Kirsten Longbottom

Kirsten Longbottom, Research Associate at EPFR, joined the company in July 2021 and her responsibilities have since expanded to encompass marketing and sales support initiatives.

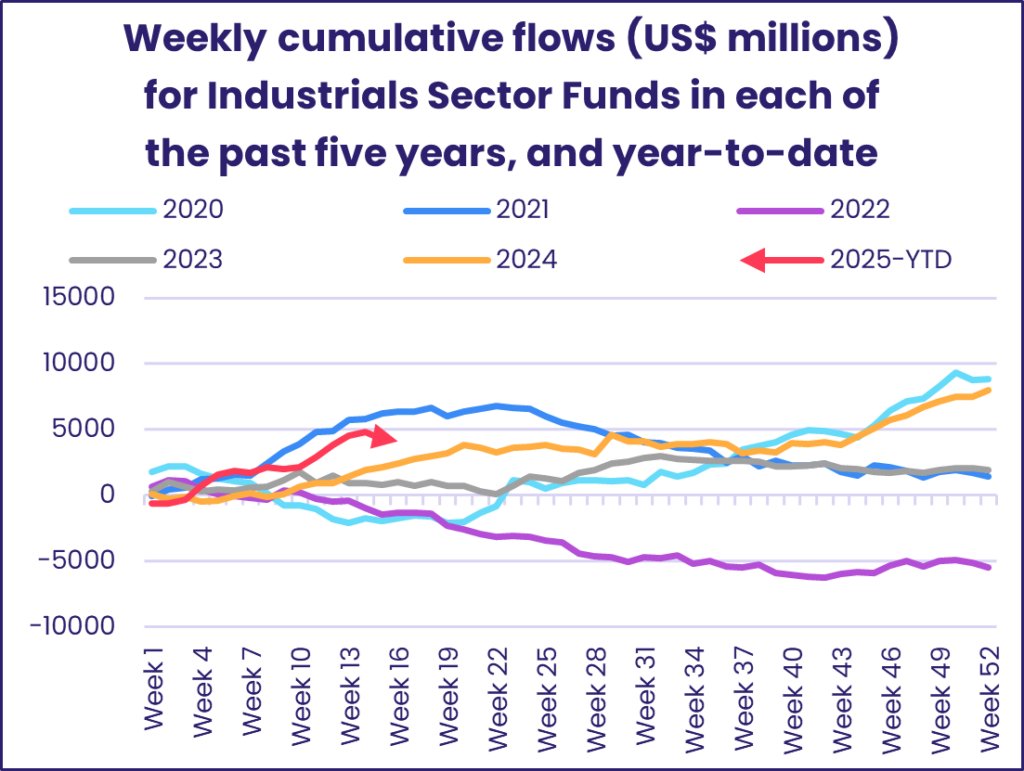

Kirsten’s main role is in editing EPFR’s publications, working closely with the research and quant team to produce relevant, frequent content, as well as monitoring and updating the company’s social media channels. She is focused on growing our social media presence by developing new ways to visualize EPFR data and creating more video content. She supports the sales teams’ client retention activities and corresponds with journalists or news sources, providing data and insight upon request. Each week, Kirsten writes the Sector Funds section for the Weekly Global Navigator and has started to contribute to various other EPFR publications.

Since September 2021, Kirsten has been the host of the EPFR Exchange Podcast, a weekly conversation with Cameron Brandt on trends in the data we track and how those trends relate to the global financial landscape. Kirsten has worked towards growing our podcast presence by creating a partnership podcast series where we invite guest speakers to share their unique perspectives on major market topics and continuing special focus episodes which provide an overview of EPFR products.

In May of 2020, Kirsten graduated with Honors from Westfield State University, and received a BA in Mathematics, BA in Economics and minored in Fine Arts. In her free time, she enjoys traveling to new places, yoga and painting.

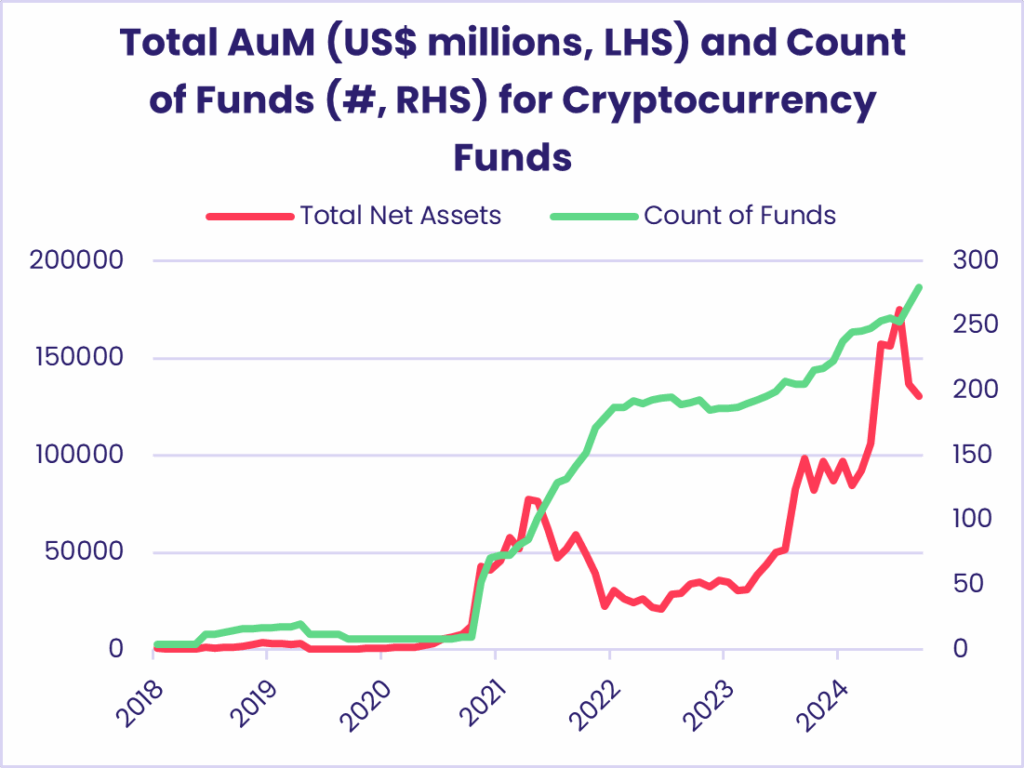

Crypto: Digital gold or fools gold?

For fund flows, back to the future?

Investors bear down on slower growth

Will US policy respond to reality’s bite?

Investors keep shuffling their hands

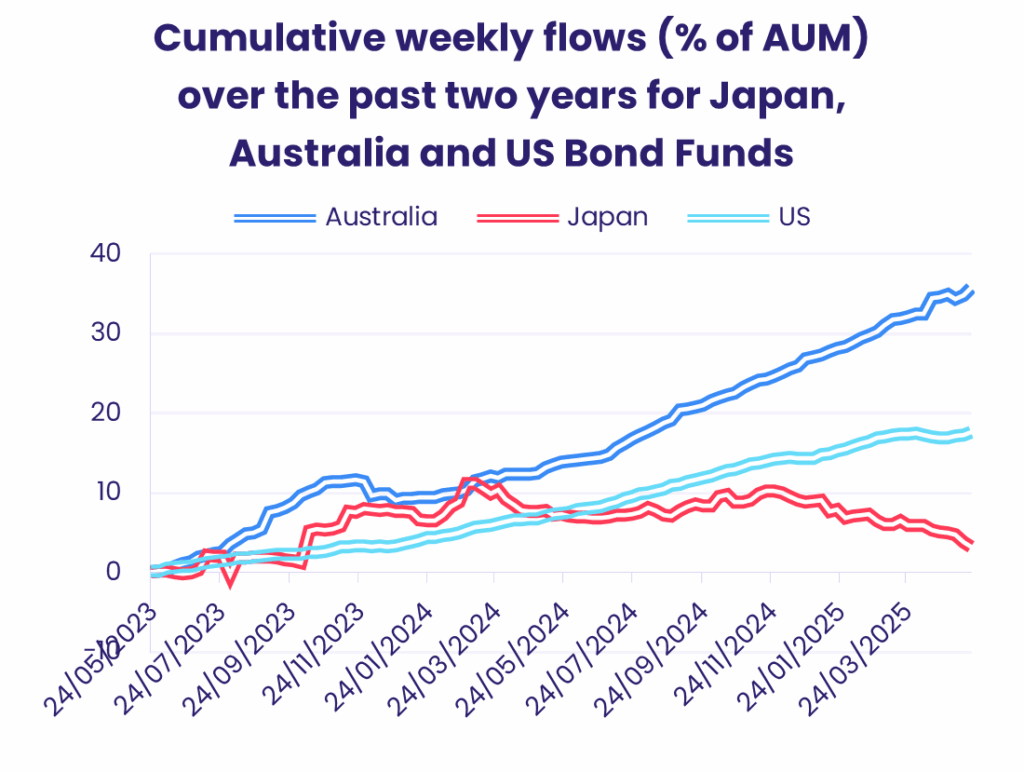

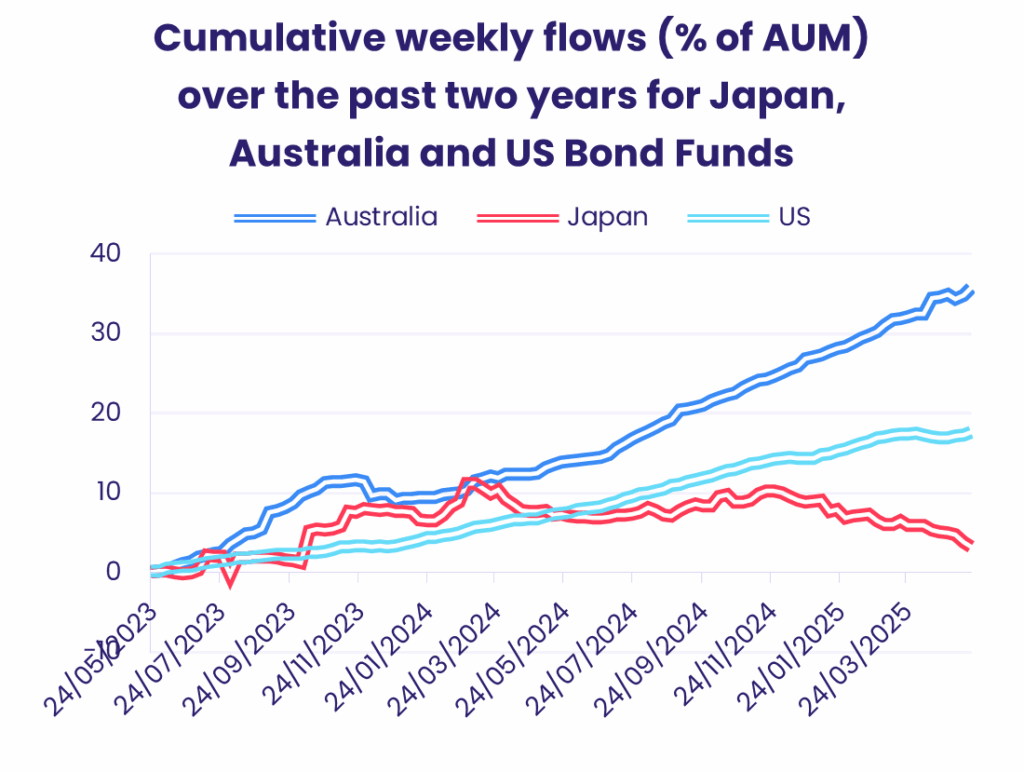

‘Safe haven’ flows bypassing US Bond Funds in mid-April

China dodges the tariff bullet, catches the inflows

For investors, safety trumps liberty on early April

Turkish assets take a roasting in late March

Caution still reigns despite a late flurry