The prospect of higher yields, and market discipline improving credit quality, drew another $19.2 billion into Bond Funds, while Alternative Funds absorbed another $4.3 billion as some investors turned to Physical Gold and Cryptocurrency Funds. Elsewhere, Balanced Funds saw $1.2 billion flow out and Money Market Funds $18 billion while Equity Funds experienced net redemptions of $9.5 billion.

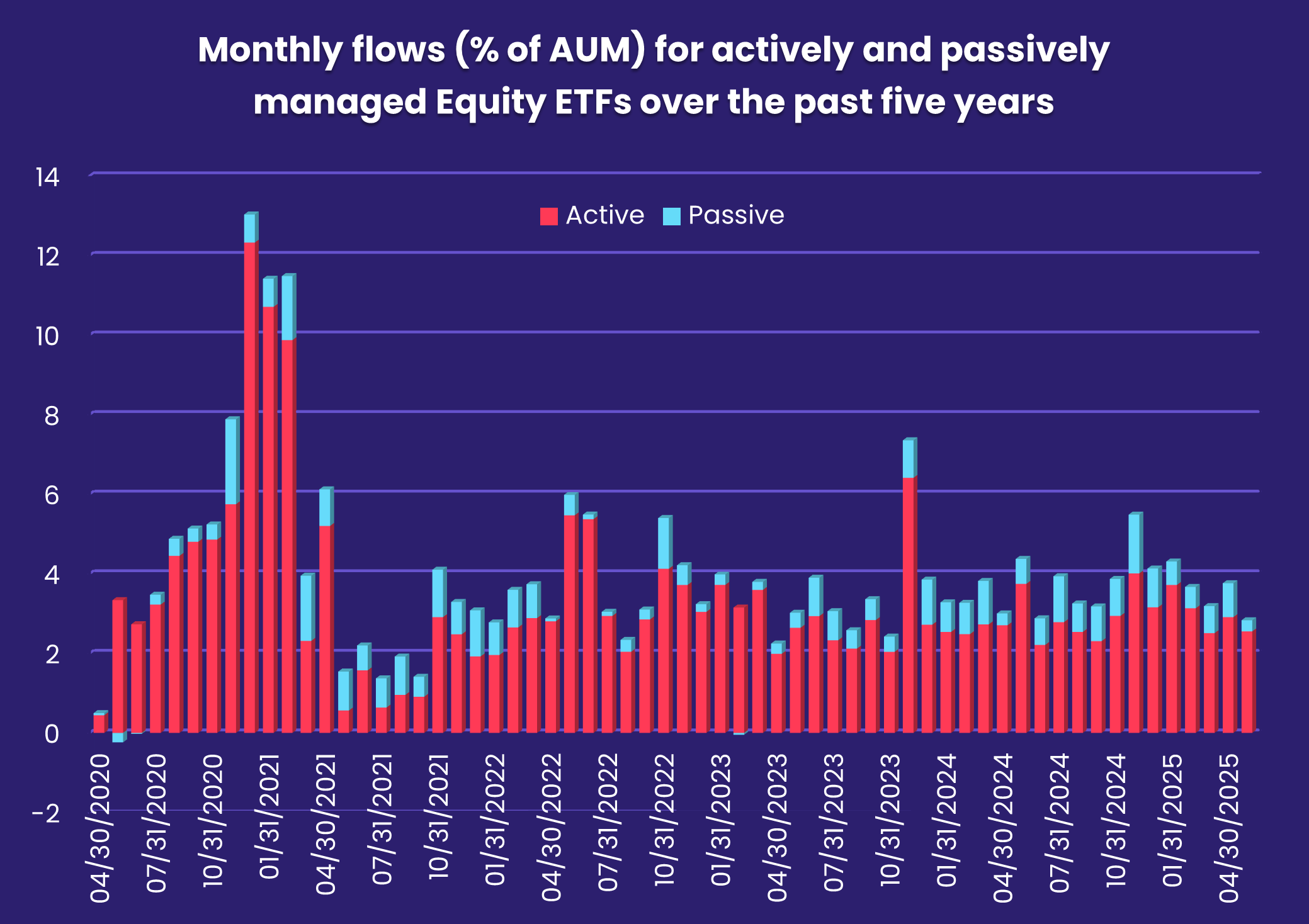

The outflows from Equity Funds again bypassed actively managed exchange traded funds (ETFs), which have seen their collective AUM grow sevenfold since the beginning of the current decade compared to the 50% increase seen by passively managed Equity ETFs. The last time actively managed Equity ETFs posted a monthly outflow was September 2019.

At the single country and asset class fund levels, China Bond Funds posted their biggest inflow since mid-1Q21, flows into Turkey Money Market Funds hit a new record high and Sweden Equity Funds chalked up their 10th outflow over the past 12 weeks. Physical Gold Funds snapped their longest run of outflows since 2Q24, Synthetic Funds tallied their biggest collective inflow in over three months and Inflation Protected Bond Funds tallied their 18th inflow since the second week of the year.

Emerging Markets Equity Funds

With all four of the major regional groups posting inflows and China Equity Funds seeing fresh money for the first time since the third week of April, collective flows for all EPFR-tracked Emerging Markets Equity Funds hit a seven-week high going into the final days of May.

The shift in sentiment did not extend beyond institutional investors, with retail share classes adding to a redemption streak that started last July. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates and EM Dividend Equity Funds tallied modest inflows while Leveraged EM Equity Funds experienced net redemptions for the fifth time during the past six weeks.

Mainland China-mandated funds absorbed just over $1 billion during the week ending May 28. China State Owned Enterprise (SOE) Funds, which enjoyed solid support in 4Q24 and the early part of the current quarter, chalked up their seventh straight outflow and Global Emerging Markets (GEM) ex-China Equity Funds were hit with record-setting redemptions for the second week running.

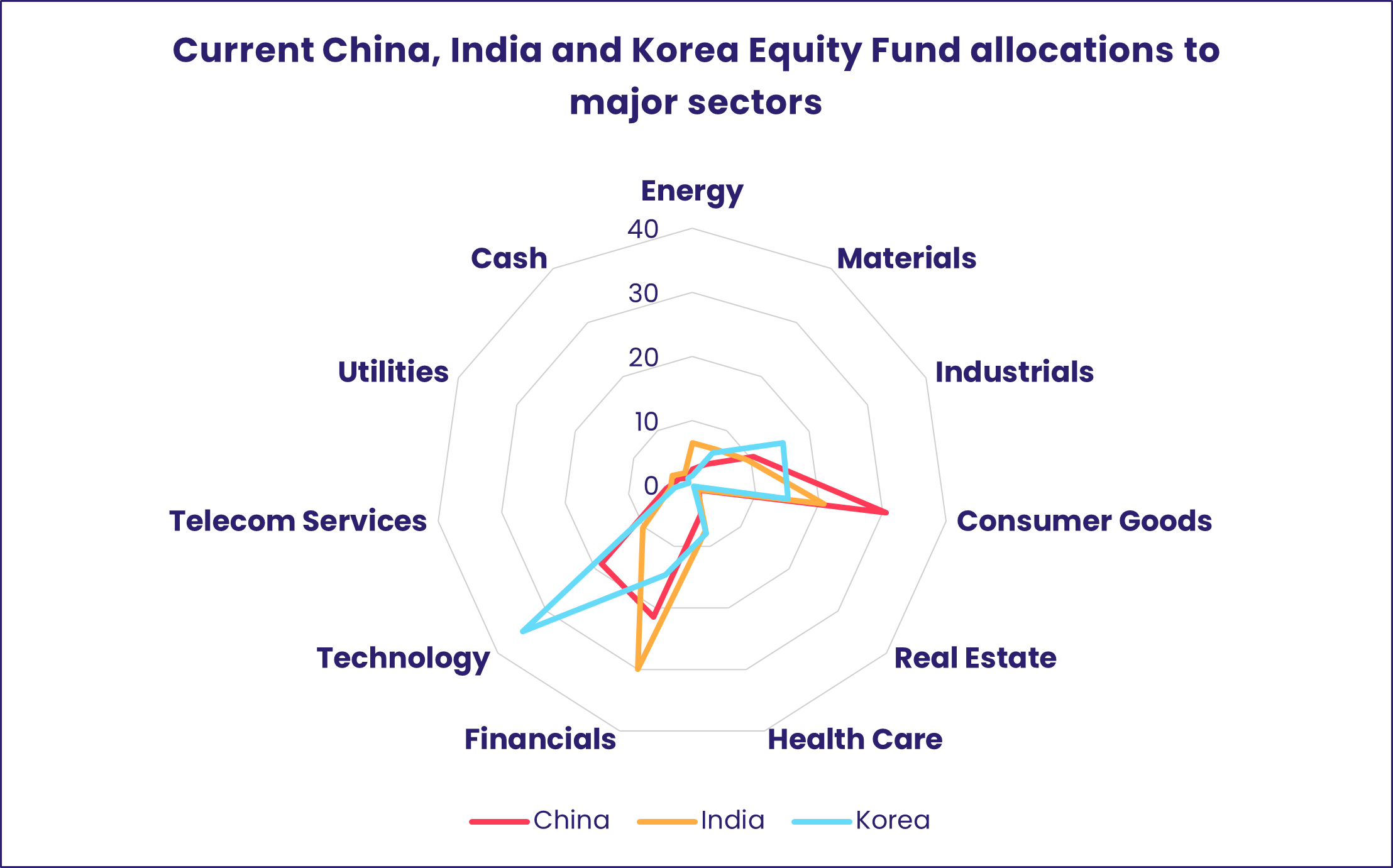

The latest sector allocations data shows that consumer plays have the heaviest average weighting among China Equity Funds while financials are the biggest single sector allocation for India Equity Funds and technology for Korea Equity Funds. The latter posted their biggest outflow in over four months as they extended their longest run of outflows since 1Q24. Koreans are starting early voting in a snap presidential election called for June 3 that, it is hoped, will draw a line under the political turmoil unleashed by impeached former president Yoon Suk Yeol’s declaration of martial law last December.

Voting is also on the minds of EMEA-oriented investors looking at one of the region’s more popular markets, Poland, where the two leading candidates face a runoff election this weekend. Poland Equity Funds did post their 17th inflow over the past four months, but investors fear that the country’s investment climate will change for the worse if the conservative candidate Karol Nawrocki emerges victorious. Among the other EMEA Country Fund groups, those dedicated to oil majors Saudi Arabia and UAE enjoyed solid inflows but, with prospects for peace in Ukraine fading, Russia Equity Funds posted their biggest outflow since the week ending Oct. 2, 2024.

Latin America Equity Funds, with the exception of Peru Equity Funds, remained popular in late May. Peru-mandated funds posted their biggest outflow since mid-3Q24 during a week when funds dedicated to neighboring Chile chalked up their biggest inflow in over 17 months.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity saw flows hit a wall in late May as Japan Equity Funds experienced record-setting redemptions and US Equity Funds chalked up their seventh outflow since the second week of April. Solid flows into Global Equity Funds and modest flows into Europe and Australia Equity Funds were not enough to maintain the overall group’s eight-week inflow streak.

Of the more than $11 billion peeled away from Japan Equity Funds during the week ending May 28, some $8 billion came from three ETF’s benchmarked to the Topix index. Retail share classes recorded modest inflows, as did foreign domiciled Japan Equity Funds, but uncertainty about Japan’s interest rate and debt dynamics kept investors on edge.

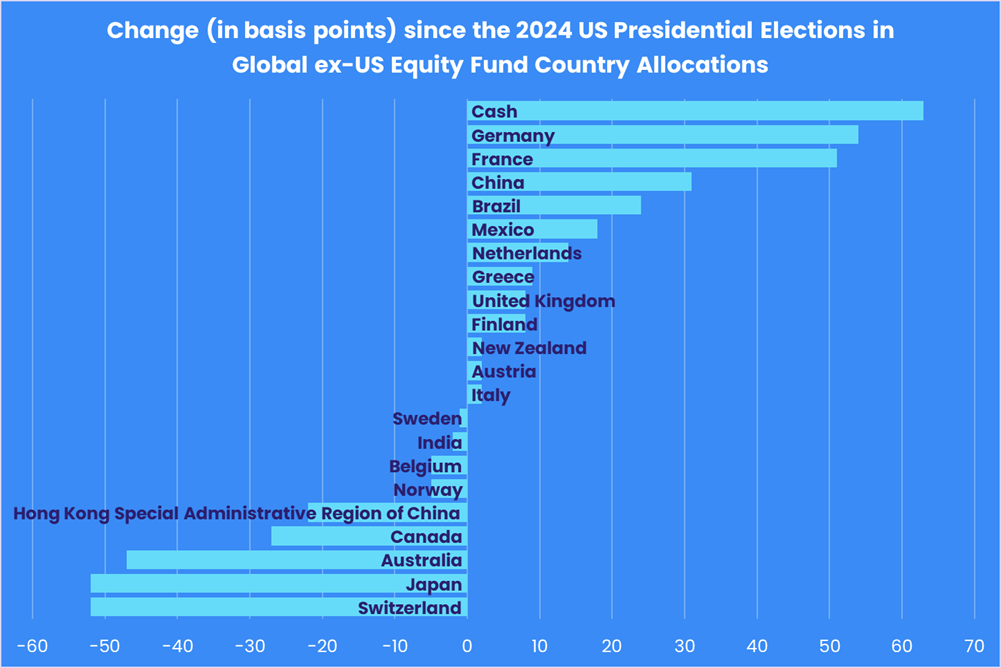

Japan has seen the greatest drop in its average allocation among Global ex-US Equity Funds since Donald Trump emerged victorious from last November’s US presidential election. Meanwhile, several of the markets squarely in Trump’s tariff sights have seen the biggest increases in their average weighting.

These ‘winners’ include two of the keystone European Union markets, France and Germany. But investor appetite for exposure to Germany’s fiscally expansive infrastructure and defense plans may have peaked as questions mount about the price of the borrowed capital needed to realize these plans. During the latest week, Germany Equity Funds posted consecutive weekly outflows for the first time since early February and Spain Equity Funds for the first time since mid-January. Elsewhere, UK Equity Funds posted their 31st outflow since the beginning of 4Q24 and Greece Equity Funds extended their longest run of inflows in over 14 months.

US Equity Funds saw flows rebound after the latest tariff suspension by President Donald Trump but still ended the week in the red. The latest redemptions hit most of the major groups by capitalization and style, with Small Cap Blend Funds posting the biggest outflow in both cash and % of AUM term. Overseas domiciled US Equity Funds posted only their sixth outflow over the past 12 months.

Global sector, Industry and Precious Metals Funds

Arriving after some of the tariff-related dust settled, the anxiously awaited earnings from AI bellwether Nvidia came in the final hours of the latest reporting period. Nvidia delivered a strong first-quarter but provided the by now usual caveats about the impacts of US export restrictions on future earnings.

The response from investors was more bull than bear. They reestablished their footprint in Technology Sector Funds, adding another $1.7 billion, and pumped $682 million into Industrials Sector Funds. Four out of the nine remaining major EPFR-tracked Sector Fund groups recorded inflows that averaged $270 million per group.

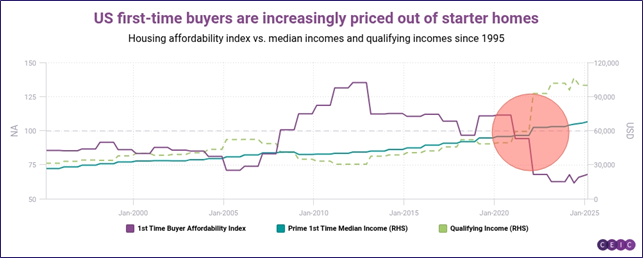

Real Estate Sector Funds were at the top of that scale, with flows for US-dedicated funds accounting for the biggest share this week at $230 million and Japan-dedicated funds saw inflows hit a six-week high. For the overall group, it marked just their third inflow of the past 17 weeks, a span that has seen nearly $9 billion flow out amidst uncertainty around US economic policy, expensive mortgage rates and record-low affordability for first time American buyers.

A recently added dataset to sister company CEIC’s suite includes a “first-time homebuyer index published by the National Association of Realtors. This affordability indicator is calculated as the ratio of first-time buyers’ median income to the required income to qualify for a housing loan.” “Today, first-time homebuyers are having the toughest time in decades — a three-year-old phenomenon that seems unlikely to change soon,” noted CEIC in a recent note to clients. “As our chart shows, early 2022 was the inflection point that saw everything change.”

Stress in real estate markets – particularly in commercial ones – continues to cast a shadow over regional banks and tightens lending conditions, with Financial Sector Funds racking up their eighth redemption of the past nine weeks. The outflow streak for All Bank Funds climbed to seven weeks and $1.15 billion total, and Regional Bank Funds are on track for a fifth monthly net outflow, their longest run since the beginning of last year.

Commodities/Materials Sector Funds snapped their seven-week redemption streak that totaled over $4.5 billion. At the top of the list of the 10 funds with the biggest inflows this week was a mutual fund with a call overwrite strategy providing exposure to natural resources, and among the list were seven gold mining funds. Overall, Gold Mining Funds racked up their first inflow in five weeks at over $134 million.

Bond and other Fixed Income Funds

The fourth week of May saw EPFR-tracked Bond Funds extend their current inflow streak to five weeks and $74 billion as investors positioned themselves for higher-for-longer yields on US, European and Japanese debt. That process included revisiting the investment case for emerging markets issuers, especially China, and paying more attention to the tax implications if markets force the US and Europe to narrow the gaps between revenue and spending.

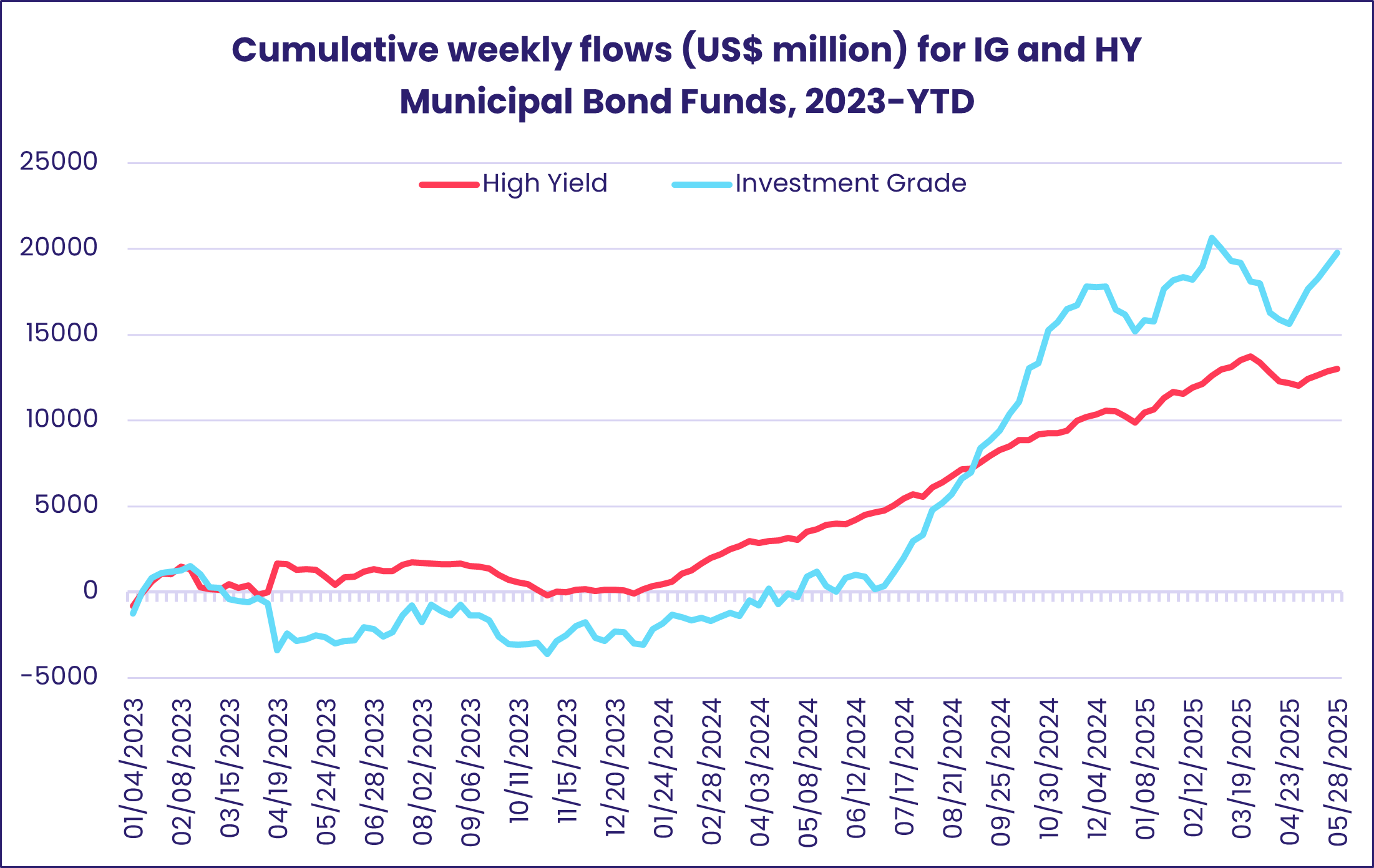

During the latest week, Emerging Markets Bond Funds posted their biggest collective inflow since 1Q23, Sovereign Bond Funds pulled in another $3.3 billion and Municipal Bond Funds tallied their fifth consecutive inflow. In the case of the latter, flows into sub-investment grade funds have ground lower over the past month despite the solid overall appetite for High Yield Bond Funds since the final week of April.

Flows into Emerging Markets Bond Funds were driven by two Asia ex-Japan Country Fund groups. Funds dedicated to mainland Chinese debt posted their biggest weekly inflow in over four years and Korea Bond Funds took in over $400 million. Retail share classes saw inflows gain momentum for the third straight week. When it came to duration, funds with mixed mandates saw collective flows soar to their highest total since 1Q23. Long Term EM Bond Funds were a distant second but still recorded their biggest inflow since last July.

Europe Bond Funds posted their sixth straight inflow and 18th year-to-date. Funds with corporate mandates absorbed more money than their sovereign counterparts for the third week running.

Foreign domiciled US Bond Funds posted consecutive weekly inflows for the first time since early April as the overall group ran its current inflow streak to five weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.