A year defined by the shock of the Covid-19 pandemic ended with $600 stimulus checks on their way to millions of Americans, the UK and European Union making guarded toasts to a new trade deal and the number of people vaccinated against the coronavirus climbing towards the 10 million mark. Benchmark US equity indexes hit new record highs in late December and consensus global GDP forecasts anticipate over 5% growth in 2021.

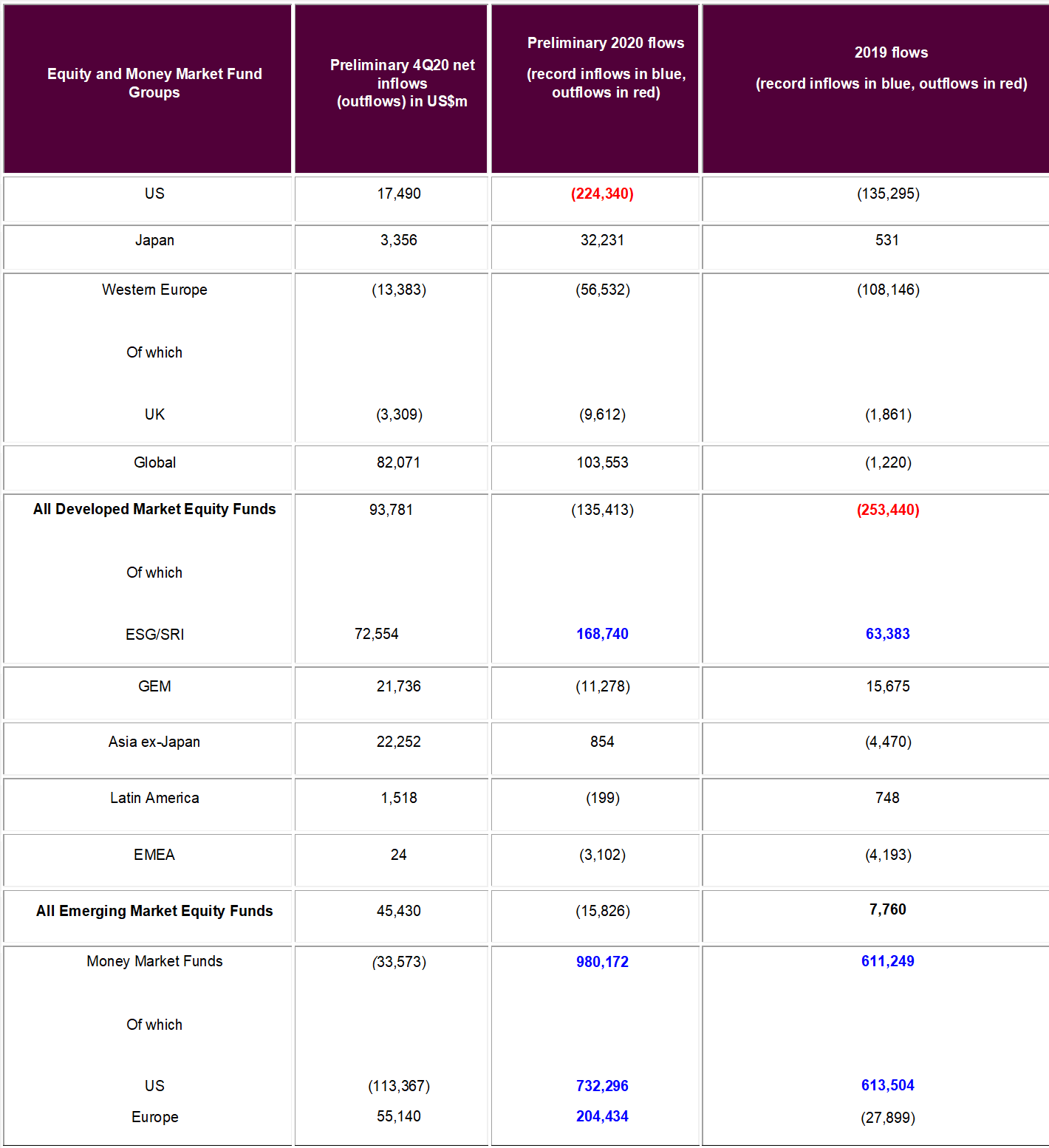

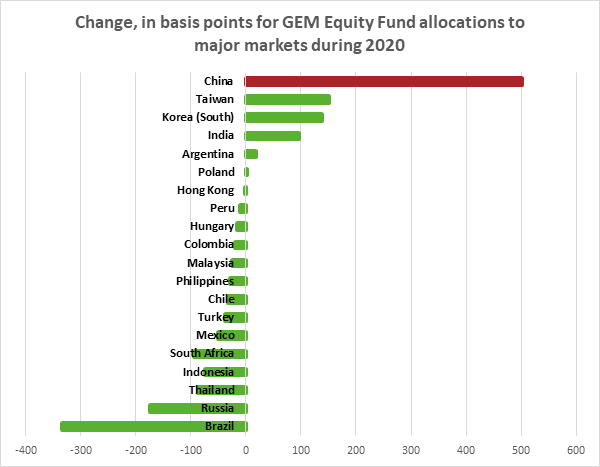

Mutual fund investors ended 2020 steadily rebuilding their exposure to emerging markets equity and debt, rotating from actively managed funds to lower cost ETFs, adding to their hedges against inflation, pumping more money into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates and buying into the post-pandemic technology, healthcare and consumer rebound narratives. EPFR-tracked SRI/ESG Equity and Bond Funds set new full-year inflow marks, as did Healthcare, Consumer Goods and Technology Sector Funds, and the collective AUM of all EPFR-tracked ETFs climbed past the $7 trillion mark in November.

There is plenty of cash on hand to pursue these and other themes in 2021. Money Market Funds attracted nearly $1 trillion in 2020, the personal savings rate soared in the US and other key markets, and major central banks remain committed to ultra-accommodative monetary policies.

Did you find this useful? Get our EPFR Insights delivered to your inbox.