7 billion.

Elsewhere, Taiwan Technology Sector Funds have absorbed roughly $6.5 billion year-to-date (or 105%+ of assets), over three times the size of the past three years of inflows. Global and US-dedicated funds, meanwhile, have pulled in more than $7 and $30 billion, respectively, though flows for both groups dropped off in September.

Two consecutive weeks of inflows to institutional share classes have raked in $1.2 billion for Real Estate Sector Funds as investors respond to the US Federal Reserve’s interest rate pivot. A healthier real estate market is also good news for bank loan portfolios, especially in the US.

Funds tracking those institutions – Bank Funds – recorded their biggest inflow since mid-April. That helped Financials Sector Funds snap a four-week, $3.3 billion redemption streak. While six of the top 10 funds with the biggest inflows for the group were China-dedicated, the first and second ranked were a US-dedicated ETF benchmarked to the S&P and a bank-focused Canada fund, each securing well over $500 million.

Energy Sector Funds saw substantial inflows of $700 million leading up to the final reporting day, Oct. 9, only for a similar amount to exit the group. Those movements were primarily driven by a single ETF tracking the S&P, but the four-day run of inflows did see two Master Limited Partnership (MLP) Funds bring in over $140 million.

Commodities/Materials Sector Funds posted their seventh inflow of the past four months and extended their longest run of inflows since May 2022. A fund tied to the energy story with “upstream natural resources” in its name pulled in over $100 million, and three funds investing in nonferrous metals placed within the top 10 with the biggest inflows for the week.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds absorbed another $17.5 billion over the seven days ending Oct. 9 as yield hunger, geopolitical concerns and the prospect of capital gains kept investors from rotating towards most Equity Fund groups. During the latest week, Emerging Markets, Municipal and Bank Loan Funds all pulled in over $1 billion, Convertible Bond Funds recorded their biggest inflow since 3Q21 and Total Return Funds extended their current inflow streak to 13 weeks and $22.8 billion.

Those investors continue to shrug off the growing tide of sovereign and corporate debt, with recent auctions of US Treasuries and French OATs seeing bid-to-cover ratios of over 2. They are also discounting the risk that inflation will rebound as North American and European interest rates fall. Redemptions from Inflation Protected Bond Funds hit a 42-week high.

Both Hard and Local Currency Emerging Markets Bond Funds posted inflows, with the latter coming in at an 11-week high, despite some notable outflows at the dedicated Country Fund level. India Bond Funds posted their biggest outflow since 1Q20 and over $500 million – a new record – flowed out of Korea Bond Funds ahead of the announcement by FTSE Russell that both Indian and Korea debt will be included in their widely followed EMGBI and WGBI indexes, respectively, during the second half of 2025.

Investors steered another $10.5 billion into US Bond Funds, with sovereign-mandated funds preferred over their corporate counterparts and intermediate (four to 10 years) the most popular duration. US Municipal Bond Funds absorbed fresh money for the 15th consecutive week, their longest run of inflows since a 30-week streak ended in late 3Q21.

Europe Bond Funds attracted retail money for the 51st time during the past 12 months and fund groups dedicated to markets outside the European Union fared better than their EU counterparts. At the asset class level, flows into Europe High Yield Bond Funds climbed to an 11-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.