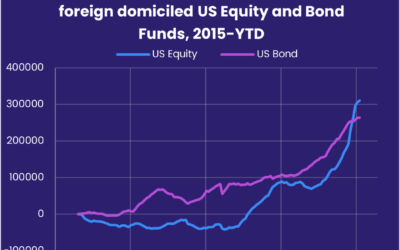

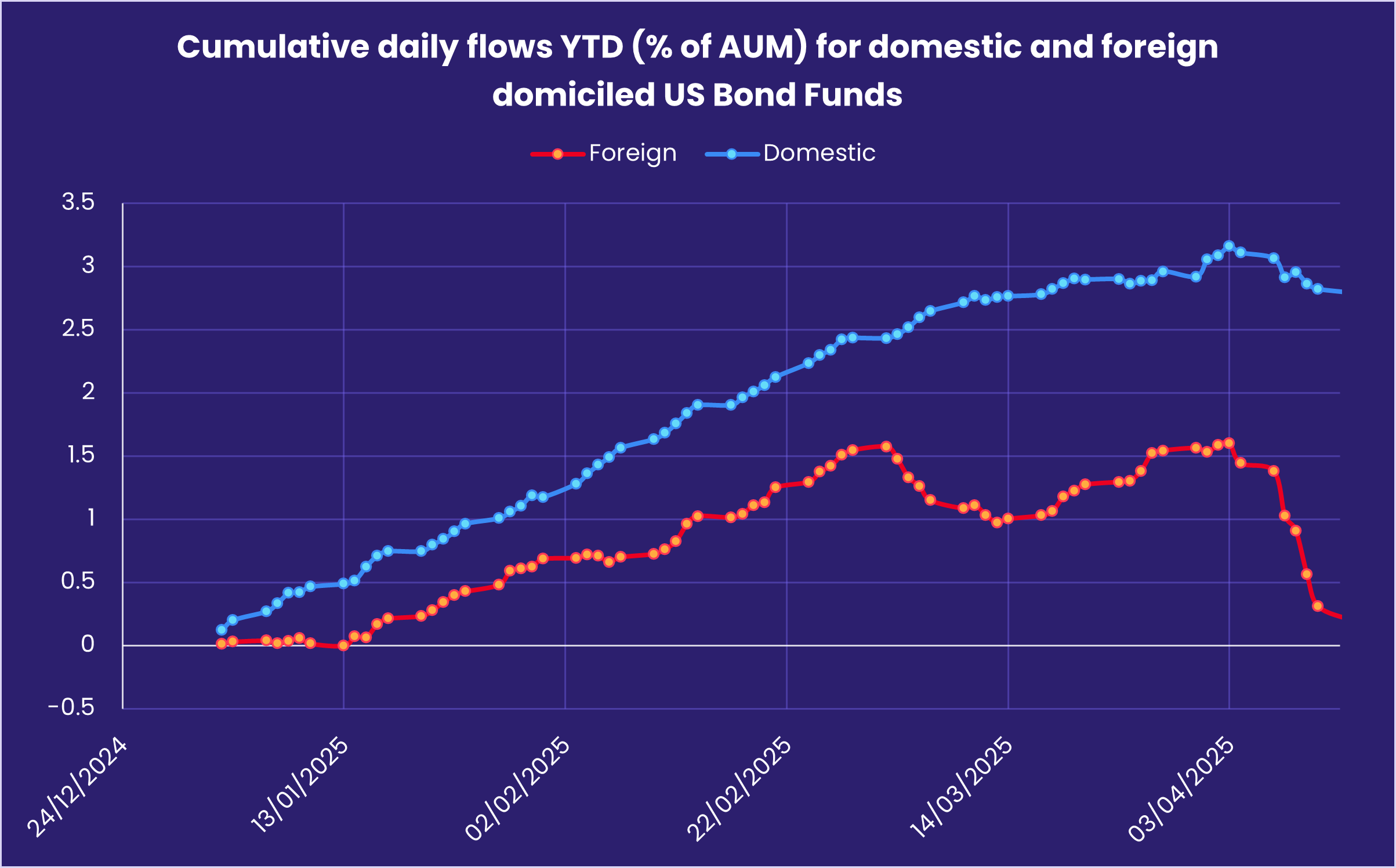

The week ending April 16 saw Physical Gold Funds post their biggest inflow since EPFR started tracking them in 2007 while redemptions from US Bond Funds hit their highest level since the final week of 1Q20. Flows to foreign-domiciled US Bond Funds, which rolled over just ahead of President Donald Trump’s announcement of a 90-day freeze for many of the new tariffs, also came in at a five-year low.

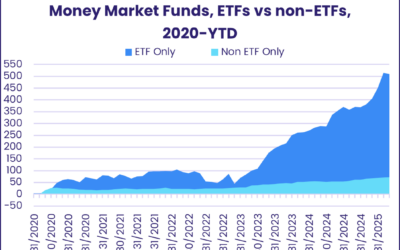

The latest week also saw a modest reversal of the previous week’s flows into US and China Equity Funds, over $6 billion committed to Europe Equity Funds and big outflows from US Money Market Funds as the annual tax filing deadline came and went.

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates had a mixed week. On the heels of last week’s record-setting redemptions, SRI/ESG Bond Funds posted their second largest outflow since EPFR started tracking them. But SRI/ESG Equity Funds collectively posted a minimal outflow as funds with Article 6 SFDR ratings took in over $1.7 billion and Article 8 funds posted their fourth largest outflow year-to-date.

At the asset class and single country fund levels, redemptions from Inflation Protected Bond Funds jumped to a 27-week high, Bank Loan Funds extended their longest run of outflows since 2Q23 and Cryptocurrency Funds chalked up their eighth outflow over the past 10 weeks. China Money Market Funds tallied their fourth straight inflow and their biggest since mid-October, Thailand Equity Funds extended a redemption streak stretching back over 14 months and flows into Switzerland Equity Funds hit a level last seen in 2Q08.

Emerging Markets Equity Funds

With flows to mainland China-mandated funds falling back from the previous week’s dramatic highs and redemptions from both Latin America and EMEA Equity Funds hitting year-to-date highs, the headline number for all EPFR-tracked Emerging Markets Equity Funds slipped into the red for the eighth time so far this year.

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did post their biggest inflow since mid-February and Leveraged EM Equity Funds extended their longest run of inflows this year. But retail investors continue to keep their distance and funds dedicated to frontier markets extended the current outflow streak to six weeks and 3.3% of their asset base.

Among the Asia ex-Japan Country Fund groups, China Equity Funds posted their first outflow in over a month and their biggest since late February as redemptions from overseas domiciled funds climbed to a record high. Meanwhile, India Equity Funds recorded their third inflow since an 11-week outflow streak ended in March and Korea Equity Funds took in fresh money for the fourth straight week.

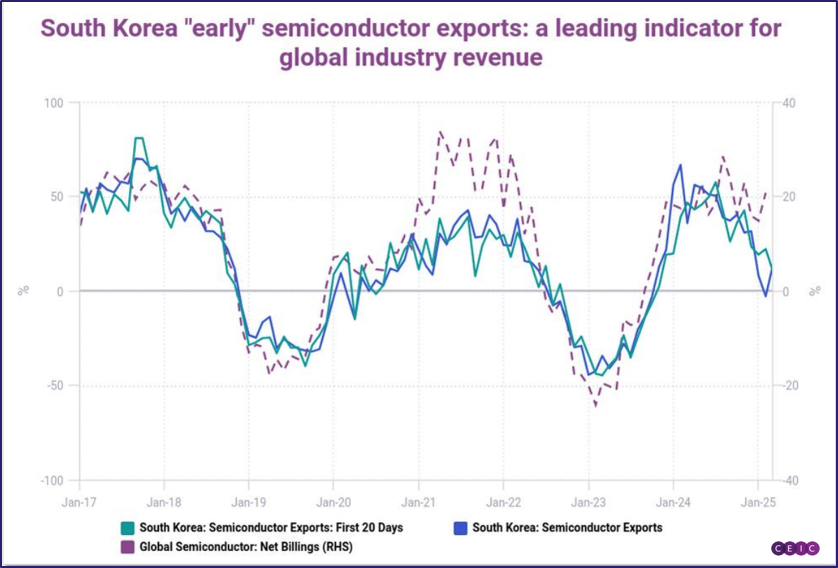

In the case of Korea Equity Funds, domestic support has underpinned the latest inflows. Some investment flows may be pivoting from real estate, which authorities fear may be entering bubble territory as heavily indebted households struggle with rising prices. Research by EPFR sister company CEIC suggests that Korea’s closely followed semiconductor exports remain resilient, but one leading indicator suggests more pain ahead.

Although appetite for exposure to developed European equity rebounded sharply during the second week of April, EMEA Equity Funds posted consecutive weekly outflows for the first time since early December. Fading hopes of a durable ceasefire in Ukraine, energy prices grinding lower and rising political tensions in Turkey all contributed to the cooling of investor sentiment. At the country level, redemptions from South Africa Equity Funds climbed to a 36-week high despite the price of gold again testing record highs.

Brazil mandated funds weighed on the headline number for all Latin America Equity Funds as the narrative around the region’s largest economy shifted from US tariffs back to domestic inflation and interest rate dynamics. Brazil’s inflation rate hit a two-year high in March and the country’s central bank hiked its key interest rate by 100 basis points earlier this month.

Developed Markets Equity Funds

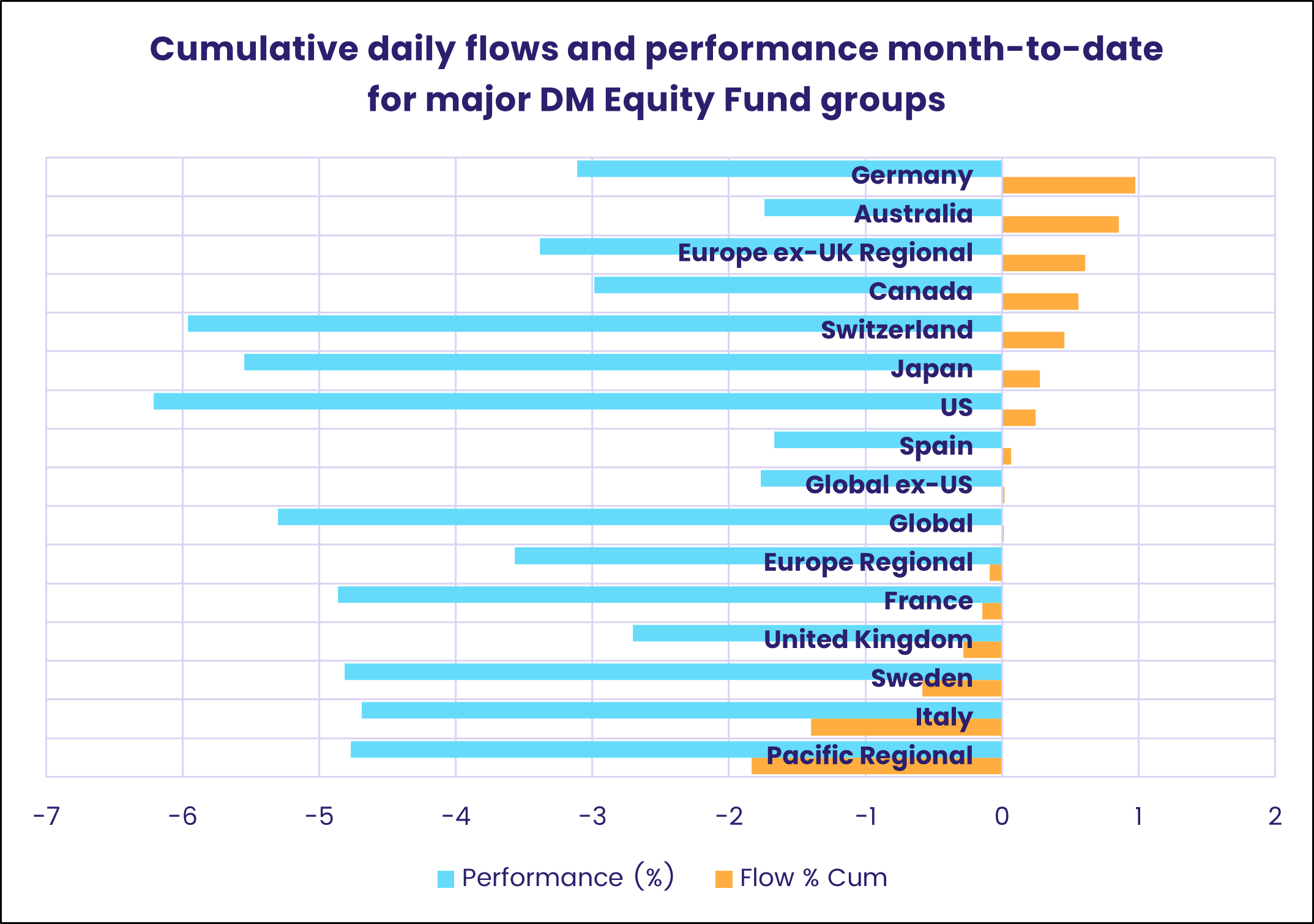

The first half of April saw US Federal Reserve Chair Jerome Powell pour cold water on expectations for lower prices and interest rates, drawing the ire of President Donald Trump, while the European Central Bank served up another 0.25% cut in its key policy rates. Flows to EPFR-tracked Developed Markets Equity Funds followed the path of least monetary resistance. Flows to Europe Equity Funds rebounded to a more than eight-year high while US Equity Funds racked up their fifth outflow of the year so far.

This shift towards Europe did not move the needle among the largest of the diversified Developed Markets Equity Funds groups. Global Equity Funds with fully global mandates attracted nearly seven times the amount of fresh money that flowed into their ex-US counterparts.

The latest flows into Europe Equity Funds were the largest since the week ending May 10, 2017, when investors decided that a populist political tide had crested. They were also geographically broader than a month ago. Funds dedicated to countries outside the core European Union markets shared the wealth, with Switzerland Equity Funds posting a new weekly inflow record and UK Equity Funds chalking up their first inflow since mid-November and biggest since mid-4Q23.

Amidst the market turmoil that followed US President Donald Trump’s ‘liberation day’ announcement, there has been no positive performance for most Country Fund groups to chase. But several, including Switzerland, Germany and US Equity Funds, have posted modest net inflows over the past two weeks.

In addition to the broad, tariff related uncertainty, US Equity Funds were hit by rising tensions between Trump and Powell and the continued absence of retail support. But flows into overseas domiciled funds rebounded and corporate activity designed to boost share prices is still maintaining a brisk pace. According to Senior Liquidity Analyst Winston Chua, “Announced corporate buying (new cash takeovers + new stock buybacks) [during the latest week] rose to a six-week high of $16.3 billion as the first-quarter earnings season kicked off.”

Japan Equity Funds pulled in over $2 billion as investors looked ahead to the Bank of Japan’s month-end policy meeting. The central bank is expected to keep interest rates on hold.

Global sector, Industry and Precious Metals Funds

Current market volatility continued to overshadow past performance in mid-April as the 1Q25 earnings season gathered steam. Four of the 11 EPFR-tracked Sector Fund groups posted inflows during the latest week, with Technology Sector Funds the only one of those four to absorb over $200 million while four groups surrendered over $900 million.

While market volatility has largely been driven by US President Donald Trump’s recent tariff moves, the Russia-Ukraine passed the three-year mark in February. Prospects for peace remain bleak, with ongoing Russian attacks targeting both energy and civilian infrastructure, and investors remain attentive to Europe’s defense posture and the likelihood of a sustained increase in defense spending.

Industrials Sector Funds eked out a modest inflow during the latest week as investors pumped nearly $350 million into a European defense ETF. The next four funds with the biggest inflows were all focused on the theme of defense. Extending their inflow streak to 15 weeks, all Aerospace & Defense Funds have experienced just two weeks of outflows since mid-November last year.

The latest outflow from Energy Sector Funds pushed the total of their six-week redemption streak past the $5 billion mark. Concerns about lower demand if tariff-related forecasts prove correct, artificial intelligence data centers stressing power grids, energy infrastructure being demolished in Ukraine and dropping numbers of employees at the US Energy Information Administration (EIA) impacting investment decisions in this market all took a toll on investor sentiment towards an already unpopular group. During the past eight months, Energy Sector Funds have posted just four weekly inflows.

Redemptions from Consumer Goods Sector Funds hit a year-to-date high, propelling their four-week redemption total to $3.2 billion. In the latest week, flows retreated from S&P ETFs targeting consumer staples and retail-focused industries. EPFR’s Industry Flows show that Retailing Industry Funds have been in negative territory for three of the past four weeks – not a pattern seen in the past year – with the latest weekly outflow at over $1.16 billion.

Flows into Physical Gold Funds hit a record high, with single ETF benchmarked to LBMA Gold Price accounting for over a quarter of the headline number. Demand for the bullion remains strong with risks of a recession still on the table and investors buying into the safe-haven tale these funds offer. Over $500 million also flowed into Physical Silver Funds, snapping their two-week streak of outflows and marking their biggest inflow since late July.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds remained under pressure going into the second half of April as fixed income investors pay more attention to the risk side of the risk-reward equation. Redemptions from the overall group climbed another notch to their highest weekly total since the start of the Covid-19 pandemic in 1Q20 and groups dedicated to riskier asset classes – emerging markets debt, junk bonds and bank loans – recorded large outflows.

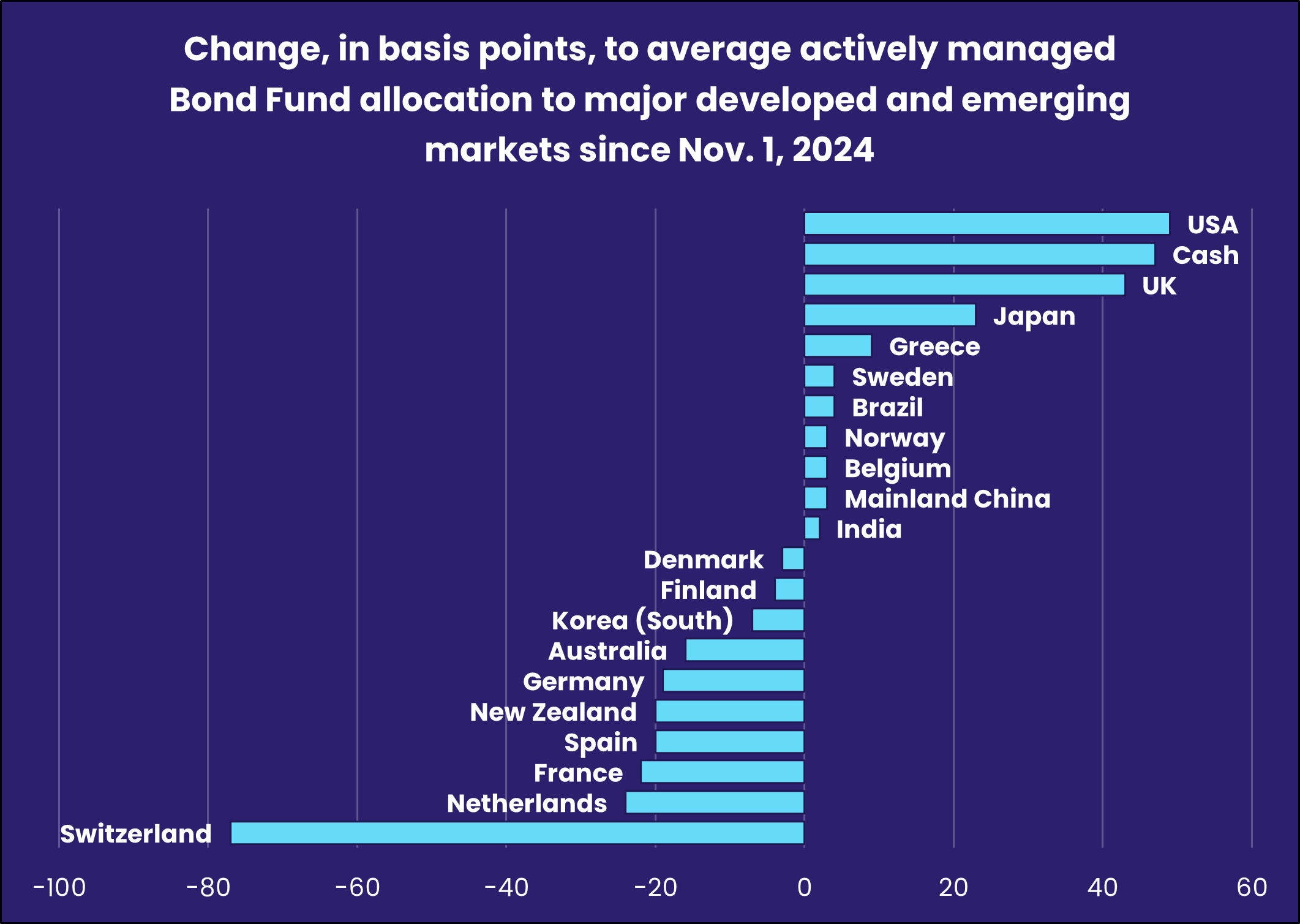

Investors, including those overseas, are markedly more cautious about US debt than they have been for several years. US Bond Funds posted consecutive weekly outflows for the first time since late 2022, with the latest week’s headline number the biggest in over five years. US Sovereign Bond Funds offering long term exposure still found takers, while mixed mandate and corporate funds experienced significant redemptions.

At the asset class level, US Treasury Inflation Protected Securities (TIPS) Funds underpinned the biggest outflow from all Inflation Protected Bond Funds in over six months. US Total Return, Municipal and High Yield Bond Funds also experienced large outflows.

Allocations data for actively managed Global Bond Funds have yet to reflect – if managers share it – in sentiment towards US debt. But cash allocations have seen the second largest increase in average allocations since the US presidential election in early November.

In the emerging markets universe, funds dedicated to mainland Chinese debt enjoyed another solid week as their current inflow streak hit five weeks and $4.1 billion. But Emerging Markets Bond Funds overall saw more than $3 billion flow out as doubts about global demand for commodities spilled over into projects of debt service capacity.

Europe Bond Funds chalked up their first consecutive weekly outflow since early 4Q23 ahead of the European Central Bank’s seventh rate cut in the current easing cycle. Germany Bond Funds posted another solid inflow, but UK, Sweden and Switzerland Bond Funds all saw over $200 million flow out.

Did you find this useful? Get our EPFR Insights delivered to your inbox.