The second week of January saw Americans mourning their 39th president, watching in horror as large swathes of Los Angeles burned and – along with the rest of the world – positioning themselves for the return of Donald Trump to the White House.

Against this backdrop, which also included better-than-expected inflation figures from the US and UK, investors steered another $20 billion into US Equity and Bond Funds, rotated from cryptocurrencies to gold, responded strongly to the first round of financial sector earnings reports and pulled over $1.8 billion from Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates.

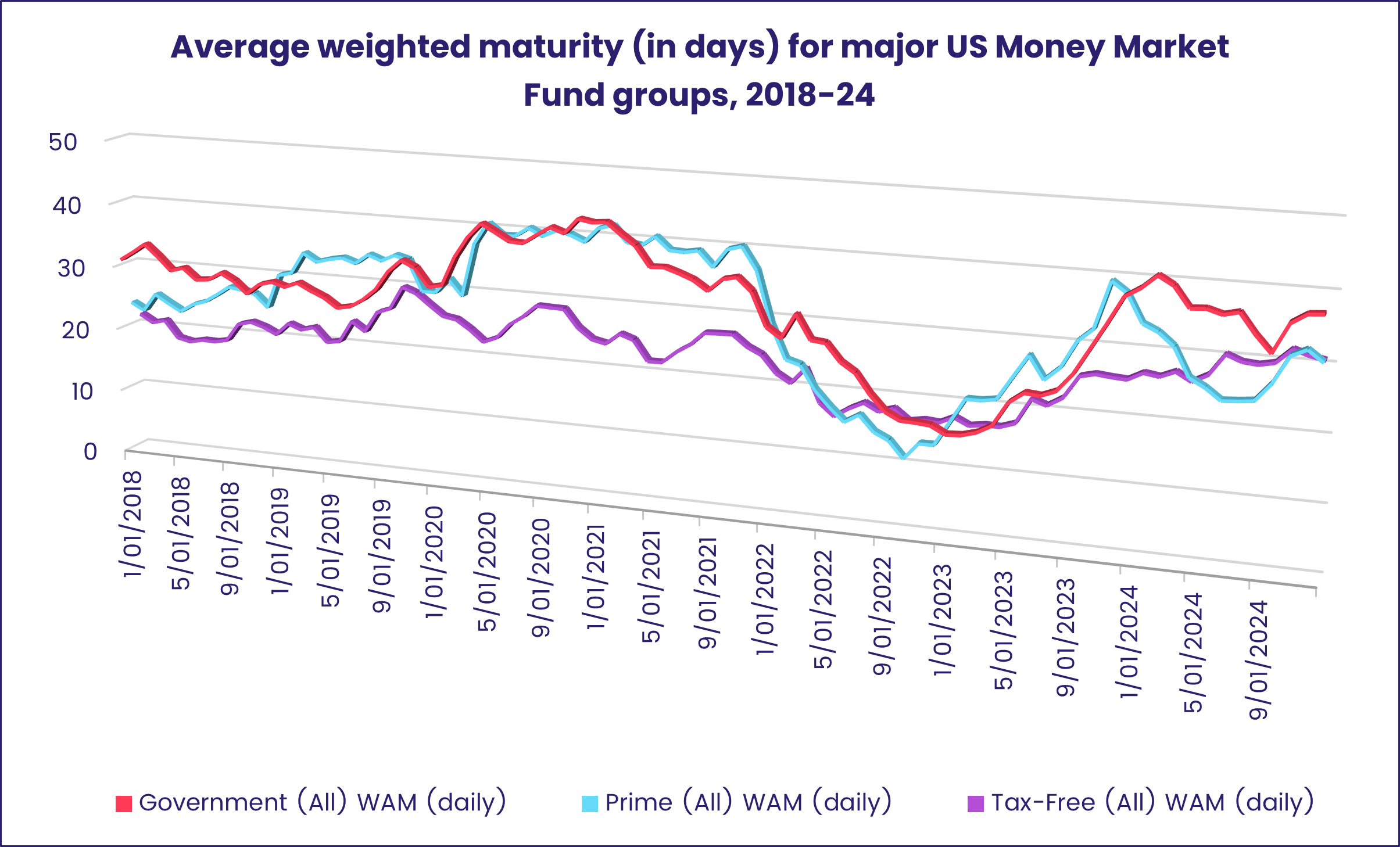

Money Market Fund flows changed direction, with the overall group posting their biggest collective outflow since the second week of April as investors dipped into US-mandated funds for their estimated tax payments and over $8 billion flowed out of UK Money Market Funds. Data collected by EPFR sister company iMoneyNet shows the average maturity of US Money Market Fund portfolios dropped in the final quarter of last year. In December, there was a sharp jump in the share of prime fund portfolios devoted to US Treasury repurchase (repo) agreements.

Overall, EPFR-tracked Equity Funds absorbed a net $13 billion during the week ending Jan. 15. Alternative Funds pulled in $1.9 billion and Bond Funds $11.4 billion while $1.3 billion flowed out of Balanced Funds and $83 billion from Money Market Funds.

At the single country and asset class fund levels, Physical Gold Funds took in over $1 billion, redemptions from Convertible Bond Funds hit an 11-week high and Bank Loan Funds extended their current inflow streak to 15 weeks and $20 billion. Thailand Equity Funds experienced net redemptions for the 53rd consecutive week, Australia Bond Funds extended a run of inflows that started in late 1Q24 and Japan Money Market Funds recorded their biggest outflow in over four months.

Emerging Markets Equity Funds

With the impending inauguration of a pro-tariff US president less than a week away, EPFR-tracked Emerging Markets Equity Funds posted their first outflow of 2025. Three of the four major geographic groups experienced net redemptions and Latin America Equity Funds missed joining them by a whisker.

The week ending Jan. 15 did see a fifth straight inflow for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates and a ninth consecutive inflow for Emerging Markets Dividend Funds.

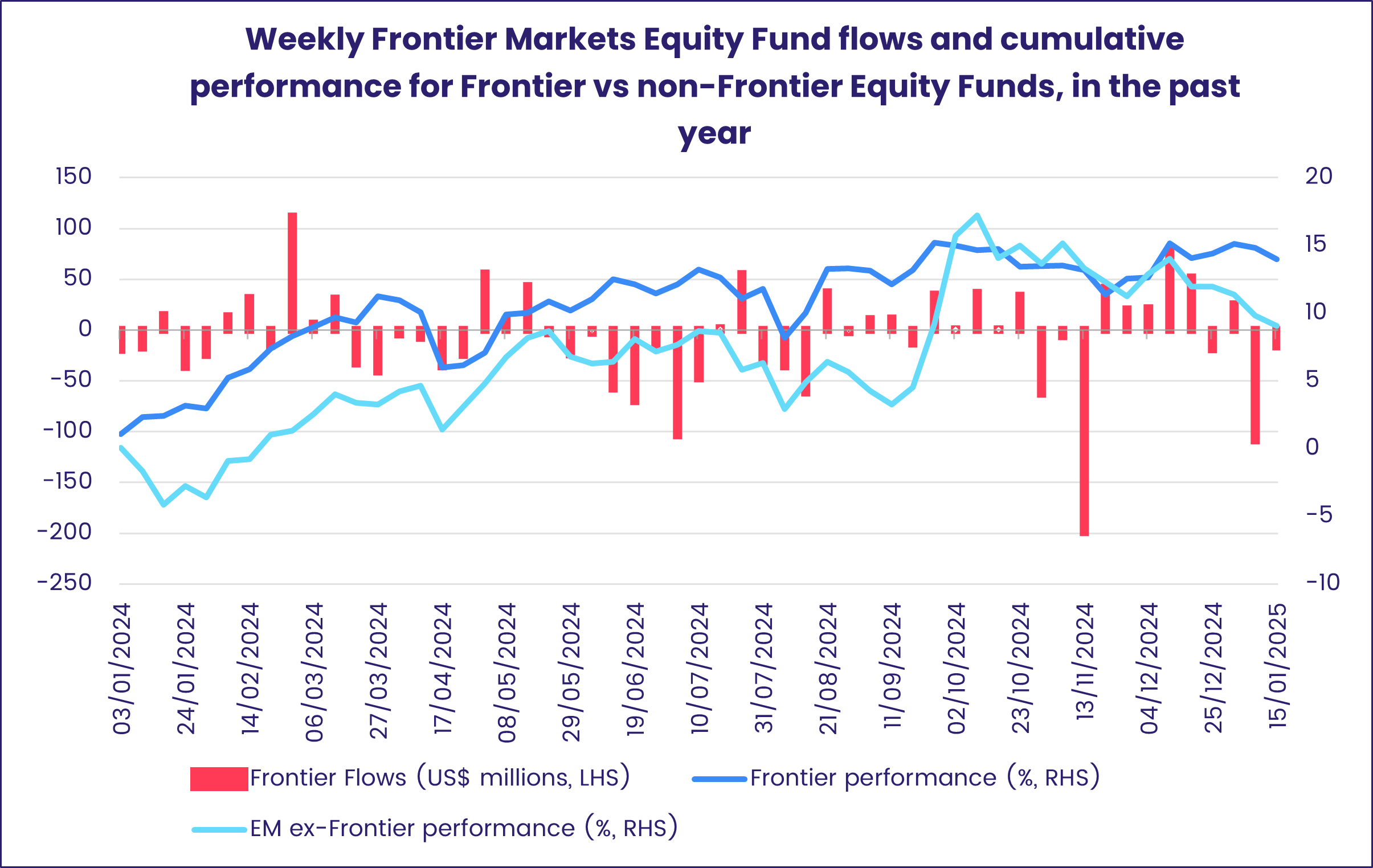

Funds dedicated to riskier, less liquid markets are also struggling. Frontier Markets Equity Funds, which have outperformed non-frontier funds over the past 12 months, chalked up their third outflow over the past four weeks. Vietnam remains the group’s largest single country allocation.

During the latest week, dedicated Vietnam Equity Funds were among the majority of Asia ex-Japan Country Funds that posted outflows, which ranged from $4 million for Philippines Equity Funds to $807 million for China Equity Funds. Between those two extremes, Thailand Equity Funds extended their record-setting outflow streak and India Equity Funds posted their 11th outflow since the beginning of 4Q24.

Meanwhile, funds dedicated to Taiwan, which China claims as a breakaway province, chalked up their biggest inflow since September. Flows into foreign domiciled Taiwan (POC) Equity Funds climbed to a 12-week high, with investors betting that the central role of artificial intelligence plays in driving US equity markets to serial record highs will curb Trump’s appetite for imposing tariffs on Taiwanese semiconductor exports.

The impact of the incoming US administration on most Latin American countries, the majority of which are governed by left-of-center parties and leaders, is expected to be less benign. Argentina, with its libertarian president, is the major exception and Argentina Equity Funds have now attracted fresh money for 12 straight weeks and 19 of the past 20. Managers of diversified funds are, however, treating this bandwagon with caution: Argentina’s average allocation among actively managed Latin America Regional Funds fell to a nine-year low in early 4Q24.

The modest inflow streak compiled by EMEA Equity Funds came to an end, with investors showing little conviction either way when it came to the diversified and single country groups in this universe.

Developed Markets Equity Funds

Flows into EPFR-tracked Developed Markets Equity Funds broadened during the second week of January, with Japan Equity Funds posting only their second inflow since mid-November and Pacific Regional Equity Funds chalking up consecutive weekly inflows for the first time since late June. But US Equity Funds remained the biggest driver as the overall group took in fresh money for the 13th time during the past 14 weeks.

Europe Equity Funds remain on the outside looking in despite attractive equity valuations and hopes that fighting on the continent’s eastern flank will die down during the coming year. The group, which posted only six weekly inflows during 2024, has started this year with two straight outflows as Germany’s economy continues to struggle, growth in the UK slows, another French prime minister struggles to curb the country’s deficit and Eurozone inflation creeps higher.

The latest inflation reading in the US, which undershot expectations, took some of the sting out of prior data highlighting the labor market’s resilience. Although retail share classes saw their inflow streak come to an end and Leveraged US Equity Funds broke the previous weekly outflow record set in 1Q14, US Equity Funds collectively recorded their 14th inflow since the beginning of the fourth quarter. The bulk of the latest inflows went to Large Cap Blend Funds.

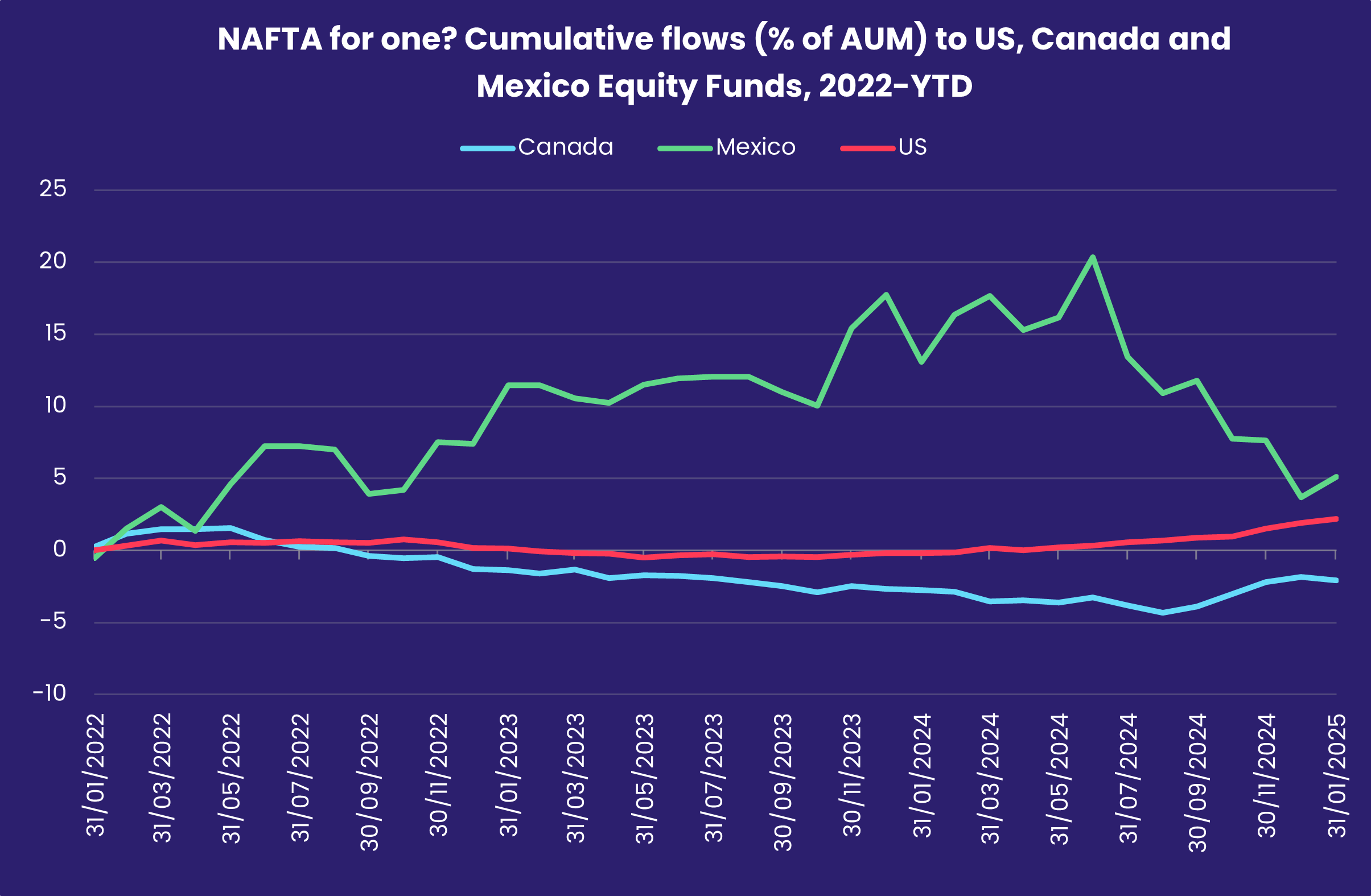

Canada Equity Funds eked out a minimal inflow ahead of US President-elect Donald Trump’s inauguration. Investors are braced for disruption given the ideological differences between Trump and Canada’s lame duck Prime Minister Justin Trudeau.

Both Japan and Australia Equity Funds enjoyed solid inflows during the latest week. In the case of the latter, retail flows hit a 19-week high and Japan Dividend Funds racked up their seventh inflow of the past 10 weeks.

Japan has been a good address for the largest of the diversified Developed Markets Equity Funds. Since the beginning of last year, Japan domiciled Global Equity Funds have posted 54 consecutive inflows totaling over $23 billion.

Global sector, Industry and Precious Metals Funds

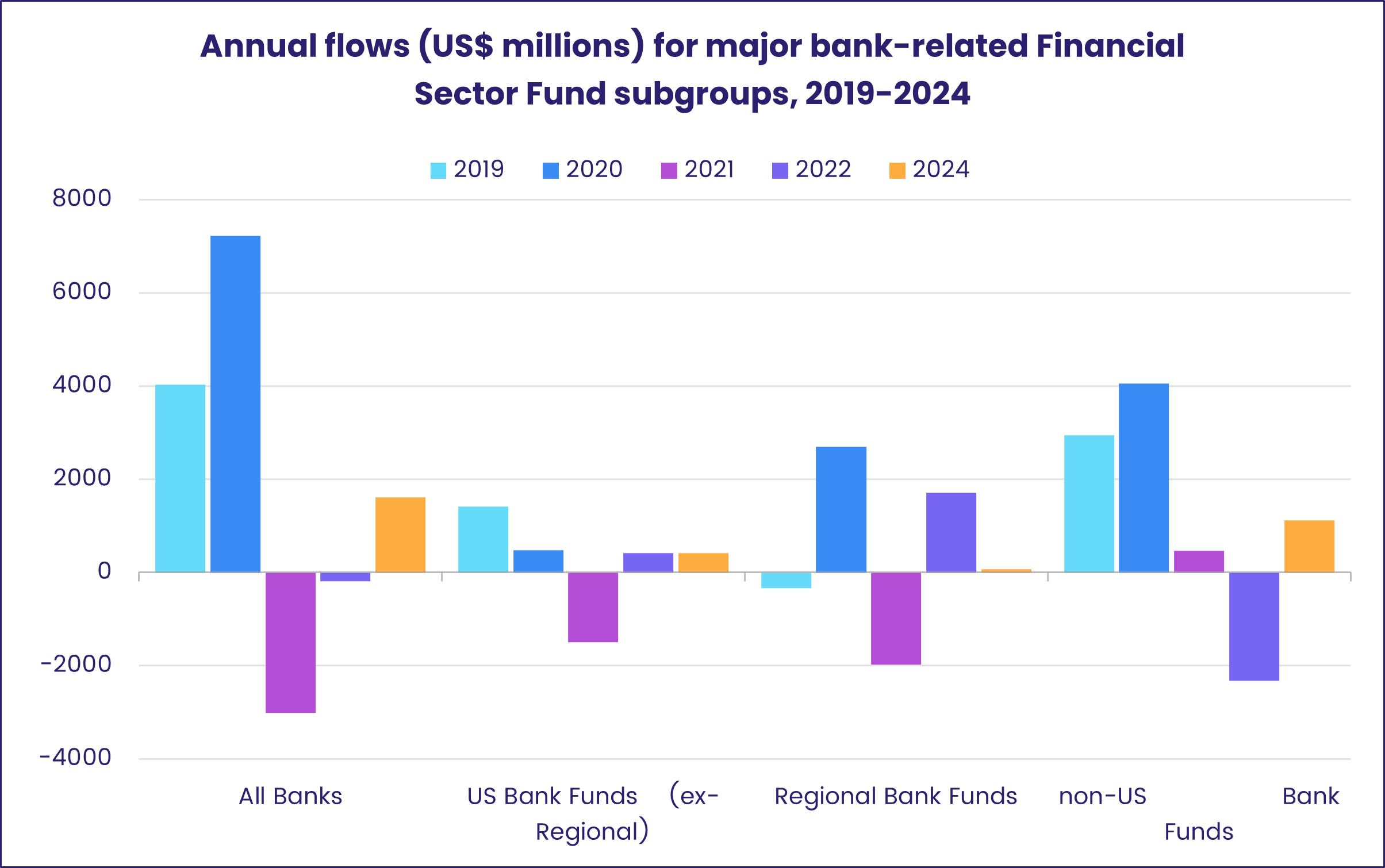

For the first time in six weeks, the number of EPFR-tracked Sector Fund groups reporting inflows (6) outweighed those reporting outflows (5) as investors responded positively to promising 4Q24 US corporate earnings reports. Flows to the usual suspect – Technology Sector Funds – had a “wait your turn” feel, dipping below the $100 million mark, as reports from JP Morgan, Citigroup, Wells Fargo and Goldman Sachs kept the spotlight on Financials Sector Funds which pulled in over $1 billion.

A single fund tracking an S&P Financials benchmark accounted for nearly all of this week’s headline number, and six of the remaining top 15 with the biggest inflows had “bank” in their fund or benchmark name. A subgroup of all US Bank Funds pulled in nearly $300 million which excludes the five Regional Bank Funds that saw a collective $283 million flow out.

The Real Estate Sector Fund group also fared well with their fourth inflow of the past seven weeks, even though REIT Funds suffered their heaviest collective redemption in seven weeks and snapped a two-week inflow streak, and Consumer Goods Sector Funds recorded back-to-back inflows for the first time since late November. Each of the final two days of the latest reporting period saw $200 million flow in.

Industrials Sector Funds snapped a two-week run of outflows. Half of the top 10 funds with the biggest inflows this week were Aerospace & Defense ETFs, and another two were shipbuilding related. All Aerospace & Defense Funds, a group that saw just three outflows during 4Q24, posted inflows at a four-week high. General Dynamics’ shipbuilding division was just awarded a nearly $200 million contract to help in building Virginia-class submarines.

Bond and other Fixed Income Funds

Helped by investors still making up for the yield famine between 2009 and 2021, EPFR-tracked Bond Funds continue to shrug off signs that the ability of primary debt markets to absorb ever growing amounts of sovereign debt may not be unlimited. During the week ending Jan. 15, they pulled in another $11 billion, lifting their year-to-date total over the $30 billion mark. That, for now, maintains the $15 billion-a-week pace that underpinned last year’s record-setting total of $805 billion.

At the country and regional level, the headline numbers ranged from an outflow of $314 million for Asia Pacific Bond Funds to an inflow of $8.2 billion for US Bond Funds. Asset class flows again highlighted the willingness to trade risk for returns, with Bank Loan Funds adding to their current inflow streak and High Yield Bond Funds chalking up consecutive weekly inflows for the first time since mid-November.

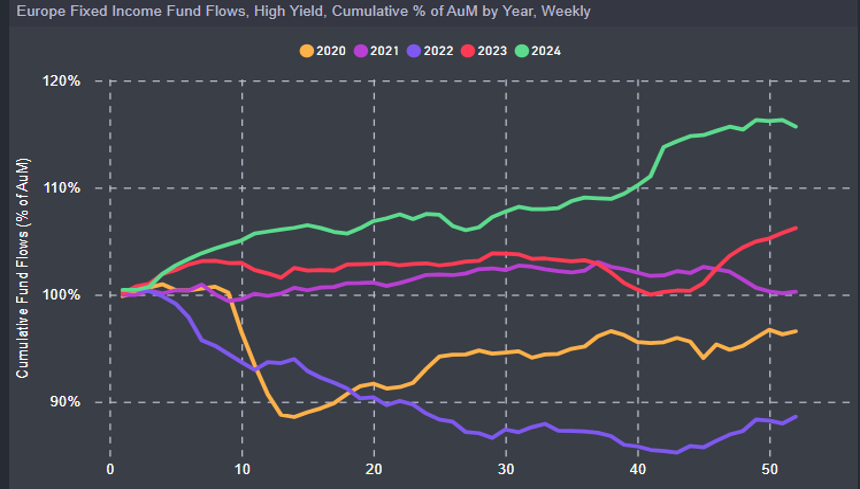

Europe High Yield Bond Funds, which set a new inflow record in 2024, have yet to regain the momentum they lost during the final weeks of last year. The latest week saw redemptions for the third time in the past four weeks as investors weigh tight spreads relative to investment grade debt and impact of weak regional growth on default rates.

At the country level, redemptions from UK Bond Funds climbed to an 18-week high and flows to Europe ex-UK Regional Bond Funds greatly exceeded those to Europe Regional Funds as concerns about the British government’s tax-and-spend policies continue to roil the UK sovereign debt market.

Redemptions from Japan Bond Funds were even more eye-catching, hitting a level last seen in mid-3Q23, with foreign domiciled funds taking the biggest hit as Bank of Japan Governor Kazuo Ueda signaled that another rate hike is a possibility when bank policymakers meet next week.

Emerging Markets Bond Funds posted another collective outflow driven by funds with hard currency mandates. Flows into Frontier Markets Bond Funds climbed to a 13-week high, Sharia Bond Funds recorded their seventh straight inflow, while funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their 10th outflow over the past 12 weeks.

A majority of the US Bond Fund sub-groups recorded inflows during the second week of January. Among the exceptions were Intermediate Term Corporate and Sovereign Funds, with the latter posting their biggest outflow since late 4Q23, and US Bond Collective Investment Trusts (CITs) with their 22nd outflow of the past 23 weeks though it was the smallest since March.

Did you find this useful? Get our EPFR Insights delivered to your inbox.