A significant number of EPFR-tracked fund groups that posted outflows the previous week – among them Global, Europe and Emerging Markets Bond Funds, China Equity Funds and Cryptocurrency Funds – chalked up modest inflows. The opposite was also true. Physical Silver, UK Equity, Europe Money Market and Korea Equity Funds were among the groups that saw the previous week’s inflows reversed.

Investors continued to rotate from riskier fixed income groups to ones offering exposure to sovereign debt, physical gold, Europe’s rearmament story, liquidity and defensive sectors.

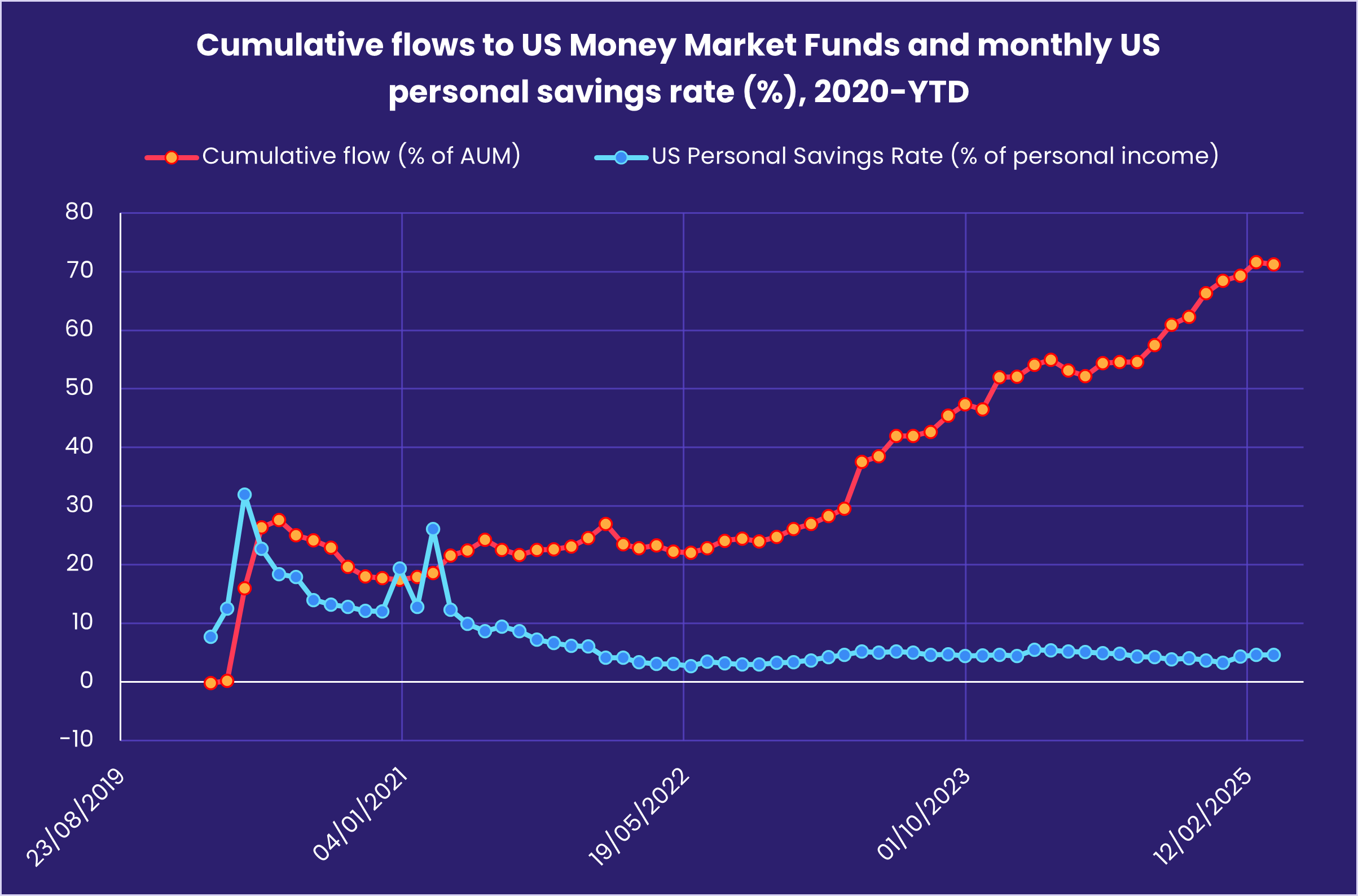

Overall, EPFR-tracked Equity Funds pulled in a net $9.1 billion during the week ending April 23. Bond Funds surrendered $718 million and Balanced Funds $2 billion while Alternative Funds absorbed $7.9 billion. The headline number for all Money Market Funds rebounded as flows into US-mandated funds, which have decisively decoupled from the personal savings rate, enjoyed a post-tax deadline bounce.

At the asset class fund level, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their fifth largest inflow year-to-date, flows into Cryptocurrency Funds jumped to a 13-week high and Long Physical Commodities Funds posted their second largest inflow since 2Q22.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds ended the third week of April by posting their fifth inflow since mid-March. Over $1.5 million flowed into funds dedicated to Greater China markets and Global Emerging Markets (GEM) Equity Funds snapped their six-week outflow streak.

Year-to-date, the overall group has seen more than $30 billion flow into ETFs while actively managed funds have been hit with redemptions of over $20 billion. Retail share classes have yet to post a collective inflow in 2025, but EM Dividend Equity Funds have absorbed fresh money 13 of the 16 weeks year-to-date.

Mainland China Equity Funds were again the biggest contributors to the headline number for all Asia ex-Japan Equity Funds, absorbing fresh money for the fifth time since the second week of March as American President Donald Trump signaled a willingness to lower recently announced tariffs on Chinese exports to the US. Meanwhile, the latest country allocations data shows average allocations to China by actively and passively managed GEM Funds hit 24 and 25-month highs, respectively, coming into April.

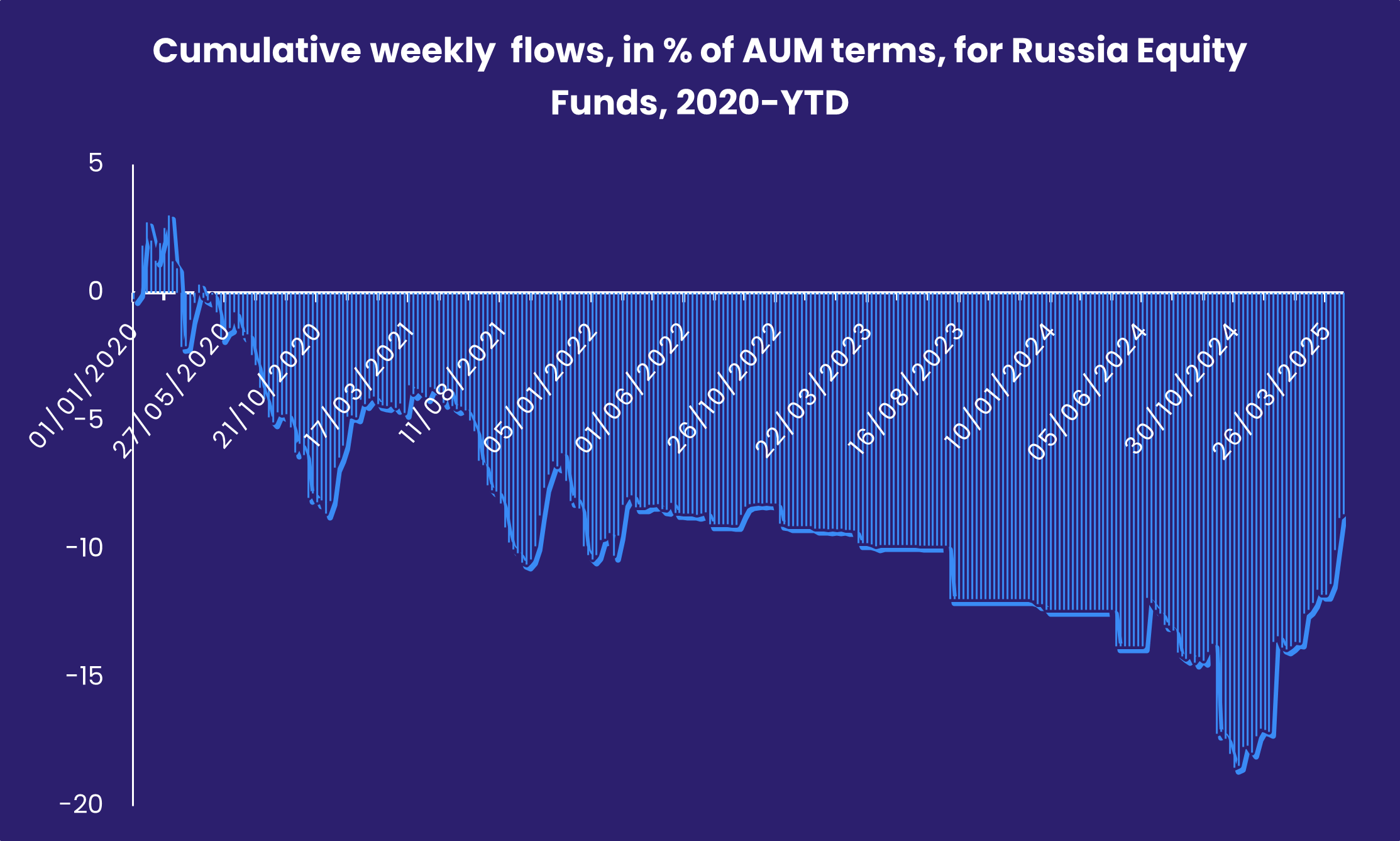

Russia’s average GEM Fund weighting remains pinned to the floor. But flows to Russia Equity Funds have, in relative terms, rebounded sharply as a ceasefire – viewed as favoring Russian interests – remains a policy goal of the new US administration. Among the other EMEA Country Fund groups, appetite for Turkey and South Africa-mandated funds has dropped off this month but Poland Equity Funds have recorded inflows 12 of the past 13 weeks.

For the second week running, redemptions from Brazil mandated funds dragged the headline number for all Latin America Equity Funds into negative territory. With inflation still north of the Brazilian central bank’s target ceiling, markets are braced for another interest rate hike of the bank’s May policy meeting. The latest week did see Argentina Equity Funds snap a run of outflows stretching back to late February.

Developed Markets Equity Funds

Although a more conciliatory tone on tariffs and central bank independence from US President Donald Trump helped stem the bleeding from US Equity Funds going into the final week of April, it was renewed appetite for European and global exposure that lifted the latest headline number for all EPFR-tracked Developed Markets Equity Funds. Over $8 billion collectively flowed into Global and Europe Equity Funds, offsetting redemptions from US and Canada Equity Funds.

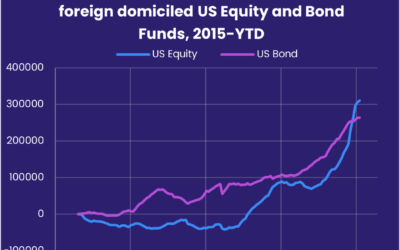

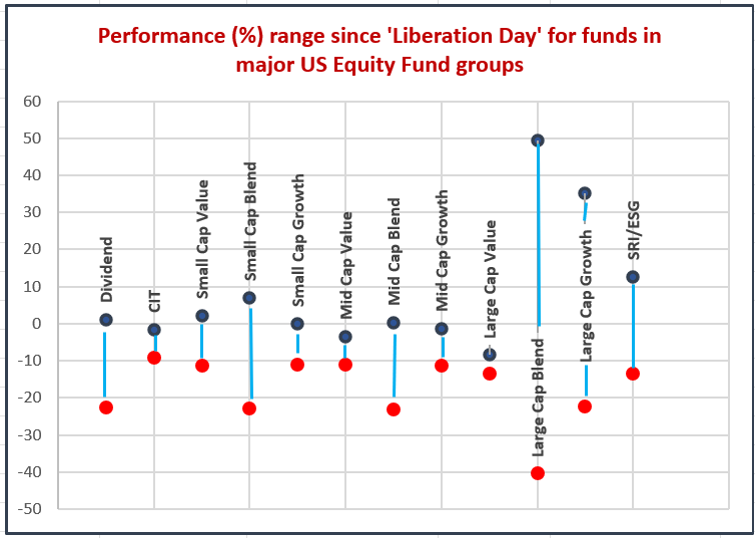

The bumpy ride endured by US Equity Funds because of the administration’s tariff-centric policies has resulted in four outflows over the past five weeks and wide spreads between the best and worst performing funds within major US Equity Fund groups. But flows to foreign-domiciled funds were positive for the second week running, and China-domiciled funds extended an inflow streak that started in mid-October.

Investors are still resisting the ”anywhere but America” narrative, anticipating a retreat to more manageable ground by the Trump administration. Research by EPFR’s sister company CEIC suggests they may be right to resist calls to jump ship. Their latest ‘nowcast’ for US GDP in the first and second quarters of the year peg growth in both quarters at over 2%, though the American consumer may be the biggest risk to these relatively benign projections.

”Amid worries that tariffs will drive inflation higher and slow growth, consumer sentiment has been deteriorating sharply, according to the University of Michigan’s latest survey,” CEIC’s economists noted. ”Shockingly, American consumers are also expecting year-ahead inflation to accelerate to 6.7%, which would be the highest level since 1981.”

Meanwhile, enthusiasm for European stocks has rebounded due to interest rate dynamics, the continent’s re-armament story, attractive valuations and Trump’s back-peddling on tariffs and central bank independence. The latest week’s inflow took the two-week total for Europe Equity Funds north of $9 billion. Retail share class flows, which surged to a more than four-year high in mid-March, were positive for the fourth time in the past six weeks.

Japan Equity Funds racked up their eighth inflow since mid-February as flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates jumped to their highest level in over 40 months. Investors utilizing Hedge Funds have been on the opposite tack, consistently pulling money out of Japan-mandated funds since mid-3Q24.

Global sector, Industry and Precious Metals Funds

For the first time in seven weeks, the number of EPFR-tracked Sector Fund groups posting inflows climbed to six while just five groups posted outflows. Inflows for those six groups averaged $290 million in the week to April 23, while outflows ranged from $80 million for Infrastructure Sector Funds to $933 million for Healthcare/Biotechnology Sector Funds. Investors, and companies, are having a hard time predicting what comes next with Trump’s tariff-driven turbulence hitting markets globally. That also means that current earnings reports and forecasts are being discounted.

A case in point is United Airlines – which operates the largest fleet of any carrier worldwide – reporting on the 15th that its outlook for the year is ”impossible to predict” amid ongoing global economic uncertainty and the chance of the US slipping into a recession. The company provided an alternative outlook in case that scenario unfolds.

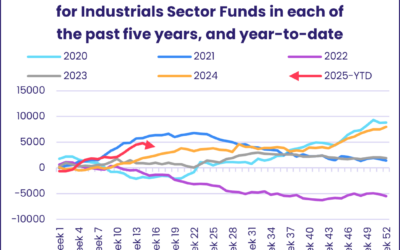

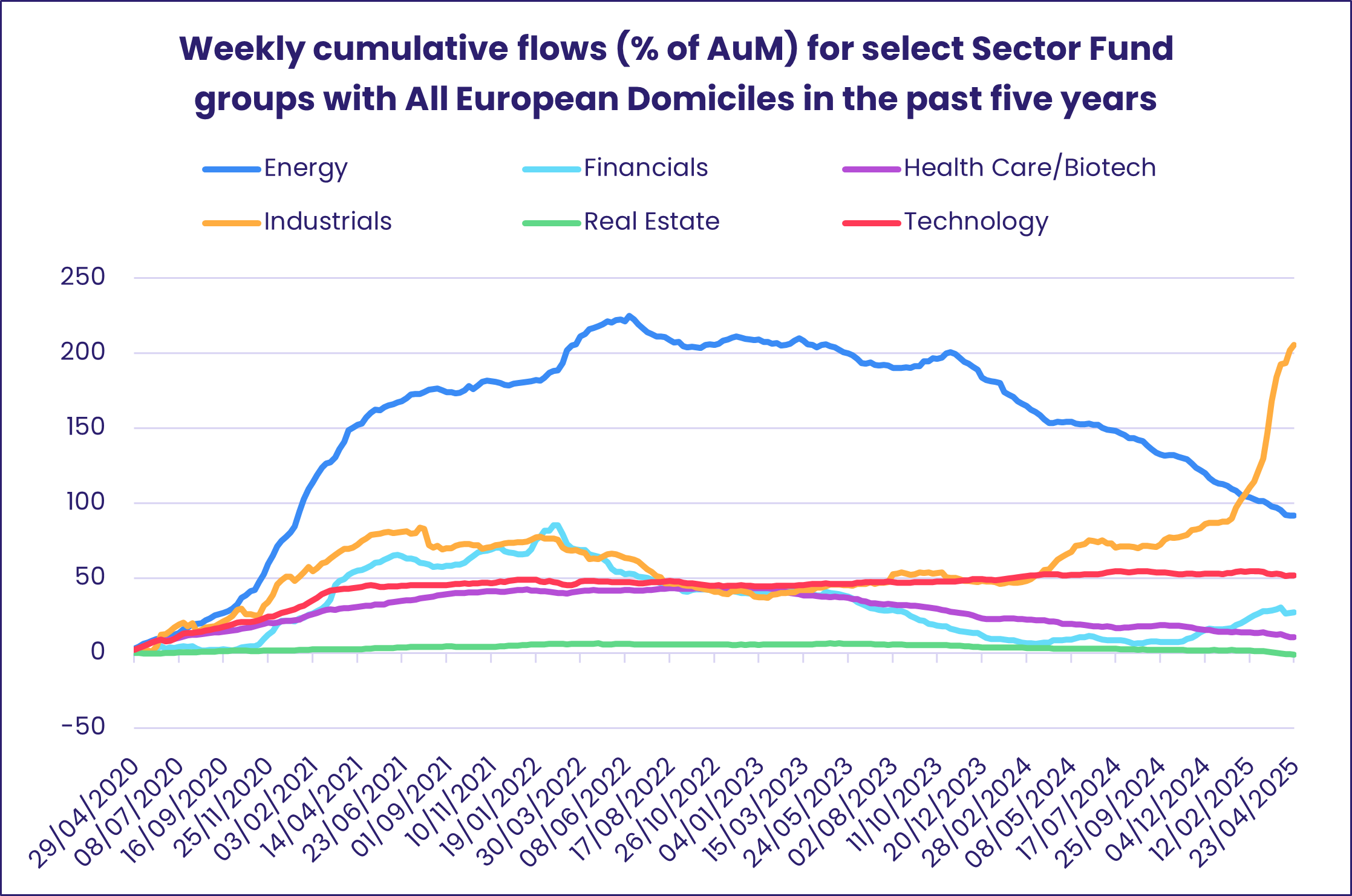

With some investors looking to Europe, the continent’s rearmament story has lit a fire under European-domiciled Industrials Sector Funds which enjoyed their 27th consecutive inflow. Among the milestones in that run was an inflow of over $1 billion in mid-March, a trend unheard of in the past two decades. Prior to this year, European-domiciled Energy Sector Funds were attracting the most interest, a trend that cooled in late 2023.

Technology and Real Estate Sector Funds have the largest presence within European-domiciled funds, with AuMs in excess of $200 billion each. Flows, however, have been dimmed – or come to a plateau – by the uptick of interest in both Industrials and more modestly, Europe Financials Sector Funds. These funds have seen inflows in 16 of the past 17 weeks, a stark contrast to the overall Financials Sector Fund group (all domiciles) which has racked up four straight weeks of outflows, totaling $5.6 billion. Meanwhile, all Technology Sector Funds extended their inflow streak to six weeks and nearly $14.5 billion and all Real Estate Sector Funds snapped a six-week outflow streak.

Overall, Energy and Healthcare/Biotechnology Sector Funds currently hold the longest outflow streaks among the 11 groups, with each currently standing at seven weeks. Redemptions have totaled nearly $6 billion (4.3% of assets) and $5.7 billion (2.6% of assets), respectively.

On the gold front, EPFR’s Liquidity Analyst Winston Chua highlighted this week that alongside Bitcoin, ”Gold also remains highly popular (and less volatile), rising 12% [since early April]. Gold Funds chalked up their 15th consecutive weekly inflow, taking in $3.5 billion (0.9% of assets) this past week. Not since the spring of 2022 have [Physical] Gold Funds enjoyed a longer stretch of weekly inflows.”

Bond and other Fixed Income Funds

Redemptions from EPFR-tracked Bond Funds slowed during the week ending April 23 as the US administration toned down its criticism of Federal Reserve Chair Jerome Powell. But the group still posted a third consecutive outflow for the first time since 3Q22. Risk appetite remained depressed, especially in comparison to the previous two years, but there were some signs of a thaw with Emerging Markets and Collateralized Loan Obligation (CLO) Bond Funds posting modest inflows.

Europe and Global Bond Funds also tallied solid inflows that offset over $3.5 billion worth of redemptions from US and Canada Bond Funds.

At the asset class level, big daily shifts in the headline number for Mortgage Backed Bond Funds netted out at a modest outflow for the week, and redemptions from Municipal, Bank Loan and Municipal Bond Funds were well down from the previous week’s eye-catching totals. High Yield Bond Funds extended their current redemption streak to five weeks and $31.1 billion, Convertible Bond Funds tallied their 10th consecutive outflow and Inflation Protected Bond Funds recorded their 14th inflow over the year-to-date.

The rotation within US Bond Funds from corporate to sovereign and long to short term continued, and foreign-domiciled funds posted their third straight outflow with funds based in Japan seeing money flow out for the eighth week running.

Europe Bond Funds pulled in a little over $1 billion, with the bulk of that money going to Europe ex-UK Regional and dedicated Germany Bond Funds. Funds with corporate mandates extended their longest redemption streak in over two years. The latest allocations data showed that Europe Regional Bond Fund allocations to the UK fell in March for the first time since July of last year.

Flows into Local Currency Emerging Markets Funds lifted the headline number for the overall group during a week when investor activity was generally subdued. At the country level, only Thailand Bond Funds absorbed over $100 million.

Both the major multi-asset groups, Balanced and Total Return Funds, experienced more redemptions. Over the past three weeks, investors have peeled a combined $24.7 billion off the two groups.

Did you find this useful? Get our EPFR Insights delivered to your inbox.