Rumors of Europe’s demise, loudly trumpeted by the new US administration, are prompting investors to follow the adage about the best time to buy. During the third week of February, EPFR-tracked Europe Equity Funds recorded their biggest inflow since early 2022 and Emerging Europe Regional Equity Funds since early 3Q21 while Europe Bond Funds absorbed fresh money for the 13th straight week.

With earlier assumptions about the trajectory of US interest rates tightening, Technology Sector Funds posted their third consecutive outflow and eighth over the past 12 weeks, Inflation Protected Bond Funds extended their longest inflow streak since 1Q22 and flows into Physical Gold Funds climbed to an eight-week high.

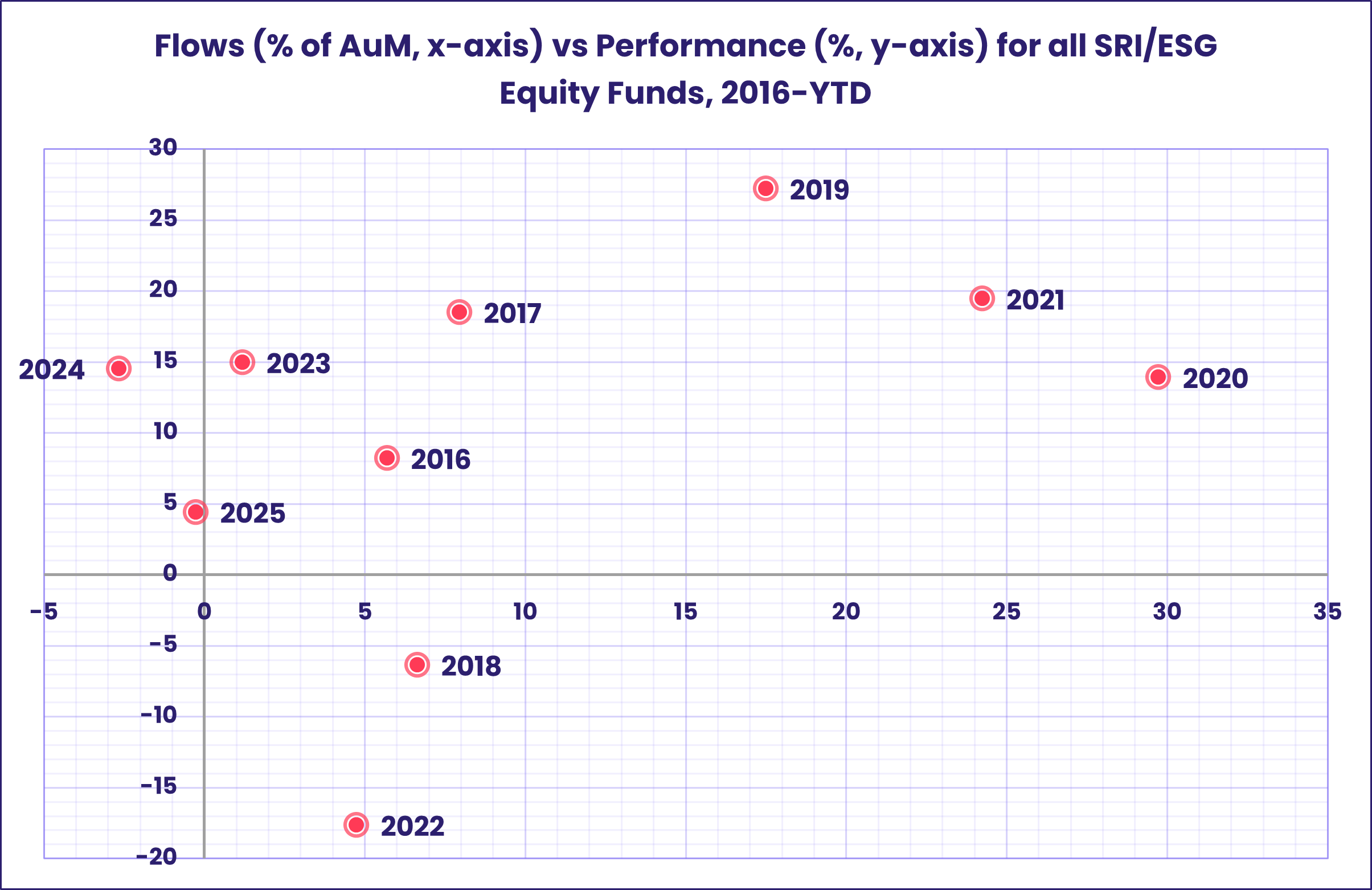

Among the asset classes struggling with the rapid policy shifts and pro-tariff rhetoric that hallmark US President Donald Trump’s administration are Chinese stocks, healthcare plays and ‘green’ technologies. Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which are coming off their first full-year outflow since 2012, experienced net redemptions for the fourth time in 2025.

Overall, EPFR-tracked Equity and Bond Funds both pulled in over $16 billion during the week ending Feb. 19 while Money Market Funds absorbed a net $3.3 billion, flows into Alternative Funds hit a 10-week high and Balanced Funds posted consecutive weekly inflows for the first time since early 2023. Year-to-date flows into Bond, Money Market, Equity and Alternative Funds currently stand at 99%, 118%, 141% and 948%, respectively, of the totals for the comparable period in 2024.

At the single country fund level, Austria Equity Funds posted their 38th consecutive outflow, redemptions from Netherland Bond Funds climbed to a 41-week high and Vietnam Equity Funds posted their biggest weekly outflow since EPFR started tracking them in 4Q07.

Emerging Markets Equity Funds

With riffs about reciprocal tariffs setting the mood music, sentiment towards emerging markets remained subdued going into the final week of February. EPFR-tracked Emerging Markets Equity Funds posted their third straight outflow, and fifth during the past six weeks, as investors cut their exposure to Asian and Latin American export plays.

There were a few bright spots in the flow picture for the latest week. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates bucked the broader trend for this asset class globally, recording their biggest inflow since mid-3Q23, and flows into EMEA Equity Funds hit a level last seen in late 1Q23.

With profits to be taken and trade relations with the US getting chillier by the week, investors pulled over $4 billion out of China Equity Funds for the second week running. They also extended the longest run of redemptions compiled by India Equity Funds since 2Q22, pinned a new outflow record on Vietnam Equity Funds and redeemed money from Thailand Equity Funds for the 59th week running.

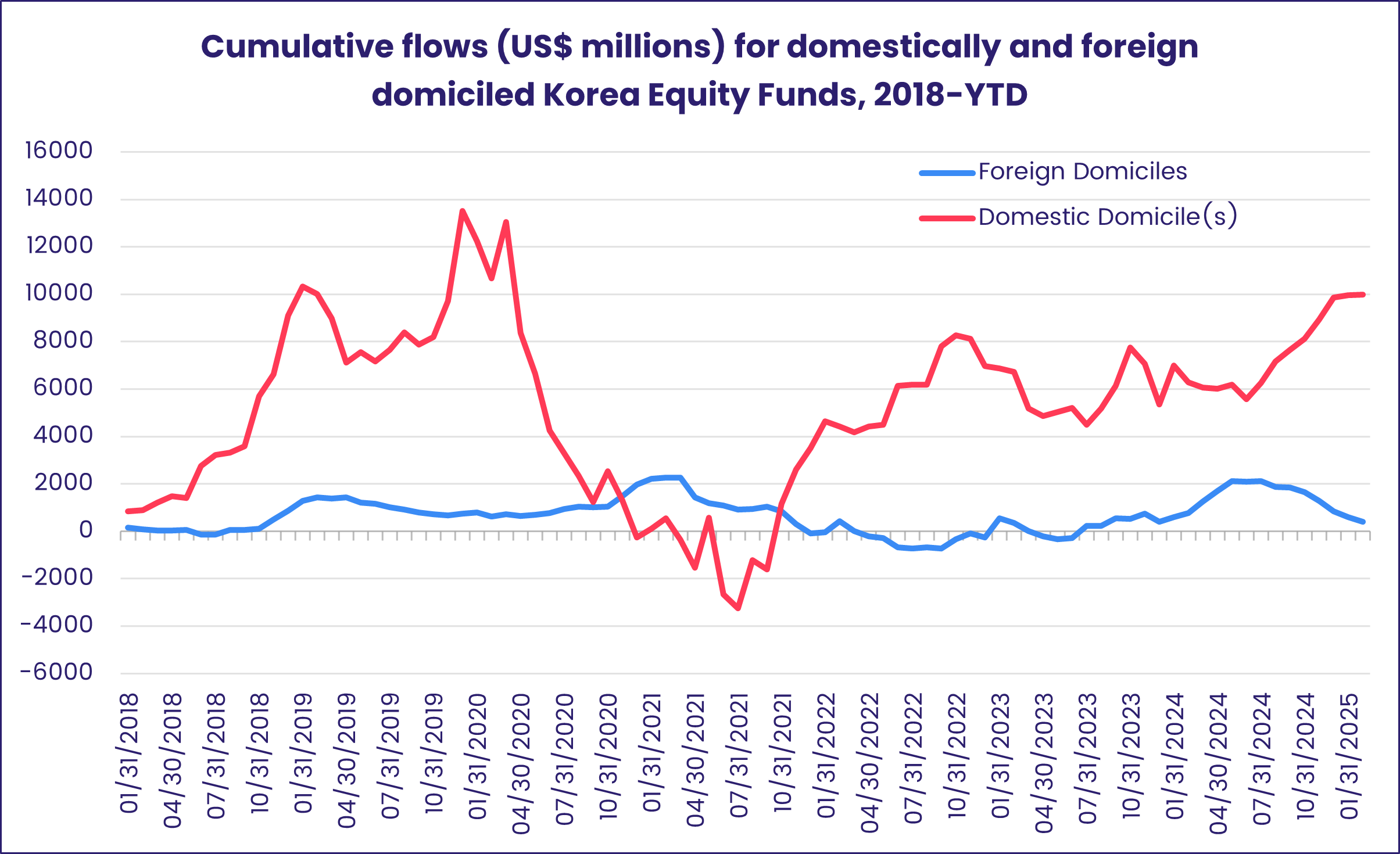

Korea Equity Funds, which came into 2025 on the back of six straight monthly inflows, posted consecutive outflows for the first time this year as redemptions from domestically domiciled funds climbed to a 36-week high. Shifting trade dynamics, a president under threat of impeachment, high levels of household debt, rising energy prices and fears the country’s technology sector is losing grip have sapped enthusiasm for this market.

Latin America Equity Funds posted a modest collective outflow as redemptions from Colombia and Brazil Equity Funds offset commitments to Chile, Mexico and Argentina Equity Funds. Brazil-mandated funds have now seen $470 million flow out since the beginning of the month as investors question the government’s appetite for the fiscal discipline needed to stabilize Brazil’s currency and allow the country’s central bank to loosen monetary policy.

Confidence that the European Central Bank will keep cutting interest rates and hopes for an end to the conflict in Ukraine boosted flows into EMEA Equity Funds. Funds offering exposure to Europe again drove the headline number.

Developed Markets Equity Funds

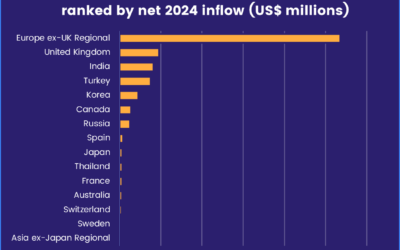

The third week of February saw developed markets focused investors persist with their reappraisal of Europe and their pivot towards diversified exposure. But, with benchmark US equity indexes pushing higher, they steered another $12 billion into US Equity Funds. That lifted the headline number for all EPFR-tracked Developed Markets Equity Funds to a three-week high.

The latest headline number for all Europe Equity Funds came in at a three-year high inflow even with the big outflow posted by UK Equity Funds and another week of net redemptions – the 36th in a row – from retail share classes. Attractive valuations, expectations of further interest rate cuts and the possibility of a ceasefire in Ukraine have boosted appetite for diversified exposure to continental markets. Investors are also positioning themselves for a rebound in Germany’s economic fortunes if next week’s election leads to a more accommodative fiscal policy.

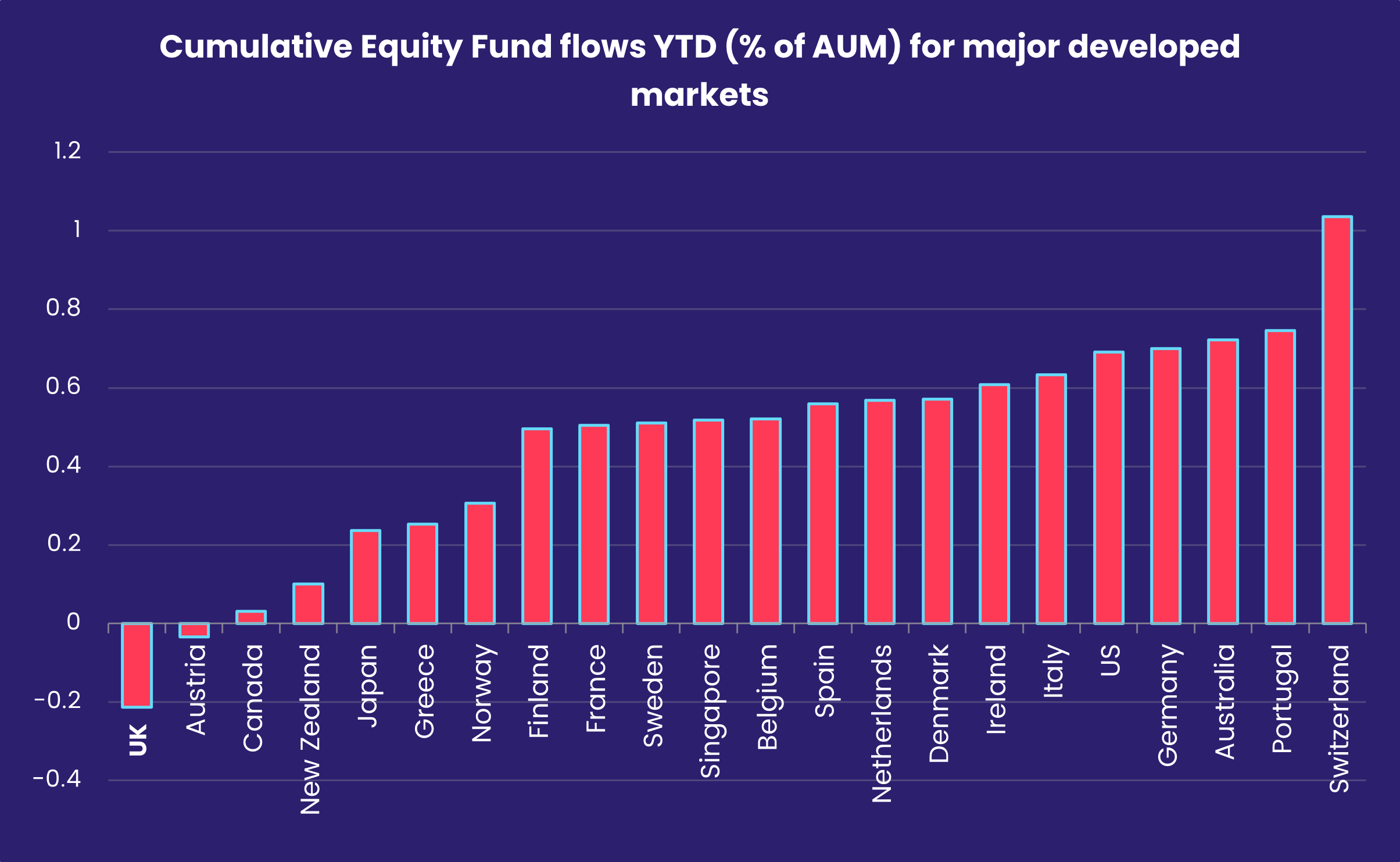

While the US has been, in cash terms, the biggest money magnet among the major developed markets so far this year, in relative terms, EPFR-tracked Equity Funds have shown greater appetite for Germany, Switzerland, Portugal and Australia.

The latest flows into US Equity Funds also bypassed retail share classes. Passively managed funds with mixed large cap mandates absorbed the bulk of the new money. Foreign domiciled funds again posted a collective inflow, their 20th in a row, while Leveraged US Equity Funds chalked up their second-largest outflow during the past eight months. US Bear Funds, which sit in EPFR’s Alternative Funds group, recorded their largest inflow since late September.

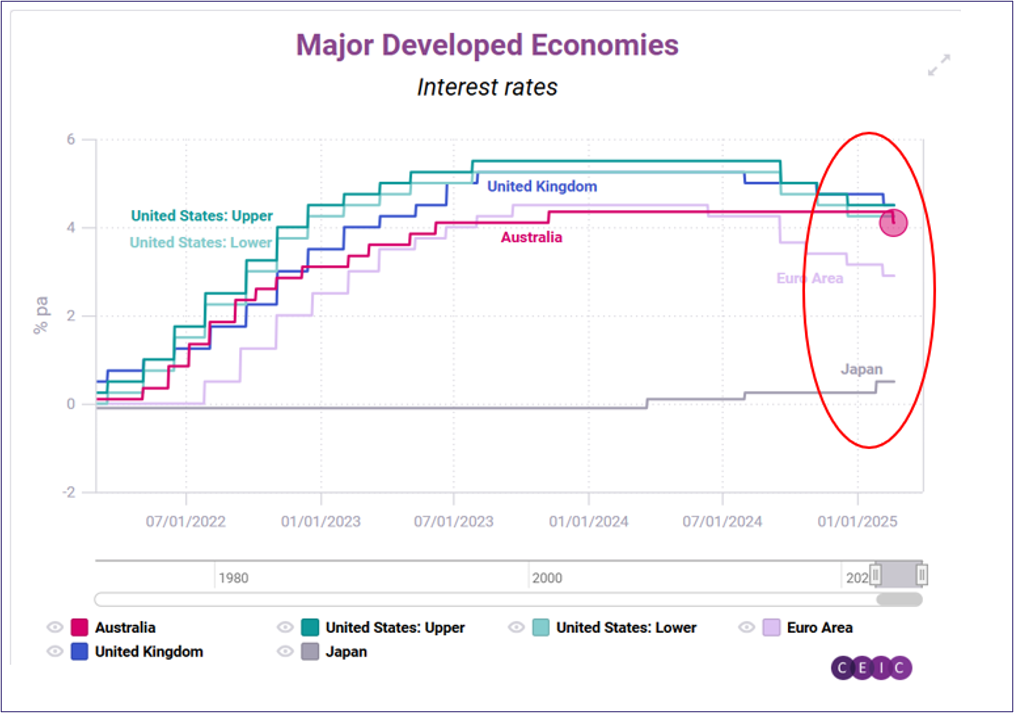

Japan Equity Funds posted a minimal outflow during a week when the country’s benchmark index moved sideways, weighed down by the uncertain outlook for global trade and the tightening bias of the country’s central bank.

The largest of the diversified Developed Markets Equity Funds groups, Global Equity Funds, attracted over $5 billion for the second straight week with flows favoring funds with fully global mandates over their ex-US counterparts by a 3-to-1 margin.

Global sector, Industry and Precious Metals Funds

In the week to Feb. 19, three of the 11 EPFR-tracked Sector Fund groups – Financials, Infrastructure and Telecoms Sector Funds – extended inflow streaks. Another three – Commodities, Industrials and Utilities Sector Funds – saw flows move into positive territory, while the remaining five extended their current outflow streaks.

Fourth quarter earnings reports remain a key driver of flows, with results from Walmart – widely regarded as a key indicator for the health of the US economy – scheduled at the tail end of this week and technology bellwether Nvidia’s report coming next week. Ahead of Nvidia’s report, Technology Sector Funds posted their third straight outflow. However, flows into Technology Sector Funds with SRI/ESG mandates were positive for the fourth time over the past five weeks.

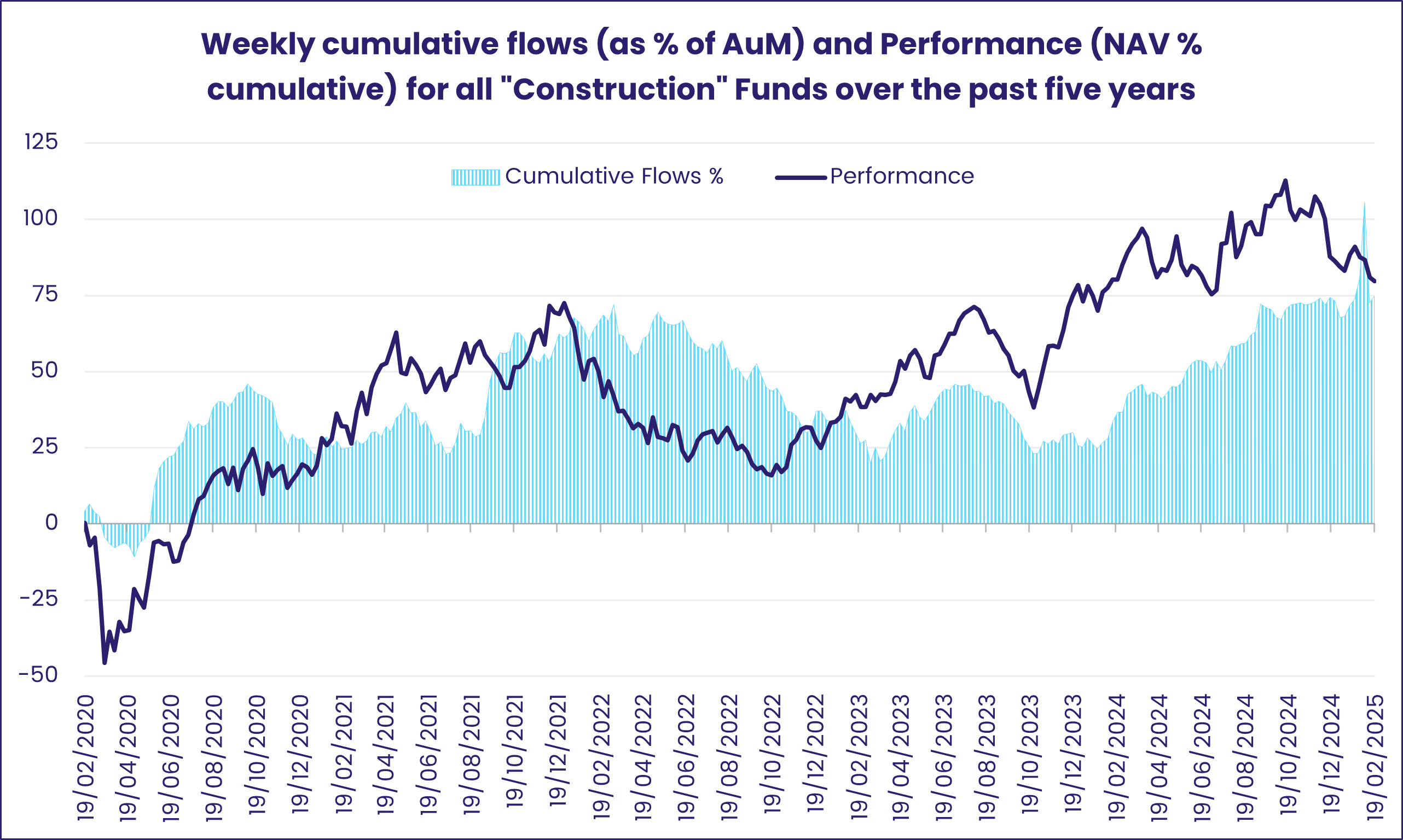

Flows into Industrials Sector Funds picked up momentum again as the group absorbed its fifth inflow of the past six weeks. Within the broader group, funds focused on construction have attracted flows equal to 30% of their starting AUM over the past year.

In four of the weeks year-to-date, Financials Sector Funds have seen inflows at or above the $1.2 billion mark. At the fund-level, six of the top 10 with the biggest inflows this week had “bank” in their name. Since mid-October, a subgroup of US Bank Funds has seen just two weeks of outflows versus 17 weeks of inflows. The four-week moving average of flows into these funds has jumped to $200 million for the first time since 2022 and exceeded $300 million in late November for just the third week on record.

A hot commodity earlier this decade, Energy Sector SRI/ESG Funds have seen flows come to a screeching halt. The group has been hit with consecutive weekly outflows since mid-July that now total over $5 billion, and the new political climate in Washington DC has only increased the headwinds it faces. The overall Energy Sector Fund group prolonged their outflow streak to eight weeks and $3.25 billion total, also marking down their 26th outflow over the past 29 weeks.

Simmering uncertainty about US economic and foreign policy has boosted demand for safe-haven Gold Funds, which saw nearly $2 billion flow in this week, pushing the total of their six-week inflow streak to $7 billion. Nearly two-thirds of that has been guided by funds tracking the gold price in London, 20% to funds tracking the market price of gold in China, and just 5% for those following the price of gold in Japanese Yen.

Bond and other Fixed Income Funds

A lengthy list of concerns ranging from higher-than-longer US interest rates to the unchecked growth of sovereign debt throughout the developed world did nothing to check flows into EPFR-tracked Bond Funds. Those flows have, so far this year, tracked last year’s record setting pace.

During the latest week, all the major groups by geographic focus and most of the asset class groups attracted fresh money. Investors remained focused on the rewards rather than the risks, with High Yield Bond Funds posting their biggest inflow since the beginning of 4Q24, Bank Loan Funds absorbing over $2 billion for the fifth time so far this year and Emerging Markets Bond Funds chalking up their third inflow since the final week of January.

Flows into Asia Pacific Bond Funds gathered momentum for the third week running as Australia’s central bank cut interest rates for the first time in over four years. In a note to clients, EPFR’s sister company CEIC noted that, [our] weekly inflation nowcast supports RBA’s move, as it projects slowdown in headline inflation in January….it is expected that price growth will cool down to 2.35% in January from 2.45% in December.” Australia Bond Funds extended an inflow streak stretching back to late 1Q24.

Next on the horizon is the European Central Bank’s policy meeting during the first week of March, with markets expecting another 0.25% cut. As with their equity counterparts, Europe Bond Funds posted a healthy collective inflow that would have been even healthier had not UK Bond Funds tallied their biggest outflow since mid-August. In the case of the latter, a single corporate tracker fund accounted for the bulk of the overall number.

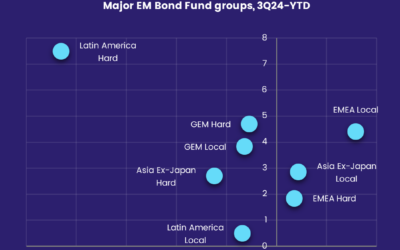

Flows into Emerging Markets Hard Currency Bond Funds were roughly balanced by the biggest outflow in 12 weeks for EM Local Currency Funds. Funds with corporate mandates outgained their sovereign peers for the third week running.

For the seventh straight week both foreign and domestically domiciled US Bond Funds recorded an inflow. Retail flows were positive for the fifth time so far this year, but the totals have been well down from their late September peaks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.