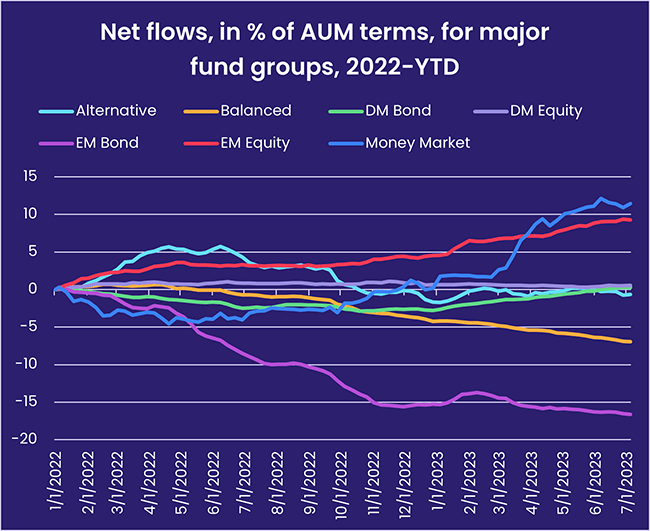

Six months into 2023, the term “goldilocks economy” has been dusted off by some investors as they contemplate declining inflation, strong labor markets, resilient corporate profits and the recent pause in the US interest rate hiking cycle. For others, the journey so far this year has been more akin to a trip with Alice in Wonderland, with tech indexes rising in tandem with higher borrowing costs, money flowing toward China despite its underwhelming recovery and Coal Funds attracting more money than ones dedicated to solar energy.

From a fund flow perspective, the second quarter ended with equity investors shifting their focus to Asia and Latin America, total Money Market Fund assets making a run at the $8 trillion mark, Energy Sector Funds mired in an 11-week, $8 billion outflow streak and flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates regaining some of their momentum.

Although the first week of July saw Emerging Markets Equity Funds post their biggest outflow since the first week of February, they pulled in a net $27 billion during the second quarter while redemptions from Developed Markets Equity Funds hit $51 billion. Year-to-date, EM Equity Funds have absorbed $69 billion while DM Equity Funds have seen $89 billion flow out.

Overall, investors steered a net $14.3 billion into all EPFR-tracked Equity Funds during the week ending July 5, with flows into Dividend Equity Funds climbing to a 14-week high, while Bond Funds attracted $8.3 billion and Money Market Funds $73 billion. The bulk of the latest flows into MM Funds went to US-dedicated ones, but Japan Money Market Funds extended their longest run of inflows since 4Q19.

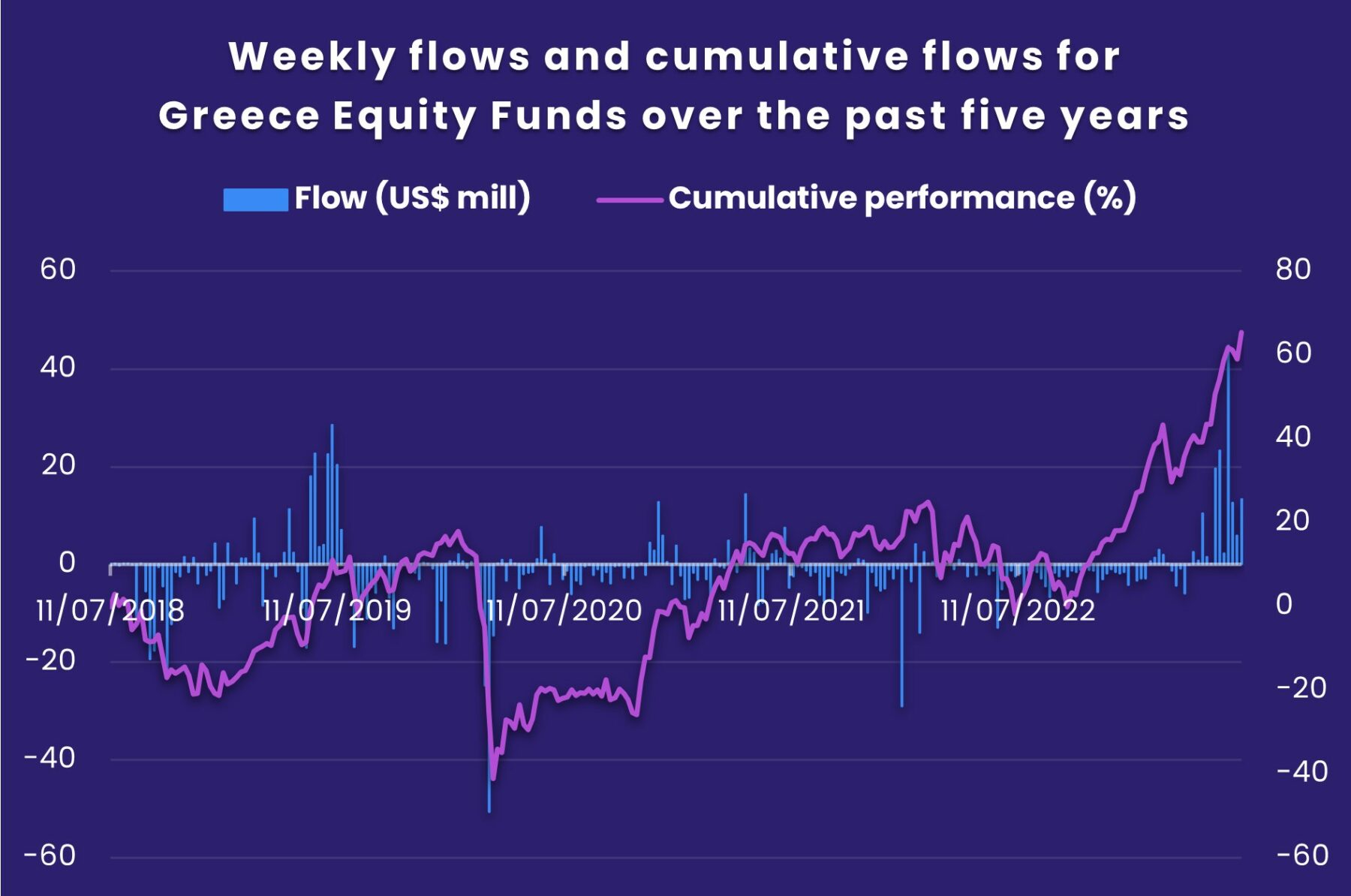

At the single country and asset class fund level, China Bond Funds posted their 7th inflow in the past 52 weeks, flows into Italy Equity Funds hit a 17-week high and Greece Equity Funds posted their 12th straight inflow. Inflation Protected Bond Funds extended an outflow streak stretching back to mid-3Q22, Bank Loan Funds chalked up their fourth inflow in the past five weeks and fresh money flowed into Cryptocurrency Funds for the third week running.

Emerging markets equity funds

EPFR-tracked Emerging Markets Equity Funds started the third quarter of 2023 by posting their second outflow in the past three weeks as questions about Chinese growth – and the willingness of Chinese policymakers to stimulate it – weighed on sentiment towards this asset class.

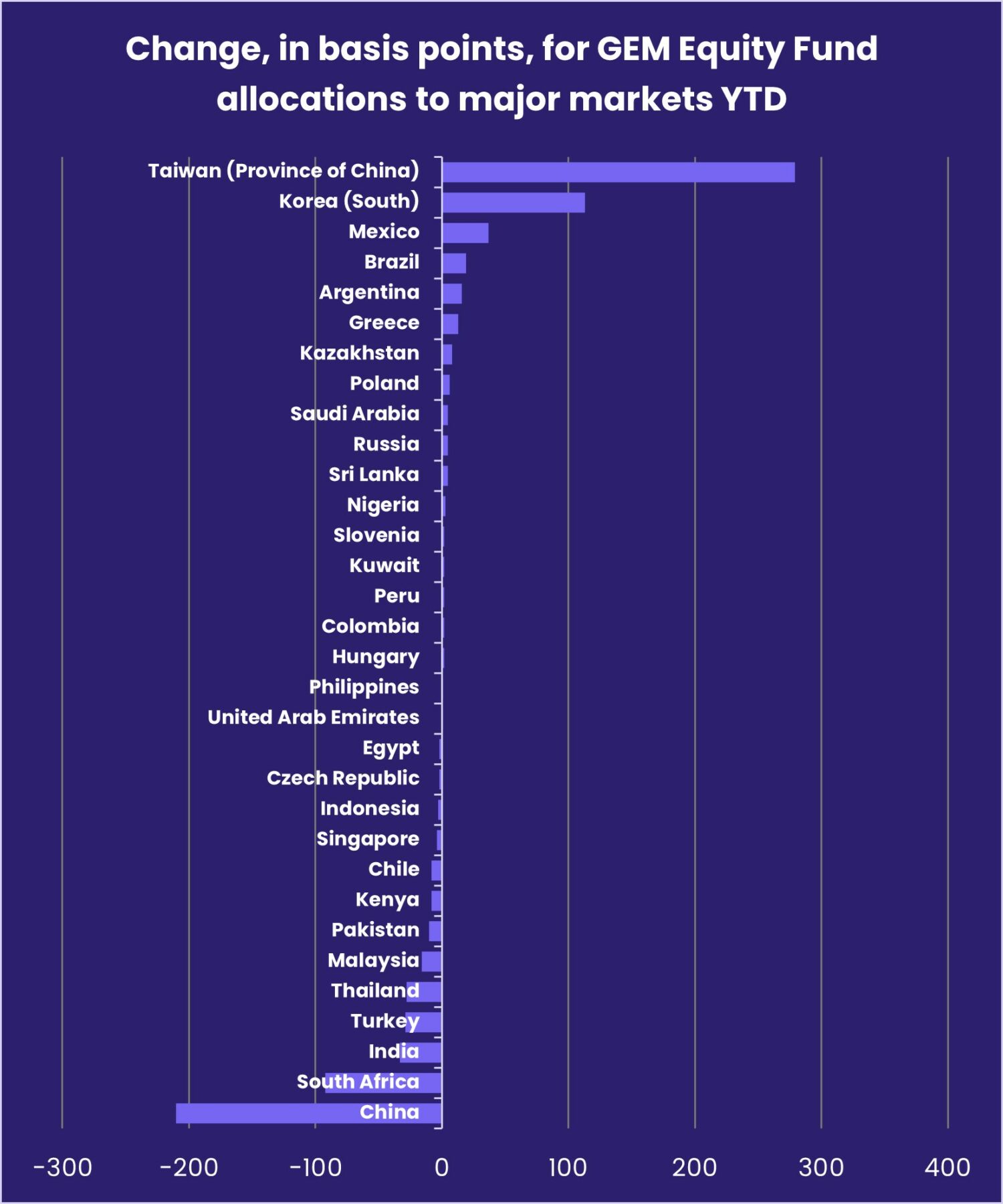

China and Taiwan (POC) Equity Funds saw a combined $1.1 billion flow out during the week ending July 5 that was partially offset by solid flows into Korea and India Equity Funds. The latest flows into the latter, which came as benchmark Indian equity indexes hit fresh record highs, extended the group’s longest inflow streak since 1H17.

Having significantly boosted their exposure to India between 2Q20 and 4Q22, managers of the diversified Global Emerging Markets (GEM) Equity Funds have shifted some of their focus – and exposure – to Latin American markets. Going into June, allocations to Brazil and Mexico were up from the beginning of the year and average exposure to Argentina was at a 14-month high.

Investors are also paying more attention. Flows into Brazil Equity Funds hit their highest level since early November and Mexico Equity Funds posted their eighth inflow in the past 11 weeks.

EMEA Equity Funds posted consecutive weekly inflows for the first time since late March, with flows into South Africa Equity Funds climbing to their highest level in over eight months. The past three weeks have seen flows into domestically-domiciled funds rebound sharply while South Africa Equity Funds domiciled overseas have posted outflows in 15 of the past 20 weeks.

Developed markets equity funds

Over $13 billion flowed into US Equity Funds during the first week of July ahead of a jobs report that dealt a hard blow to hopes the Federal Reserve is at, or close to, its ‘pivot point’ for US interest rates. The influx of fresh money, which saw 30 funds take in over $200 million, helped EPFR-tracked Developed Markets Equity Funds post their fourth collective inflow in the past six weeks.

Global and Japan Equity Funds also recorded solid inflows during the week ending July 5 while Canada, Australia and Europe Equity Funds posted outflows ranging from $32 million to $1.26 billion.

The redemptions from Europe Equity Funds extended an outflow streak stretching back to early March, with investors digesting data showing the Eurozone economy stalling in June and fretting that China’s lackluster economic rebound will sap its demand for European exports. The latest sector allocations data shows Europe ex-UK Regional Fund allocations to industrial and technology stocks at 17-month highs while exposure to the materials sector is at its lowest level in over 17 years.

At the country level, investors continue to pile into Greece Equity Funds, whose current inflow streak is the longest since 1H15, as the recently re-elected Prime Minister Kyriakos Mitsotakis moves to deliver on promises of further reform. Greece Equity Funds were the best-performing Developed Markets Equity Fund group during the second quarter, followed by Japan, US and Spain Equity Funds.

Japan Equity Funds added to their current inflow streak despite the weakest flows into foreign-domiciled funds since early May. Optimism about corporate reforms, wage growth which blunt the deflationary forces that Japanese policymakers have wrestled with for decades and still attractive valuations are among the drivers of recent flows to this fund group. Elsewhere in the region, Singapore Equity Funds recorded their biggest inflow since 1Q22.

Large Cap Blend Funds absorbed the lion’s share of the money committed to US Equity Funds, with Small Cap Blend Funds a distant second. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their second biggest inflow of the year.

Global sector, industry and precious metals funds

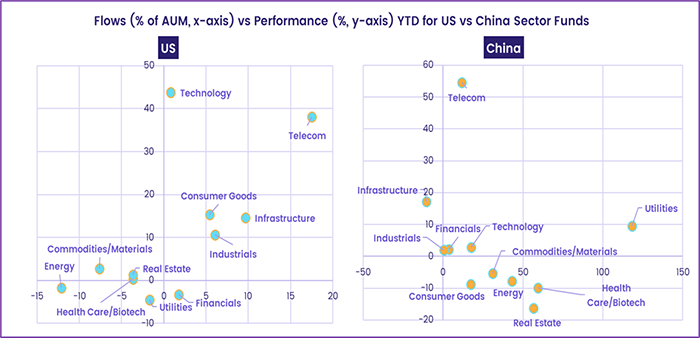

Flows to EPFR-tracked Sector Funds struck a more positive note coming into July, with six of the 11 major groups recording an inflow compared to just three the previous week. Those flows ranged from $14 million for Telecoms Sector Funds to $855 million for Technology Sector Funds.

In the case of Technology Sector Funds, the top 10 funds ranked by inflows for the week were all ETFs, bar one, and offered a mixed bag of Internet, anime comic and gaming, Hong Kong, Taiwan, and semiconductor mandates. Anime, Comic and Gaming Funds pulled in an eight-week high of $183 million, Internet Funds posted their seventh inflow of the past eight weeks, and Semiconductor Funds snapped a three-week inflow streak.

Once again China Technology Sector Funds were the biggest contributor to the headline number for all Technology Sector Funds. When compared to US-dedicated funds, investors seem willing to discount current performance.

Elsewhere, four groups added to their current outflow streaks. Financials Sector Funds posted consecutive weekly outflows for the first time since a three-week run ended mid-May. Commodities/Materials and Energy Sector Funds both extended their runs to 12 weeks during which $4.5 billion and $9.2 billion, respectively, has flowed out.

Money also flowed out of Utilities Sector Funds for a second straight week and fourth time in the past five weeks despite the fresh commitments to China Utilities Sector Funds, their fourth straight inflow and eighth in the past nine weeks.

Bond and other fixed income funds

Investors committed another $8.3 billion to EPFR-tracked Bond Funds during the week ending July 5, lifting the year-to-date total over the $255 billion mark. Flows into retail share classes hit a nine-week high and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest inflow since the second week of February. For Emerging Markets and Asia Pacific Bond Funds, inflows reached 11 and 37-week highs, respectively.

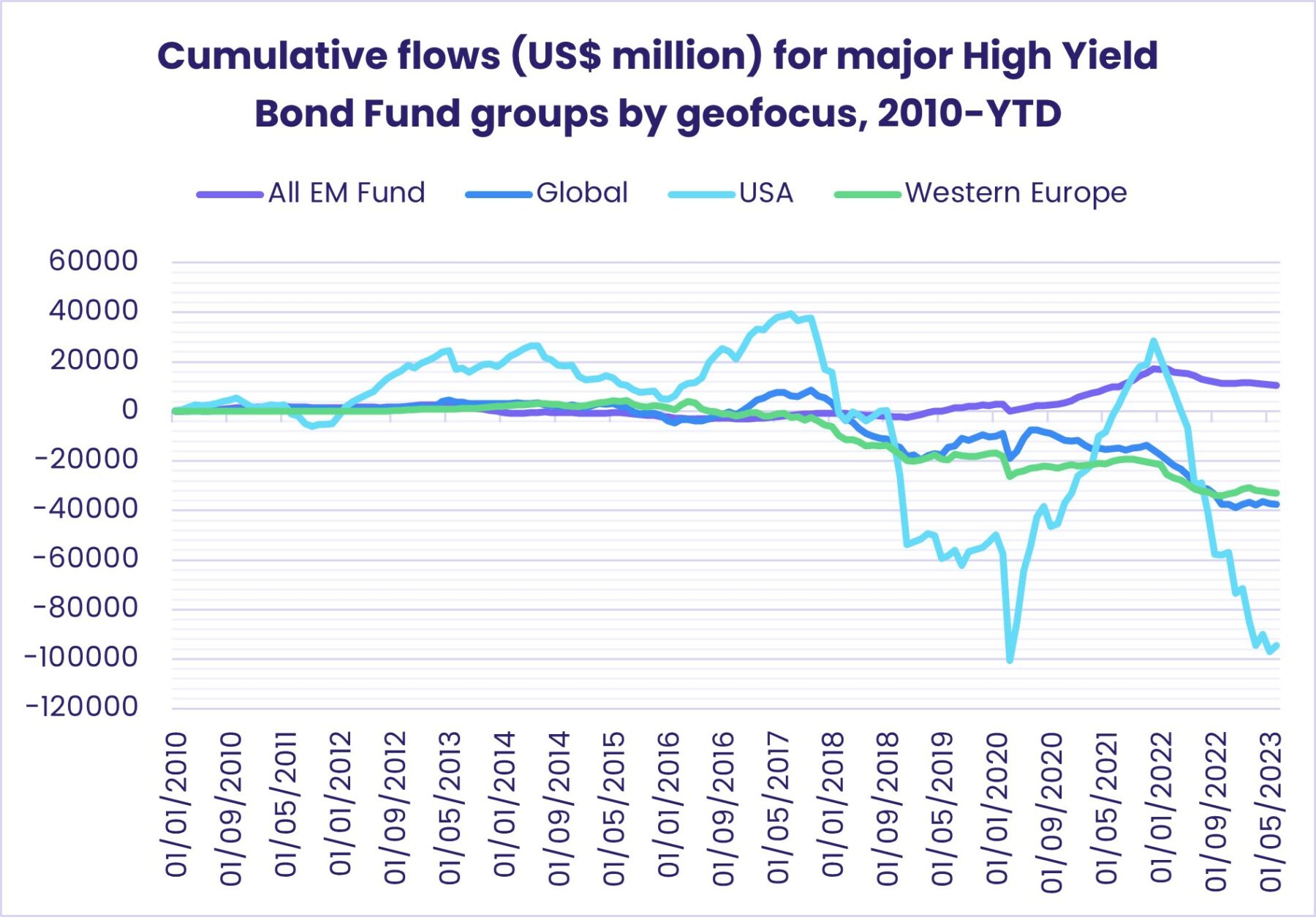

At the asset class level, flows into all High Yield Bond Funds hit a four-week high, Inflation Protected Bond Funds posted their 45th consecutive outflow, Convertible Bond Funds chalked up their 23rd outflow of 2023 and Mortgage-Backed Bond Funds absorbed fresh money for the fourth week running.

Investors with an emerging market focus favored mixed funds when it came to their currency exposure, Asia when it came to geographic exposure and long-term when it came to duration. At the country level, Korea Bond Funds racked up their 13th straight inflow and 31st since mid-November and flows into South Africa Bond Funds hit a 13-week high. Redemptions from Brazil Bond Funds climbed to a level last seen in 3Q20 and Latin America Regional Bond Funds posted their biggest outflow in 18 months.

Money kept flowing into US Bond Funds ahead of more strong labor market data that pushed the yield on two-year Treasuries to a 16-year high in anticipation of further interest rate hikes. But Collective Investment Trusts (CITs) dedicated to US debt have not had the same success attracting new money. They have now posted outflows in 34 of the past 36 weeks.

Interest in Asian markets was not confined to the EM space, with Australia Bond Funds adding to a record-setting inflow streak and flows into Japan Bond Funds hitting a year-to-date high.

After two straight weeks of net redemptions, flows into Europe Bond Funds rebounded as flows into retail share classes climbed to a four-week high. Investors are showing sustained interest in some of the so-called PIIGS markets that were at the heart of Europe’s sovereign debt crisis. Italy Bond Funds have chalked up 10 straight weekly inflows while Spain Bond Funds have absorbed fresh money nine of the past 10 weeks and Greece Bond Funds four of the past seven weeks.

Global Bond Funds posted their fourth consecutive inflow and biggest since early May. Funds with fully global mandates absorbed the biggest share of the new money, but flows into Global ex-US Bond Funds were the biggest in over five months.

Did you find this useful? Get our EPFR Insights delivered to your inbox.