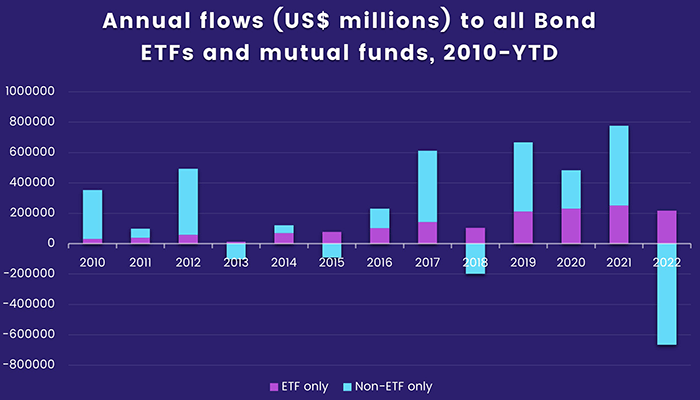

The final week of 2022 saw EPFR-tracked Bond Funds post consecutive weekly outflows for the first time since mid-October, capping a year when the overall group smashed its previous outflow record as central banks scrambled to contain inflation running at multi-decade highs.

Behind the headline number, however, was a marked shift from active to passive management. While actively managed Bond Funds saw over $600 billion redeemed, Bond ETFs recorded their second highest full-year inflow. It was a similar story for Equity Funds, with Equity ETFs attracting over $400 billion and Equity MFs surrendering over $300 billion.

Although the shocks came thick and fast in 2022, from Russia’s invasion of Ukraine through the rapid tightening of monetary policy to the crash of many cryptocurrencies, investors did find some themes that they were willing to back. Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted inflows in 12 of the year’s final 15 weeks, with the latest inflow hitting a 22-week high. Dividend Equity Funds chalked up their 17th inflow in the past 21 weeks, China Equity Funds pulled in another $1.3 billion and Frontier Markets Equity Funds posted their ninth consecutive inflow.

Overall, EPFR-tracked Equity Funds absorbed a net $8 billion during the week ending December 28 and $13.6 billion flowed into Money Market Funds, with the bulk going to funds with US mandates as China Money Market Funds extended their longest redemption streak since 4Q21. Investors pulled $1 billion out of Bond Funds, $1.7 billion from Alternative Funds, and $4.8 billion – a 10-week high – from Balanced Funds.

At the asset class and single country fund levels, China Bond Funds posted their first inflow since late June and biggest since early February, UK Equity Funds took in fresh money for the first time in over six months and Austria Equity Funds posted their 15th straight outflow. Inflation Protected and Total Return Bond Funds extended their current redemption streaks to 18 and 19 weeks, respectively, Silver Funds snapped a four-week run of outflows and Derivatives Funds recorded a third straight outflow for the first time since 1Q21.

Emerging Markets Equity Funds

For Emerging Markets Equity Funds, 2022 ended as it began with dedicated China Equity Funds accounting for the bulk of the headline number for all EM Funds. The fourth week of December also saw EMEA and Latin America Equity Funds post modest inflows and Frontier Markets Equity Funds extend their longest run of inflows since 1Q17.

China Equity Funds were not the only Asia ex-Japan Country Fund group to fare well in 2022. With the region offering a generally better inflation narrative than Europe and the Americas, and several markets offering exposure to semiconductor and supply chain relocation stories, India, Vietnam and Taiwan (POC) Equity Funds set new full-year inflow records and Korea Equity Funds absorbed over $4 billion.

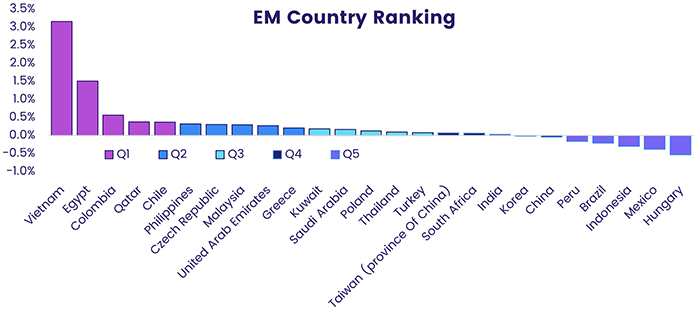

Despite the consistent inflows recorded by China Equity Funds, managers of the diversified Global Emerging Markets (GEM) Equity Funds remain cautious about the economic rebound that is anticipated now that China’s restrictive zero-Covid policies have been rolled back. Average allocations to China, which peaked at over a third of the average GEM Fund portfolio in 4Q20, are still under 25%. EPFR’s weekly EM Country Rankings also place China in the middle of a pack that is currently headed by Vietnam.

GEM Fund managers and investors are more aligned when it comes to Turkey, whose unorthodox policies have fueled dramatic gains for the country’s equity markets while slashing the cost of buying Turkish equities for those that have access to hard currencies. Turkey Equity Funds ended December with their biggest inflow in over a year while the country’s average GEM Fund weighting stands at a 29-month high.

Solid flows into Mexico Equity Funds helped Latin America Equity Funds snap a four-week run of outflows. The political climate in Latin America turned chilly for free markets in 2022, with Peru, Argentina, Mexico, Venezuela and Chile already headed by critics of ‘neo-liberalism’ and left-of-center candidates winning the presidencies of Brazil and Colombia.

Developed Markets Equity Funds

A year that started with six straight inflows ended with EPFR-tracked Developed Markets Equity Funds posting only their second inflow in the past six weeks as tighter monetary conditions, price and energy instability, the lingering effects of the Covid pandemic and Russia’s ongoing assault of Ukraine sapped investor appetite.

Europe Equity Funds have been buffeted by all these factors, carrying a record-setting 46-week redemption streak into the New Year that has seen four dollars leave actively managed funds for every dollar pulled out of ETFs. Retail investors last committed fresh money to this fund group in mid-June. But funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates have posted modest inflows 11 of the past 14 weeks.

At the country level, even the so-called ‘frugal five’ markets – Austria, Sweden, the Netherlands, Finland and Denmark – have collectively posted outflows for 15 straight weeks. UK Equity Funds, which have been hit with steady redemptions as investors viewed its deteriorating current account deficit with growing concern, did end the year with their first inflow since mid-June.

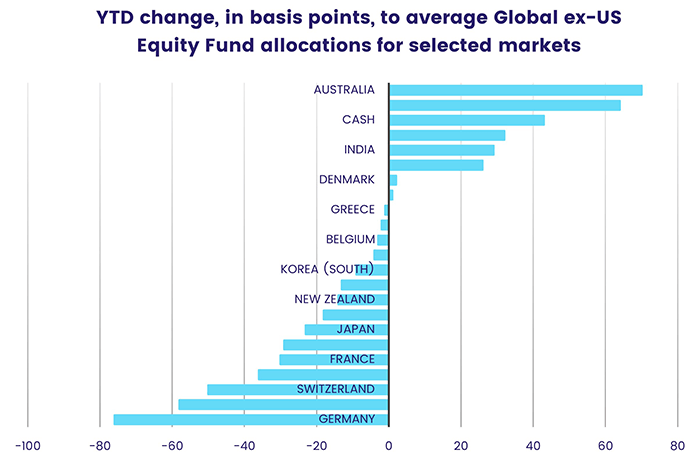

Global ex-US Equity Fund managers have shifted a chunk of their European exposure to Australia, Canada, Brazil, India and cash over the course of 2022. That group, unlike their peers with fully global mandates, has attracted some $40 billion in fresh money over the past 12 months.

US Equity Funds also ended 2022 with money to allocate, having absorbed over $80 billion during the past 12 months. The group ended the year with consecutive retail inflows for the first time since early April, and the number of weeks with positive retail flows – 11 – was the most in a year since 2013. Large Cap Funds attracted the lion’s share of the inflows and funds managed for both value and growth lagged, in flow terms, funds with mixed mandates.

The lackluster end to the year for Japanese equity markets, which were unsettled by signs the Bank of Japan may be calling time on some aspects of the ultra-accommodative monetary policies in place since 2013, triggered a pick-up in flows into Japan Equity Funds which carried their longest inflow streak in over 14 months into the New Year. During the fourth week of December flows into domestically domiciled funds and redemptions from foreign domiciled Japan Equity Funds hit 13-week highs.

Global Sector, Industry and Precious Metals Funds

EPFR-tracked Sector Funds had little to cheer about during the fourth week of December, with all 11 of the major groups getting the cold shoulder from investors bracing themselves for an earnings season where rising costs take the shine off higher revenues. Redemptions ranged from $49 million for Commodities Sector Funds to $1.1 billion for Financial Sector Funds.

With more tightening expected from the US Federal Reserve, European Central Bank and Bank of England, Financial Sector Funds posted their fifth outflow in the past six weeks. The impact is being felt in the Sector Flows dataset, which tracks flows to each sector from all funds whose mandate allows them to invest. Despite increased US, Japan and Global Equity Fund allocations to the sector, financials are on track to record the biggest outflow of any sector in 2022.

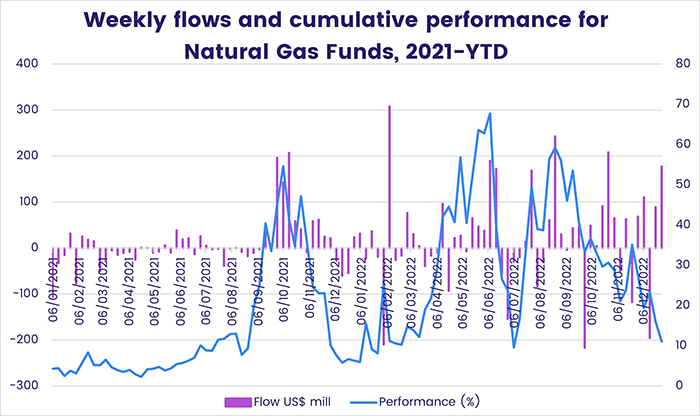

With the sanctioning of Russia, the current wave of Covid-19 in China and slowing global growth biting into forecasts for demand, Energy Sector Funds ended 2022 with a six-week run of outflows. But, within the broader group, there were some points of light. Dedicated Natural Gas Funds have now posted inflows four of the past five weeks even though a spell of warmer weather in Europe has dropped prices in line with pre-Ukraine conflict levels.

Expectations of further monetary policy tightening weighed on Technology and Real Estate Sector Funds, with the former chalking up their fifth consecutive outflow and the latter experiencing their heaviest redemptions since early November. China Technology Sector Funds, however, extended an inflow streak stretching back to early August as Chinese authorities use more supportive language when discussing a sector they have cracked down on over the past two years.

Bond and other Fixed Income Funds

The third year of the Covid pandemic ended with major central banks trying to stuff the inflation genie back in the bottle. Given that price growth is still running north of 7% in the US and 9% in the Eurozone, those central banks are more interested in managing inflationary expectations than giving markets what they are wishing for – a pivot from interest rate hikes to interest rate cuts.

With more hikes anticipated in 1Q23, fixed income investors remained largely on the defensive in late December. EPFR-tracked Bond Funds concluded a year that saw the previous redemption record smashed as most of the major asset class groups posted outflows and Europe Bond Funds experienced net redemptions for only the second time since mid-October. But there was some willingness to take on diversified exposure, with Global Bond Funds posting their fourth inflow in the past seven weeks and Global Emerging Markets (GEM) Bond funds their sixth in the past seven weeks.

At the asset class level, Bank Loan Funds chalked up their eighth straight outflow and 28th in the past 30 weeks, Municipal and Mortgage-Backed Bond Funds wrapped up a year that saw both set new outflow records, Inflation Protected Bond Funds extended a redemption streak stretching back to late August as they posted their biggest full-year outflow since 2013 and High Yield Bond Funds saw another $2.3 billion flow out.

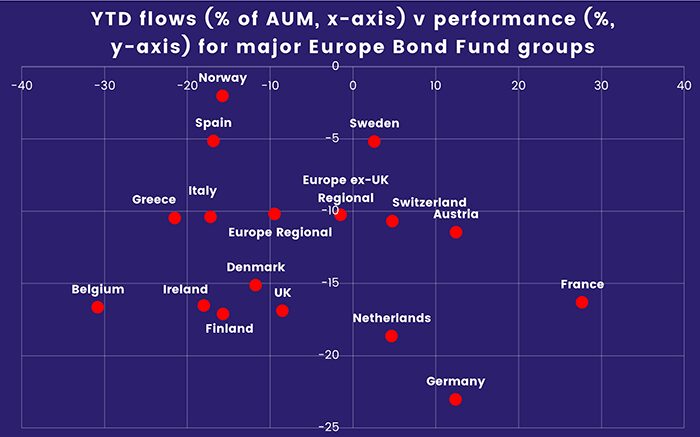

The redemptions from Europe Bond Funds were driven by Europe ex-UK Regional and Germany Bond Funds, with the latter posting their biggest outflow since mid-4Q19 as yields on German sovereign debt climbed to a 14-year high ahead of increased issuance to fund energy support programs. Year-to-date, none of the Europe Bond Country Fund groups have achieved positive performance, with Sweden, Norway and Spain Bond Funds coming the closest.

Local Currency Emerging Markets Bond Funds ended 2022 by posting consecutive weekly inflows for the first time since early February as all EM Bond Funds, which carried a 15-week outflow streak into December, recorded their third inflow in the past four weeks. Retail flows were, however, negative for the 48th time year-to-date. At the country level China Bond Funds ended the year with their biggest weekly inflow in over 10 months.

Retail investors were conspicuous in their absence when it came to US Bond Funds, pulling money out of the group every week of the year. Investor appetite for exposure to US investment grade corporate debt, which peaked in November, waned during the final weeks of 2022.

Did you find this useful? Get our EPFR Insights delivered to your inbox.