Global Navigator

Looking back at Global Navigators in Q1

Data-driven towards another rate hike?

The second week of April offered investors two data points, the latest US jobs report and the inflation numbers for Match, that they hoped would...

A liquid start to the second quarter

US Money Market Funds kicked off April by recording their fourth straight inflow in excess of $50 billion as investors sought alternatives to...

March’s pain may be April’s gain

Flows to and from EPFR-tracked fund groups during the final week of March continued to paint a picture of risk aversion and fear among investors....

Riding the waves in liquidity funds

In the face of this uncertainty, and the unwillingness of major Western central banks to suspend the battle against inflation, investors continued...

Banking on the cavalry’s prompt arrival

The second week of March was dominated by the crumbling fortunes of large US regional banks and European major Credit Suisse. Although this...

Fed following data, investors running from it

The third month of 2023 started with investors pulling another $5 billion out of EPFR-tracked US Equity Funds, extending that group’s longest...

Investors respond to red shoots of recovery

February was a bumpy month for investors and markets. Interest rates climbed higher in the US, Europe and Australia, the benchmark Dow Jones...

Craving certainty, markets get uncertainty

How much longer will the war in Ukraine go on? How much further will central banks go before they deem inflation contained? How much damage will the...

Investment compass keeps spinning in mid-February

With the one-year anniversary of Russia’s attack on Ukraine looming, the latest US inflation data showing headline inflation down and core inflation...

Help wanted making sense of US data

A stellar employment report, showing that the US added 517,000 jobs in January, threw another wrinkle at investors in early February. Those...

Glass remains half full in late January

Actions spoke louder – to equity investors – than words coming into February, with the fact that the latest interest rate hike by the US Federal...

Europe equity funds latest to catch a lift

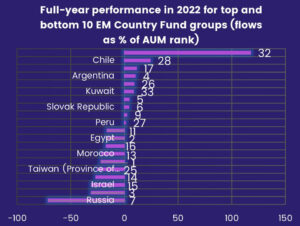

Flows into EPFR-tracked Emerging Markets Equity Funds during the third week of January climbed to their highest level since mid-1Q21 as investors...

Emerging markets funds catch a wave in mid-January

Flows into EPFR-tracked Emerging Markets Equity Funds during the third week of January climbed to their highest level since mid-1Q21 as investors...

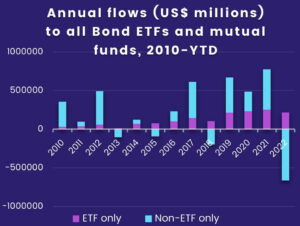

Bond Funds buoyed by lower inflation

Evidence that inflation is falling and global growth is stalling gave EPFR-tracked Bond Funds a shot in the arm during the first full week of...

Investors tip-toe into the New Year

Over $110 billion – a 131-week high – flowed into EPFR-tracked Money Market Funds during the week ending Jan. 4 as investors surveyed an investment...

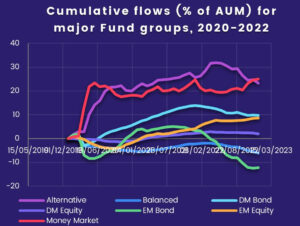

2022: A tale of active versus passive

The final week of 2022 saw EPFR-tracked Bond Funds post consecutive weekly outflows for the first time since mid-October, capping a year when the...