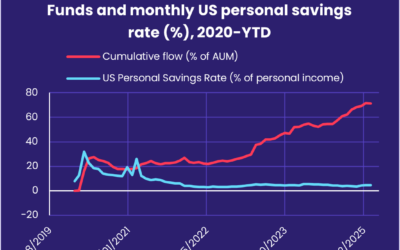

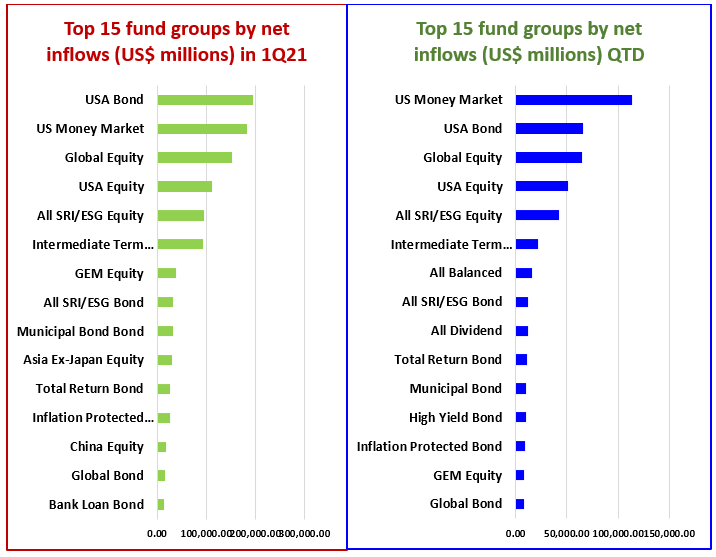

While pent-up consumer demand and catch-up business investment have been key assumptions behind the US reflation story, one reservoir of fuel for this narrative continues to fill up. During the week ending May 26, flows into EPFR-tracked US Money Market Funds hit a 51-week high, lifting year-to-date inflows to these liquidity vehicles over the $300 billion mark.

Investors remain torn between the eye-popping rebound in US economic growth, bolstered by epic levels of fiscal stimulus and expectations that the combination of current vaccinations and past infections will add up to ‘herd immunity’ against Covid-19 by 3Q21, and fears this rebound will lift inflation – and inflationary expectations – to disruptive heights. US Equity Funds recorded their 15th inflow in the past 16 weeks while Bank Loan and Inflation Protected Bond Funds absorbed fresh money for the 21st and 27th consecutive week respectively and flows into Gold Funds hit a 35-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.