April is known for its showers, warming trends and sudden changes in climate. This April, it has been missiles and attack drones that made up the showers, prices that have stayed warm and the investment climate that has shifted abruptly.

Flows for EPFR-tracked funds in mid-April reflected this unsettled outlook. Redemptions from Israel Equity Funds jumped to 44-week high, money flowed out of Europe Equity Funds for the 51st time over the past 12 months, US and Japan Equity Funds posted consecutive weekly outflows for the first time since mid-January and early December, respectively, and High Yield Bond Funds recorded their biggest outflow in just over six months.

The latest week also saw a record-setting outflow from US Money Market Funds as millions of American businesses and individuals filed their 2023 tax forms, and another hefty outflow – the biggest since late 1Q23 – for Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates.

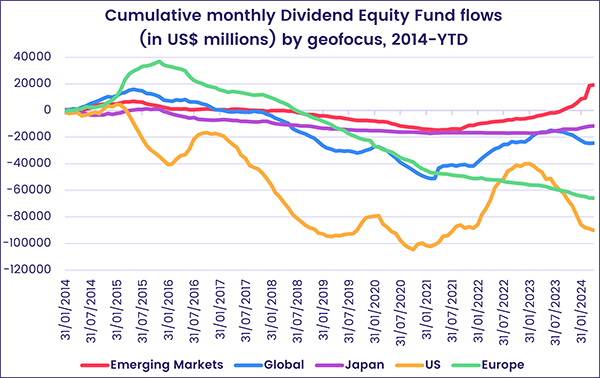

Overall, the week ending April 17 saw Equity Funds posted a collective net outflow of $7.7 billion, with Dividend Equity Funds seeing their longest run of inflows since September come to an end, while $802 million flowed out of Alternative Funds, $2.7 billion out of Balanced Funds and $159 billion out of Money Market Funds.

At the asset class and single country fund levels, redemptions from Silver Funds hit their highest level since mid-1Q21, Inflation Protected Bond Funds saw money flow out for the 11th time year-to-date and Bank Loan Funds recorded their biggest outflow since the first week of January. Flows into China Bond Funds climbed to a 16-week high, Austria Equity Funds posted their 15th consecutive outflow and Brazil Money Market Funds recorded their biggest inflow since mid-2Q22.

Emerging markets equity funds

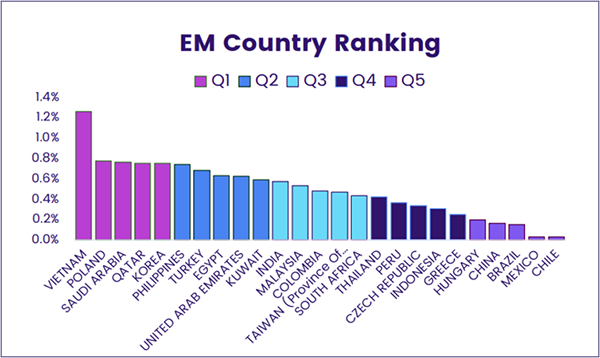

The prospect of only one cut in US interest rates this year and the specter of all-out war between Israel and Iran weighed on EPFR-tracked Emerging Markets Equity Funds in mid-April. The group posted its biggest collective outflow since the final week of October as redemptions from the diversified Global Emerging Markets (GEM) Equity Funds hit a 24-week high and Latin America Equity Funds posted their sixth consecutive outflow.

Investors pulled money out of retail share classes for the 15th time year-to-date, but Leveraged EM Equity Funds recorded their second-biggest inflow so far this year and EM Dividends added to their latest inflow streak.

Asia ex-Japan Equity Funds were the one major regional group to attract fresh money as India Equity Funds extended their inflow streak to 57 weeks and Taiwan (POC) Equity Funds absorbed over $1 billion. In the case of the latter, seven of the top 10 funds ranked by inflows for the week were dividend funds. These inflows offset the sixth straight outflow from China Equity Funds – the longest such run since 2Q20 – despite data showing better than expected, manufacturing-driven growth during the first quarter.

China is now in the bottom quintile of EPFR’s weekly EM rankings, a bucket it currently shares with four of the major Latin American markets. Uncertainty about Chinese growth and the impact of higher-for-longer US interest rates have sapped investor appetite for this region, although Brazil Equity Funds did post their biggest inflow so far this year during the latest week.

With Iranian drones and missiles flying towards Israel, the backdrop for EMEA Equity Funds got worse rather than better during the second full week of April. Redemptions from Poland and Israel Equity Funds hit 13 and 44-week highs, respectively, Turkey Equity Funds added to their longest outflow streak in over eight months and funds dedicated to the flood-stricken United Arab Emirates (UAE) recorded their second-largest weekly outflow since mid-3Q22.

Developed markets equity funds

All but one of the major EPFR-tracked Developed Markets Equity Fund groups experienced net redemptions during the week ending April 17 as diminishing expectations of interest rate cuts, rising geopolitical risks and key indexes dropping away from their late March highs kept investors in a defensive frame of mind. Canada Equity Funds were the exception, with inflows climbing to a year-to-date high.

Japan Equity Funds posted consecutive weekly outflows for the first time this year, even though flows into retail share classes climbed to a five-week high, Japan Dividend Funds recorded their 13th inflow of the year so far and China-domiciled Japan Equity Funds extended an inflow streak stretching back to late November. Investors are worried that Japan will be hit hard if tensions in the Middle East do drive up oil prices, given that the commodity is denominated in US dollars and Japan imports 99% of the oil it uses.

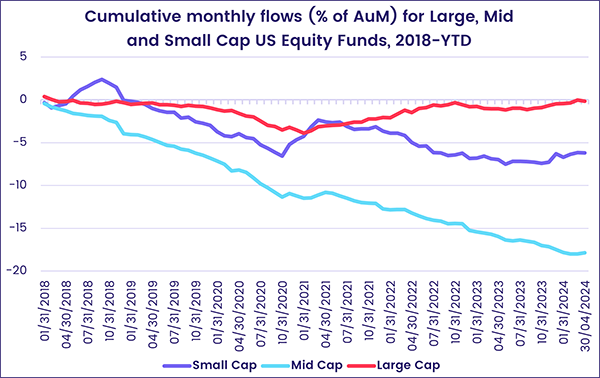

Oil production in the US has soared to record levels, but the market’s recent focus is on the financial conditions facing US firms as interest rates remain high, the US Federal Reserve continues to unwind its balance sheet and banks tighten their lending standards. US Equity Funds posted their third outflow over the past five weeks as redemptions from retail share classes jumped to an 18-week high.

Fears of another energy shock kept the pressure on Europe Equity Funds, which posted another collective outflow despite cautious optimism that current inflationary trends in the Eurozone will allow the currency Union’s central bank to start cutting interest rates at the end of the current quarter. At the country level, redemptions from Germany and Sweden Equity Funds hit six and 54-week highs, respectively, and UK Equity Funds posted their 21st consecutive outflow.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, posted an outflow driven by funds with fully global rather than ex-US mandates.

Global sector, industry and precious metals funds

With the number of projected US interest rates this year dwindling from six to three or less, investors kept cutting their exposure to interest-rate sensitive sectors during mid-April. Of the 11 major EPFR-tracked Sector Fund groups, eight posted outflows during the latest week that ranged from $25 million for Infrastructure Sector Funds to $740 million for Commodities/Materials Sector Funds.

Redemptions from Commodities/Materials Sector Funds hit a nine-week high, with a single Gold Miners ETF accounting for 60% of the headline number. Overall, Gold Funds within Commodities/Materials Sector Funds – or Gold Mining Funds – saw redemptions climb to their highest level since mid-June 2019. Among the other sub-groups, Timber & Forestry Fund flows have been negative for much of the past two years with only one monthly inflow since May 2022.

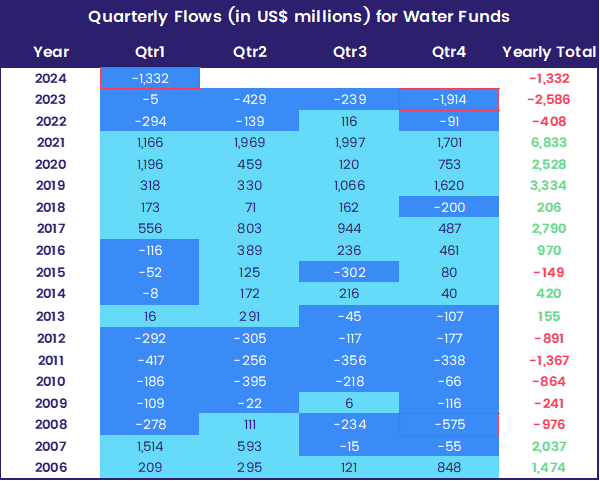

Utilities Sector Funds, which have posted 10 straight monthly outflows, added to their current weekly redemption streak which stands at 14 weeks. Year-to-date outflows now stand at over $5 billion. Drilling down to the fund level, those with ties to the water industry featured prominently in the lists of individual funds experiencing the heaviest redemptions.

Investors have now pulled money out of dedicated Water Funds 34 of the past 35 weeks. Before 3Q23, quarterly redemptions for this group had topped $500 million only once (in 4Q08). But outflows in the final quarter of last year reached a record $1.9 billion and, so far this year, another $1.5 billion has flowed out.

With China’s property crisis lingering and mortgage rates in the US jumping after “higher-for-longer” signals from the US Federal Reserve, Real Estate Sector Funds posted outflows for a second consecutive week. US and Europe Real Estate Sector Funds have both seen roughly $1.7 billion flow out so far this year.

Of the three groups attracting fresh money, Technology Sector Funds posted the biggest inflow ahead of earnings reports from key plays that investors hope will shed further light on the outlook for artificial intelligence applications.

Bond and other fixed income funds

More money flowed into EPFR-tracked Bond Funds during the second week of April, but the headline number was well shy of their $17 billion weekly average during the first quarter. Once again, investors sent mixed messages when it came to their risk appetite, with outflows from Bank Loan and High Yield Bond Funds climbing to 11 and 27-week highs, respectively, while Emerging Markets Bond Funds recorded their biggest weekly inflow since early 1Q23.

Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates added another $1 billion to their year-to-date total, which now exceeds $20 billion. Two funds investing in corporate green bonds garnered the biggest inflows during March while a carbon capture fund turned in the best performance.

Among the major Developed Markets Bond Fund groups, US Bond Funds posted their smallest collective inflow since the final week of January, Global Bond Funds absorbed fresh money for the 15th time so far this year, money flowed out of Asia Pacific Bond Funds for the third week running and investors steered another $1.3 billion into Europe Bond Funds.

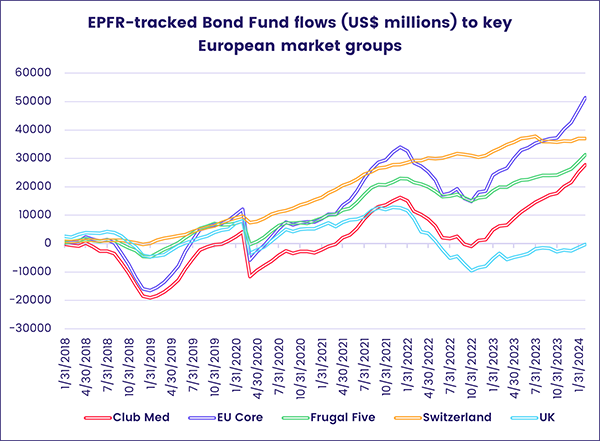

While the latest week saw Sweden Bond Funds post their ninth straight inflow and flows into Netherlands Bond Funds hit an 11-week high, flows from all EPFR-tracked Bond Funds whose mandates allow them to invest in Europe have favored core and Mediterranean markets over the so-called ‘Frugal Five’ nations.

The latest flows into Emerging Markets Bond Funds extended that groups longest inflow streak in over 14 months and was driven by funds with Asia ex-Japan and local currency mandates. Flows into China Corporate Bond Funds hit their highest total since the final week of 2Q22.

It was a different story for US Bond Corporate Funds, which posted their biggest outflow since late September. Among US Sovereign Bond Funds, long-term was the preferred duration. Foreign-domiciled US Bond Funds have yet to post a weekly outflow so far this year.

The diversified Global Bond Funds remain popular with retail investors, who have committed fresh money to this group 14 of the 16 weeks YTD.

Did you find this useful? Get our EPFR Insights delivered to your inbox.