A damn-the-torpedoes spirit gripped investors during the first week of the New Year.

Faced with bond vigilantes stampeding UK sovereign yields and year-ahead forecasts devoting space to overheated US valuations, the impact of tariffs on inflation and trade, China’s moderating economic expansion, rising corporate defaults and the vast borrowing requirements of most leading economies, investors responded in contrarian fashion. They steered over $10 billion into both US Equity and Bond Funds while flows into China Equity and High Yield Bond Funds climbed to four and seven-week highs, respectively.

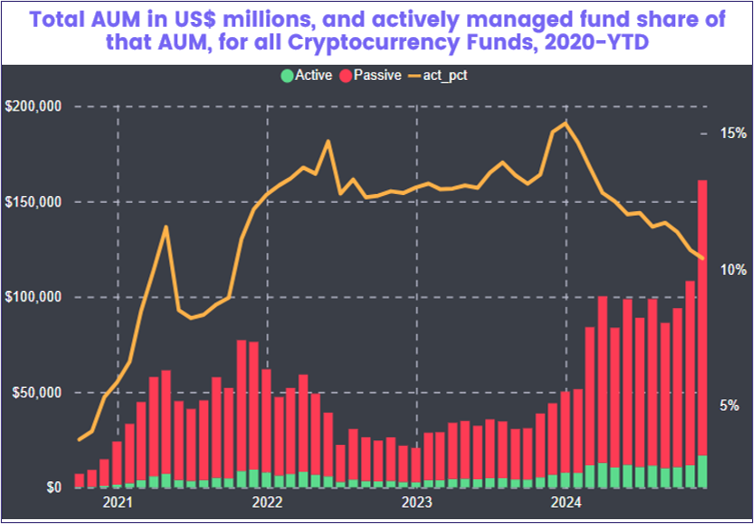

With US president-elect Donald Trump’s inauguration less than two weeks away, investors followed the conventional wisdom when it came to Cryptocurrency Funds. But Trump’s recent rhetoric did not stop Mexico Equity Funds from posting their biggest inflow since late 2Q24 and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates from extending their longest run of inflows since September.

The week ending Jan. 8 was a good one for liquidity funds in both developed and emerging markets. US Money Market Funds, which are currently offering seven-day yields of 4% to 4.3%, took in another $90 billion while Europe Money Market Funds posted their biggest weekly inflow in over two years as flows into UK-mandated funds hit a level last seen in early 4Q22. In the emerging markets universe, South Africa, China and Korea Money Market Funds all pulled in over $700 million while Turkey Money Market Funds posted a new weekly inflow record.

Overall, the first week of January saw a net $21.6 billion flow into all EPFR-tracked Bond Funds and $25.6 billion into Equity Funds while Balanced Funds absorbed $2.7 billion, Alternative Funds $2.9 billion and Money Market Funds $143.9 billion.

Emerging Markets Equity Funds

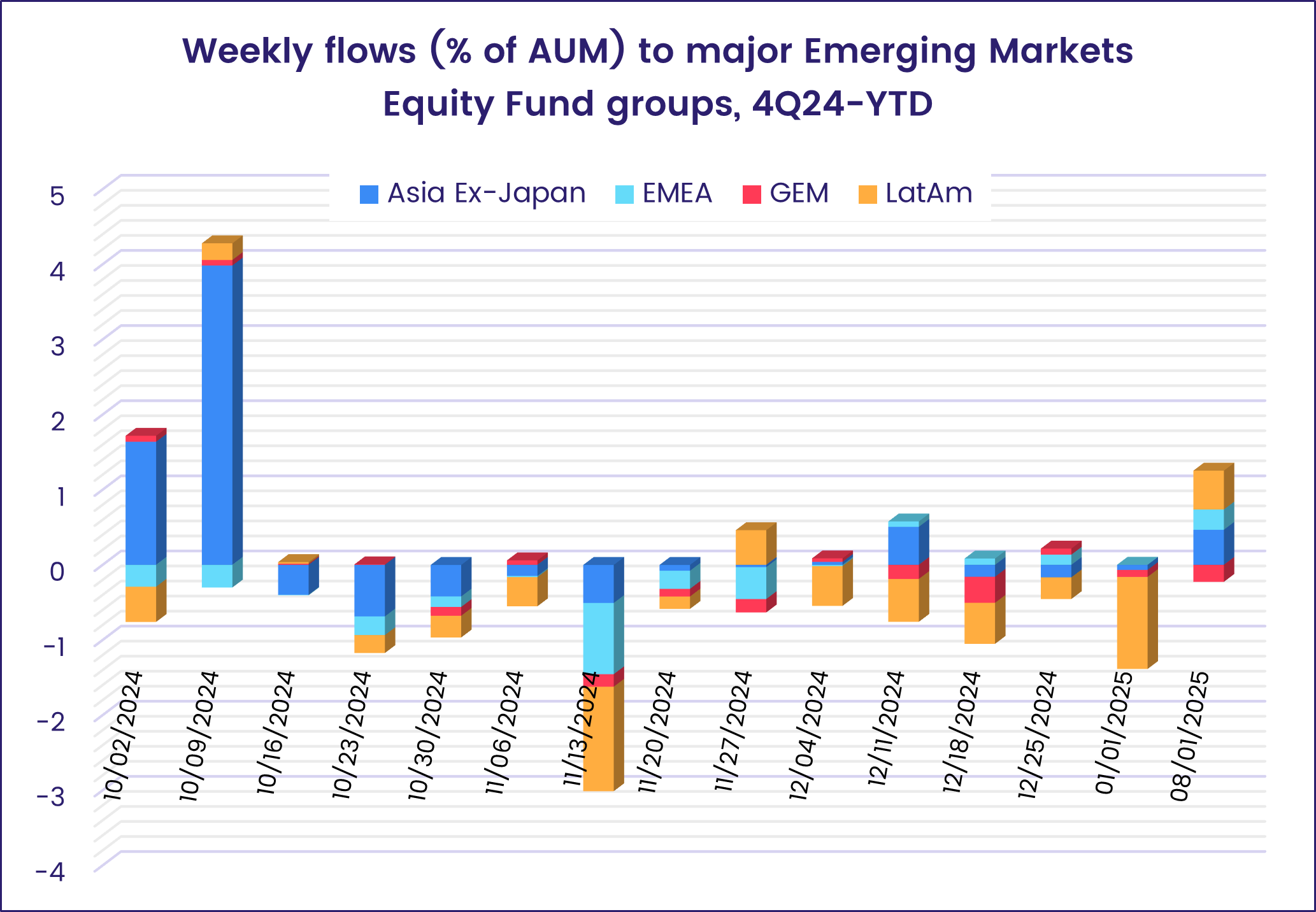

In a repeat of the pattern that held sway for the first nine months of last year, strong flows into China Equity Funds lifted EPFR-tracked Emerging Markets Equity Funds during the first week of 2025, with the overall group posting only their fourth inflow since the beginning of 4Q24.

Both Latin America and EMEA Equity Funds contributed to the headline number for all funds, with the former posting their biggest inflow since late 2023 and EMEA Equity Funds since mid-3Q24. But Frontier Markets Funds chalked up their second-largest outflow over the past 12 months and another $1.3 billion was redeemed from the diversified Global Emerging Markets (GEM) Equity Funds.

ETFs continue to absorb the lion’s share of the fresh money coming into Emerging Markets Equity Funds, with conventional mutual funds mired in a collective outflow streak stretching back to mid-June of last year.

The latest week’s flows into China Equity Funds came as policymakers rolled out the latest in a sequence of stimulus measures unveiled over the past four months, aimed at bolstering domestic consumer confidence. While those policymakers are seeking to sustain 5% GDP growth while keeping deflation at bay, India’s are trying to balance growth with an inflation rate that remains uncomfortably close to the Indian central bank’s target ceiling. Investors, who poured money into India Equity Funds during 2023 and 2024, are stepping back while they see how things play. The redemptions from India-mandated funds during the first week of January were the largest since March 2022.

EMEA Equity Funds added to their longest inflow streak since 3Q24 as investors continue to project varying degrees of political and military peace on South Africa, the Middle East and Ukraine during the next 12 months. Flows into Turkey and South Africa Equity Funds climbed to four and 20-week highs, respectively, while Israel Equity Funds extended their longest run of inflows in over nine months.

Hopes that US President-elect Donald Trump’s enthusiasm for tariffs will be moderated by contact with the reality of more expensive goods for American voters prompted investors to revisit the case for Mexico in early January. Mexico Equity Funds saw over $100 million flow in, while Trump’s presumed enthusiasm for Argentine President Javier Milei’s economic policies helped Argentina Equity Funds post their second highest weekly inflow on record.

Developed Markets Equity Funds

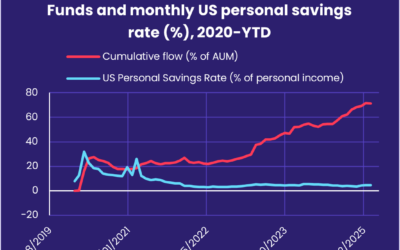

When it came to US Equity Funds absorbing above average amounts of fresh money, the new year picked up where 2024 left off. During the first week of January, flows into US Equity Funds since the beginning of November climbed by another $11 billion to over $190 billion, helping EPFR-tracked Developed Markets Equity Funds chalk up their 12th inflow over the past three months. Global and Australia Equity Funds also attracted healthy inflows while Europe and Japan Equity Funds experienced net redemptions.

Retail investors have jumped on the US bandwagon, with the retail share classes of US Equity Funds recording a third straight collective inflow for the first time since early 2Q22. So have overseas investors, with foreign-domiciled US Equity Funds recording bigger inflows than their domestically-based counterparts for the fifth time during the past seven weeks.

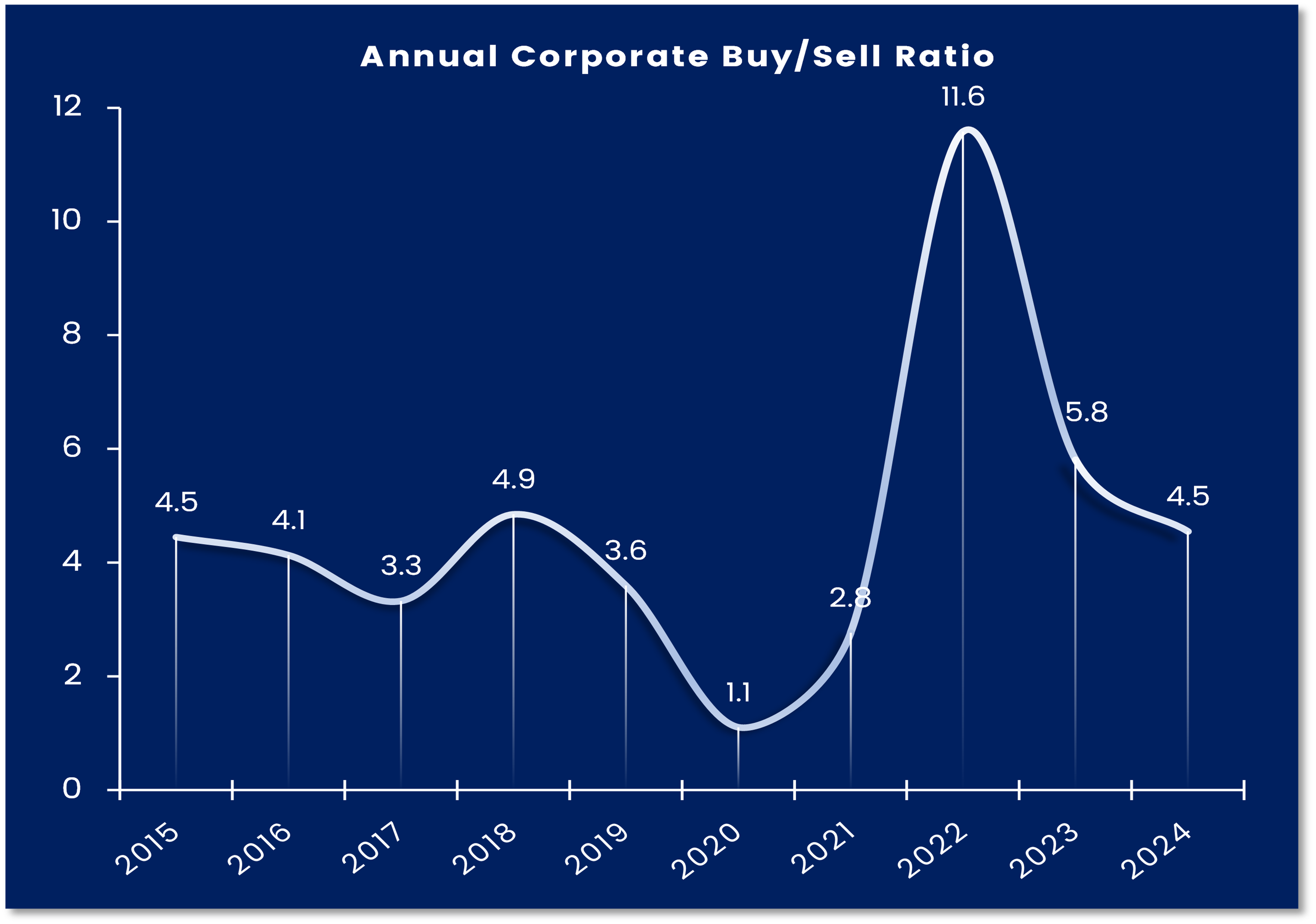

Among the tailwinds that US stock funds are enjoying is the record-setting levels of free-float shrink engineered by US companies, which announced $1.34 trillion worth of share buybacks in 2024. The impact of this on stock prices and supply was moderated by a pick-up in new share issuance. According to EPFR’s Senior Liquidity Analyst, Winston Chua, “New offerings [from US companies] in 2024 rose by 60% year-on-year to $360.1 billion, which was 2.4 times the 2022 total, and that dropped the corporate buy/sell ratio to a three-year low.”

On the other side of the Atlantic, appetite for European equity exposure remains at a low ebb. Europe Equity Funds chalked up their 47th weekly outflow since the beginning of last year as investors digested weak manufacturing data from Germany, lackluster consumer and business sentiment numbers for the European Union and the growing uncertainty about the UK’s economic trajectory. Switzerland retains its allure as a port in economic storms, with Switzerland Equity Funds building on last year’s record-setting inflow by absorbing another $703 million.

Among the Asia Pacific Country Fund groups, Australia Equity Eunds started 2025 with their biggest weekly inflow since 4Q20 as investors showed a greater willingness to buy into China’s stimulus story and the markets that will benefit if the measures are successful. But uncertainty about US trade policy and weakening domestic demand gave investors reason to book some of the gains on their Japanese exposure. Japan Equity Funds posted another outflow – their seventh over the past eight months – despite the first net flow into retail share classes since late November.

Global sector, Industry and Precious Metals Funds

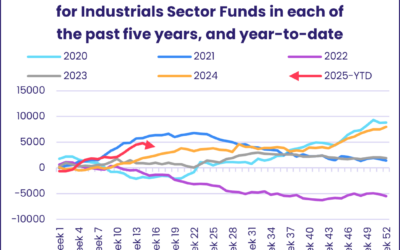

With the fourth quarter earnings season about to kick off and the White House changing hands on Jan. 20, investors had reason to kick the tires on the sector investments during the first week of the New Year. They ended up pulling money out of six of the major EPFR-tracked Sector Funds and committing fresh money to the other five with Technology and Telecoms Sector Funds to the fore.

The money that flowed into Technology Sector Funds offset roughly a third of the net redemptions over the previous five weeks, and the headline number would have been significantly higher but for some significant outflows from leveraged funds. Unleveraged Semiconductor & Chip Industry Funds posted inflows of almost $800 million and funds benchmarked to NYSE FANG+ posted their 15th consecutive inflow, with the latest total a record high.

Close to $1 billion flowed into Telecoms Sector Funds, marking the biggest weekly inflow in roughly 10 months and the seventh of the past nine weeks. A single fund tracking the Communication Services Select Sector index attracted nearly 90% of this week’s headline number.

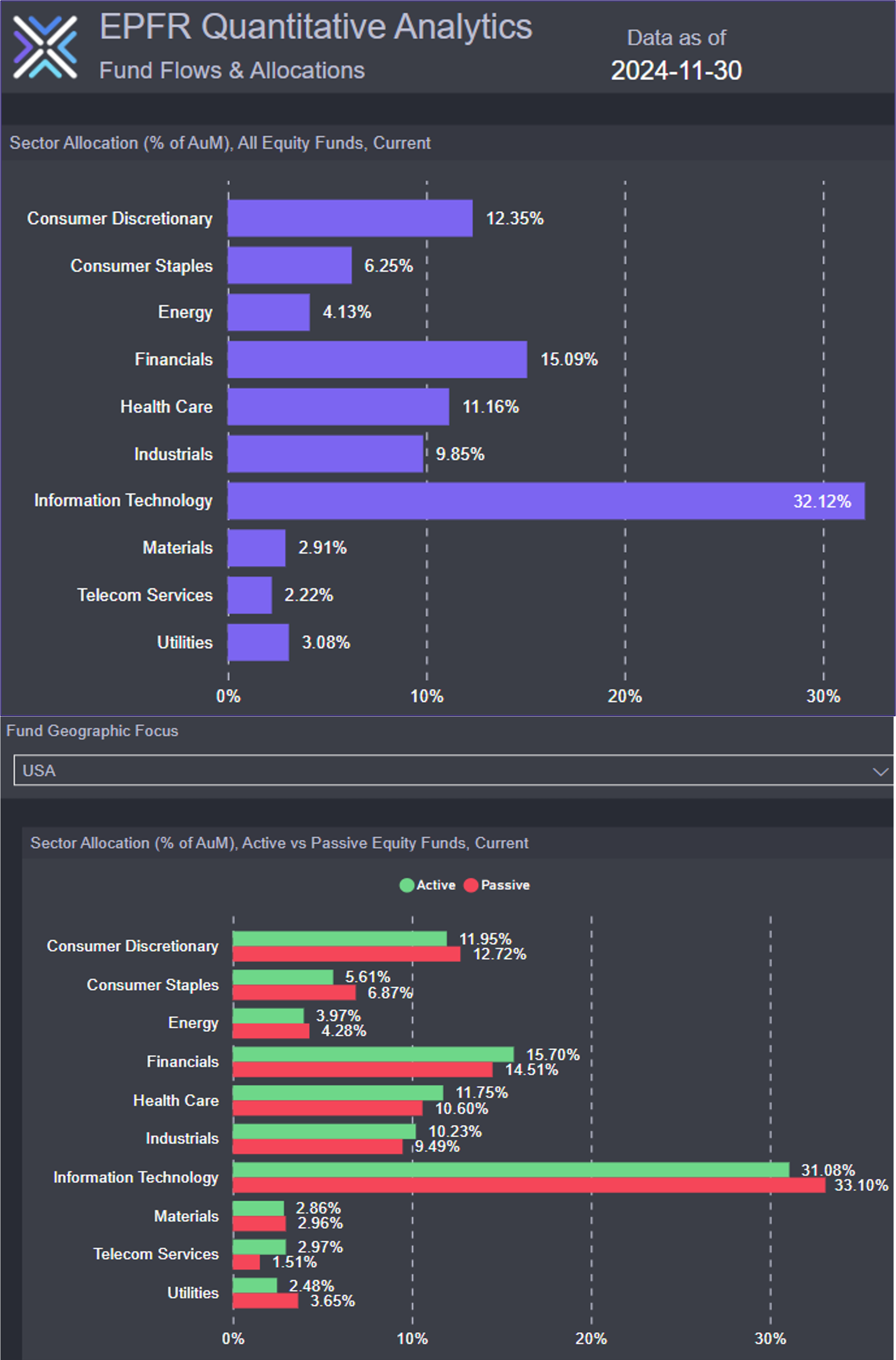

Current EPFR Sector Allocations data shows actively-managed US Equity Funds are overweight Telecom Services (1.5%) and underweight Information Technology (2%).

Financials Sector Funds posted a decent inflow, though it amounted to less than 0.2% of their assets, as US Bank Funds absorbed the majority of the headline number, a four-week high of $225 million. But redemptions from Real Estate Sector Funds came in at their highest level in nearly two months.

Investors continued to opt for cryptocurrencies over gold. Physical Gold Funds posted a second consecutive weekly outflow, though the group did fare well overall during the fourth quarter. Following three yearly outflows, the group chalked up inflows of $5.78 billion in 2024, though that was well short of the record-setting and pandemic-induced $45 billion they pulled in during 2020. Flows into Copper Mining Funds last year roughly matched their previous record – $1.4 billion – set in 2021.

Bond and other Fixed Income Funds

A selloff in US and UK sovereign debt markets, expectations of shallower rate reduction trajectories and heavy issuance in primary markets did not stop EPFR-tracked Bond Funds from kicking off the New Year with their biggest collective inflow since the second week of October. Of the major groups by geographic focus, only Emerging Markets Bond Funds posted an outflow.

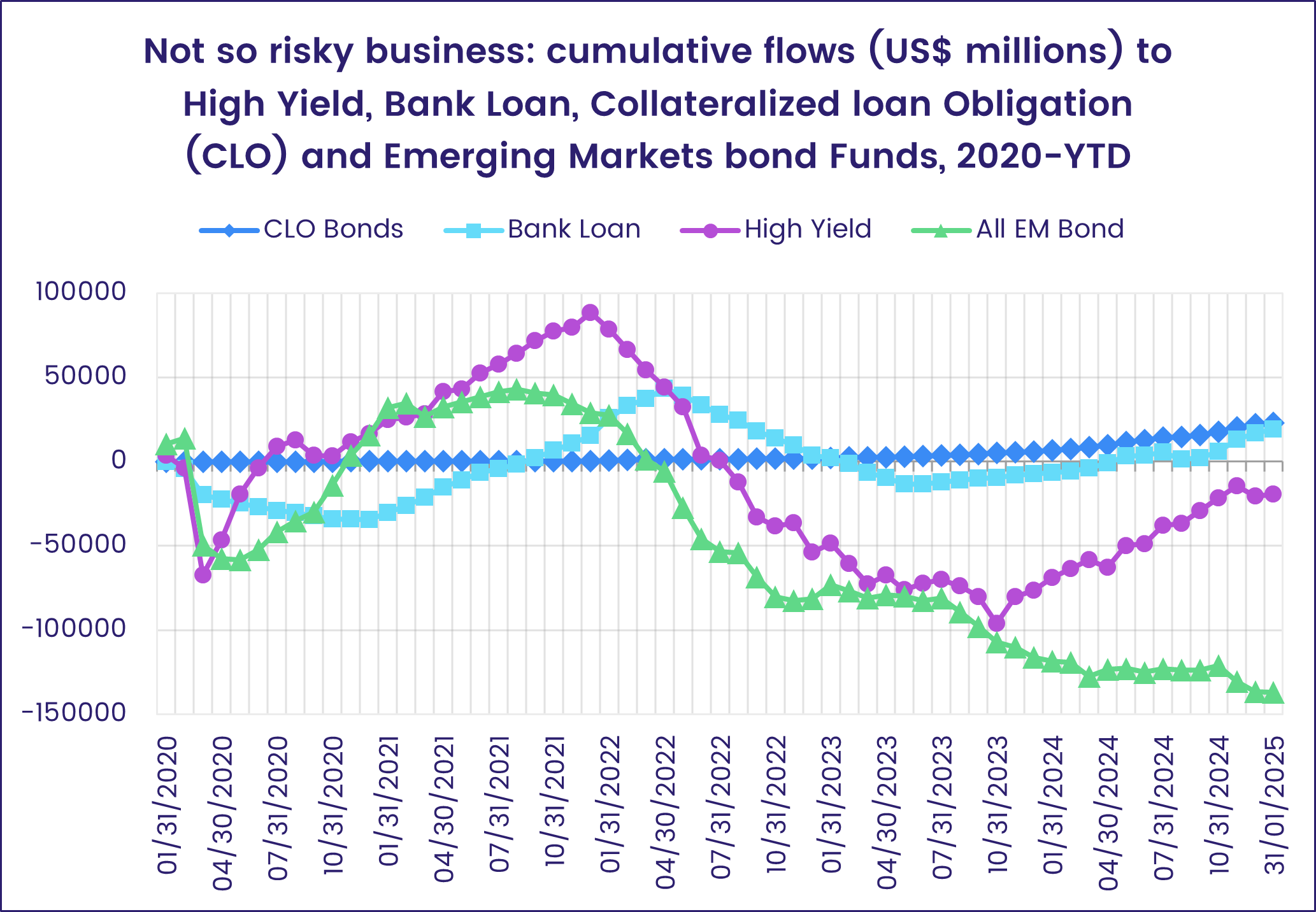

At the asset class level, risk appetite also showed resilience, with High Yield Bond Funds absorbing over $2 billion while Bank Loan and Collateralized Debt Obligation (CLO) Bond Funds enjoying record setting inflows. Municipal Bond Funds snapped their longest outflow streak since mid-4Q23, Mortgage Backed Bond Funds pulled in over $1 billion for the fourth time over the past seven weeks and Total Return Funds for the 23rd time since the beginning of 3Q24.

Europe Bond Funds, which set a new full-year record in 2024, kicked off January with another solid inflow. Europe ex-UK Regional Bond Funds accounted for the biggest share of the headline number but, despite the turmoil in UK gilt markets which saw yields on British 10-year notes hit levels last seen in 2008, UK Bond Funds racked up their 17th inflow since the beginning of September.

For Emerging Markets Bond Funds, a modest net outflow was shaped by another $1 billion flowing out of funds with hard currency mandates while Emerging Markets Local Currency Bond Funds chalked up their biggest inflow since the third week of 2Q24, when fears of a wider conflict in the Middle East and only one US interest rate cut for the year shaped sentiment. At the country level, flows into South Africa Bond Funds set a new weekly record.

US Bond Funds recorded their biggest weekly inflow since mid-July as retail share classes saw fresh money for the first time since early December.

Did you find this useful? Get our EPFR Insights delivered to your inbox.