In keeping with Trump’s mantra of “America first”, non-US-mandated funds struggled to attract fresh money, with Europe Bond, Global Equity and Bond and Europe Money Market Funds the only groups to attract over $1 billion. Emerging Markets Bond Funds posted their biggest outflow since the first week of 4Q23, China Equity Funds added to their second-longest run out outflows year-to-date and Europe Equity Funds saw money flow out for the 45th time during the past 12 months.

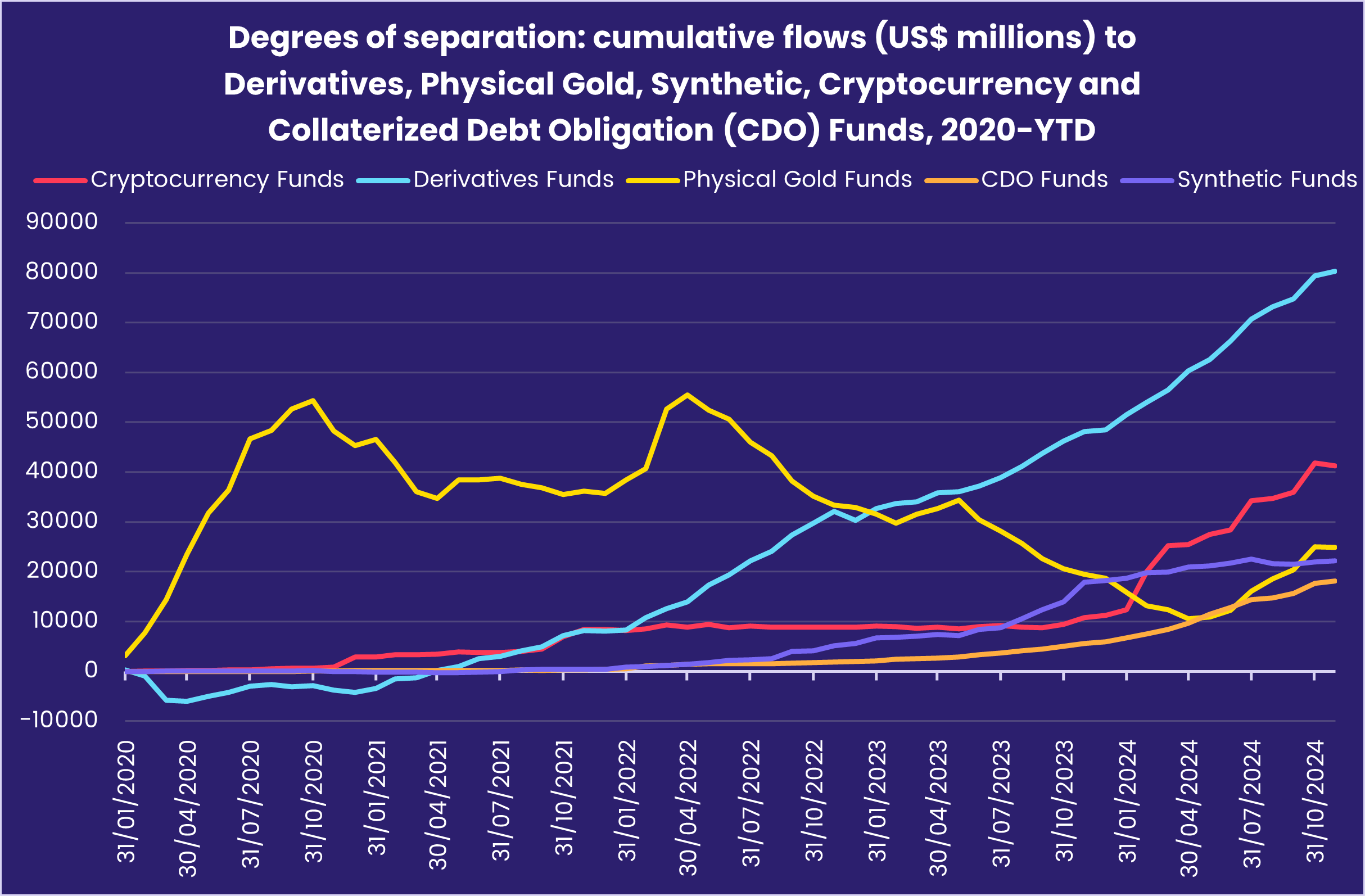

At the asset class level, Cryptocurrency Funds posted their first outflow in nearly two months and Physical Gold Funds their first in a month. Dividend Equity Funds took in fresh money for the 19th week since mid-June, Bank Loan Funds chalked up their second biggest inflow of the year so far and Derivatives Funds extended an inflow streak stretching back to late August.

Overall, a net $36 billion flowed into all EPFR-tracked Equity Funds during the first week of November, Bond Funds absorbed $14.5 billion and Money Market Funds $117 billion while $142 million was redeemed from Alternative Funds and $1 billion from Balanced Funds.

In flows as a % of AuM terms, the weekly total for Equity Funds was 0.16% versus 0.11% during the comparable week in 2016. For Bond Funds it was 0.18% versus -0.0059%, for Alternative Funds -0.019% versus 0.012%, for Balanced Funds -0.054% versus -0.23%, and for Money Market Funds 1.26% versus 0.54% in 2016.

Emerging Markets Equity Funds

With investors rapidly revisiting earlier assumptions about global trade and tariffs in the wake of Donald Trump’s victory in the US presidential election, EPFR-tracked Emerging Markets Equity Funds started November by extending their longest outflow streak since an eight-week run ended 11 months ago. Retail share classes saw money redeemed for the 16th straight week and among the major groups by geographic mandate, only the diversified Global Emerging Markets (GEM) Equity Funds recorded an inflow.

Investors did commit fresh money to EM Dividend and Leveraged Equity Funds. But funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest collective outflow since late 2Q21.

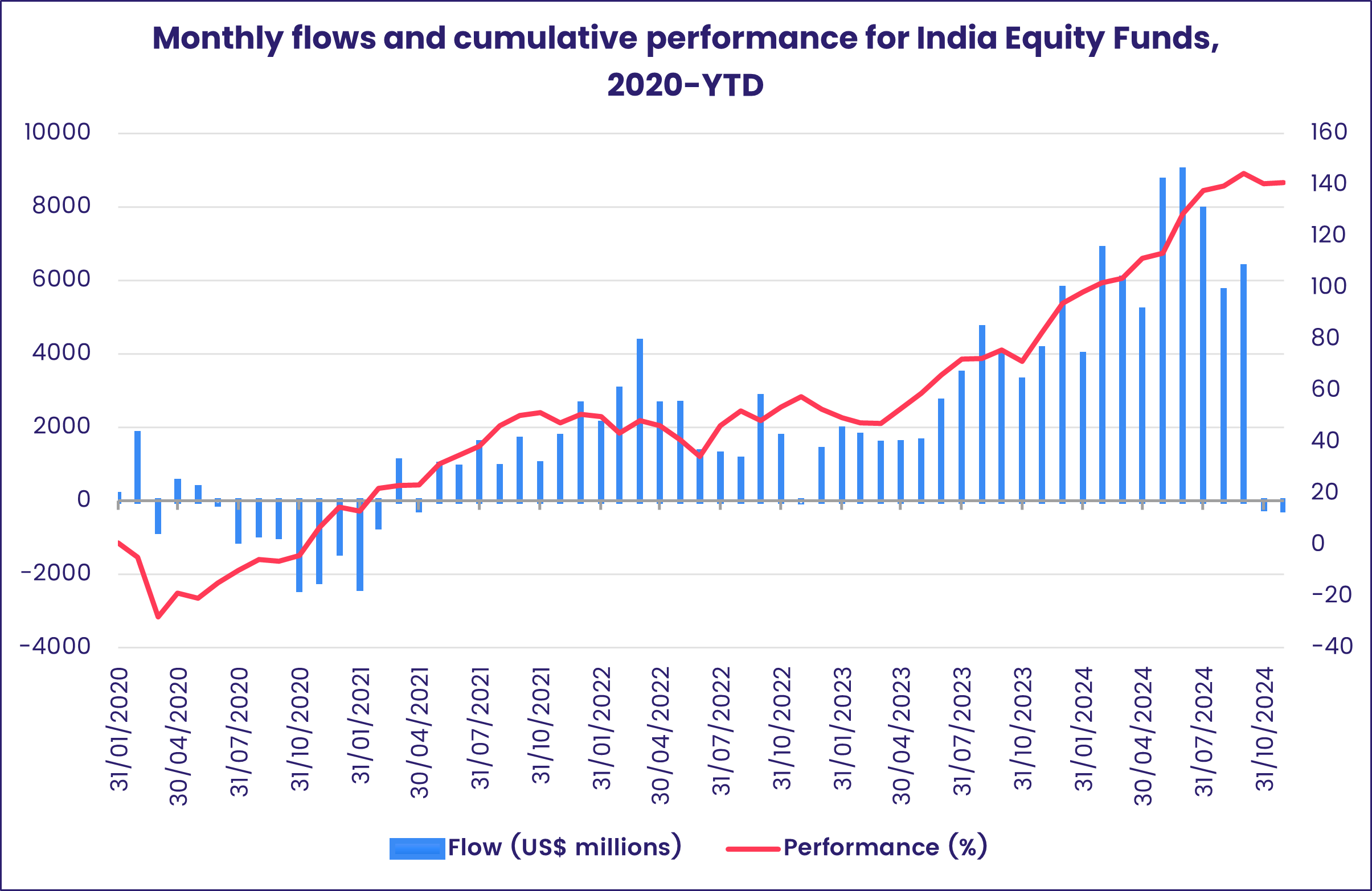

Among the Asia ex-Japan Country Fund groups, China Equity Funds surrendered another $1.1 billion while a combined $1.4 billion flowed into funds dedicated to the other greater China markets, Taiwan (POC) and Hong Kong (SAR). India Equity Funds posted their third straight outflow, the first time that has happened since early 4Q22, as a lackluster earnings season for Indian companies takes a toll on foreign investor sentiment.

Elsewhere, Vietnam-mandated funds posted their 16th outflow during the past 20 weeks and Thailand Equity Funds extended a redemption streak stretching back to the beginning of the year.

It was a mixed week for EMEA Equity Funds, with flows into South Africa Equity Funds climbing to a 12-week high while Africa Regional Equity Funds posted their biggest outflow since mid-July. Among groups tied to countries with significant energy stories, Saudi Arabia, Kuwait, UAE and Qatar Equity Funds all recorded modest outflows during a week when funds dedicated to Turkey, which imports the vast majority of the fuel it uses, posted consecutive weekly inflows for the first time since late July.

Despite the outcome of the US presidential election, Mexico Equity Funds snapped their four-week run of outflows. Argentina Equity Funds also enjoyed solid inflows as investors bet on its reform story and the perceived similarities between Trump and Argentine President Javier Milei.

Developed Markets Equity Funds

Former and future US President Donald Trump’s Nov. 5 victory opened the floodgates for US equity markets while sending chills through European markets. The week ending Nov. 6 saw EPFR-tracked US Equity Funds record their fourth-largest weekly total year-to-date, with flows the day after the election hitting their highest daily total since June 18, as all Developed Markets Equity Funds chalked up their 35th inflow of 2024.

The tailwind from Trump’s victory and Republican majorities in both houses of Congress provided a particularly strong tailwind for US Small Cap Equity Funds, which saw inflows climb to a 16-week high versus three and six-week highs, respectively, for Mid and Large Cap Funds. Investors pulled money out of US Dividend Funds for only the third time since the beginning of July, and US Leveraged Equity Funds recorded their seventh consecutive outflow.

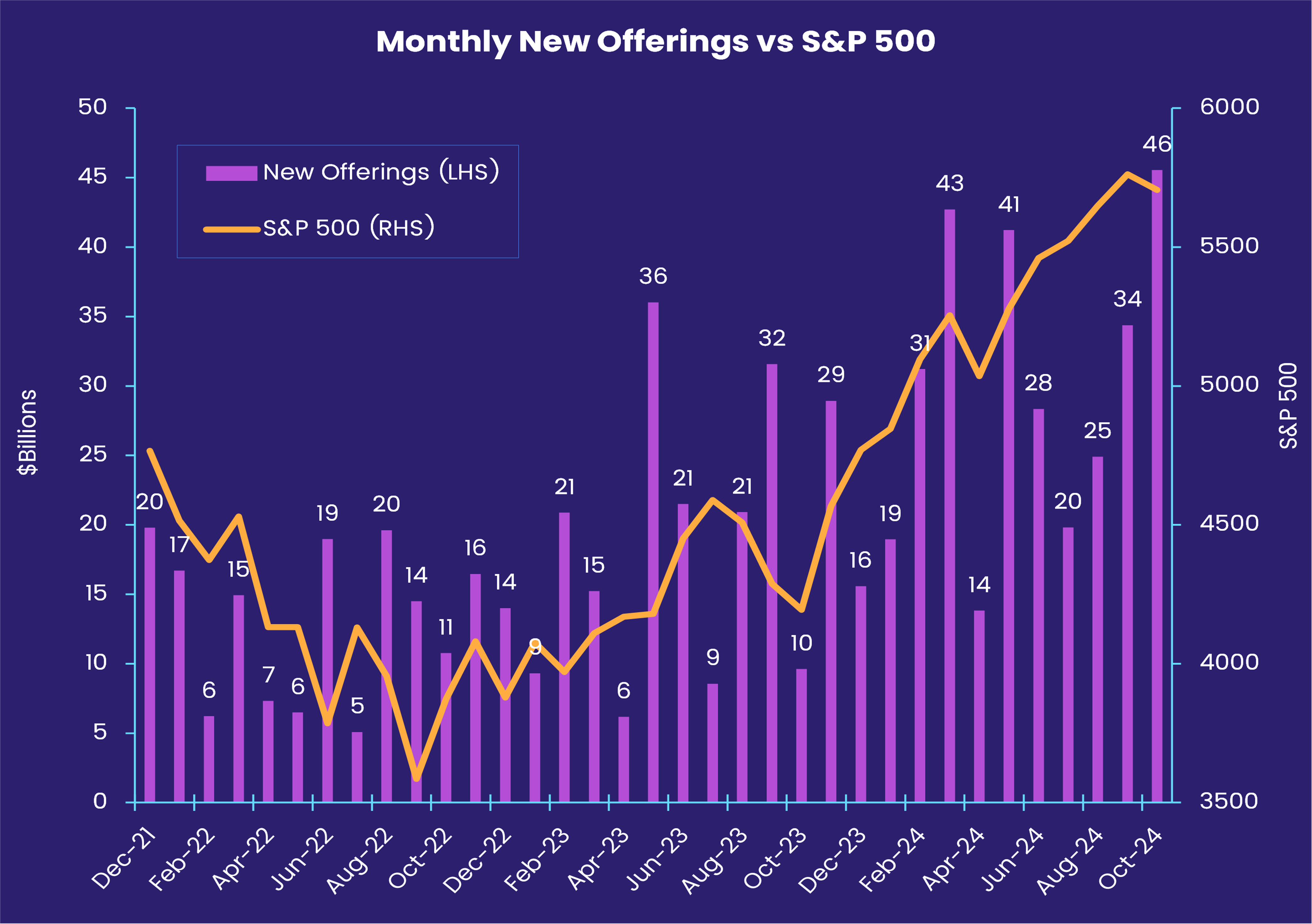

Research by Senior Liquidity Analyst Winston Chua indicates that the free-float for publicly traded US shares continues to shrink, with buybacks and cash acquisitions taking $1.4 billion worth of shares out of play so far this year. But issuance in October was the highest in nearly three years. “A buoyant year for stocks and increased clarity surrounding the election spurred underwriters to crank out $45.5 billion worth of new shares,” noted Chua in a recent report. “The last time October witnessed such a high volume was in the dot-com era of 2000.”

While US stock indexes climbed to fresh record highs, European indexes pulled back as fears of heightened trade tensions with the US hit investor sentiment. Europe Equity Funds overall posted their seventh straight outflow and 22nd since mid-May. At the country level, Greece and Austria Equity Funds extended their current redemption streaks to 22 and 23 consecutive weeks, respectively. Spain Equity Funds posted their biggest outflow since early 2Q24 and Sweden Equity Funds since early 2Q22 while UK Equity Funds recorded only their second inflow of 2024.

For Japan, both flows and the performance of their benchmark index were positive. Japan Equity Funds domiciled overseas did post their 12th consecutive outflow, but the overall market rose on perceptions that currency dynamics will boost Japanese exporters’ competitiveness in the US.

It was a bumpier week for New Zealand Equity Funds, which posted their biggest outflow since mid-March after the country’s central bank gave a tepid assessment of the country’s growth prospects.

Global sector, Industry and Precious Metals Funds

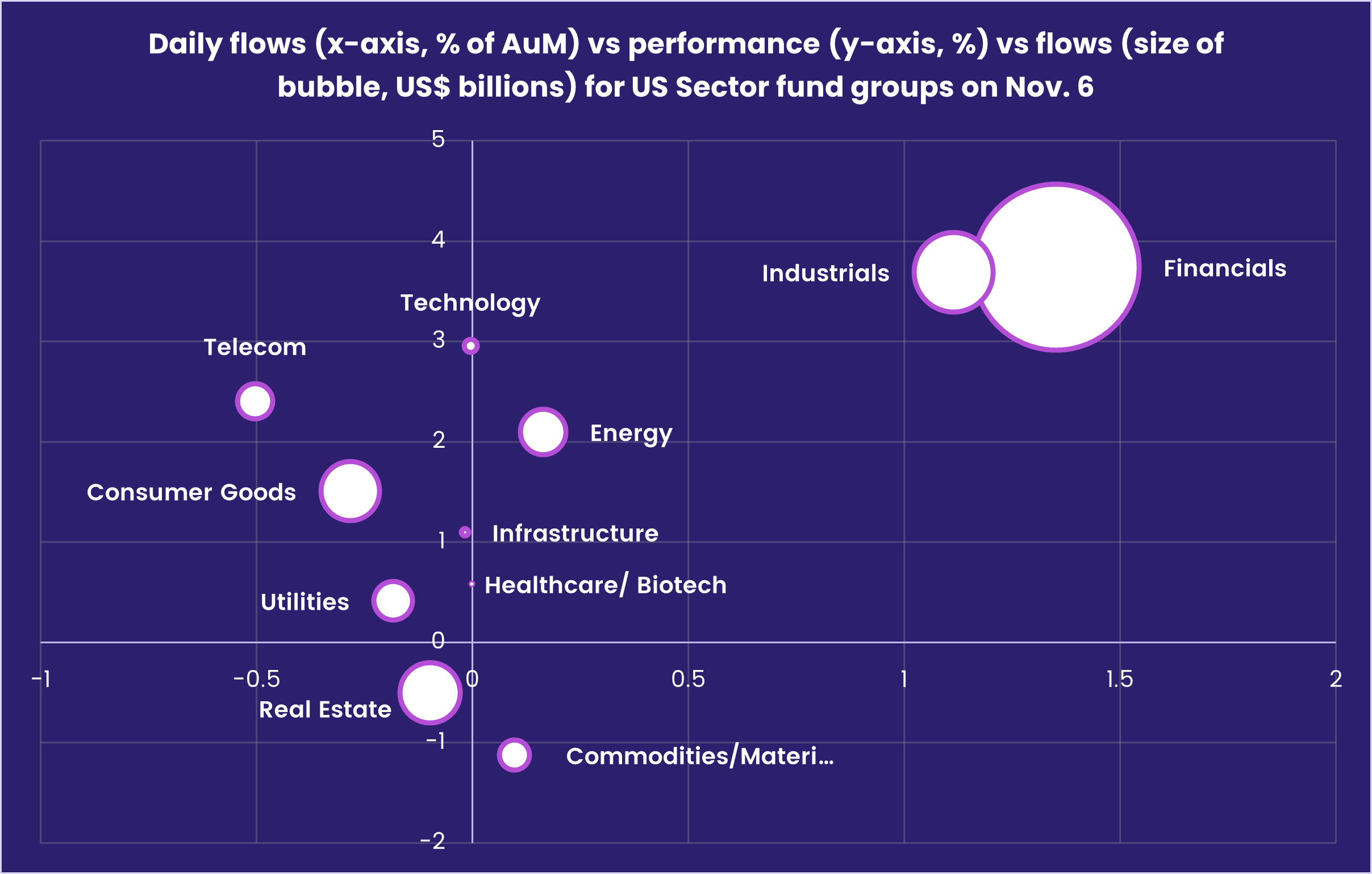

The final weekly figures for the 11 EPFR-tracked Sector Fund groups showed that four – Financials, Technology, Industrials, and Infrastructure – ended the first week of November in positive territory, and trading volume (the absolute value of outflows + inflows) for all funds touched above $7 billion, a four-week high.

Among US-mandated funds, there was a rapid shift from defensive to cyclical sectors reflected in daily flows on November 6, the day after the US presidential election won by Republican Donald Trump, with US Financials, Commodities, Technology and Energy Sector Funds all taking in fresh money.

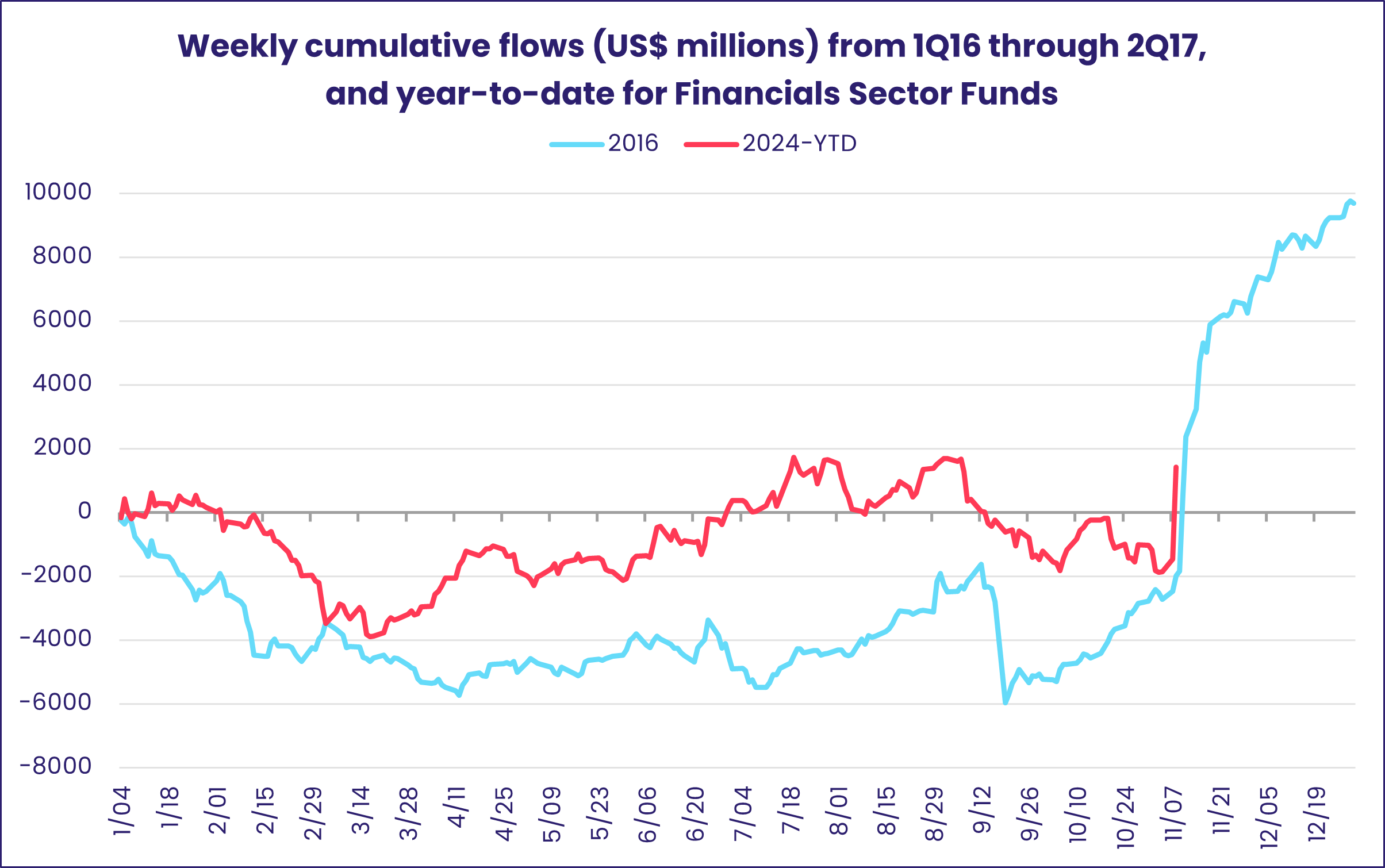

The last time daily flows into Financials Sector Funds hit the $2 billion mark was after the 2016 election. Daily flows data on Nov 6, the day after this year’s election, saw $2.9 billion flow into Financials Sector Funds, surpassing their previous daily inflow of $2.5 billion on November 11, 2016, just days after the first time Trump succeeded in winning the US presidential election.

In terms of the full week, it was the biggest weekly inflow for Financials Sector Funds since early 1Q22. China Financials Sector Funds, however, posted their biggest outflow since 3Q22 at over half a billion and extended their redemption streak to 12 weeks.

Elsewhere, Industrials Sector Funds posted consecutive weekly inflows for the first time since late August. The headline number was directed by a single ETF benchmarked to S&P Industrial Select Sector that pulled in over $800 million. Technology Sector Funds saw their three-week run of redemptions come to an end.

Redemptions for Real Estate Sector Funds climbed above $1 billion as the group extended their outflow streak to four weeks. Five funds saw over $200 million flow out this week, three of which track the performance of REITs.

Bond and other Fixed Income Funds

Political and geopolitical uncertainty allied to lingering yield hunger after the years of financial repression in the wake of the great financial crisis of 2007-09 kept the money flowing into EPFR-tracked Bond Funds during the first week of November. Year-to-date inflows for all funds now stand at $720 billion.

Despite US President-elect Donald Trump’s tax cutting agenda, and the prospect of even bigger US deficits, the week ending Nov. 6 saw another $14 billion flow into US Bond Funds with Asia Pacific, Canada, Europe and Global Bond Funds also attracting fair-to-good amounts of fresh money. At the asset class level, over $1 billion flowed into both High Yield and Bank Loan Funds while Mortgage Backed and Municipal Bond Funds extended their current inflow streaks to 12 and 19 straight weeks, respectively, and Total Return Funds pulled in another $2.7 billion.

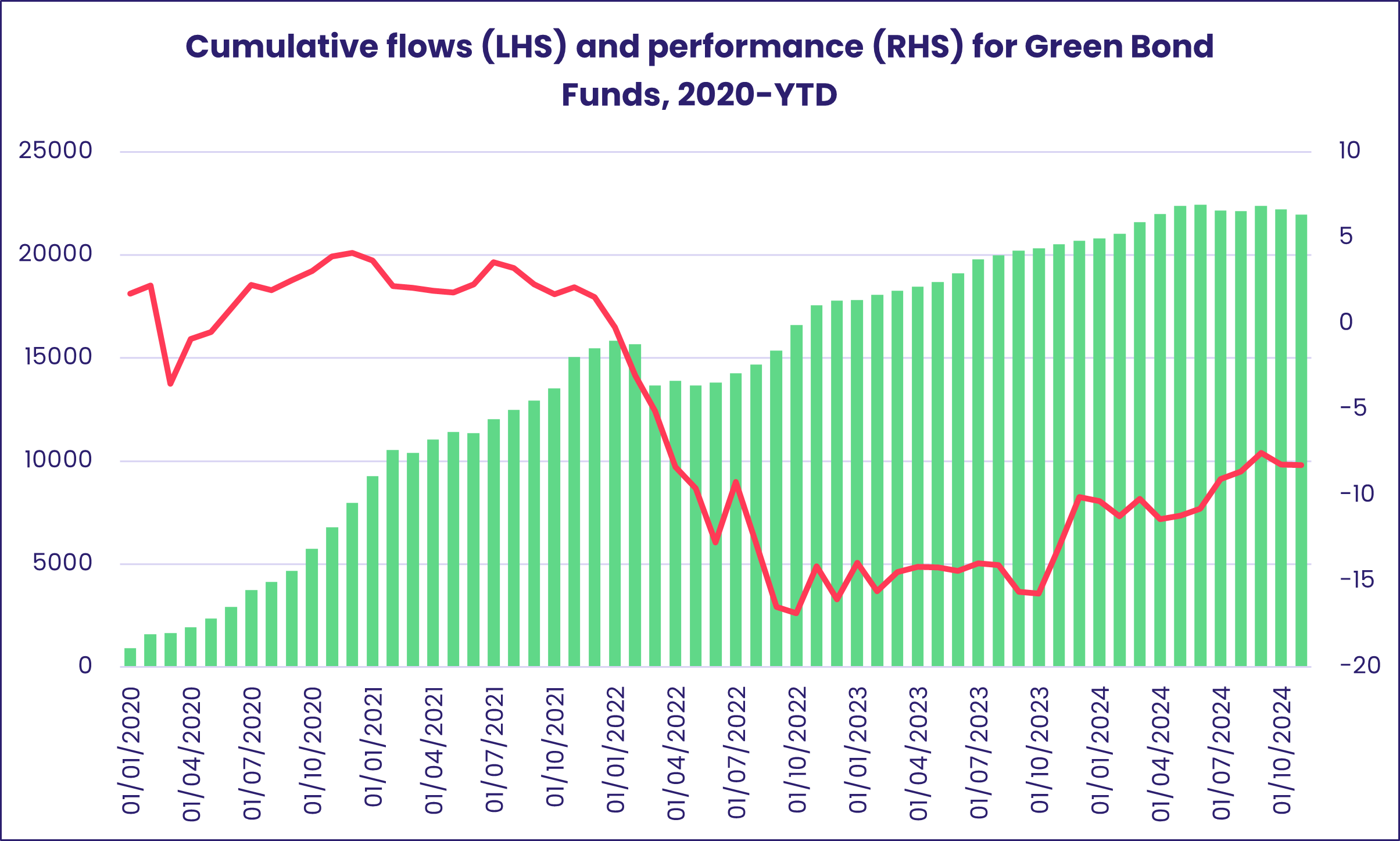

Although all Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates racked up their 12th consecutive inflow, it was a different story for Green Bond Funds. This group, which invests in debt issued to discrete projects with a positive environmental impact, were hit with their heaviest redemptions since late 1Q20.

Emerging Markets Bond Funds experienced their heaviest redemptions in over 13 months. Diversified funds with hard currency mandates made the biggest contribution to the headline number. Frontier Markets Bond Funds did pull in fresh money for the seventh time during the past eight weeks and Sharia Bond Funds recorded their fifth inflow since the beginning of October.

Flows into Europe Bond Funds were less than a third of the previous week’s total, with Corporate Bond Funds again attracting more fresh money than their sovereign counterparts and retail share classes receiving inflows for the 19th consecutive week. Dedicated Country Funds struggled, with redemptions from Germany Bond Funds climbing to an 11-week high and Spain Bond Funds posting their biggest outflow since early June.

Long Term US Bond Funds took in more new money than their short and intermediate term counterparts for the first time since early September ahead of the second cut, this time by 25 basis points, in the Federal Reserve’s policy rate.

Did you find this useful? Get our EPFR Insights delivered to your inbox.