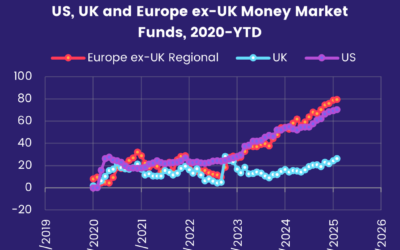

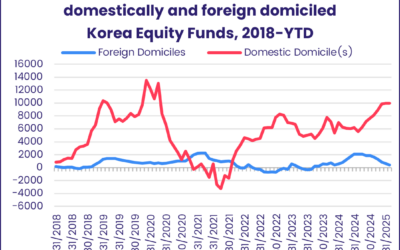

As key US indexes closed their books on a month that saw the Nasdaq record its biggest drop since October 2008, investors seeking to escape market volatility turned to cash and to Chinese equity. Flows into EPFR-tracked Money Market Funds hit a 27-week high during the fourth week of April while China Equity Funds recorded their 15th inflow in the 17-weeks year-to-date and their biggest since late January.

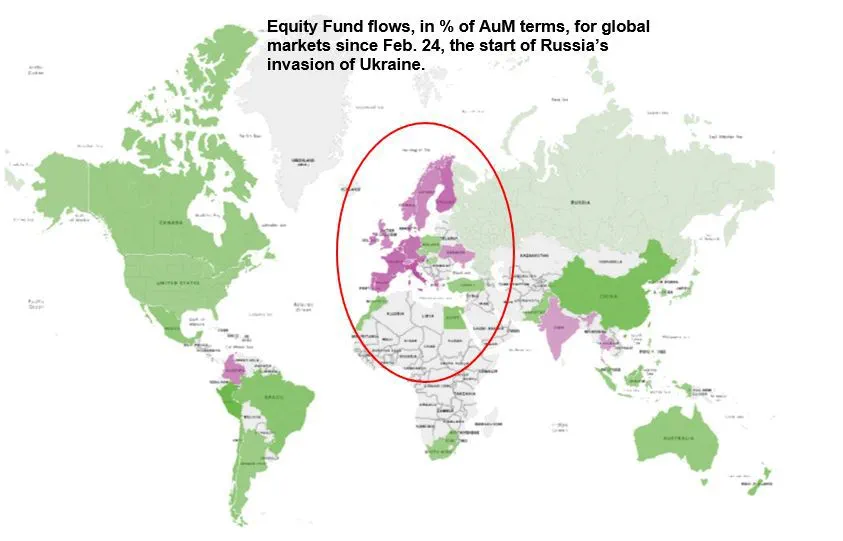

Looking ahead, next month promises continued fighting in Ukraine, another increase in US interest rates, further pressure on Chinese growth and global supply chains as China defends its zero-Covid policy and a raft of mixed earnings reports. Among these, investors and the managers who allocate their money continue to see Russia’s assault of Ukraine as a largely European issue.

Overall, the week ending April 27 saw investors steer $60 billion into Money Market Funds and pull $1.2 billion from Equity Funds, $1.7 billion from Alternative Funds $6.7 billion from Bond Funds and $7 billion – a 68-week high – from Balanced Funds. The redemptions from Equity Funds were less than a 10th of the previous week’s total, in part because of strong investor appetite for Dividend Equity Funds which have posted inflows 15 of the past 18 weeks with the latest inflow the biggest since early February.

At the single country and asset class fund levels, flows into Mortgage-Backed Bond Funds hit a YTD high, Bank Loan Funds recorded the 65th inflow since the beginning of last year and Total Return Bond Funds extended their current redemption streak to 12 weeks and $27 billion. Outflows from China Bond Funds set a new weekly record, Austria Equity Funds recorded their biggest inflow since mid-4Q21 and flows into Vietnam Equity Funds hit a 41-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.