When it came to asset markets, central banks were again front and center during the third week of March. Between March 18-21, the US Federal Reserve, European Central Bank, Bank of England, Swiss National Bank, and Bank of Japan held policy meetings that delivered a range of outcomes from the SNB’s first rate cut since early 2015 to the BOJ’s first rate hike since 2007.

Markets responded strongly to the Fed’s signal that, while its key rate remains on hold, three rate cuts are still on the table. The Dow Jones Industrials, Nasdaq and S&P 500 hit fresh record highs that failed to pull fresh money into EPFR-tracked US Equity Funds.

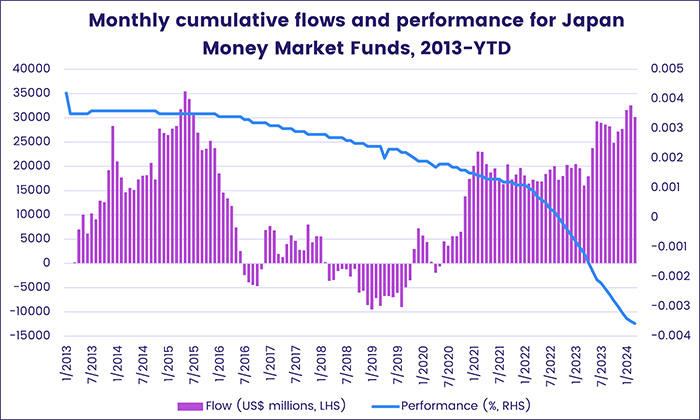

The BOJ’s decision to end its experiment with negative interest rates drew a mixed response, with redemptions from Japan Bond Funds hitting a nine-week high while Japan Equity Funds extended their longest inflow streak since 1H18. Japan Money Market Funds, meanwhile, posted their biggest outflow in over a year.

The week ending March 20 also saw Cryptocurrency Funds post only their second outflow since the beginning of 4Q23, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extend their longest outflow streak since 2010, flows into Physical Gold Funds climb to a 17-week high and Inflation Protected Bond Funds chalk up their 46th outflow over the past 12 months.

Overall, EPFR-tracked Bond Funds absorbed a net $5.3 billion during the latest week. Alternative Funds also recorded a collective inflow, while Balanced, Equity and Money Market Funds recorded outflows of $3.7 billion, $21.2 billion and $61.1 billion, respectively. Assets managed by all Exchange Traded Funds (ETFs) climbed past the $12 trillion mark in February and the AUM of all Collective Investment Trusts (CITs) is north of $1 trillion.

Emerging markets equity funds

During the third week of March, waning appetite for exposure to Asian markets and the continuing absence of retail support saw EPFR-tracked Emerging Markets Equity Funds post consecutive outflows for the first time since late November.

Redemptions from Asia ex-Japan, Latin America, EMEA and Frontier Markets Funds more than offset modest flows into the diversified Global Emerging Markets (GEM) Equity Funds as outflows from retail share classes climbed to a 21-week high. The week did see Leveraged EM Funds post their first inflow since late January and EM Dividend Funds absorb fresh money for the 11th time year-to-date.

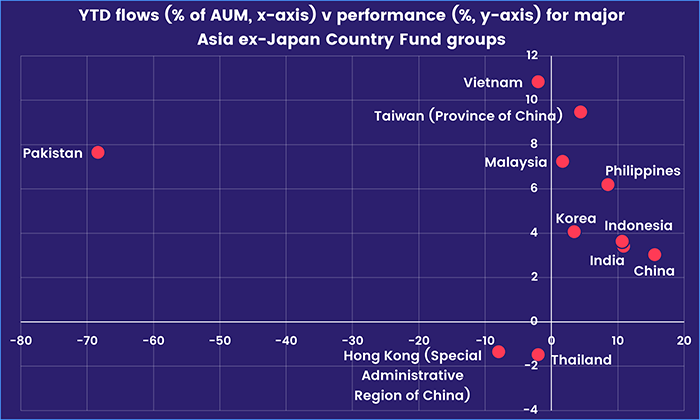

Although most Asia ex-Japan Country Fund groups have had, in both flow and performance terms, fair-to-good starts to 2024 the latest week saw several stumble. China Equity Funds posted consecutive weekly outflows for the first time since early November, investors pulled money out of Korea Equity Funds for the fifth week running, redemptions from Thailand and Vietnam Equity Funds climbed to 10 and 27-week highs, respectively, and flows into India Equity Funds dropped to their lowest level since mid-3Q23.

The reasons for these underwhelming flows are varied, ranging from policy concerns (China), internal politics (Thailand and Vietnam), a threatening neighbor (South Korea) and valuation worries (India). Investors remain reluctant to substitute diversified for individual country exposure. Asia ex-Japan Regional Equity Funds have not posted an inflow since the second week of April 2023.

Investors with a Latin America focus are also running shy of funds offering regional exposure. Latin America Regional Equity Funds have only posted one inflow so far this year, and the latest week’s outflow was the biggest in over 26 months.

EMEA Equity Funds with Africa mandates continue to struggle, with South Africa Equity Funds racking up their sixth outflow over the past seven weeks and redemptions from Africa Regional Equity Funds hitting a 14-week high. Flows also bypassed Turkey Equity Funds, which posted their biggest outflow year-to-date ahead of a further interest rate hike which lifted the key rate to 50%. But flows into Poland and Israel Equity Funds climbed to 21 and 160-week highs, respectively.

Developed markets equity funds

A reversal of US Equity Fund flows, and a general reluctance to chase stock prices that have soared to record highs without a clearer sense of central bankers’ thinking about interest rates, left EPFR-tracked Developed Markets Equity Funds looking at the biggest outflow in three months heading into the fourth week of March. US, Europe, Australia and Canada Equity Funds saw a combined $25 billion redeemed, more than offsetting flows into Global and Japan Equity Funds.

The latest flows into Japan Equity Funds came during a week when the country’s central bank closed the book on the negative interest rate and yield control policies it adopted to fight deflation. Against this backdrop, foreign domiciled Japan Equity Funds posted consecutive weekly outflows for the first time this year as investors fretted about the competitive implications of a stronger currency.

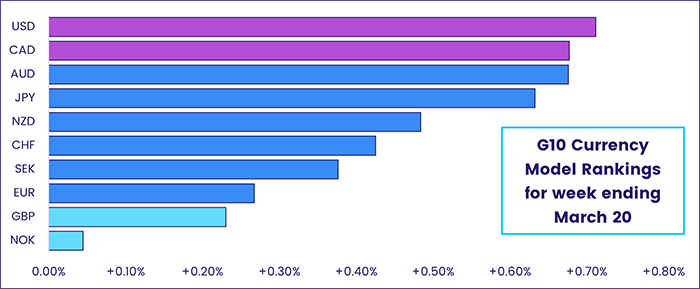

The Bank of Japan’s first step towards normalizing its ultra-accommodative polices, however, came as little surprise. Despite its historic weakness, the Japanese yen has been in the second quintile of EPFR’s G-10 currency rankings for five straight weeks.

A week after posting a record weekly inflow, US Equity Funds saw half of that influx flow back out. Large Cap Growth Funds bucked the overall trend, posting their biggest collective inflow since late 4Q20 as they extended their longest run of inflows in over three and a half years. On the corporate actions front, research by EPFR Liquidity Analyst Winston Chua indicates that insider selling by those required to file Form 4 with SEC is running at levels last seen in the run up to the 2022 market correction.

On the other side of the Atlantic, major continental stock markets at record levels has not banished the dour investor sentiment dogging Europe Equity Funds. The group posted their 51st outflow of the past year as redemptions from retail share classes hit their highest level since late 2Q22. At the country level, redemptions from Sweden, UK and France Equity Funds hit six, 13 and 14-week highs, respectively, while flows into Ireland Equity Funds climbed to a 49-week high.

Global sector, industry and precious metals funds

Just four of the 11 major EPFR-tracked Sector Fund groups – Commodities, Industrials, Real Estate and Energy Sector Funds – posted inflows during the third week of March as investors weighed various central bank decisions and guidance.

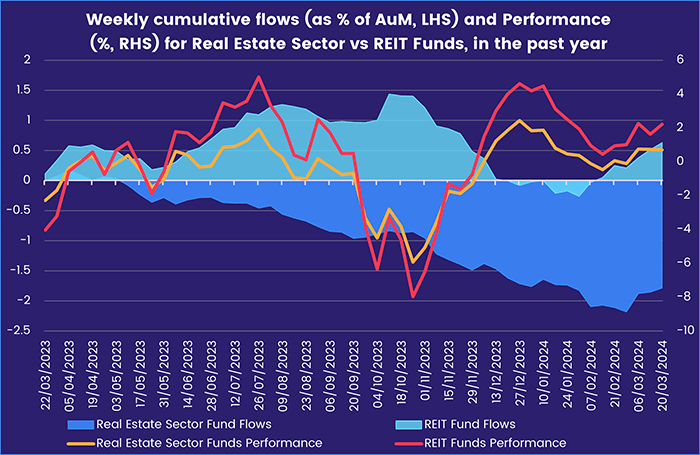

With the US Federal Reserve signaling that three rate cuts are still on the table this year, Real Estate Sector Funds extended their current inflow streak to three weeks and $1.6 billion. The group hasn’t seen four straight weeks of inflows since mid-1Q22. REIT Funds, a more liquid option within this universe, posted their sixth inflow of the past seven weeks, and ninth of the past 12 weeks.

Energy Sector Funds posted their second inflow since the start of November, bringing an end to their three-week redemption run. Prior to 2023, the first quarter had been good to this fund group. Since EPFR started tracking Energy Sector Funds in 2000, inflows during the first quarter have averaged $2.1 billion, including a quarterly inflow record of $20 billion in 1Q21. But last year, amid uncertainty about global demand, the impact of climate pledges and tensions in the Middle East, the sector struggled to gain traction with $8 billion and $9.85 billion exiting in the first and second quarters, respectively. This year, flows are following a similar pattern with nearly $6 billion redeemed year-to-date.

Technology and Telecom Sector Funds saw the previous week’s eye-catching inflows reversed. For the latter group, the record inflow experienced last week was overturned by this week’s record outflow. Both were driven by a single US-domiciled communication services ETF.

Physical Gold Funds, which are typically regarded as safe havens, snapped their 11-week streak of outflows with their biggest inflows since late November. Silver Funds also enjoyed solid inflows for a second consecutive week, topping the previous week by nearly $100 million.

Bond and other fixed income funds

Year-to-date flows into EPFR-tracked Bond Funds climbed past the $185 billion mark during the third week of March as the Swiss National Bank became the first major developed markets central bank to pivot from interest rate hikes to rate cuts. The latest week’s headline number was, however, the smallest since the current inflow streak began in mid-December.

The latest flows reflected a drop in risk appetite. Emerging Markets Bond Funds chalked up their 10th outflow over the past 11 weeks, High Yield Bond Funds recorded their first outflow since early January and biggest since late October and flows in the investment grade space favored funds with sovereign debt mandates.

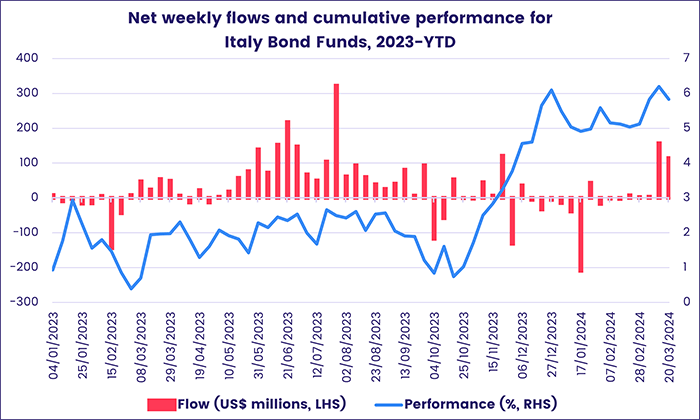

Europe Bond Funds were the major exception to the sovereign-corporate split, with corporate funds taking in twice as much fresh money as their sovereign peers. At the country level, Switzerland Bond Funds attracted over $600 million – an 89-week high – ahead of the Swiss National Bank’s rate-cutting decision. Italy Bond Funds are also popular as investors rerate the country’s debt in light of its better-than-expected economic growth.

Also influenced by central bank actions were Japan Bond Funds, which saw outflows climb to a nine-week high after the Bank of Japan decided to end its yield control program for 10-year government bonds. That opens the door to higher yields, which move inversely to the price of a bond.

US bond markets will be living with current interest rates a while longer after the Federal Reserve kept short-term rates on hold at its latest policy meeting. US Bond Fund retail share classes collectively absorbed fresh money for the sixth straight week and the 11th time so far this year, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates racked up their 13th straight inflow. Intermediate remained the preferred duration.

Among Emerging Markets Bond Funds, those dedicated to Asian local currency debt attracted fresh money while those with diversified and hard currency mandates did not.

Did you find this useful? Get our EPFR Insights delivered to your inbox.