With major central banks in Europe and North America still tightening policy in the face of inflation rates three or four times their official targets, investors turned to Asia in the final weeks of 1H23. During the fourth week of June, EPFR-tracked China and Japan Equity Funds absorbed $4.3 billion between them while flows into India Equity Funds hit their highest level since 1Q15 and Pacific Regional Funds enjoyed record-setting inflows.

With further interest rates near certain in the US, Eurozone and UK, investors steered clear of fund groups dedicated to those markets. Their appetite for liquidity also appears to have peaked: US Money Market Funds collectively posted a third consecutive outflow for the first time since mid-August of last year.

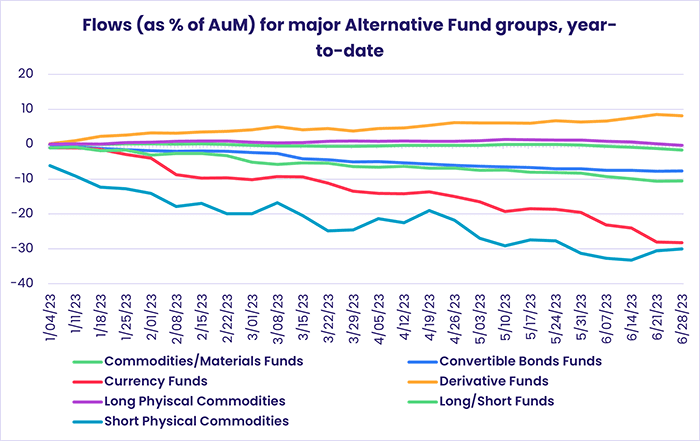

Elsewhere, redemptions from Alternative Funds hit their highest level since mid-March. The $2.5 billion headline number included a seventh consecutive outflow –and the largest in 27 weeks – for Long Physical Commodities Funds and the end of Derivative Funds’ three-week inflow streak.

June was a better month for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. SRI/ESG Equity Funds have posted inflows for three of the past four weeks, taking their year-to-date total over $33 billion and SRI/ESG Bond Funds have attracted fresh money for 10 consecutive weeks and 32 of the past 35 weeks. However, SRI/ESG Balanced Funds are on track to post their first outflow in six years.

Overall, the final week of June saw all EPFR-tracked Equity Funds take in a net $1.5 billion, their fourth inflow in the past five weeks, while Bond Funds absorbed just over $500 million, a 10th of the amount they attracted the previous week. Money Market Funds suffered a $33.5 billion outflow and Balanced Funds saw over $3 billion flow out for the second week running.

Emerging markets equity funds

For the first time since mid-May, all four of the major Emerging Markets Equity Fund groups pulled in fresh money. Flows into Asia ex-Japan Equity Funds rebounded to a four-week high, Global Emerging Markets (GEM) and EMEA Equity Funds snapped their respective outflow streaks and Latin America Equity Funds recorded their ninth inflow of the past 11 weeks.

The week ending June 28 saw retail share classes record their biggest inflow since the final week of January, EM Dividend Funds post their 11th inflow since the beginning of April and EM Equity ETFs take in more money than their actively managed counterparts for the 12th straight week.

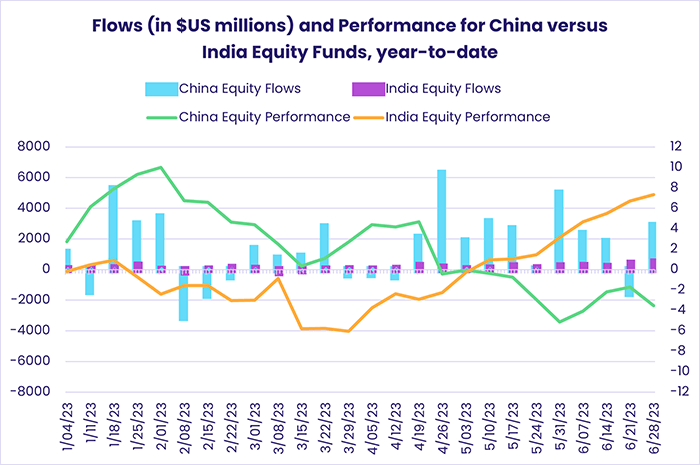

Of the top 10 EM Country Fund groups ranked by inflows, half were part of the Asia ex-Japan universe. China Equity Funds saw another $2.8 billion flow in as Chinese policymakers considered more stimulus measures, India Equity Funds absorbed their largest inflow in over eight years – and their sixth largest on record – South Korea Equity Funds posted their second straight inflow and Thailand Equity Funds snapped a four-week redemption run with their largest inflow since late 1Q22.

Although Brazil Equity Funds remained popular with investors, investors turned a cold shoulder to most of the other Latin America dedicated fund groups. Flows dwindled for Mexico Equity Funds as they snapped a two-week inflow streak, redemptions from Chile Equity Funds were the largest since the first week of the year and Peru Equity Funds posted their biggest outflow since mid-4Q22. Argentina Equity Funds, however, shrugged off talk of a currency crisis, inflation pushing over 100% and drought hitting the farming industry to post their biggest inflow in over four months.

The headline number for EMEA Equity Funds this week was backed by the biggest inflow for South Africa Equity Funds in 16 weeks and Saudi Arabia Equity Funds’ third inflow of the past four weeks. Turkey Equity Funds kept the total in check with their fifth straight outflow as investors weighed the implications of the country’s recent rate hike.

Developed markets equity funds

The East-West divide was evident among EPFR-tracked Developed Markets Equity Funds in late June as Japan Equity Funds posted their fourth straight inflow while redemptions for Europe Regional Equity Funds hit their highest level since 3Q22 and US Equity Funds posted consecutive weekly outflows for the first time since a six-week run ended in late May.

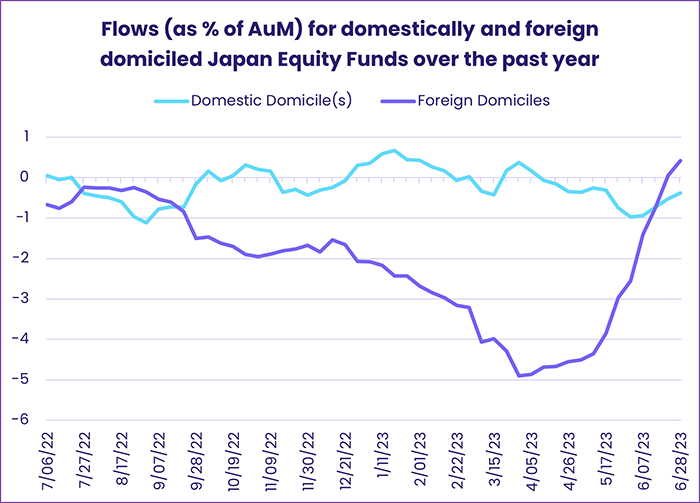

Among the other Asia Pacific Equity Fund groups, the diversified approach offered by Pacific Regional Equity Funds proved popular as they absorbed $713 million – an all-time high – and Hong Kong (SAR) Equity Funds chalked up their biggest inflow since mid-March as they extended their current streak to 22 weeks. There has been a huge uptick in flows from foreign domiciled Japan Equity Funds, with flows growing exponentially and surpassing those into domestically domiciled ones during the second quarter.

For North America, the 14-week high inflow experienced by Canada Equity Funds at $311 million was not nearly enough to offset the $1.5 billion flowing out of US Equity Funds. In the case of the latter, investor appetite was dulled by the impending 2Q23 corporate earnings season which is expected to show an average decline of over 6% for companies listed in the S&P 500 index.

Europe Equity Funds continue to take a beating from rising interest rates, political unrest in France, a technical recession in Germany, drought and the war in Ukraine. Funds with regional mandates took the biggest hit in late July, but investors pulled over $1 billion from UK Equity Funds as rising borrowing and debt servicing costs weigh on both public and private budgets.

Among the eight Europe Country Fund groups to record an inflow, Sweden Equity Funds snapped a seven-week outflow streak, flows into Norway Equity Funds climbed to a 22-week high, Greece Equity Funds enjoyed their 11th straight inflow and Switzerland Equity Funds brought an end to a two-week outflow streak that saw $906 million flow out.

Global sector, industry and precious metals funds

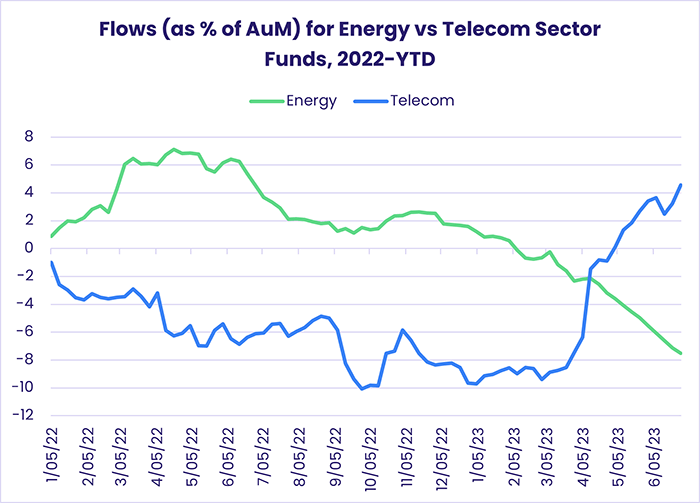

Investors waiting for the second quarter earnings reports to start arriving in mid-July leaned on the side of caution in late June. Of the 11 major Sector Fund groups tracked by EPFR, eight posted outflows and no group recorded inflows above $500 million. Technology, Telecoms and Real Estate Sector Funds were the only groups to receive fresh money this week while redemptions from the other groups ranged from $66 million for Infrastructure Sector Funds to $637 million for Energy Sector Funds.

Apart from Technology Sector Funds, groups associated with growth fared poorly. Financials Sector Funds snapped a five-week inflow streak that totaled $2.8 billion and over $500 million flowed out of both Commodities and Energy Funds Sector Funds.

Telecom Sector Funds, sometimes referred to as the virtual side of the energy picture, experienced their largest inflow since this year’s record high seen in mid-April. Since early March, interest has been on this virtual aspect – cable, satellite, 5G cell service, internet – versus physical energy aspects like oil and gas. Energy Sector Funds extended their run of outflows to 11 weeks and nearly $9 billion total, although it was their smallest outflow of the streak.

As Japan’s central bank raised the 10-year government bond yield ceiling by 25 basis points, impacting both the country’s banking and real estate industries, flows into Japan Real Estate Sector Funds hit a five-week high. The inflow for all Real Estate Sector Funds this week added to their longest streak since January of this year.

Infrastructure and Healthcare/Biotechnology Sector Funds saw their current outflow streaks hit the $2 billion mark. These groups have recorded only six and four weekly inflows, respectively, so far this year.

Silver and Gold Funds both experienced net redemptions, with the latter seeing over $1 billion flow out. That was the biggest weekly total since late 3Q22.

Bond and other fixed income funds

Going into the second half of 2023, fixed income investors have more questions than answers. Are we, for the moment, in a Goldilocks situation that undermines the case for a US recession later this year? Will forward guidance during the 2Q23 earnings season support or shoot down hopes of a soft landing?

During the final week of June, those investors were weighing the likelihood of two more rate hikes from US Federal Reserve, the European Central Bank (ECB) concerns about over wage growth, the Bank of Japan decision to keep short term interest rates unchanged but hike the yield cap on government bonds and inflation in Australia dropping to its lowest level since 2Q22.

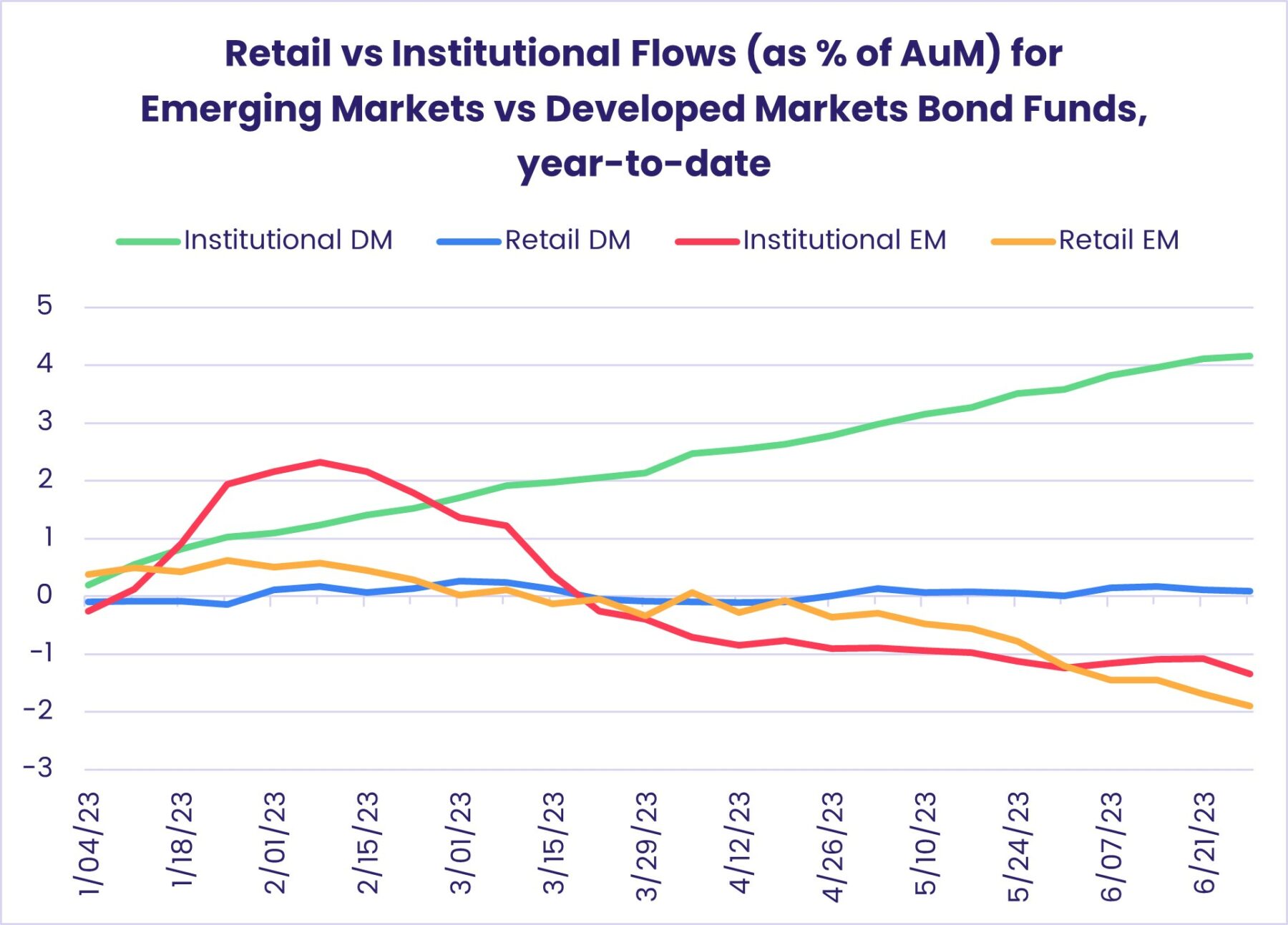

EPFR-tracked Bond Funds eked out a modest inflow that owed much to institutional flows into US and Global Bond Funds. Retail investors pulled money out of Developed Markets Bond Funds for their second straight week and from Emerging Markets Bond Funds for the eighth week.

US Bond Funds kept up their momentum with their 26th inflow year-to-date. Intermediate Term Mixed Funds recorded the biggest inflow while Short Term Mixed and Corporate Funds both surrendered over $900 million

Among Europe Bond Fund groups, flows into Germany Bond Funds hit a four-week high, Italy Bond Funds extended their current inflow streak to nine weeks and $888 million, Spain Bond Funds took in fresh money for the seventh week running and Sweden Bond Funds enjoyed solid inflows. That was not enough to stop all Europe Bond Funds from posting consecutive weekly outflows for the first time since mid-March.

Emerging Markets Local Currency Bond Funds saw outflows accelerate during the latest week, reaching their highest level since early March, while EM Hard Currency Bond Funds extended their redemption streak to 20 straight weeks.

At the asset class level, Bank Loan Funds posted their third inflow since they snapped a 19-week redemption streak in late May, Inflation Protected Bond Funds added to their record-setting run of outflows and High Yield Bond Funds chalked up their sixth outflow in the past eight weeks.

In the multi-asset space, Total Return Funds posted consecutive outflows and Balanced Funds saw total redemptions YTD push past the $73 billion mark. Last year investors pulled $125 billion out of Balanced Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.