About EPFR’s Fund Flows and Allocations Data and Insights

Unparalleled understanding of how money is moving and why

Our best-in-class Fund Flows and Allocations Data helps you reveal the investible truth by looking at market trends, investor sentiment, liquidity, risk signals and corporate actions, and can be tailored to your specific use case.

$55T+

93%

151K+

$7T+

25+

Primary benefits

Industry-leading timeliness and granularity

Supports both bottom-up and top-down asset allocation strategies

Illustrated analysis of key factors driving current flow trends

Critical insights at macro and stock levels

Unique views on fund manager and investor sentiment

Insight into the fixed Income fund market at a bond ownership and security level

Connecting the dots with EPFR’s Fund Flows

Dating back to 1995, our fund flow data provides as-reported coverage of the net flows into and out of a universe of over 151,000 share classes and more than $55 trillion in assets tracked (AUM), helping our clients reveal the investible truth from:

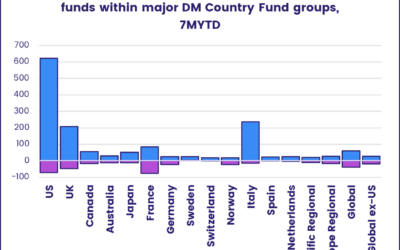

- Equity Fund Flows

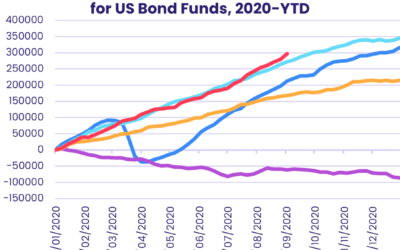

- Bond Fund Flows

- All other major asset classes, including: Money Market Flows, Alternative Fund Flows, and Multi-Asset Flows

Trusted by:

%

of the Bulge Bracket (the world’s largest investment banks)

%

of the “top 20” global asset management firms (by AUM)

%

of the Bulge Bracket (the world’s largest central banks)

%

of the “top 20” global asset mgmt firms (by AUM)

Latest Insights

Thought leadership and analysis that help you find a signal in the noise

All goldilocks and no bears in late August

The Paris Summer Olympics ended with the US and China occupying first and second position in the medal standings. They occupied the same positions when the latest week’s fund flows were tallied, with EPFR-tracked China Equity Funds pulling in over $6 billion for the fifth time so far this year and combined flows into US Equity, Bond and Money Market Funds exceeding $40 billion for the third week running.

Webinar: Central Banks in the Spotlight – The Fed and Bank of Japan Consider Momentous Policy Choices

As we head into September’s next round of central bank meetings, all eyes will be on the Federal Reserve and the Bank of Japan.

Positioning for the US rate cut bounce

With only a few key data points standing between now and the Federal Reserve’s September meeting, expectations of a first cut in US interest rates since 1Q20 continue to harden.

All goldilocks and no bears in late August

The Paris Summer Olympics ended with the US and China occupying first and second position in the medal standings. They occupied the same positions when the latest week’s fund flows were tallied, with EPFR-tracked China Equity Funds pulling in over $6 billion for the fifth time so far this year and combined flows into US Equity, Bond and Money Market Funds exceeding $40 billion for the third week running.

Webinar: Central Banks in the Spotlight – The Fed and Bank of Japan Consider Momentous Policy Choices

As we head into September’s next round of central bank meetings, all eyes will be on the Federal Reserve and the Bank of Japan.

Positioning for the US rate cut bounce

With only a few key data points standing between now and the Federal Reserve’s September meeting, expectations of a first cut in US interest rates since 1Q20 continue to harden.

Investors back in the pre-correction saddle

Two weeks after global markets corrected sharply, fund flows have regained much of their previous shape.