The week going into November encompassed two major central bank meetings, the next stage in Israel’s war against Hamas, more weak macroeconomic data from the Eurozone and China and a major setback for clean energy advocates.

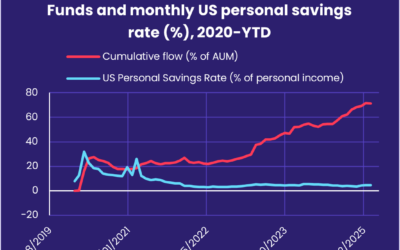

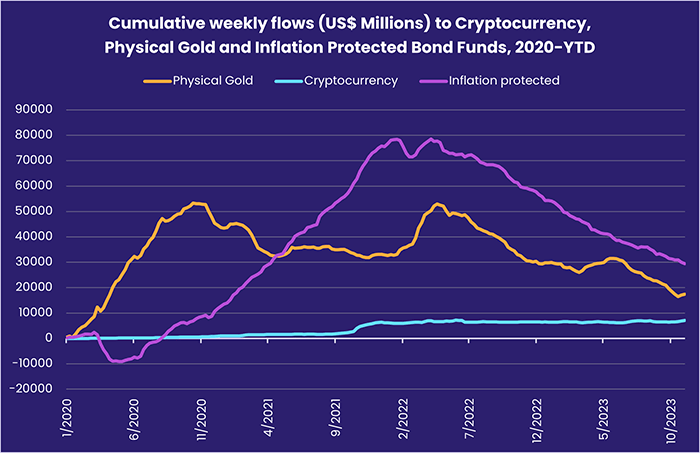

Against this backdrop, investors pulled their horns and turned to cash and its equivalents. Over $65 billion flowed into EPFR-tracked Money Market Funds and US Sovereign Bond Fund flows hit a 15-week high, while Physical Gold Funds posted consecutive weekly inflows for the first time since mid-May and Cryptocurrency Funds took in fresh money for the fifth week running.

While central banks continue to stress that inflationary risks persist, investors pulled money out of Inflation Protected Bond Funds for the eighth straight week and 50th time in the past 52 weeks. They also hit all 11 of the major EPFR-tracked Sector Fund groups with net redemptions, the first time that has happened since the final week of 2022, and extended the current outflow streaks for Europe and Global Emerging Markets (GEM) Equity Funds.

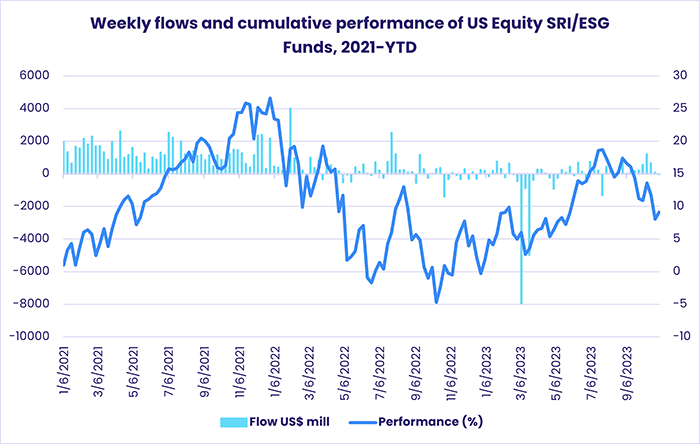

Overall, the week ending Nov. 1 saw a net $2 billion flow out of Equity Funds, with Dividend Equity Funds posting their third outflow in the past four weeks and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates their sixth in the past seven weeks. Alternative and Balanced Funds also recorded collective outflows of $253 million and $4.3 billion, respectively, while Bond Funds absorbed $4.7 billion and Money Market Funds $65.7 billion.

At the asset class and single country fund level, Total Return Funds extended their longest run of outflows since 4Q22, Convertible Bond Funds chalked up their 18th consecutive outflow and redemptions from Mortgage-Backed Bond Funds hit a 43-week high. Investors committed fresh money to Hong Kong Equity Funds for the 39th week in a row and pulled money out of Hong Kong Bond Funds for the 43rd consecutive week, Austria Equity Funds posted their biggest outflow since the third week of March and over $400 million flowed out of Thailand Bond Funds.

Emerging markets equity funds

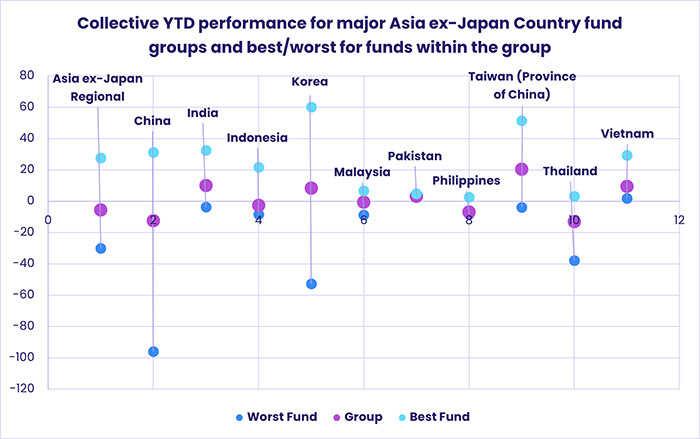

During the final week of October, investors maintained their ambivalence about emerging markets while retaining their enthusiasm for some of the larger Asian markets. Redemptions from the diversified Global Emerging Markets (GEM) Equity Funds hit a 97-week high as they recorded their 14th consecutive outflow while Korea, Taiwan (POC) and India Equity Funds absorbed a combined $1.5 billion.

Overall. EPFR-tracked Emerging Markets Equity Funds posted their fourth straight outflow – the longest run of redemptions since mid-2Q22 – as retail share classes saw money flow out for the 13th straight week.

China Equity Funds were the one major Asia ex-Japan Country Fund group to post an outflow. Optimism among investors that Chinese policymakers will deploy significant stimulus to bolster a faltering economic rebound and prevent deflation from getting a grip on the world’s second-largest economy is beginning to fade. A contractionary reading for a closely followed manufacturing PMI was the latest blow to investor confidence. Both foreign and domestically domiciled funds saw money flow out.

Among the other major groups, Korea Equity Funds recorded their biggest inflow since the first week of July, India Equity Funds extended their longest inflow streak in over a decade and flows into Taiwan (POC) Equity Funds hit a seven-week high.

Although the reporting period ended with another 50 basis point cut in Brazil’s key interest rate, Brazil Equity Funds were hit by their third outflow of more than $100 million in the past four weeks. Mexico Equity Funds also posted their biggest outflow since early September as concerns about the impact of higher-for-longer US interest rates trumped the country’s nearshoring story and higher prices for its oil exports.

EMEA Equity Funds continue to battle multiple headwinds ranging from conflict in the Middle East and Ukraine to the weakness of the Eurozone economy.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds came into November on the back of a four-week outflow streak driven largely by redemptions from Europe and Global Equity Funds. Both groups saw over $1 billion flow out during the week ending Nov. 1, offsetting the combined inflows recorded by US, Canada, Japan and Australia Equity Funds.

A desire for greater clarity about the trajectory of US and Japanese monetary policy played a part in the muted flows. The week ended with US Federal Reserve policymakers keeping interest rates on hold and warning that inflation is not yet fully contained. Flows into US Equity Funds crept up to 0.006% of the fund group’s AUM as Large Cap Funds absorbed fresh money for the sixth week running. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their first outflow since mid‑August.

The Bank of Japan (BOJ) also ended its policy meeting with interest rates unchanged, although it gave itself more flexibility when it comes to controlling yields on 10-year Japanese sovereign bonds. Japan Equity Funds ended the week with a solid inflow, nearly half of which was absorbed by retail share classes. At the individual fund level, a leveraged index fund posted the week’s biggest inflow.

Europe Equity Funds racked up another outflow during a week that started with the European Central Bank keeping interest rates on hold and indicating they will stay at that level into the middle of next year. At the country level, investors gravitated to markets outside both the Eurozone and European Union, with UK Equity Funds recording their biggest inflow since late 2Q22 and Switzerland Equity Funds since late 1Q08.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, extended their longest outflow streak in over a year.

Global sector, industry and precious metals funds

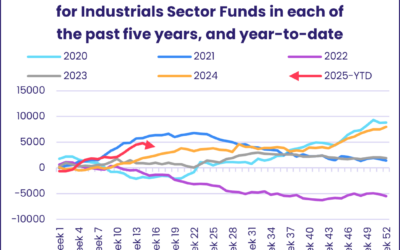

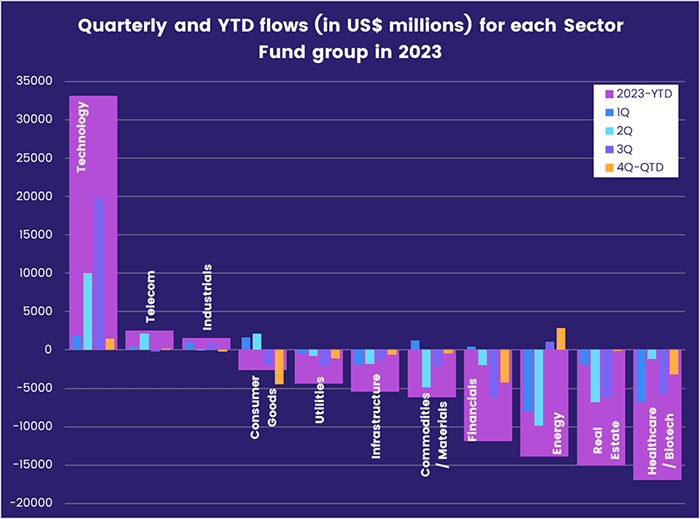

October ended with sector-oriented investors taking money off every available table. For the first time in over 10 months, all 11 of the major EPFR-tracked Sector Fund groups posted outflows in the same week, with redemptions exceeding $500 million for three groups and topping $1 billion for another three – Consumer Goods, Financials, and Healthcare/Biotechnology Sector Funds.

Redemptions for Financials Sector Funds climbed above the $1.5 billion mark for the second time since the start of their current outflow streak. Although China, Canada and Japan dedicated funds brought in roughly $400 million combined, that was not nearly enough to offset the $1.7 billion redeemed from US Financials Sector Funds. With over $11 billion flowing out over the past 14 weeks, Financials Sector Funds‘ collective year-to-date total has fallen well into negative‑territory.

Looking at quarterly flows reveals a similar pattern for Consumer Goods Sector Funds, which absorbed $3.8 billion in the first half of the year but have seen $6.5 billion flow out since the beginning of the third quarter. Over the past six weeks, they have recorded outflows of $1 billion or more five times as investors factor higher-for-longer interest rates into their outlook for consumers on both sides of the Atlantic.

One of the four groups posting net outflows in each quarter this year – Healthcare/Biotechnology Sector Funds – chalked up their ninth outflow of the past 10 weeks and their largest since the final week of January. Global and US-dedicated funds equally contributed to this week’s headline number. Technology Sector Funds, the only group recording inflows in each quarter so far this year, posted their second consecutive outflow as China Tech Funds saw money flow out for the second time in the past four weeks.

Those investors still focused on earnings had reports from several energy majors to chew over during the latest week as well as some major M&A announcements to digest. The latter included Chevron’s $60 billion acquisition of Hess Corporation and Exxon Mobil’s acquisition of Pioneer Natural Resources. After last week’s 85-week high inflow, Energy Sector Funds posted their largest outflow in 19 weeks which brought an end to their eight-week, $5.2 billion inflow streak. Four of the funds with the largest outflows this week had “clean energy” or “sustainable” in their name despite the recent cancellation of some major offshore wind energy projects.

Bond and other fixed income funds

With four major central banks keeping interest rates unchanged between Oct. 26 and Nov. 2, EPFR-tracked Bond Funds got a shot in the arm that translated into their biggest weekly inflow since mid‑September.

The bulk of that money went to US Bond Funds and, within that group, to Short Term Sovereign Bond Funds. But US Corporate Bond Funds posted their first collective inflow in over a month, and their biggest since the second week of September, with junk bond funds pulling in over $400 million.

Hopes that US interest rates have peaked did not stop the bleeding for Municipal Bond Funds, which extended their longest outflow streak of the year to nine weeks and $4.5 billion, and redemptions from US Mortgage-Backed Bond Funds hit a 43-week high as the Fed continues to run down its holdings of mortgage-backed securities.

Fixed investors retained their recent aversion to diversified exposure, with Total Return, Global and Global Emerging Markets (GEM) Bond Funds and Balanced Funds all posting outflows for the week.

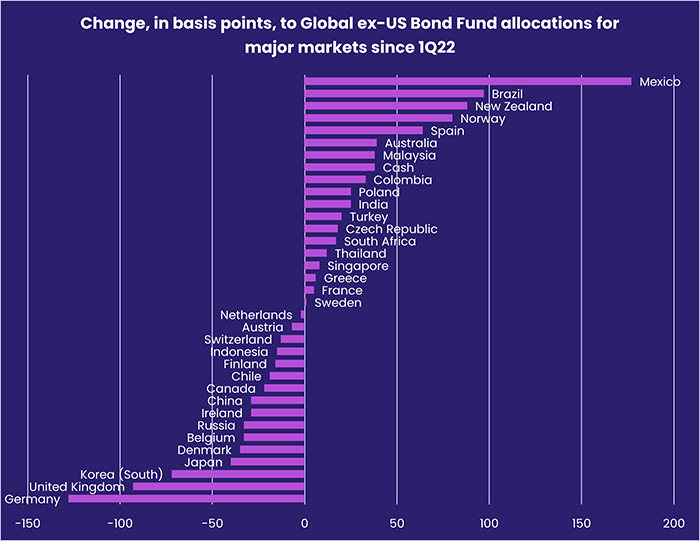

The latest country allocations data highlights the pivot that Global ex-US Bond Fund managers have made over the past 35 months to Latin America’s two biggest markets, Brazil and Mexico. Investors are less enthusiastic. Over the same period, they have redeemed 6% of Brazil Bond Funds AUM and nearly 40% of Mexico Bond Funds.

During the latest week, it was Asia ex-Japan Country Fund groups that were feeling the pinch as investors pulled a combined $600 million from China, Thailand and Korea Bond Funds. In the case of the latter, it was the first time in over a year they have posted three consecutive outflows with the latest the fifth largest year-to-date.

The two major regional Europe Bond Fund groups saw flows head in opposite directions, with Europe ex-UK Funds recording their biggest inflow in nearly two months while funds with fully regional mandates posted their sixth straight outflow. Overall, the group continues to enjoy solid retail support, with retail share classes absorbing fresh money for the eighth straight week and 14th time in the past 16 weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.