Fund flows, monetary policies and key macroeconomic indicators interact in intricate ways.

The dramatic selloff recently experienced across global markets was thought to have been triggered by the Bank of Japan’s latest decision, leaning towards a monetary normalization policy. Weaker-than-expected indicators coming from the US have also affected market sentiment.

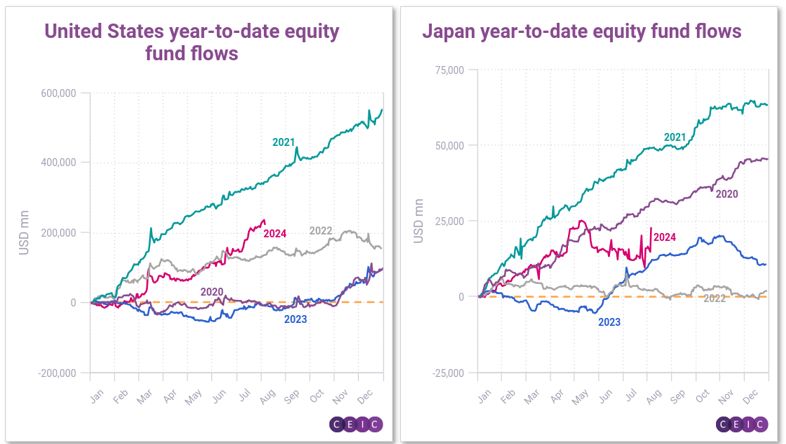

What were money flows showing before the selloff?

Using EPFR’s fund flow data and CEIC’s proprietary, machine learning-driven economic nowcasts, this Chart Pack dissects the market positioning in the run up to sell-off.

To request your complimentary copy, please fill out the form below.