Net flows into all EPFR-tracked Equity Funds hit a year-to-date high during the third week of March. But the headline number was boosted by an influx of fresh money on the final day of the reporting period, and it glossed over what was another mixed period for many fund groups as investors tried to make sense of US economic policy.

European stocks remain the brightest star among the major asset classes, with Europe Equity Funds seeing inflows accelerate for the third week running as they hit their highest total since mid-2Q17. Physical Gold Funds also remain popular, extending their longest run of inflows in over 19 months, and flows into Physical Silver Funds climbed to a 20-week high.

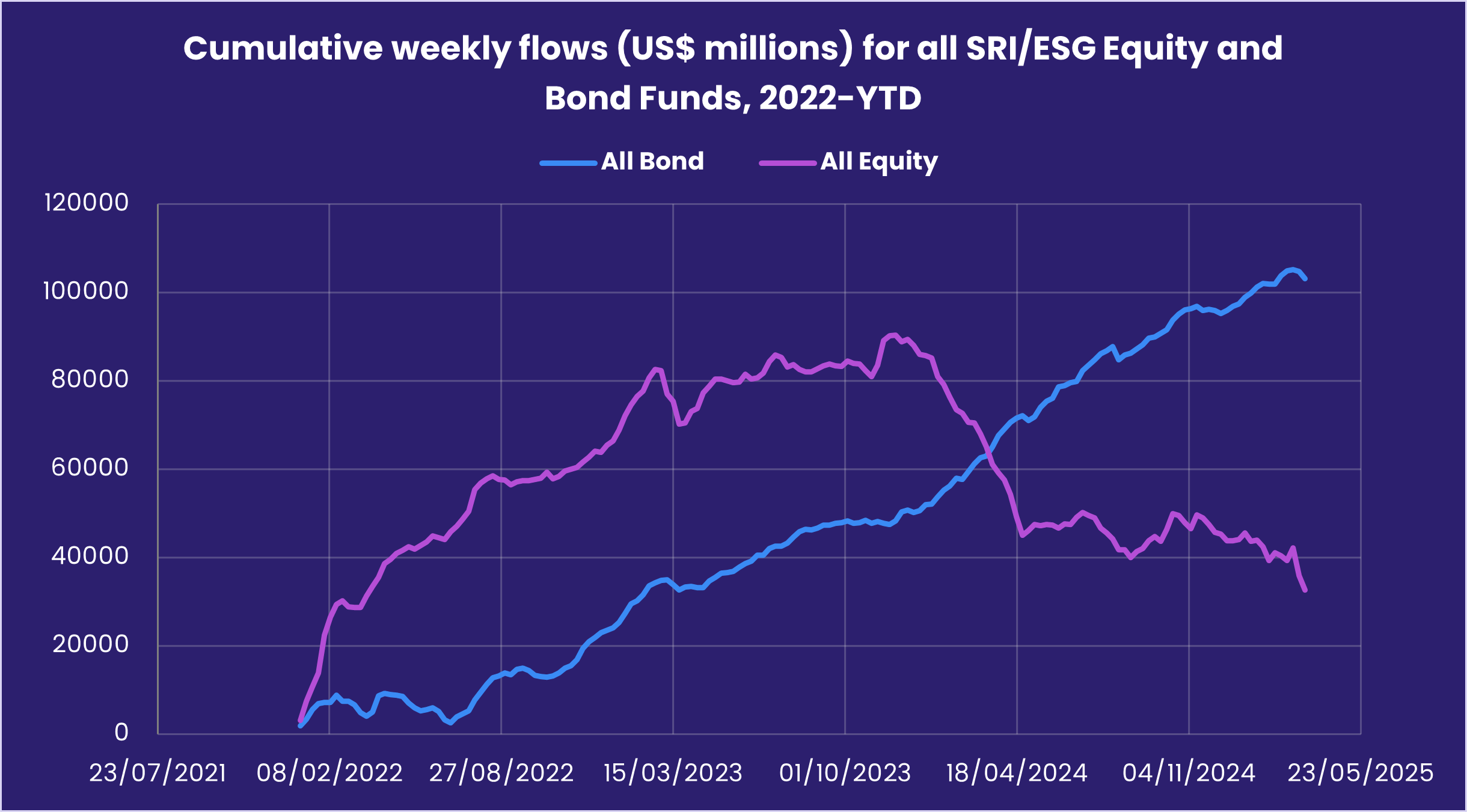

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates endured another tough week. On the heels of the new record outflow set last week, SRI/ESG Equity Funds saw another $3.2 billion flow out. SRI/ESG Bond Funds, meanwhile, experienced their heaviest redemptions since mid-3Q24.

Overall, the week ending March 19 saw EPFR-tracked Equity Funds absorb a net $43.4 billion while Bond Funds took in $4.8 billion and Alternative Funds $4.5 billion. Balanced Funds posted their biggest outflow YTD and $6.3 billion flowed out of Money Market Funds.

At the asset class and single country fund levels, Synthetic Funds extended their longest redemption streak in over five months, Convertible Bond Funds posted their biggest outflow since late October and Cryptocurrency Funds snapped a five-week run of outflows. Flows into China Bond Funds climbed to an 11-week high, Austria Equity Funds posted consecutive weekly inflows for the first time since 3Q22 and Thailand Money Market Funds chalked up their biggest outflow in over 10 months.

Emerging Markets Equity Funds

Cautious appetite for China’s stimulus story and strong appetite for Europe’s defense-driven rebound story helped all EPFR-tracked Emerging Markets Equity Funds, which posted outflows every week in February, chalk up their second inflow of March.

Behind the headline number, EM Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their eighth consecutive inflow, EM Bear Funds their eighth inflow over the past nine weeks and EM Dividend Funds their 19th since the beginning of November.

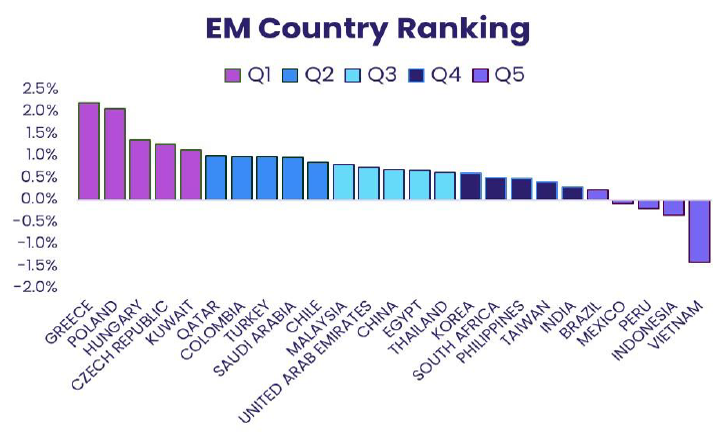

The latest flows into EMEA Equity Funds extended their longest run of inflows since 2Q22. At the country level, flows into Saudi Arabia, United Arab Emirates (UAE) and Poland Equity Funds hit their highest level since 3Q24, 1Q24 and 3Q13, respectively. EMEA and European markets currently occupy all of the slots in the top quintile of EPFR’s weekly EM Rankings, and the latest allocations data for the diversified Global Emerging Markets (GEM) Equity Funds show the average exposure to Poland and Saudi Arabia at nine year and record highs.

When it comes to Asia, GEM Fund allocations to China have climbed to a 16-month high while their exposure to Indonesia ahead of the latest market sell off stood at its lowest level since January 2022. China Equity Funds, meanwhile, attracted modest inflows on the heels of the China State Council’s announcement of fresh measures to boost domestic consumption.

The headline number for all Latin America Equity Funds was pulled into the red as Brazil Equity Funds saw money flow out for the sixth time in the past seven weeks, Mexico Equity Funds posted their first outflow of 2025 and Argentina Equity Funds added to their current redemption streak. Colombia Equity Funds did record their biggest inflow since 3Q23 during a week when further resignations from the country’s left-of-center government boosted hopes of early elections that result in a more business friendly administration.

Developed Markets Equity Funds

Another strong week for Europe Equity Funds and a late surge of money into US Equity Funds saw all EPFR-tracked Developed Markets Equity Funds end the third week of March having posted their biggest collective inflow since mid-December. Global, Canada and Japan Equity Funds also recorded inflows.

The latest flows into US Equity Funds were broadly based, with 42 funds pulling in over $250 million and nine of those absorbing over $1 billion. The bulk of the money arrived as the US Federal Reserve wrapped up its March meeting by keeping interest rates on hold while signaling two cuts during the remainder of the year. Leveraged US Equity Funds extended their longest run of inflows since 3Q23 and US Dividend Equity Funds set a new weekly inflow record.

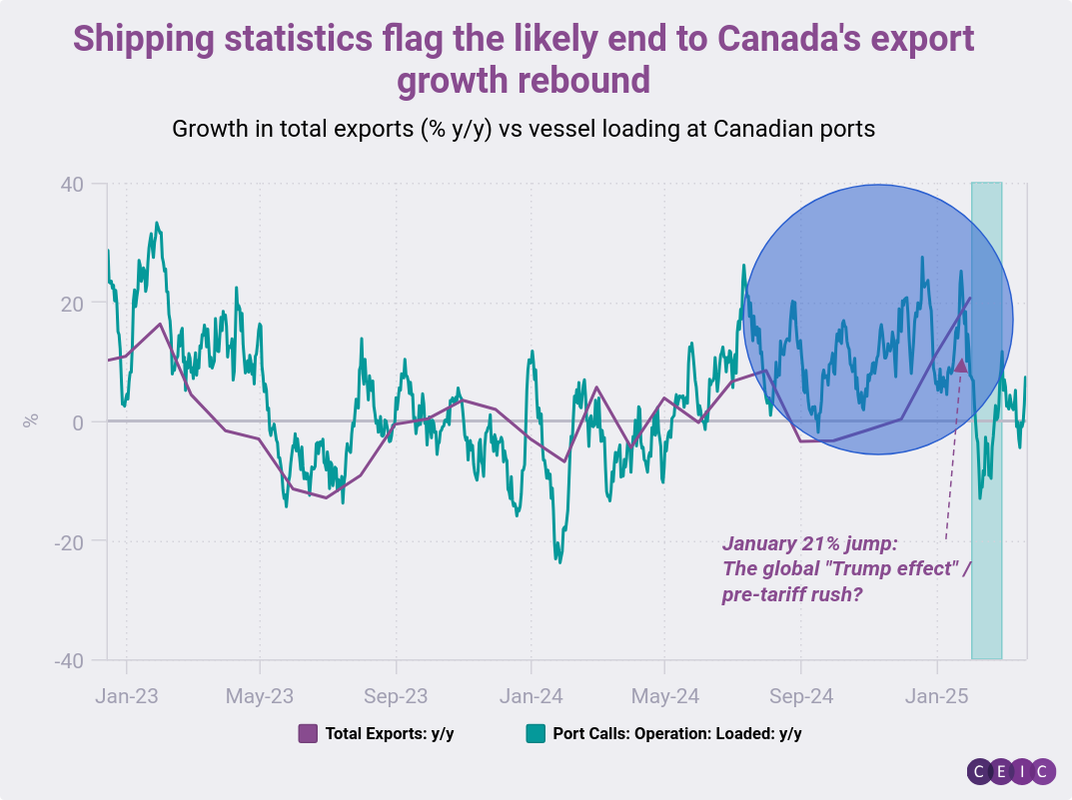

To the north, the threat of higher US tariffs did not stop Canada Equity Funds from posting their second largest inflow of the year so far. Research by EPFR sister company CEIC indicates the shifts in Canadian trade with the US are already taking a toll. In a recent note, CEIC analysts pointed out that, “Canadian export growth had been improving for six months. But that streak is likely to be broken when February data is released. This official indicator is closely correlated with Marine Traffic’s port-call statistics, specifically, the measure of vessels being loaded at Canadian ports…by February, port loading was in contraction.”

Flows into Europe Equity Funds continue to run at levels last seen in 2017 and to be concentrated on fund groups dedicated to core European Union markets. During the latest week, Germany Equity Funds posted their biggest inflow since 2Q12 while UK Equity Funds surrendered another $1 billion and Switzerland Equity Funds recorded a third straight outflow for the first time since late 2Q24.

Japan Equity Funds chalked up their fourth straight inflow despite redemptions from retail share classes, funds domiciled outside Japan and Japan Dividend Equity Funds. The market is still picking up a tailwind from US market guru Warren Buffet, whose company has been rotating money from the US to Japan.

Allocations to Japan among Global ex-US Equity Funds slipped coming into March. But exposure to Germany hit a 42-month high and France’s average weighting rebounded to a nine-month high.

Global sector, Industry and Precious Metals Funds

With the first quarter earnings season still three weeks away, flows to EPFR-tracked Sector and Precious Metals Fund groups traced broader market themes – European rearmament, the DeepSeek challenge, US dollar weakness – going into the second half of March. Of the 11 major Sector Fund groups, five posted inflows ranging from $93 million to $2.4 billion while six recorded outflows.

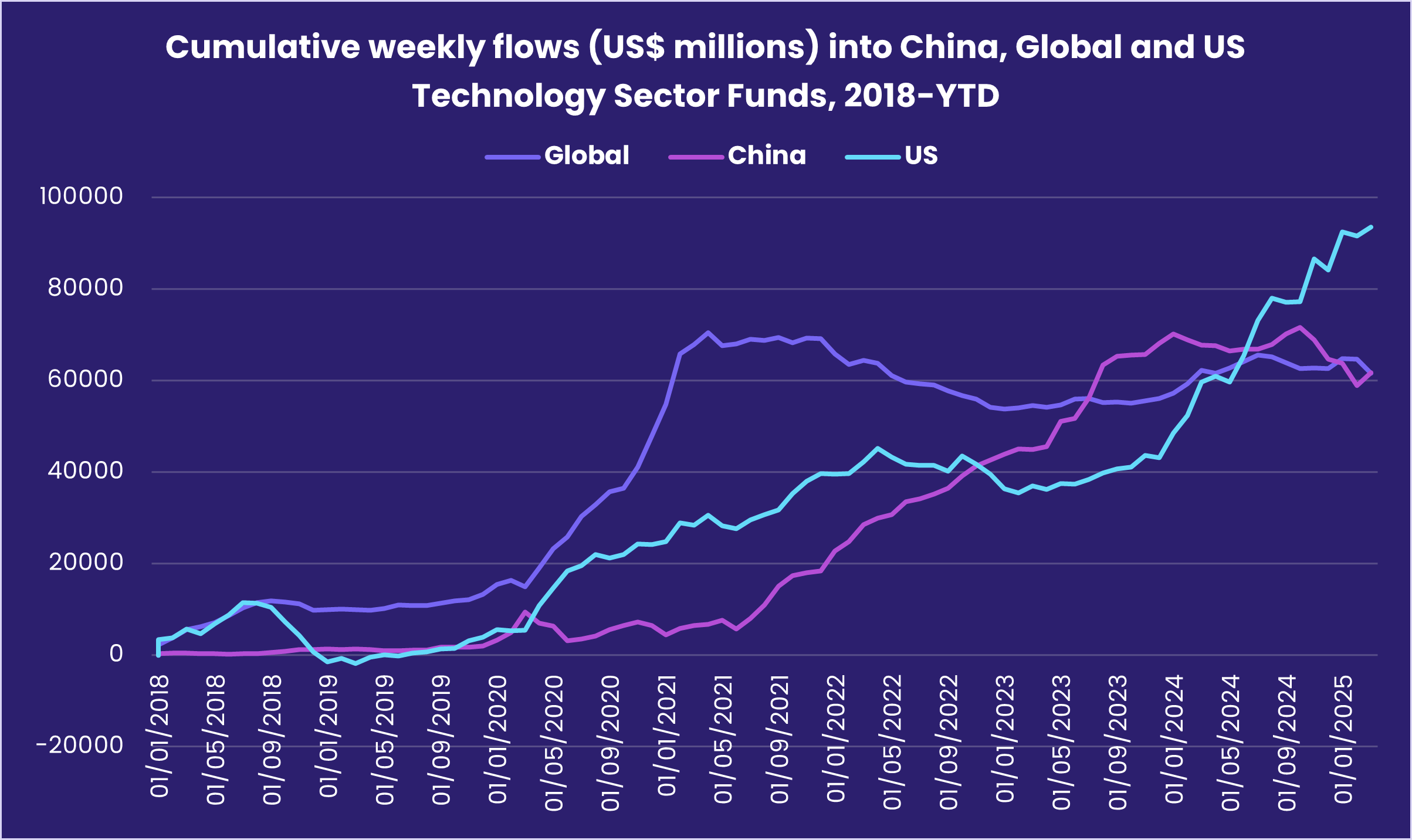

Flows into Technology Sector Funds bounced back from the previous week’s outflow as China-mandated funds chalked up their biggest inflow since early October. The fresh money arrived just ahead of an overall sell-off in Chinese stocks attributed to profit taking following the Chinese central bank’s latest policy meeting. Drilling down, tech funds offering direct exposure to anime and gaming plays posted their fourth straight inflow.

Elsewhere, the prospect of a rearming Europe propelled flows into Europe Industrial Sector Funds higher for the sixth week running, with the latest inflow the biggest since EPFR started tracking the group in 2006. US Industrial Sector Funds, meanwhile, are mired in their longest outflow streak since 4Q23 as investors weighed the impact of tit-for-tat tariffs on US manufacturers.

The new trade landscape is increasingly viewed as dollar-negative, and investors steered a combined $3 billion into Physical Gold and Silver Funds during the week ending March 19.

Among the groups experiencing net redemptions, Healthcare and Biotechnology Sector Funds posted the biggest outflow as investors remain braced for cuts in US and European government-funded programs, the former for ideological reasons and the latter because of the need to find more money for higher defense spending.

Energy Sector Funds posted their 30th outflow since the beginning of last August, with the latest week’s total a three-month high.

Bond and other Fixed Income Funds

Flows into EPFR-tracked Bond Funds ground lower for the third straight week as fixed income investors wrestled with a rapidly changing policy landscape, the prospect of even higher levels of sovereign issuance and the uncertain outlook for inflation in many markets. US Bond Funds saw the biggest inflows during the third week of March while Europe Bond Funds posted their first outflow since mid-November and their biggest since mid-August.

At the asset class level, Inflation Protected Bond Funds extended their longest inflow streak since 2H21, redemptions from Convertible Bond Funds climbed to an 18-week high, Green Bond Funds posted their biggest outflow since mid-November and Bank Loan Funds tallied consecutive outflows for the first time in over six months.

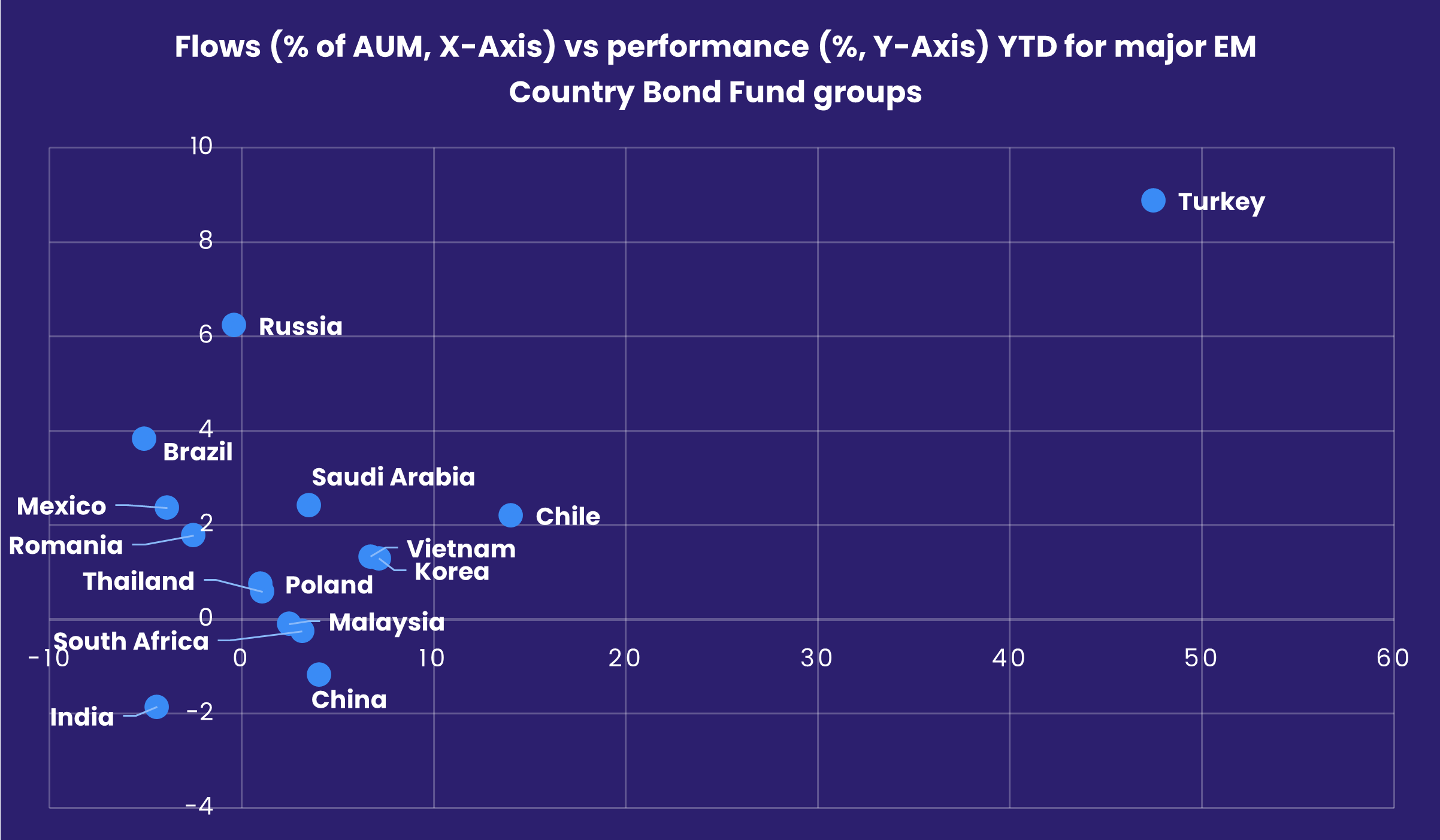

Emerging Markets Bond Funds took a hit from the lower risk appetite, posting their sixth outflow of 2025 despite the biggest inflow for China Bond Funds since the final week of December and the 11th inflow for Frontier Markets Bond Funds over the past 12 weeks. The latest allocations data for Global Emerging Markets (GEM) Bond Funds shows exposure to Ukraine, Nigeria, Turkey and India at 31-month, 64-month, 66-month and record highs, respectively, while allocations to China are at their lowest level since 4Q17 and to Brazil on record.

Sovereign and Corporate Europe Bond Funds both experienced net redemptions in mid-March, with the latter posting their first outflow since late December and biggest since mid-3Q24. Investors showed considerable conviction at the country level, with outflows from Norway and Sweden Bond Funds hitting 13 and 29-week highs, respectively, and nearly $800 million flowing out of UK Bond Funds.

Appetite for US high yield exposure bounced back, with funds dedicated to that asset class taking in over $1 billion for the seventh time so far this year. Flows into overseas domiciled US Bond Funds also rebounded.

Asia Pacific Bond Funds posted their biggest inflow in four months as Japan and Singapore Bond Funds both pulled in more than $100 million.

Did you find this useful? Get our EPFR Insights delivered to your inbox.