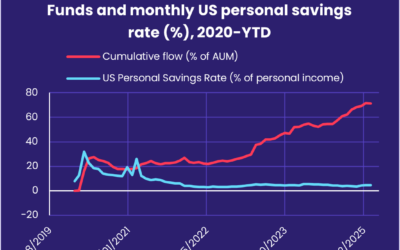

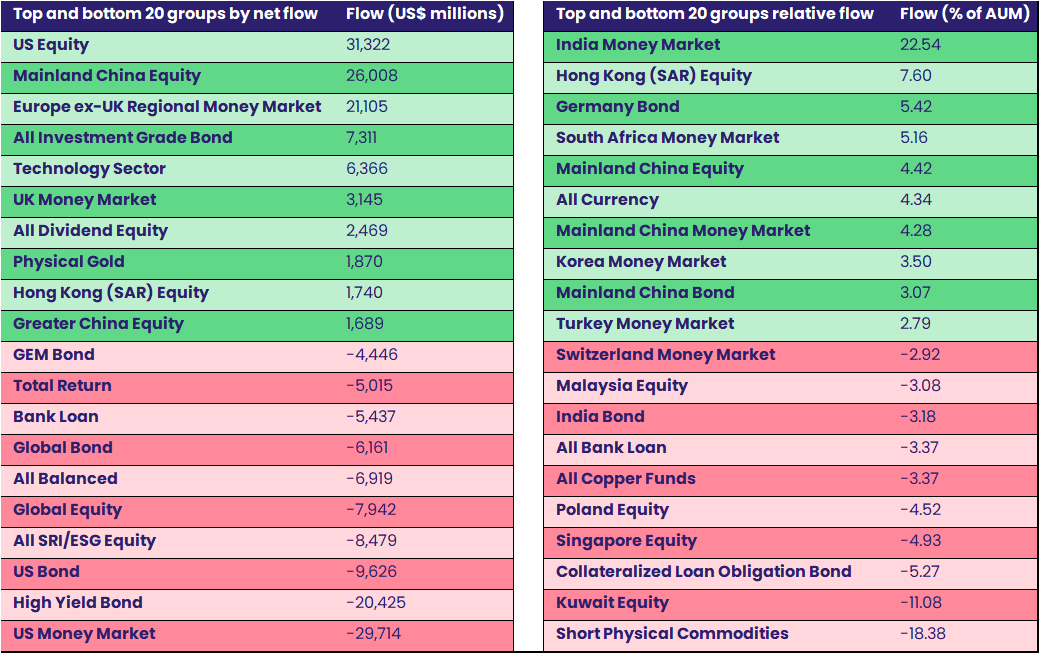

US Equity Funds also posted impressive flow numbers during the week ending April 9, pulling in over $31 billion. But US Bond Funds recorded their biggest outflow since late 2022 and redemptions from High Yield Bond Funds hit levels last seen at the start of the Covid-19 pandemic as Trump’s on again, off again tariff roll-out roiled US and global debt markets.

For the second week running, investors shunned funds with global, multi-asset and SRI/ESG mandates in favor of those offering liquidity (ex-US) or exposure to the technology sector, gold and dividend paying stocks.

Overall, a net $48.8 billion flowed into all EPFR-tracked Equity Funds while outflows from Alternative, Money Market, Balanced and Bond Funds totaled $894 million, $3.7 billion, $6.9 billion and $20.7 billion, respectively.

At the single country and asset class fund levels, Canada Bond Funds posted their biggest outflow since mid-2Q22, outflows from both Sweden Equity and Bond Funds hit year-to-date highs and Argentina Equity Funds extended their longest redemption streak since early 2Q23. Bank Loan Funds experienced record-setting outflows, flows into Inflation Protected Bond Funds climbed to their highest level in over three years and Artificial Intelligence Funds tallied their biggest outflow since early September.

Emerging Markets Equity Funds

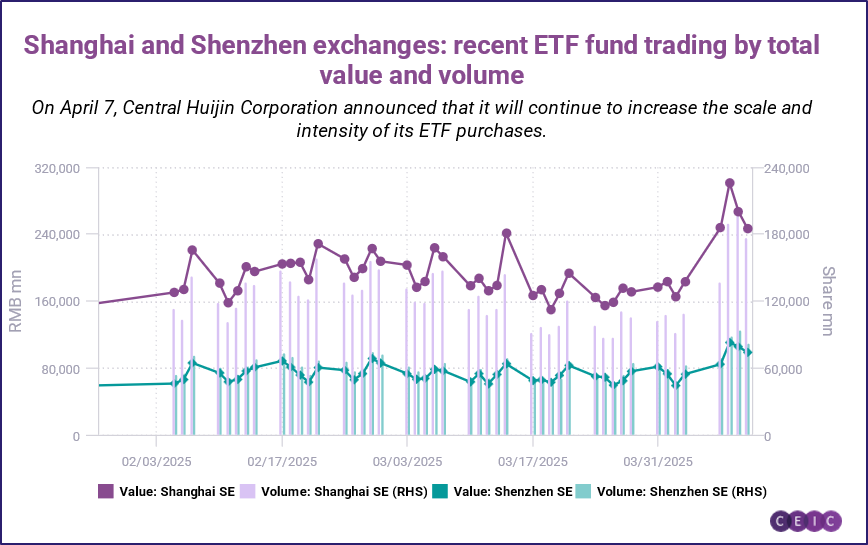

The second biggest net flow into dedicated China Equity Funds on record lifted the headline number for all EPFR-tracked Emerging Markets Equity Funds during the latest week to a six-month high, offsetting further redemptions from the diversified Global Emerging Markets (GEM) Equity Funds and the snapping of EMEA Equity Funds’ latest inflow streak.

Flows into Leveraged EM Equity Funds increased for the third week running to a six-month high while redemptions from EM Bear Funds hit their highest level since EPFR started tracking these funds in 1Q10.

The eye-catching inflow posted by China Equity Funds was supported by internal measures, with EPFR sister company CEIC noting that, “On April 7, Central Huijin Corp., a unit of China’s US$1.3 trillion wealth fund, said it would increase the scale and intensity of its ETF purchases….as [the below] chart shows, April 7 and 8 saw daily ETF trading volume and value figures jump on the Shanghai and Shenzhen stock exchanges. “

Elsewhere, Indonesia Equity Funds narrowly extended their current inflow streak, India Equity Funds posted their 12th outflow over the past 14 weeks and flows into Korea Equity Funds climbed to a 21-month high. As was the case with China-mandated funds, overseas domiciled Korea Equity Funds recorded a collective outflow.

Having compiled their longest inflow streak since 1Q17, EMEA Equity Funds posted their first outflow in eight weeks as investors reassessed the prospects for global growth and the demand for oil and gas. Redemptions from Poland, Emerging Europe Regional and Kuwait Equity Funds hit 18, 41 and 120-week highs, respectively. Fresh money did flow into Turkey-mandated funds as investors looked past domestic political tensions and focused on the country’s improving inflation and interest rate dynamics.

Latin America Equity Funds benefited from perceptions that the impact of the latest US tariffs – currently suspended – will be smaller than it will in other regions. Brazil and Mexico Equity Funds both took in over $100 million during the latest week. Europe domiciled Latin America Equity Funds tallied their 11th collective inflow over the past 12 weeks and US domiciled funds their 13th inflow since the final week of December.

Developed Markets Equity Funds

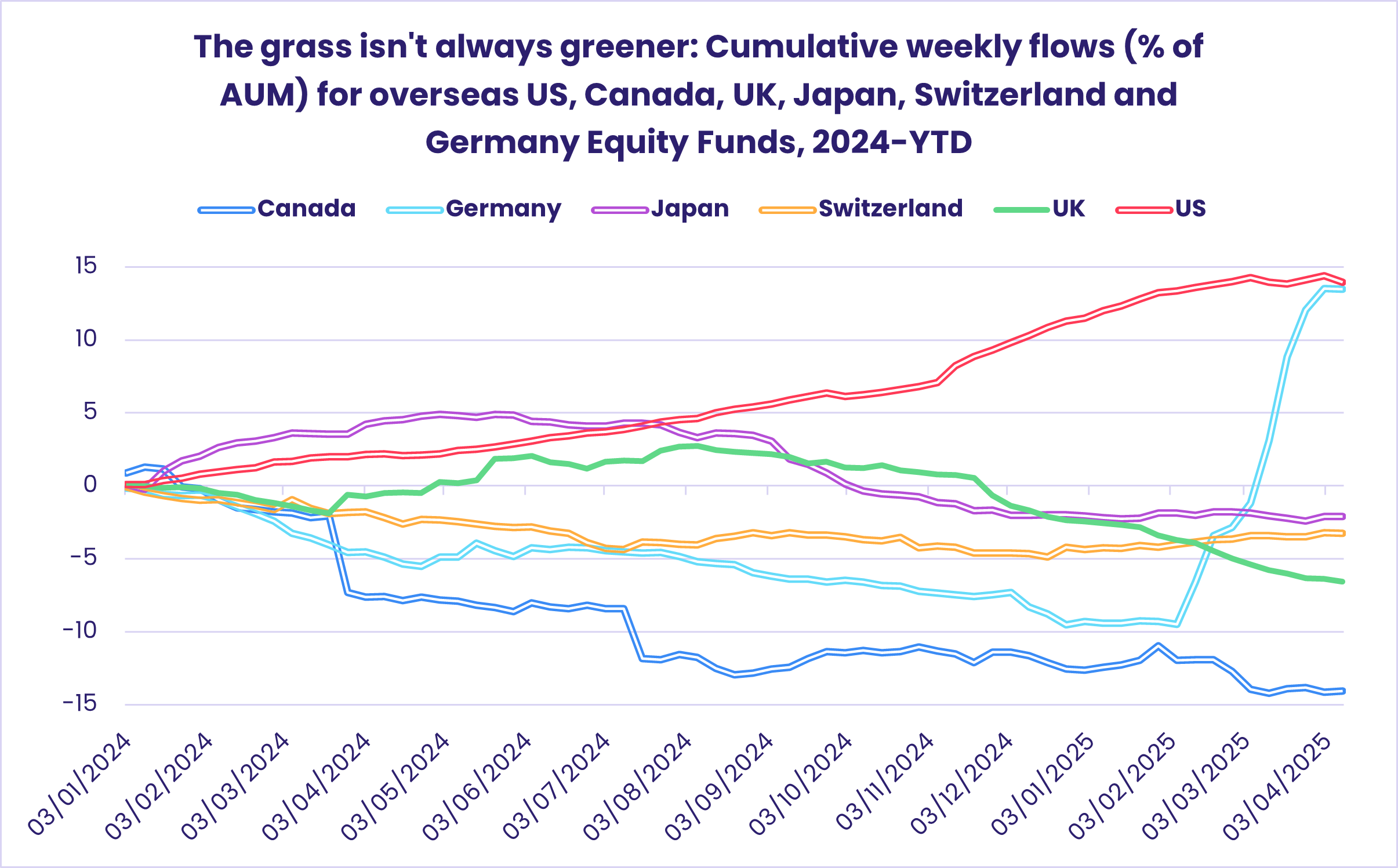

Despite the tariff-induced turmoil in most major equity markets, EPFR-tracked Developed Markets Equity Funds ended the week of April 9 with their fourth largest inflow year-to-date. In a reversal of the previous week, US Equity Funds underpinned the headline number, offsetting outflows from Europe, Global, Japan and Pacific Regional Equity Funds.

The impressive number for US Equity Funds rested largely on nine major ETFs that took in between $1 billion and $19 billion apiece, fueling speculation that institutional investors were using them as vehicles to short a market that lost some 12% between April 2 and April 8. Flows into Leveraged US Equity Funds soared to a record high, with the latest total nearly three times the previous high, but redemptions from retail share classes were the biggest in nearly four months and foreign domiciled US Equity Funds tallied their biggest outflow since 1Q23.

Overseas domiciled Germany Equity Funds also saw previously strong inflows falter as investors pulled back from a region many fear will be caught in the middle of the intensifying Sino-US trade war. Europe Equity Funds overall posted their first outflow in two months, snapping their longest run of inflows since 2Q21. At the country level, money returned to Switzerland Equity Funds but redemptions from Sweden and Finland Equity Funds jumped to 22 and 26-highs, respectively, and Greece Equity Funds posted their biggest outflow since 1Q20.

With Japan’s key automotive industry threatened by the latest US tariffs, investor confidence in the country’s ability to ride out any trade storm slipped several notches in early April. Japan Equity Funds chalked up their fifth inflow of the year so far and their biggest since mid-December. Retail share classes did record their fifth inflow over the past seven weeks, and Japan Dividend Funds posted their biggest inflow in over 13 months.

Among the diversified Developed Markets Equity Funds groups, Pacific Regional Equity Funds – which on average allocated nearly a third of their portfolios to Japan – recorded their biggest outflow since late 3Q24. The biggest group, Global Equity Funds, experienced their heaviest redemptions in over 15 months.

Global sector, Industry and Precious Metals Funds

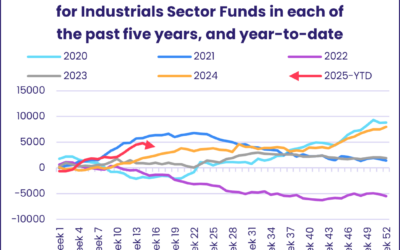

In the first full week of April, the total trading volume (absolute value of outflows plus inflows) for all 11 EPFR-tracked Sector Fund groups reached over $17 billion, just shy of the record-setting volume experienced in mid-4Q16. A third of that was attributable to Technology Sector Funds, the only group to post an inflow.

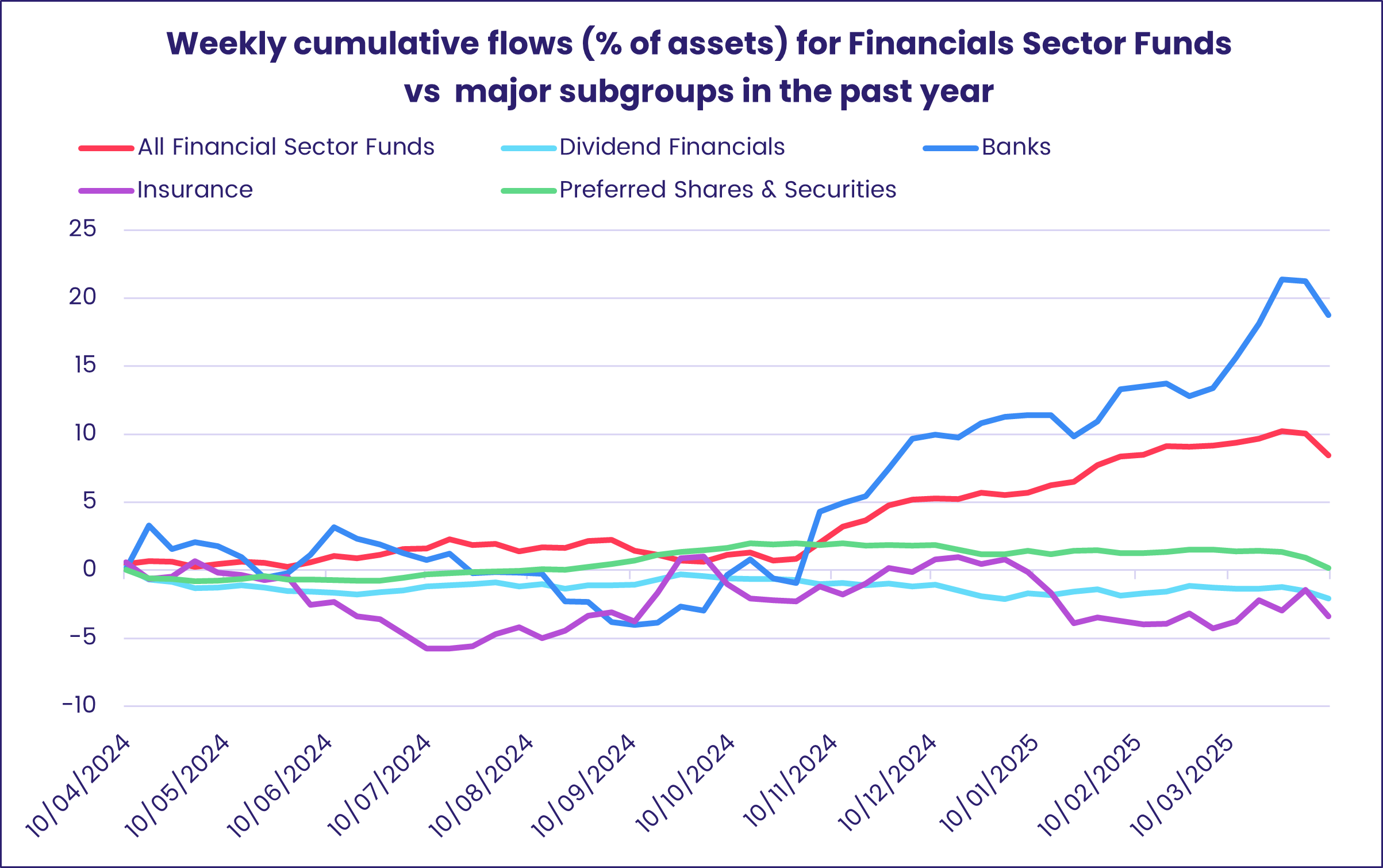

For the 10 other groups, investors exited Real Estate, Commodities/Materials and Energy Sector Funds at a brisk pace – all experienced redemptions above the $1 billion mark – and hit Financials Sector Funds with outflows of over $3.5 billion, a record-high.

Flows into Technology Sector Funds hit a 10-week high that pushed their current inflow streak to four weeks and $13.2 billion. US-mandated funds took in more money than their China focused counterparts for the first time since late February. Leveraged Technology Sector Funds posted a record setting $4.6 billion inflow, surpassing their previous one set in late November by $1.3 billion.

At the individual fund level, a single semiconductor ETF seeking 3x leveraged exposure of its benchmark led the way with a net inflow for the week of $3.2 billion.

The last time Financials Sector Funds recorded an outflow of the latest week’s magnitude was in early March 2022, when the group was in the early stages of a flow drought that lasted for nearly five months. Worries of slower economic growth – or an impending recession – after US President Trump’s reciprocal tariffs drove this week’s redemptions while, back in 1Q22, investors were bracing for the first interest rate hike by the Federal Reserve since 2018.

Of the major Financial Sector Fund subgroups, All Bank Funds were the heaviest hit this week as $834 million (or 2.6% of assets) flowed out. Preferred Shares & Securities Funds saw nearly $500 million (0.75% of assets) redeemed and Insurance Funds experienced outflows of $126 million (1.9% of assets).

The biggest outflows for passively managed Commodities/Materials Sector Funds in nearly eight years, and a retreat from active funds after strong inflows the prior week, resulted in the biggest outflow for the overall group since early 3Q22. Of the 10 funds with the heaviest outflows this week, half were focused on the mining industry (three gold and one copper), while others more broadly mentioned precious and nonferrous metals.

Gold Mining Funds suffered their 13th outflow of the past 15 weeks, while Physical Gold Funds – a larger universe captured within EPFR’s Alternative Fund database that tracks the price of gold and is regarded as a safe-haven – tallied their 13th consecutive week of inflows.

Bond and other Fixed Income Funds

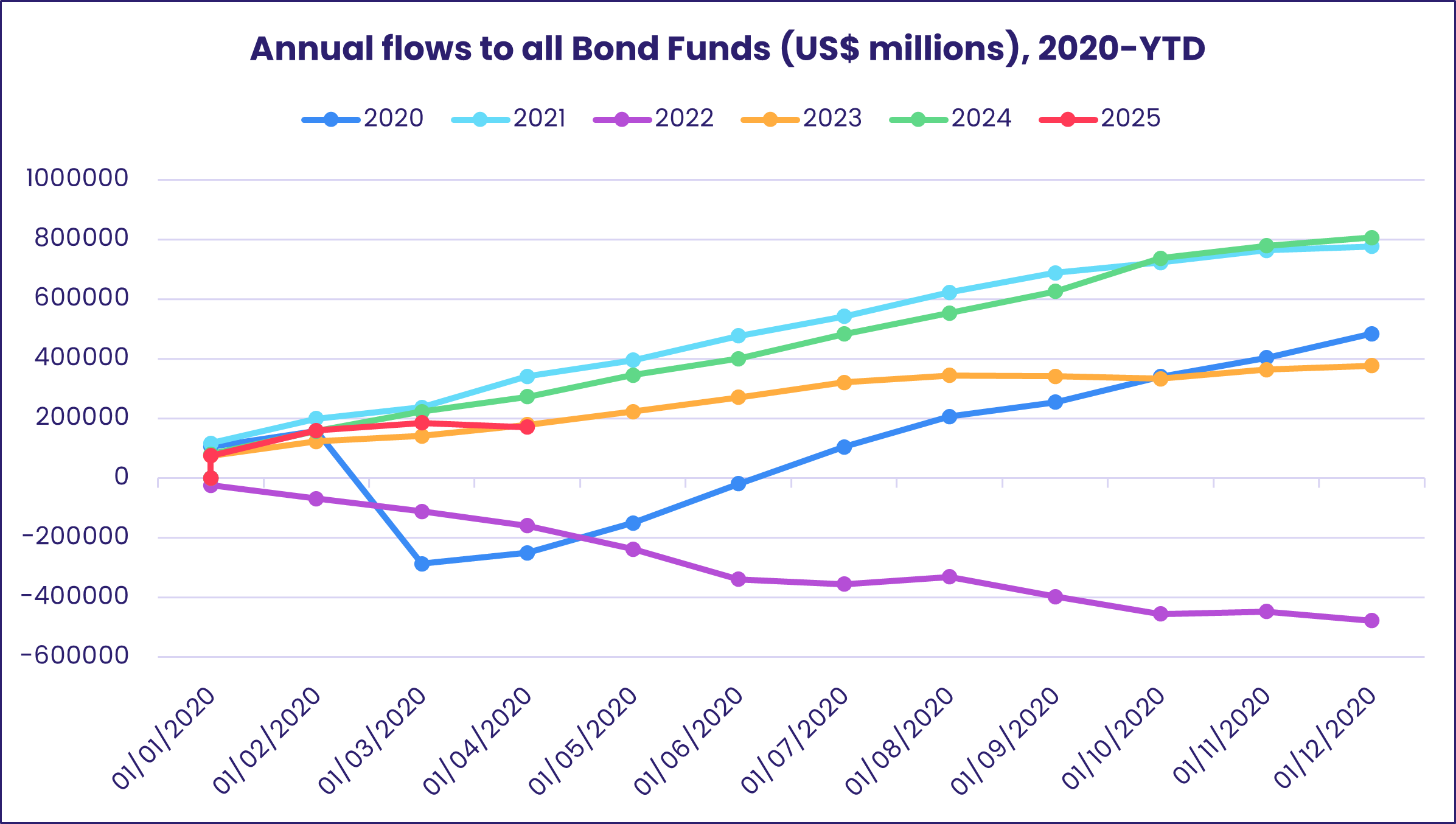

After months of shrugging off fiscal deficits in key markets, tight spreads between investment grade and junk-rated debt and uncertainty about the trajectory of US interest rates, investors threw in the towel – at least for a week – in early April. EPFR-tracked Bond Funds chalked up their biggest outflow since late 2Q22 as redemptions from High Yield and Bank Loan Bond Funds hit five-year and record highs, respectively.

At the asset class level, the uncertainty and risk aversion spread to Mortgage Backed Bond Funds, which experienced their heaviest redemptions in over two years, and Total Return Bond Funds which racked up their biggest outflow in over five years. Convertible Bond Funds also suffered, with redemptions climbing to a 76-week high.

Among US Bond Funds, net outflows from funds dedicated to corporate debt were closely matched by flows into Sovereign Bond Funds. When it came to duration, flows favored funds with short and ultra-short term mandates. Flows into Treasury Inflation Protected Securities (TIPS) Funds hit a level last seen in 4Q21 as investors positioned themselves for the price increases expected when and if the new tariffs are fully implemented.

On the other side of the Atlantic, Europe Inflation Protected Bond Funds were among the many groups to see money flow out as Europe Bond Funds recorded only their fifth outflow over the past 16 months. Redemptions from Europe Corporate Bond Funds posted their biggest outflow since mid-1Q22 when markets were adjusting to the prospect of higher US interest rates.

At the country level, Germany Bond Funds enjoyed record-setting inflows while redemptions from Sweden Bond funds climbed to a 32-week high and UK Bond Funds tallied their ninth outflow over the past 10 weeks.

Emerging Markets Bond Funds also had to look back to 2022 to find comparable outflows as modest commitments to local currency funds were swamped by over $3 billion worth of redemptions from their hard currency counterparts.

Did you find this useful? Get our EPFR Insights delivered to your inbox.