Even though they knew it was coming, investors reacted defensively to the iconoclastic, on-the-fly policymaking of America’s 47th president in early February, with major US indexes moving sideways and the price of gold hitting a fresh record high. The uncertainty generated by Donald Trump’s flurry of proposals, threats and executive orders also shaped their appetite for mutual funds and ETFs, with those offering exposure to alternative asset classes, cash and bonds the preferred options.

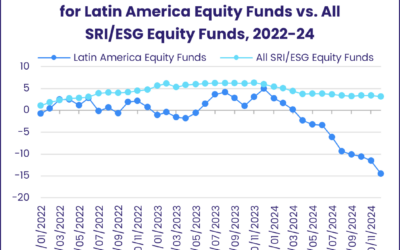

The week ending Feb. 5 saw EPFR-tracked Equity Funds post their first collective outflow since mid-December as redemptions from Dividend Equity Funds and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates climbed to 19 and 42-week highs, respectively. But Bond and Money Market Funds pulled in a combined $63.3 billion, Cryptocurrency, Bank Loan and High Yield Bond Funds all pulled in over $2 billion and Physical Gold Funds extended their longest run of inflows since October.

The consensus that Trump’s aggressive start to his second presidency is likely to keep prices higher for longer, and limit the Federal Reserve’s scope for cutting US interest rates, was reflected in the outflows from Technology and Biotechnology Sector Funds, the solid flows into Gold and Platinum Funds, and the biggest inflow recorded by Inflation Protected Bond Funds since late October.

At the single country and asset class fund levels, Japan Money Market Funds posted their biggest outflow in over 22 months, redemptions from Singapore Bond Funds tallied their third outflow of more than $100 million since mid-December and Denmark Equity Funds tallied their biggest outflow in exactly a year. Flows into Cybersecurity Funds hit a 52-week high, Physical Silver Funds posted their biggest outflow since the third week of 2Q24 and Catastrophe Bond Funds recorded their ninth consecutive inflow.

Emerging Markets Equity Funds

With the specters of fresh trade barriers and higher-for-longer US interest rates gaining substance as the new US administration outlined its goals and priorities, flows for most EPFR-tracked Emerging Markets Equity Funds stalled during the first week of February. Flows, in % of AuM terms, for EMEA, Latin America, Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds came in at 0.2%, 0.17%, 0.066% and -0.035%, respectively.

Retail share classes bore the brunt of the latest redemptions, posting their biggest headline number since late 1Q20 as they extended an outflow streak stretching back to mid-July.

The tailwind generated by the announcement of DeepSeek’s AI model faded rapidly as investors turned their attention to rising Sino-US trade tensions and waited to see what additional measures Chinese policymakers will deploy to stimulate their country’s economy. China Equity Funds posted their third outflow of the year-to-date and Hong Kong (SAR) Equity Funds their first since the third week of October.

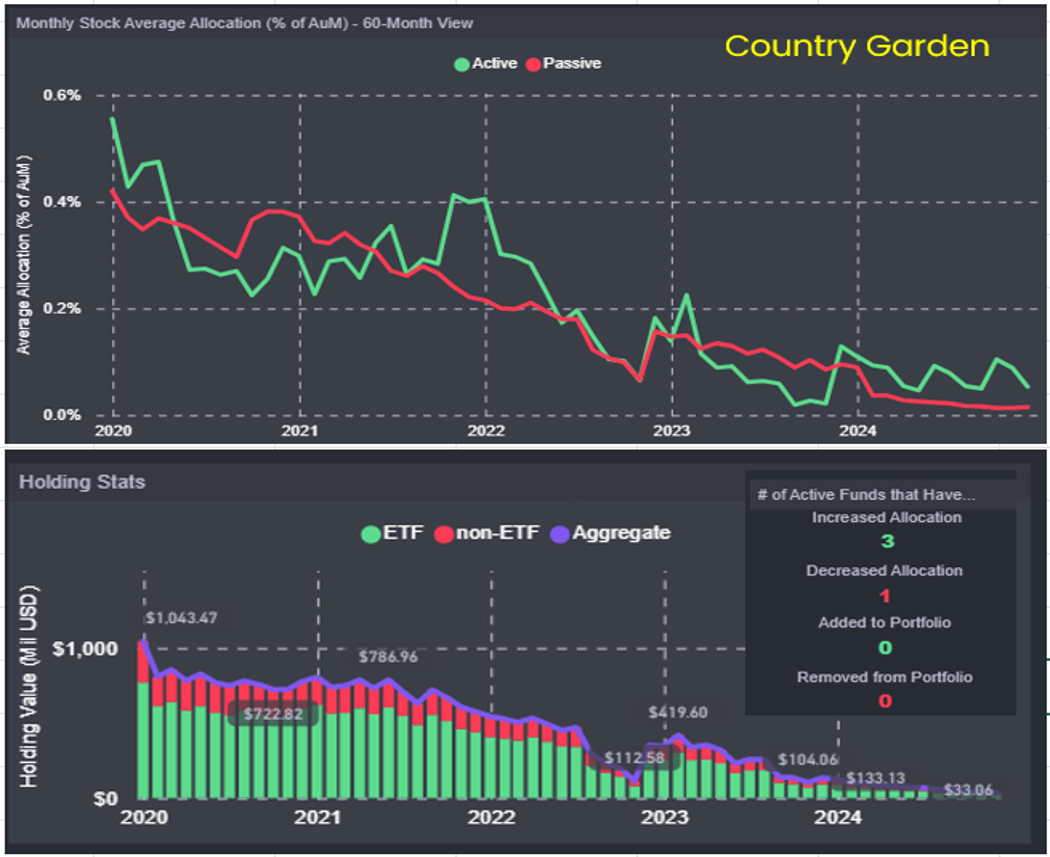

The announcement of significant losses by developer China Vanke also reminded investors that China’s property market remains under pressure, though fund managers are showing some willingness to test whether China’s real estate cycle has bottomed out. EPFR’s stock-level data shows that several actively managed funds have increased their holdings of Country Garden equity after shares in that embattled company resumed trading earlier this year.

Among the other Asia ex-Japan Country Fund groups, those dedicated to India and Taiwan stood out. India Equity Funds posted their fifth straight outflow, and their 13th during the past 16 weeks, as investors digested the country’s latest budget while broad faith in the AI story saw another $1.1 billion flow into Taiwan (POC) Equity Funds.

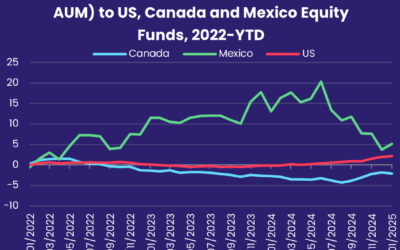

With Mexico given a reprieve from threatened US tariffs, flows into dedicated Mexico Equity Funds climbed to a 34-week high. But persistent concerns about Brazil’s fiscal deficit, and the knock-on effects this could have on inflation and interest rates, chased over $100 million out of Brazil Equity Funds. Brazil’s central bank hiked rates by another 100 basis points at the end of January, ands some forecasts seeing the key rate hitting 15% later this year.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds started February by posting their first collective outflow of 2025 as redemptions from Global, Canada and Europe Equity Funds offset flows into Japan and US Equity Funds. Many investors hit the pause button while they waited to see if US President Donald Trump’s rhetoric on trade and tariffs ends in a series of compromises or a full-blown trade war with China, Europe and other countries that currently enjoy trade surpluses with the US.

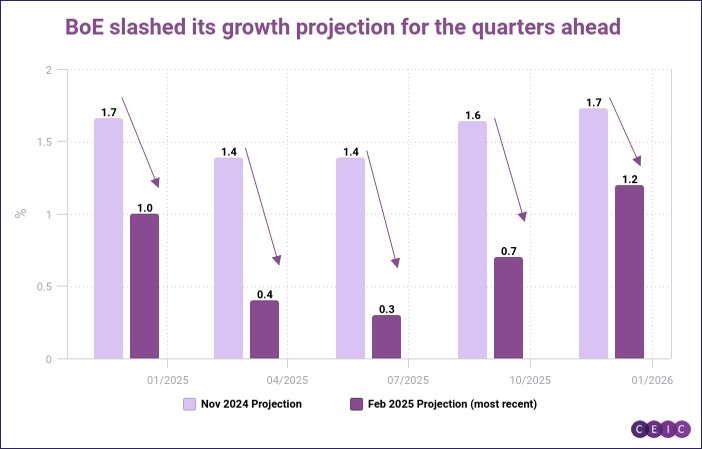

Despite the threat posed by new tariffs, major European equity markets tested record highs as investors translated the region’s economic woes into further interest rate cuts. But Europe Equity Funds posted another collective outflow, their 18th on the trot, as over $1 billion flowed out of UK Equity Funds. Another rate cut by the Bank of England was accompanied by significant cuts, captured in this chart from EPFR sister company CEIC, in the BOE’s forecasts for growth well into 2026.

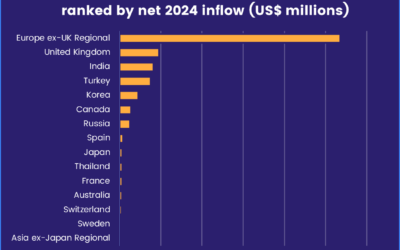

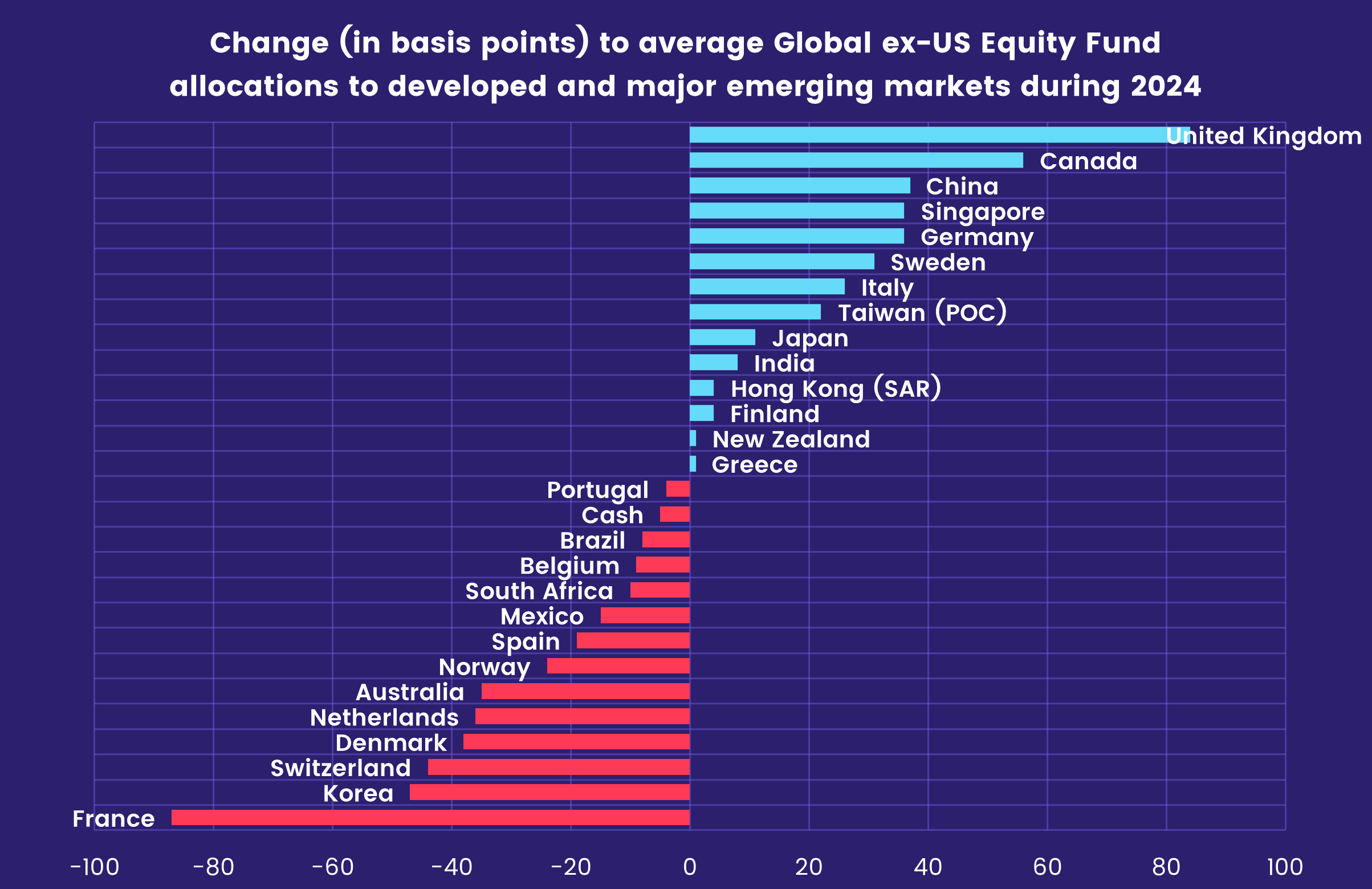

The headwinds facing the British economy did not stop Global ex-US Equity Fund managers from giving the UK the biggest allocations boost in 2024. Although these funds ended the latest week by posting their biggest outflow since mid-December, they took in fresh money 44 of the 52 weeks in 2024, totaling over $80 billion.

US Equity Funds posted a minimal outflow driven by commitments to Large and Mid Cap Blend Funds. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates experienced net redemptions for the third time over the past four weeks and US Equity Collective Investment Trusts (CITs) recorded their biggest outflow since 2Q22. Appetite from overseas investors held up, with foreign domiciled US Equity Funds extending an inflow streak that began in early October.

Flows into Japan Equity Funds rebounded to a 14-week high, with leveraged funds accounting for two-thirds of the headline number.

Global sector, Industry and Precious Metals Funds

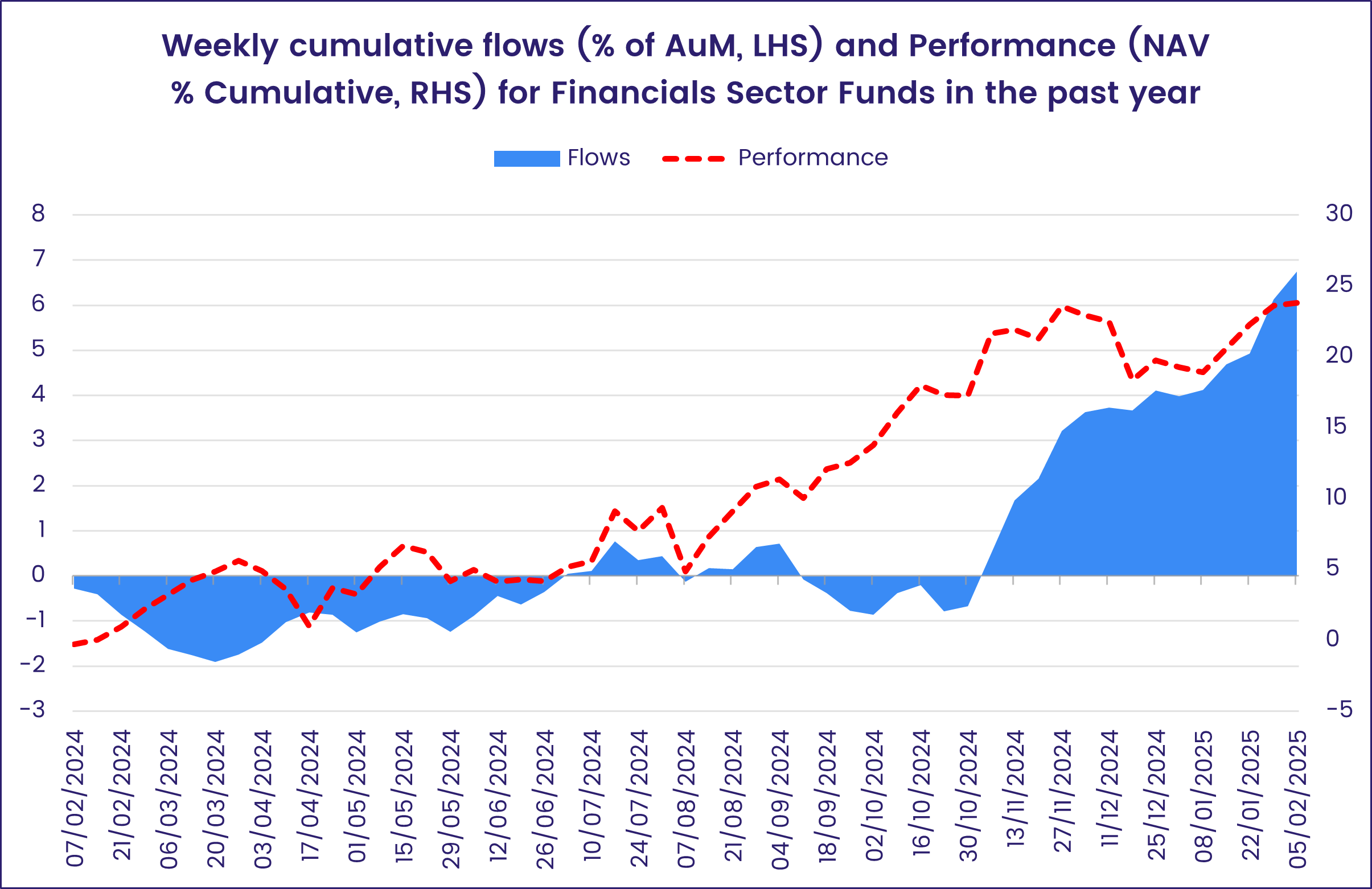

With February a week old, three of the 11 EPFR-tracked Sector Fund groups – Financials, Industrials and Telecoms Sector Funds – have already experienced inflows exceeding 2.2% of their total assets, something that has not occurred since 2022, 2021, and 2020, respectively. At this point last year, those three groups were being dumped.

Consumer Goods Sector Funds are not far behind, attracting 1.3% of assets year-to-date. The group has posted inflows for five weeks running, their longest run in nearly two years, with the latest inflow the biggest in nearly four months. Three of the top four funds ranked by inflows for the week track home building and construction. The other was a bullish fund tracking Tesla stocks, despite a whipsaw reaction in the market following a lackluster 4Q24 earnings reports delivered by a very sanguine Elon Musk.

For Financials Sector Funds, the latest inflow was the 15th of the past 18 weeks. At the fund-level, over $500 million flowed into a single-fund that tracks the six largest Canadian banks and over $200 million was committed to a fund benchmarked to S&P Regional Banks.

Technology Sector Funds snapped their longest run of inflows since mid-3Q24. Redemptions from three semiconductor ETFs totaled nearly $1 billion and another $400 million flowed out of funds tracking the performance of the largest 100 companies from the NASDAQ stock exchange. That outweighed inflows of over $650 million for a single software-focused ETF and a collective $350 million into two Leveraged Nvidia ETFs.

Outflows for Healthcare/Biotechnology Sector Funds climbed to nearly $1 billion. Five of the top 10 funds with the biggest redemptions this week tracked a S&P benchmark, and three were specifically focused on biotechnology.

Bond and other Fixed Income Funds

Flows to EPFR-tracked Bond Funds carried the previous week’s template into February, with US, Europe, Japan, Canada and Global Bond Funds enjoying solid inflows and enthusiasm for Turkish and South African debt allowing Emerging Markets Bond Funds to post consecutive weekly inflows for the first time since mid-October.

Risk appetite among fixed income investors remains at a high level despite the hefty borrowing requirements of many major economies, with the US deficit in 2025 expected to total nearly $2 trillion. During the week ending Feb. 5, flows into High Yield Bond Funds exceeded $2 billion for the fourth time so far this year, Bank Loan Funds extended their current inflow streak to 18 weeks and $27.7 billion and Collateralized Loan Obligation (CLO) Funds set a new weekly inflow record.

There was less enthusiasm for Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which posted their first outflow since mid-December.

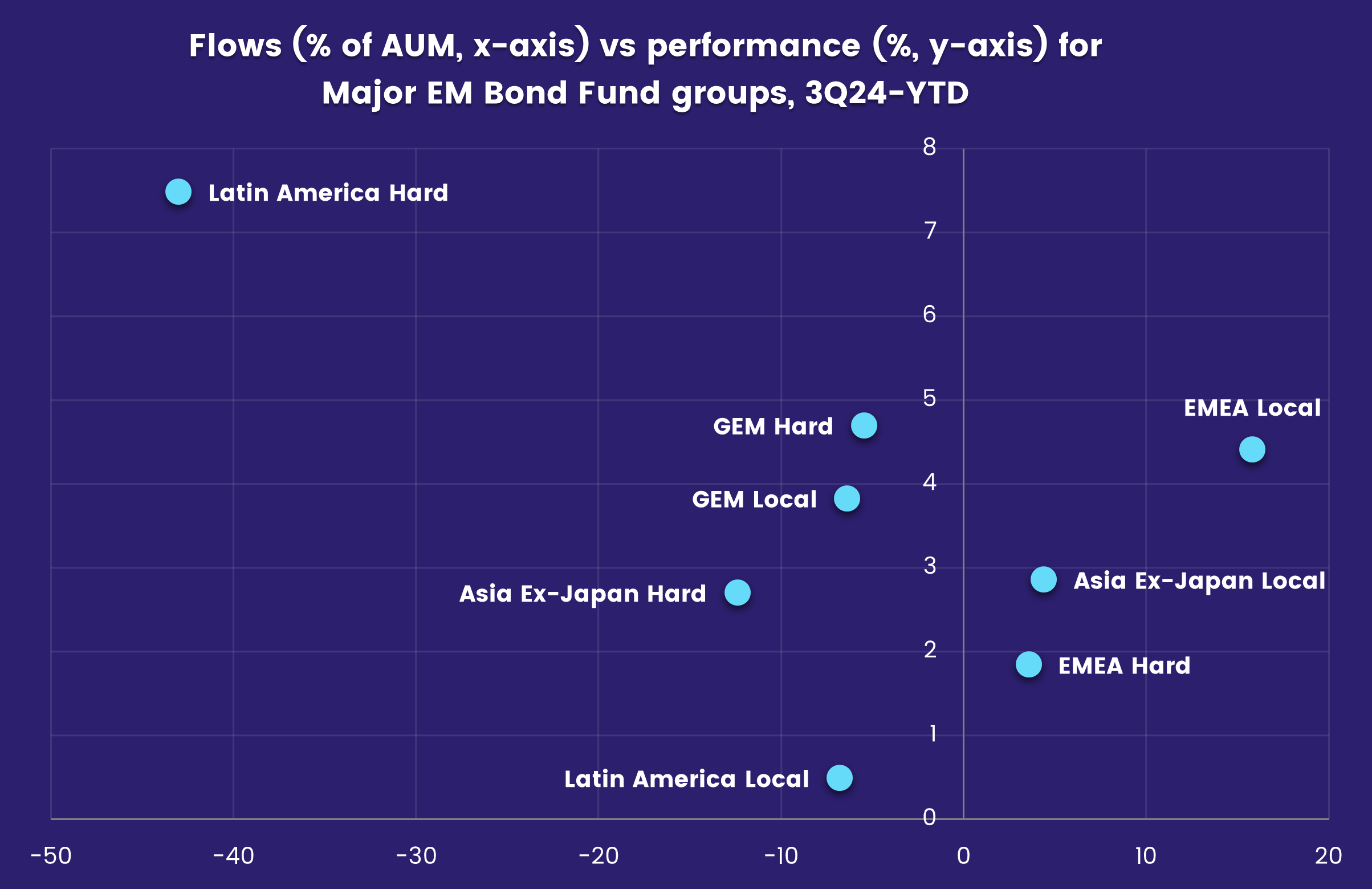

Emerging Markets Bond Funds posted above average inflows for the second week running as Turkey Bond Funds absorbed another $972 million, South Africa Bond Funds recorded their third largest inflow during the past year and flows into India Bond Funds climbed to a 26-week high. Funds with local currency mandates again attracted the lion’s share of the latest inflows.

US Bond Funds saw retail money flow out for the eighth time over the past three months and funds with sovereign debt mandates recorded their first outflow since mid-December but, overall, the group still added to a year-to-date total that now stands at $60.1 billion. At the same point last year, they had absorbed a net $66.7 billion.

Europe Bond Funds extended their latest inflow streak even though the headline number was the smallest in 11 weeks. At the country level, redemptions from France Bond Funds came in at a seven-week high and Italy Bond Funds posted their biggest weekly outflow since EPFR started tracking them in 2012.

Did you find this useful? Get our EPFR Insights delivered to your inbox.