The final week of May ended with US lawmakers voting to lift the country’s debt ceiling, markets assigning a one-in-three chance that the Federal Reserve will raise interest rates in mid-June and the price of oil testing 18-month lows. Against this backdrop, flows into all EPFR-tracked Equity Funds hit a 17-week high on the back of record-setting inflows to Technology Sector Funds and China Equity Funds absorbed nearly $5 billion.

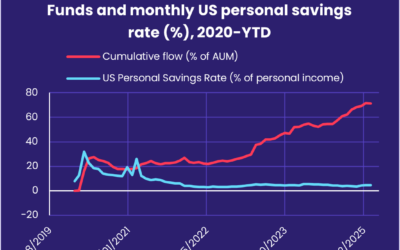

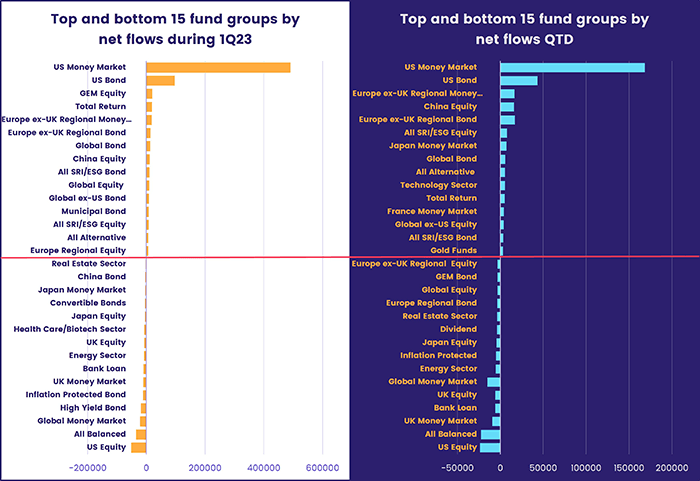

Despite this shift, many investors were slow to abandon the defensive, risk-cutting approach they adopted coming into May. US Money Market Funds added another 417 billion to their eye-catching quarter and year-to-date inflows, redemptions from Emerging Markets Bond Funds hit a 10-week high and flows into Utilities Sector Funds climbed to a level last seen in mid-March.

Overall, investors steered $1.1 billion into Bond Funds, $11.1 billion into Money Market Funds and $14.8 billion into Equity Funds during the week ending May 31 while redeeming a net $132 million from Alternative Funds and $3.2 billion from Balanced Funds.

At the asset class and single country fund level, redemptions from Municipal and Mortgage Backed Bond Funds hit six and 21-week highs, respectively, Gold Funds posted their first outflow since early March and Inflation Protected Bond Funds extended their record redemption streak. Flows into Switzerland Equity Funds climbed to their highest level in nearly three months and Switzerland Bond Funds pulled in over $600 million for the third time YTD.

Emerging markets equity funds

A fresh surge of money into China Equity Funds during the final week of May underpinned EPFR-tracked Emerging Markets Equity Funds’ 17th inflow of the year-to-date.

In addition to China-mandated funds, investors steered significant sums into Hong Kong (SAR), India and Taiwan (POC) Equity Funds while shunning diversified exposure and fund groups exposed to EMEA and frontier markets. Asia ex-Japan Regional Funds posted their second largest outflow of the year, flows to all of the diversified Global Emerging Markets (GEM) Equity Funds netted out at just $11 million and Frontier Markets Equity Funds – which carried a 17-week inflow streak into late February – chalked up their eighth consecutive outflow.

Investors retained their appetite for EM Dividend Funds, which recorded their biggest inflow since mid-3Q22, but funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted consecutive weekly outflows for the first time in over six months.

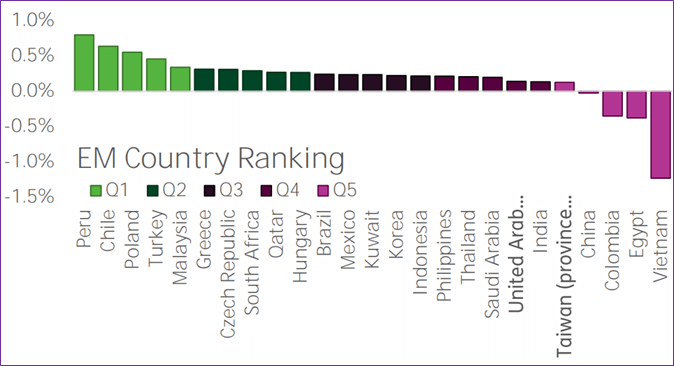

The latest flows into China Equity Funds were broadly distributed, with 75 funds absorbing over $15 million and 27 of those taking in over $50 million. Fund managers remain less bullish. The latest EPFR EM Country Rankings, which are based on the flows and allocations of funds with cross-border mandates, show China languishing in the bottom quintile.

India is also in the lowest quintile despite dedicated India Equity Funds taking in fresh money for the 11th straight week as the world’s most populous nation awaits the onset of the annual monsoon rains that are vital to its farmers. The latest flows into India Equity Funds were the biggest in six weeks and extended the group’s longest inflow streak since 1H17.

Collective redemptions from EMEA Equity Funds climbed to a 16-week high as investors took issue with all of the regions in this universe. Authoritarian governance and the war in Ukraine continue to cast a shadow over funds dedicated to Emerging Europe, Russia and Turkey while drought, corruption and geopolitics have sapped enthusiasm for Africa. During the latest week Africa Regional Funds racked up their 17th outflow in the past 21 weeks and South Africa Equity Funds their 10th in the past 12 weeks.

Latin America Equity Funds took in over $100 million for the third week running, the first time that has happened since mid-4Q22, as both Brazil and Mexico Equity Funds posted solid inflows.

Developed markets equity funds

Buoyed by the biggest flows into US Equity Funds so far this year, EPFR-tracked Developed Markets Equity Funds ended May by snapping their six-week outflow streak. In addition to funds dedicated to the US, investors committed fresh money to Australia and Canada Equity Funds while Global, Europe, Pacific Regional and Japan Equity Funds experienced net redemptions ranging from $62 million to $1.7 billion.

Flows to US Equity Funds were lopsided, with three US Equity ETFs taking in over $19.5 billion between them. The bulk of the money came in during the final two days of the reporting period as confidence that the debt ceiling will be lifted and interest rates will stay on hold in June boosted investor spirits and prompted them to chase recent gains in the technology sector. For the second week running, however, none of the major groups by capitalization and style that are actively managed recorded an inflow.

The latest allocations data shows that US Equity Fund managers reduced their average allocation for financial stocks to a 30-month low coming into May and trimmed their exposure to technology plays.

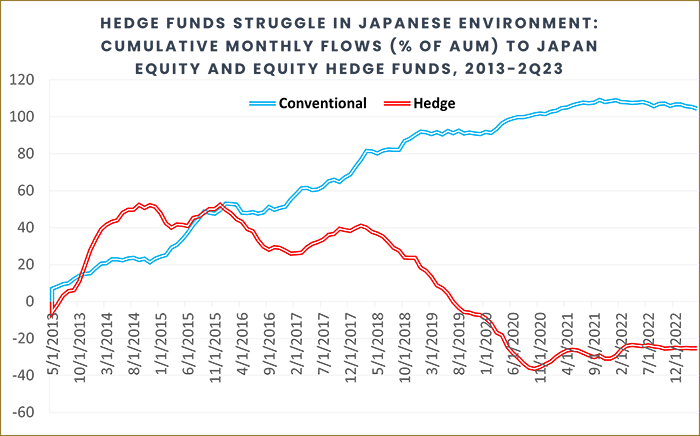

Japan Equity Funds recorded their second straight outflow and seventh in the past nine weeks as redemptions from domestically domiciled funds again offset flows into ones domiciled overseas. Flows to Japan Equity Hedge Funds are also flat-to-negative despite the Nikkei-225’s recent performance and inflation, whose absence has driven Japanese monetary policy for three decades, hitting a 41-year high.

Money continued to flow out of Europe Equity Funds in late May. Investors are leery of the combined impact of regional policy responses to inflation (interest rate hikes, price controls), the effects of widespread drought on transportation, agriculture and industry, and the weakness in bank lending and private business investment. During the latest week Germany, Italy, Sweden, Spain, France and UK Equity Funds all recorded outflows, with the latter extending a redemption streak stretching back to early January.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, recorded their biggest outflow since mid-March as outflows from retail share classes hit their third highest total year-to-date and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates saw money flow out for the third time in the past four weeks.

Global sector, industry and precious metals funds

Flows to one of the 11 major EPFR-tracked Sector Fund groups left all the others standing during the final week of May. Technology Sector Funds recorded a net inflow of over $8 billion, 26 times more than the runner up – Financial Sector Funds – managed to pull in. While the inflow was consistent with recent patterns and the outsized role a few technology stocks have played in driving US equity markets, the magnitude was not.

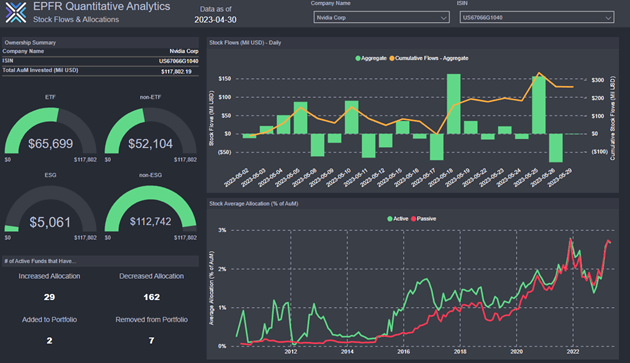

Over $6 billion of the flows to all Technology Sector Funds went to a single fund, the Vanguard Information Technology ETF (VGT). “It appears that the moving of Microsoft and Visa from technology to financials as part of the latest MSCI shake-up was seen as a chance by investors to jump into a fund that, of necessity, is rebalancing holdings and increasing its exposure to Apple, Microsoft and Nvidia,” noted EPFR Research Associate Kirsten Longbottom. “The latter company – a leader in artificial intelligence – has seen the funds we track buy roughly $250 million of its stock this month despite the fact that, for every two active funds increasing their allocation, 11 cut their exposure.”

Beyond the inflow tied to VGT, China Technology Sector Funds took in another $1 billion during the week. Drilling down, Artificial Intelligence Funds recorded their largest inflow since the second week of 2022 and Cloud Computing Funds posted their biggest inflow year-to-date while Semiconductor Funds suffered consecutive weekly outflows.

Elsewhere, flows into Utilities Sector Funds reached an 11-week high, taking their current inflow streak to four weeks and $655 million, and Telecoms Sector Funds extended their run of inflows to five weeks and a net $811 million.

Bond and other fixed income funds

EPFR-tracked Bond Funds ended May by posting their 10th straight inflow. But, with the US debt ceiling deal not done by the end of the reporting period, the headline number was the smallest since the group last posted an outflow in the third week of March. US Bond Funds extended their inflow streak and Europe, Global and Asia Pacific Bond Funds also recorded inflows.

At the asset class level, investors continued to cut risk. Redemptions from Emerging Markets Bond Funds hit a 10-week high, Bank Loan Funds extended an outflow streak stretching back to late January and High Yield Bond Funds posted their fourth straight outflow during a week when one major investment bank predicted the default rate for junk bonds could peak around 9%.

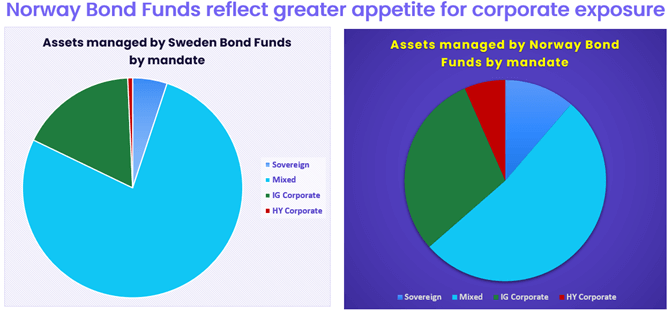

Europe Bond Funds recorded the week’s biggest inflow among groups by geographic mandates. Sovereign funds took in $1 for every $1 committed to their corporate counterparts. At the country level, Italy Bond Funds recorded their biggest weekly inflow in over a year, Switzerland Bond Funds absorbed over $600 million and Spain Bond Funds attracted over $100 million for the third week running. Among groups dedicated to Nordic markets, Sweden Bond Funds posted their eighth inflow in the past nine weeks while redemptions from Norway Bond Funds climbed to a 10-week high.

Emerging Markets Bond Funds with hard currency mandates again bore the brunt of the outflows from all EM Funds. Retail share classes experienced their heaviest drawdown since early November and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their eighth outflow in the past 12 weeks.

Solid flows into Long Term Sovereign and Intermediate Term Mixed Funds allowed US Bond Funds to extend their current inflow streak, although the headline number was the smallest since that run began in early January.

Fixed income investors looking for multi-asset exposure continue to show a marked preference for total return strategies. During the latest week, Total Return Funds recorded their seventh inflow in the past nine weeks while the other major multi-asset group, Balanced Funds, chalked up their 19th outflow since mid-January.

Did you find this useful? Get our EPFR Insights delivered to your inbox.