The question of when major central banks will declare victory in their battles against inflation or, in the case of China, misallocation of credit and shift their focus to economic growth continued to preoccupy investors during the second week of September. Based on flows to EPFR-tracked funds, the current answers are soon (the US), not soon enough (China) and not as soon as we thought a week ago (Europe).

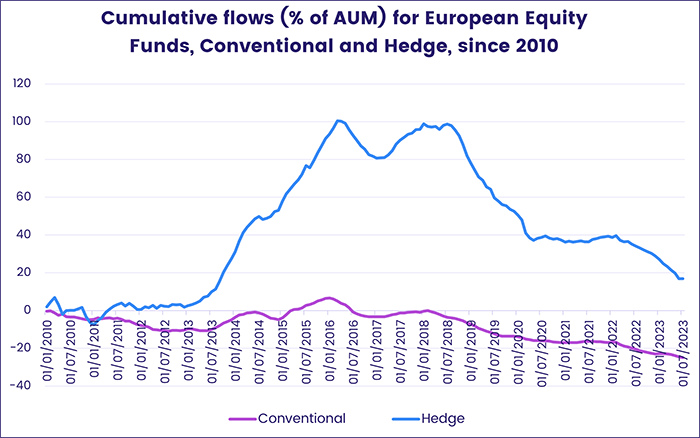

Ahead of the European Central Bank’s September policy meeting, which delivered another 25 basis point rate hike instead of the hoped-for pause, Europe Equity Funds extended an outflow streak stretching back to early March. China Equity Funds posted consecutive weekly outflows for the first time since mid-April as that country’s central bank focused on the renminbi’s weakness versus the US dollar.

With the US Federal Reserve’s stated focus on core inflation and moving averages, investors remain optimistic that the Fed will not hike rates again next week despite the energy-driven jump in August’s consumer price inflation (CPI) number. US Equity Funds saw over $25 billion flow in as they posted their biggest weekly inflow in nine months.

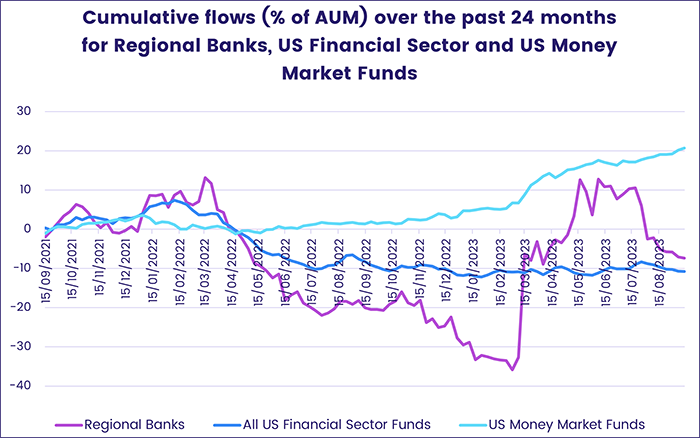

Also taking in over $20 billion were US Money Market Funds, which saw their quarter-to-date total hit $220 billion and their year-to-date total climb past the $900 billion mark. That keeps the pressure on short-term funding costs for US regional banks, and Regional Bank and US Financial Sector Funds saw money flow out for the fifth and seventh straight week, respectively.

Overall, the week ending Sept. 13 saw all EPFR-tracked Money Market Funds absorb a net $28.8 billion while $25.3 billion flowed into Equity Funds and $4.8 billion into Bond Funds. Investors pulled another $2.7 billion from Balanced Funds, which have posted outflows all but three of the 37 weeks YTD, and $806 million from Alternative Funds.

At the single country and asset class fund level, redemptions from Indonesia Equity Funds hit a 33-week high, Malaysia Equity Funds recorded their biggest outflow since mid-2Q22, Italy Bond Funds absorbed fresh money for the 20th consecutive week and Korea Bond Funds attracted another $215 million. Gold Funds extended their current outflow streak to 16 weeks and $9.8 billion, Copper Funds posted their fourth outflow in the past five weeks and Bank Loan Funds recorded their seventh straight inflow.

Emerging markets equity funds

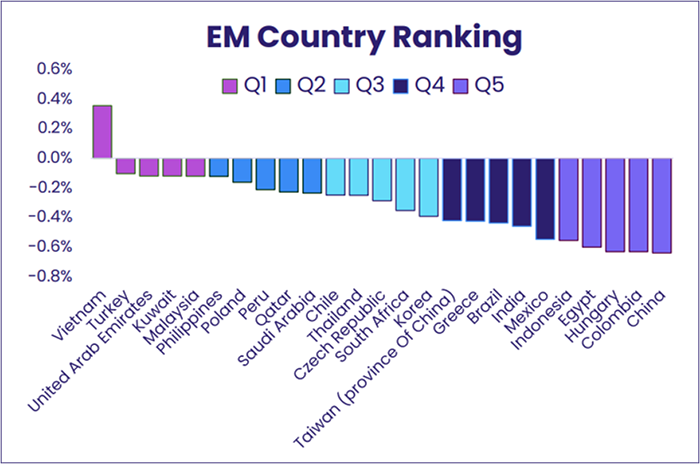

Sentiment towards China in particular and emerging markets in general slipped another notch during the second week of September. With redemptions from China Equity Funds hitting a 12-week high and the diversified Global Emerging Markets (GEM) Equity Funds extending their longest outflow streak since an 11-week run ended in 4Q22, EPFR-tracked Emerging Markets Equity Funds posted their biggest collective outflow since the first week of February.

Investors retained their appetite for dividend payers – EM Dividend Funds chalked up their biggest weekly inflow in over 21 months – and India’s star remained in the ascendant as flows into India Equity Funds hit an eight-week high.

Although flows to China Equity Funds only turned negative coming into September, managers of diversified funds have been markedly less bullish with GEM Funds cutting their allocation to China in four of the first six months of the year. EPFR’s weekly Emerging Markets Rankings, which utilize the flows and allocation data from funds with cross-border mandates, currently has China ranked at the bottom of its lowest quintile.

In addition to India Equity Funds, investors seeking Asian exposure steered over $400 million into both Taiwan (POC) and Korea Equity Funds while bypassing Indonesia and Malaysia-mandated funds. Leveraged Korea Equity Funds posted their fourth collective inflow in the past six weeks while Leveraged Taiwan Equity Funds recorded their first outflow since the fourth week of July.

Among the Latin America Country Fund groups, Brazil Equity Funds saw another $85 million flow out while Mexico Equity Funds posted their fourth inflow over the past five weeks and commitments to Colombia Equity Funds hit a 19-week high. China is by far and away Brazil’s biggest trading partner while the US, whose economy is still pegged for a ‘soft landing’, is Mexico’s major trading partner and accounts – as does China – for roughly 25% of Colombia’s external trade.

Flows to the EMEA Equity Fund universe remain muted despite stronger oil prices. But Turkey Equity Funds did record their biggest inflow since early May.

Developed markets equity funds

For only the second time this year and third time in the past 10 months, EPFR-tracked Developed Markets Equity Funds recorded a third consecutive weekly inflow as US Equity Funds absorbed over $25 billion. The week ending Sept. 13 also saw Global and Japan Equity Funds taking in fresh money while Europe, Australia and Canada Equity Funds experienced net redemptions.

The latest flows into US Equity Funds came ahead of the third “triple witching” of 2023 when stock options and stock index options and futures all expire on the same day, an event which is sometimes preceded by bigger than average inflows for this fund group. Over 50 funds recorded an outflow of at least $50 while over 90 took in that much or more. Foreign-domiciled US Equity Funds chalked up their ninth consecutive inflow, their longest run since 1Q22.

Europe Equity Funds, which had flirted with snapping their current outflow streak the previous two weeks, saw redemptions exceed $1 billion as the 5.3% reading for core inflation in the Eurozone during August dented hopes that the European Central Bank (ECB) would keep interest rates on hold this month. Instead, the ECB increased them by another 0.25% despite the weakness of Germany’s economy and shrinking corporate demand for bank loans.

At the country level, Germany Equity Funds racked up their ninth straight outflow and 22nd during the past 25 weeks, redemptions from Italy Equity Funds climbed to an eight-week high and Finland Equity Funds posted their biggest weekly outflow in over 10 months.

Flows to Japan Equity Funds rebounded as the group recorded its 13th inflow since the beginning of June. With speculation again mounting that the Bank of Japan will bring the era of negative interest rates to a close sooner rather than later, investors are anticipating currency gains on existing investments and stronger performance by Japan’s financial sector.

Global sector, industry and precious metals funds

How to position yourself for oil at $100 a barrel, US interest rates at current levels well into next year, a slowing Chinese economy and Eurozone interest rates up another 25 basis points? Sector-oriented investors scratched their heads and headed toward the exits during the second week of September. Of the 11 major EPFR-tracked Sector Fund groups, only two posted an inflow. The other nine were hit with redemptions that ranged from $48 million for Industrials Sector Funds to over $800 million for Healthcare/Biotechnology Sector Funds.

Once again, Technology Sector Funds appeared to float above the fray. These funds recorded their 11 inflow of the past 12 weeks. In the second half of the year so far, the group has absorbed $18.5 billion, topping inflows for all of 1H23 by $6 billion. China Technology Sector Funds attracted fresh money for the 12th week running, although the latest inflow was the smallest since that streak began in late June.

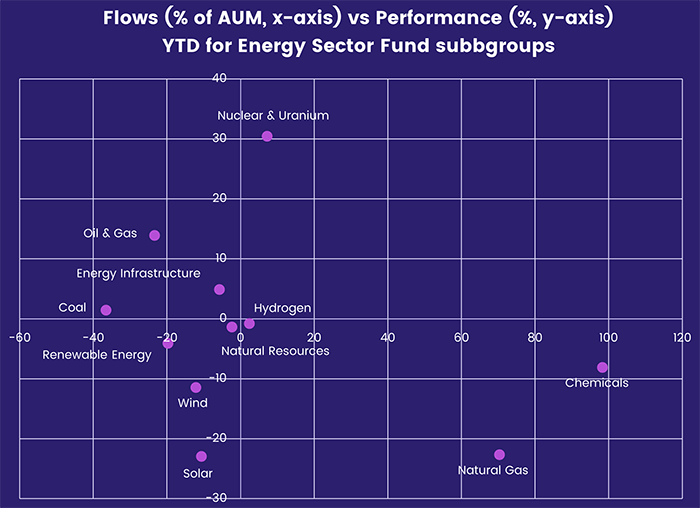

Energy Sector Funds, meanwhile, posted only their 10th inflow during the past 43 weeks as the latest round of announced oil production cuts by Russia and Saudi Arabia show more staying power than previous iterations. Among major sub-groups, investors committed fresh money to Nuclear & Uranium Funds – the best performing subgroup this year – for a ninth straight week, with the latest inflow the biggest since mid-1Q23. Natural Gas Funds saw inflows reach a six-week high and Solar Funds maintained their longest streak of inflows since a four-week run early December last year.

Redemptions for Consumer Goods Sector Funds reached their highest level since early 4Q22. With seven outflows in the past eight weeks, investors have redeemed a net $2.4 billion (1.6% of assets). Again, the key players were funds with global, US and China mandates.

Another defensive group that captured investors’ interest in the second quarter, taking year-to-date inflows up to a net $3.7 billion at the end of August, is now getting dumped as investors lean more heavily on tech. Outflows for Telecoms Sector Funds – a typically safer dividend play – climbed from last week’s $300 million to the $400 million mark this week, the largest outflow in a year.

Bond and other fixed income funds

Year-to-date flows into all EPFR-tracked Bond Funds hit the $340 billion mark going into the second half of September as investors retain their appetite for sovereign debt whose yield is at multi-year highs. With three-and-a-half months of 2023 left, US Sovereign Bond Funds are on track to post the second biggest full-year inflow and Europe Sovereign Bond Funds could set a new full-year record.

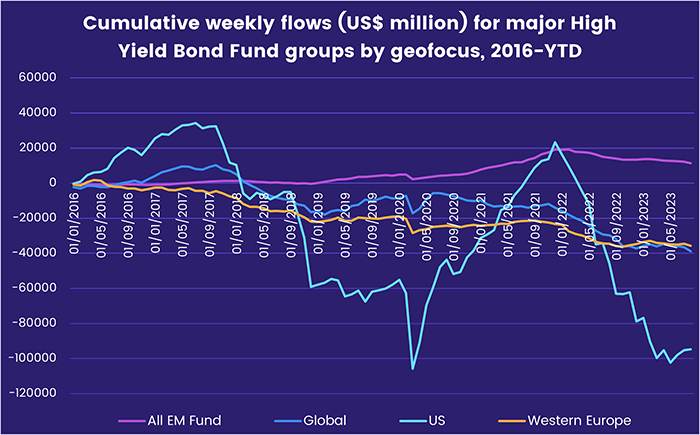

This enthusiasm for US and European government debt has come at the expense of High Yield and Emerging Markets Bond Funds, both of which are struggling to attract fresh money. During the latest week, High Yield Funds eked out an inflow that equaled 0.003% of their AUM while Emerging Markets Bond Funds racked up their seventh straight outflow.

While both groups saw money flow out, redemptions from Local Currency Emerging Markets Bond Funds exceeded those from hard currency funds for the first time since the fourth week of July. In addition to the headwinds from higher US and European interest rates, the asset class is under pressure from the struggles of China’s heavily indebted real estate sector and the assumption that Argentina is lurching towards its 10th sovereign default.

Appetite for global exposure is also doing a slow fade. For the third week running, flows for Global Bond Funds were worse than the week before, although retail share classes recorded a net inflow for the ninth straight week.

Europe Bond Funds enjoyed another week of solid inflows, with sovereign-mandated funds taking in more fresh money than their corporate counterparts for the sixth time in the past seven weeks. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did see a seven-week inflow streak come to an end. At the country level, interest in the two major southern tier markets – Italy and Spain – remains high. Flows into Spain Bond Funds hit a 13-week high as the group extended their current run of inflows to 18 weeks.

Another $5 billion flowed into US Bond Funds as they recorded their 37th consecutive inflow. That is their longest since a streak of similar length ended in mid-4Q21.

Did you find this useful? Get our EPFR Insights delivered to your inbox.