Coming into August, the advance of global asset markets was checked by a ratings downgrade for the world’s largest economy, more charges against former US President Donald Trump and the Japanese central bank’s increasing of its target range for 10-year government bond yields. Giving investors further reason to pause were impending earnings reports from Apple and Amazon and the Bank of England’s August policy meeting.

Overall flows to EPFR-tracked funds during the week ending August 2 reflected some of the uncertainty triggered by these events. While Equity and Bond Funds both recorded collective inflows for the week, they were a third and two-thirds of the previous week’s total, respectively. Redemptions from Alternative Funds hit a five-week high and Balanced Funds posted their 17th consecutive outflow, a run that has seen $45 billion pulled out of this group.

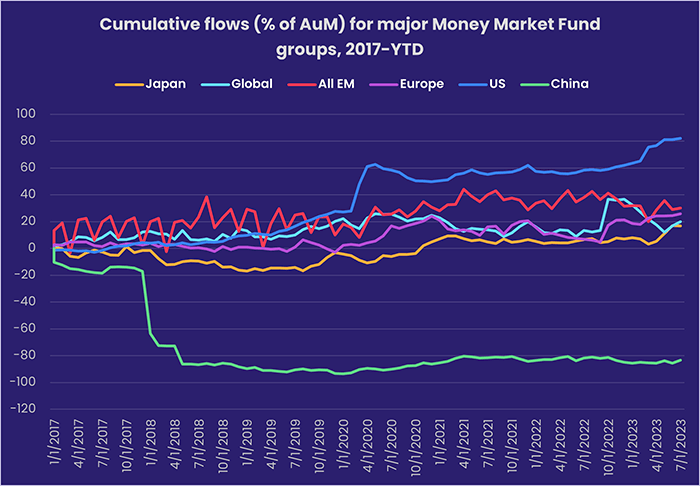

After a lull in June, flows into US Money Market Funds have picked up again. The group, which absorbed nearly $700 billion during the first five months of the year, has taken in $55 billion during the past two weeks. Lured by average seven-day yields at or above 5%, money previously sitting in low-yielding bank products has poured in this year, taking the total asset base for all US Money Market Funds to over $6.7 trillion. China Money Market Funds, meanwhile, saw outflows climb to an 11-week high.

At the single country and asset class fund level, redemptions from Mexico, South Africa and Kuwait Equity Funds hit 10, 25 and 33-week highs, respectively, while Spain Bond Funds recorded their 12th straight inflow and Italy Bond Funds took in fresh money for the 14th week running. Investors pulled money out of Inflation Protected Bond Funds for the 51st time in the past 12 months, Cryptocurrency Funds posted their biggest outflow since late May, Gold Funds posted their 10th consecutive outflow and Mortgage-Backed Bond Funds chalked up their biggest inflow since the second week of January.

Emerging markets equity funds

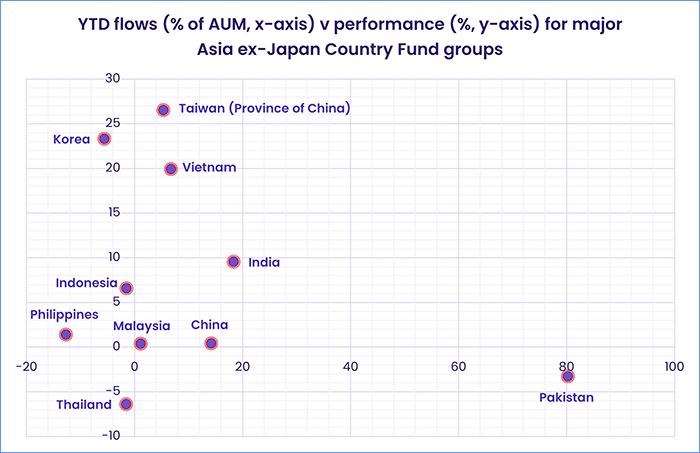

Funds dedicated to the two biggest Emerging Asian markets dominated the flow picture for all EPFR-tracked Emerging Markets Equity Funds during the week ending August 2. Between them, China and India Equity Funds pulled in a combined $5.1 billion, more than offsetting redemptions from EMEA and the diversified Global Emerging Markets (GEM) Equity Funds.

Flows into Emerging Markets Equity ETFs climbed to a nine-week high while redemptions from actively managed funds hit an eight-week high. Year-to-date, investors have committed $9 to ETFs for every $1 steered into actively managed funds.

The latest flows into China Equity Funds came despite the growing focus inside and outside China on the headwinds facing the world’s second largest economy. These include high levels of youth unemployment, shrinking demand for Chinese exports, lackluster investment by private businesses, signs of deflation and rising levels of household debt. Investors still believe these and other issues will spur Chinese policymakers to roll out more aggressive stimulus measures. India’s economic narrative remains considerably more bullish, and India Equity Funds have now recorded inflows for 20 consecutive weeks.

Latin America Equity Funds extended their longest inflow streak since 4Q18, when investors were boosting their exposure to Brazil in anticipation of the structural reforms promised by President-elect Jair Bolsonaro. The latest headline number was driven by flows into diversified regional funds, which posted their biggest collective inflow in over 15 months, while both Brazil and Mexico Equity Funds experienced net redemptions.

The three major EMEA Country Fund groups all posted outflows going into August. Outflows from both South Africa and Turkey Equity Funds hit 25-week highs and Russia Equity Funds recorded their biggest outflow since mid-1Q22. In the case of the latter, the headline number reflected the winding up of a foreign-owned and managed ETF that has been unable to trade in the wake of Russia’s assault on Ukraine.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds chalked up their fourth inflow in the past five weeks going into August, although the downgrading of the US by ratings agency Fitch and the political implications of Donald Trump’s latest indictments sucked some of the wind out of US equity markets. Flows into Global, US, Japan, Canada and Pacific Regional Equity Funds that ranged from $29 million to $2.4 billion narrowly offset the over $3 billion redeemed from Europe Equity Funds.

Investors have now pulled money out of Europe Equity Funds for 21 straight weeks despite the first flows into retail share classes since early March. During the latest week, redemptions from US-domiciled funds hit a 51-week high as investors compared the 2.4% GDP growth achieved by the US in 2Q23 with the Eurozone’s 0.3% increase.

At the country level, investors pulled money out of both Spain and Germany Equity Funds for the 13th time in the past 15 weeks and UK Equity Funds racked up their 30th consecutive outflow, Greece Equity Funds recorded their 16th straight inflow, commitments to Sweden Equity Funds climbed to a 23-week high and France Equity Funds recorded their sixth largest inflow YTD.

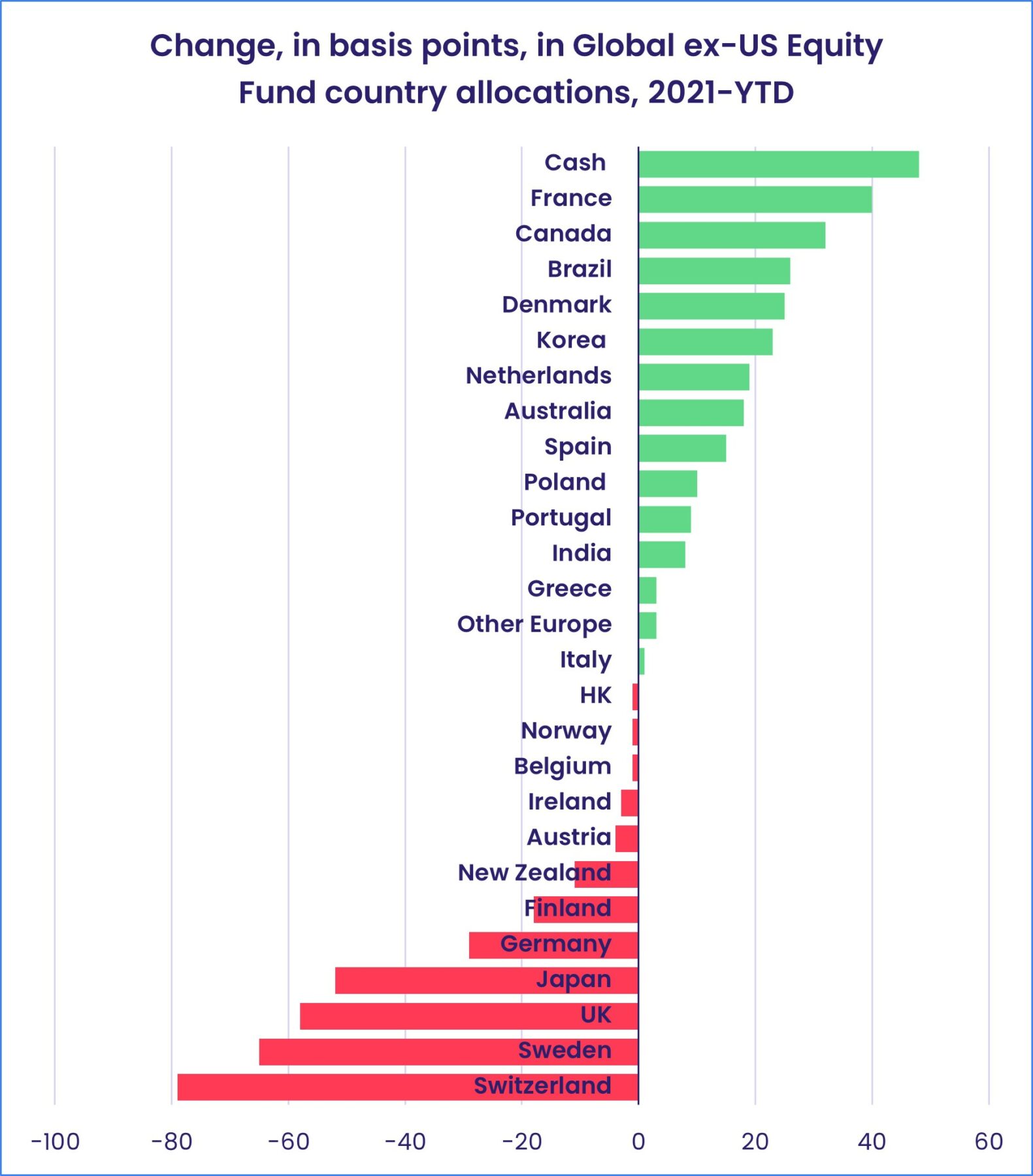

France has been one of the favored markets among Global ex-US Equity Fund managers over the past 18 months. During that time, only cash has seen its average allocation increase by more. Coming into August, Global ex-US Equity Funds took in fresh money for the 16th time in the past 17 weeks.

Japan’s average weighting among Global ex-US Equity Funds is among the biggest fallers over the past year-and-a-half. But Japan remains popular with investors, who have steered fresh money into Japan Equity Funds eight of the past nine weeks. Japan Dividend Funds, meanwhile, have chalked up 14 consecutive weekly inflows.

US Equity Funds posted their fourth inflow of the past five weeks and seventh in the past 10. Among the major groups by capitalization and style, Mid Cap Blend Funds recorded the biggest inflows in both cash and % of AUM terms. Flows to funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which posted their biggest outflow in four months the previous week, rebounded this week.

Global sector, industry and precious metals funds

The number of EPFR-tracked Sector Funds dwindled for the second week running in early August, with only four of the 11 EPFR-tracked Sector Funds taking in fresh money. Investors had much, from the US ratings downgrade to the Bank of Japan’s latest policy tweak, to factor into their assessments. Inflows ranged from $150 million for Real Estate Sector Funds to $1.8 billion for Technology Sector Funds while Utilities, Financials, Healthcare/Biotechnology and Consumer Goods Sector Funds all saw over $350 million flow out.

The group hit with the biggest drawdown, Financials Sector Funds, posted their largest outflow in nearly three months as a three-week inflow streak came to an end. Behind the headline number was the record weekly outflow from China Financial Sector Funds of $1.2 billion which beat their previous record, set in May of 2021, by just $38 million. Drilling down, Regional Bank Funds suffered their heaviest outflow since mid-2022.

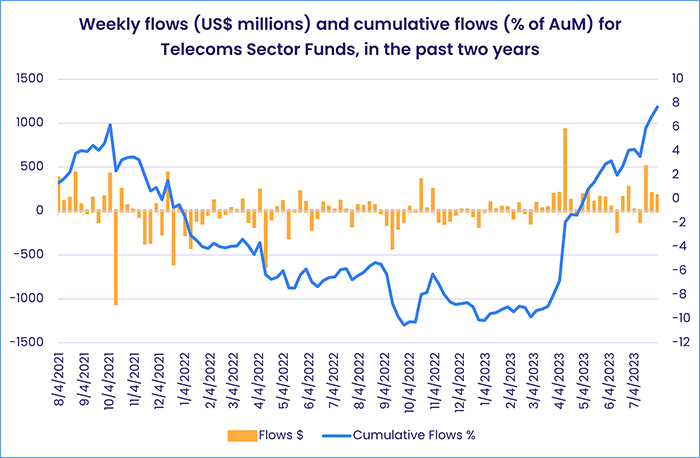

With the fifth-generation rollout not living up to expectations, Telecoms Sector Funds struggled to attract fresh money throughout 2022 and into the first quarter of this year. A grouping of funds with “5G” in their name has seen outflows for 11 straight weeks and 26 of the past 29 weeks. But Telecoms Sector Funds picked up some momentum – in flow terms – during the second quarter. Since the final week of March, the group has posted only three outflows and seen a net $3 billion flow in.

Flows into Technology Sector Funds continue to defy gravity, topping the $1.5 billion mark for the third time in their current six-week inflow streak. Flows into Artificial Intelligence Funds hit an eight-week high inflow – it was also their 15th of the past 16 weeks – while Anime, Comic and Gaming Funds extended their outflow streak to three weeks. These flows occurred ahead of earnings reports from bellwethers Amazon and Apple.

Elsewhere, investors pulled over $500 million from Consumer Goods Sector Funds, the largest outflow since mid-4Q22, and redemptions from Utilities Sector Funds climbed to an eight-week high.

Bond and other fixed income funds

Expectations of further UK and Eurozone interest rate hikes and a ratings downgrade for the US were not enough to check flows into EPFR-tracked Bond Funds during the week ending August 2. US and Europe Bond Funds pulled in over $7 billion between them as all Bond Funds posted their 29th inflow in the 31 weeks year-to-date.

Japan Bond Funds did post their biggest outflow since 1Q21 during a week when the Bank of Japan’s lifted the cap on government bond yields to 1%, a move that added fuel to expectations that the BOJ’s days of defending its ultra-accommodative policies are numbered.

At the asset class level, High Yield Bond Funds posted consecutive weekly outflows for the first time since late May, redemptions from Municipal Bond Funds hit a 15-week high, after a single weekly inflow Inflation Protected Bond Funds saw more money flow out and Convertible Bond Funds racked up their 31st outflow in the past 35 weeks.

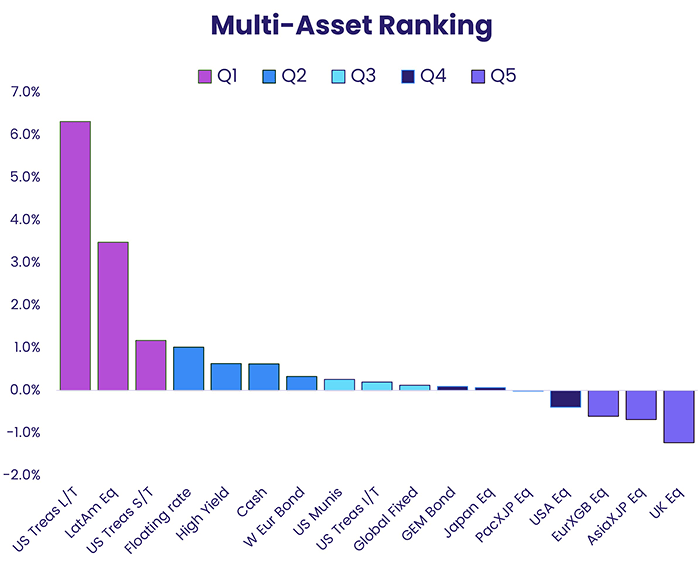

The latest week saw another $4.8 billion flow into US Bond Funds, which have yet to post a collective outflow this year. Intermediate Term Mixed and Long Term Sovereign Funds saw significant inflows while over $2 billion was removed from Short Term Bond Funds. EPFR’s latest multi-asset rankings have long term treasuries at the top of the current table, while intermediate term treasuries have slipped into the fourth quintile.

Emerging Markets Bond Funds posted their biggest outflow since late June as redemptions from funds with hard currency mandates hit a 19-week high and redemptions from retail share classes hit a 39-week high. EM Bond Funds dedicated to corporate debt have not posted an inflow since the third week of March.

Investors looking to Europe committed roughly the same amounts to Europe Sovereign and Corporate Bond Funds as flows to retail share classes jumped to a level last seen during the final week of February.

Did you find this useful? Get our EPFR Insights delivered to your inbox.