The second week of April offered investors two data points, the latest US jobs report and the inflation numbers for March, that they hoped would make the case for a pause in the Federal Reserve’s tightening cycle. Although headline inflation in March came in at a one-year low and the number of new non-farm jobs created was the least in over two years, investors were left hoping that the Fed will focus on the trends rather than the actual, positive numbers.

Between waiting for these data points, celebrating Easter and, in the US, preparing taxes, flows to most EPFR-tracked fund groups remained subdued. Once again, Money Market Funds stood head and shoulders above other groups when it came to attracting fresh money. Most Country and Regional Fund groups experienced redemptions — or posted inflows — that equaled less than 0.15% of their AUM.

There was some conviction in the flows to Sector Fund groups as the 1Q23 corporate earnings season kicks off in the US Technology Sector Funds posted their biggest outflow since late 4Q18 while flows into Financial, Healthcare/Biotechnology and Telecoms Sector Funds hit nine, 19 and 243-week highs respectively.

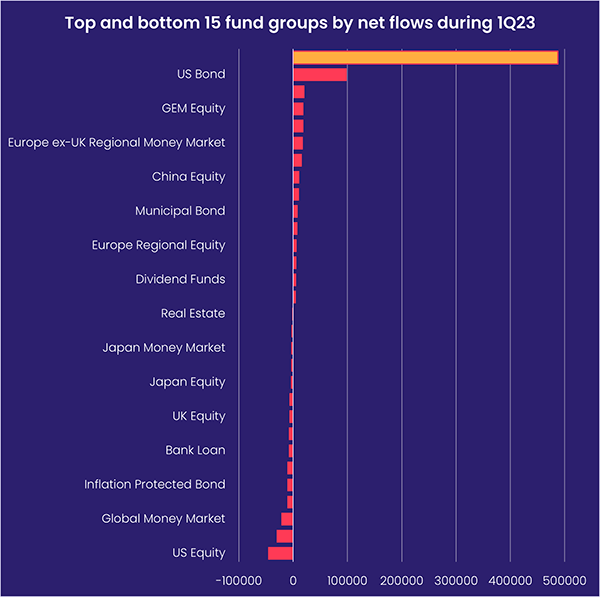

Overall, the week ending April 12 saw EPFR-tracked Bond Funds post a collective inflow of $2.2 billion while Equity Funds absorbed $3.9 billion. A net $861 million flowed out of Alternative Funds and $1.2 billion from Balanced Funds. Flows into Money Market Funds totaled $51 billion, with US MM Funds again accounting for the biggest share of that money after a first quarter where they absorbed nearly $500 billion.

At the asset class and single country fund level, Silver and Gold Funds extended their longest inflow streaks since 1Q22 and 1H20, respectively, Convertible Bond Funds posted their 17th outflow since mid-December and money flowed out of Municipal Bond Funds for the seventh time in the past eight weeks. Spain Equity Funds chalked up their biggest outflow in over 16 months, flows into India Equity Funds climbed to a seven-week high and UK Bond Funds added to their longest run of outflows since 3Q22.

Emerging markets equity funds

EPFR-tracked Emerging Markets Equity Funds posted consecutive weekly outflows for the first time year-to-date during the second week of April as the outlook for Chinese and US growth remained uncertain. China Equity Funds, which recorded inflows only seven times during 2022, chalked up their third straight outflow and sixth in the past 10 weeks.

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did take in fresh money for the 21st consecutive week. So far this year, only Latin America SRI/ESG Equity Funds have outperformed their non-SRI/ESG counterparts. The other three major regional groups, EMEA, Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds have seen SRI/ESG funds underperform non-SRI/ESG funds by margins ranging from 1.3% to 31.4%.

The latest redemptions from China Equity Funds were the biggest in nearly two months. In addition to a spike in Sino-US tensions tied to Taiwanese President Tsai Ing-wen’s stopover in the US, investors remain uncertain just how strongly China’s economy will rebound given the slowing global economy, domestic debt issues and the caution being shown by Chinese consumers.

The impact of the deteriorating relations between China and the US is captured in the latest China Share Class Allocations (CSCA) data. Both active and passive funds tracked by EPFR have significantly cut the value of US-listed Chinese equity in their portfolios over the past three years.

Among the other major Asia ex-Japan Country Fund groups, flows to India Equity Funds climbed to a seven-week high, Vietnam Equity Funds posted only their second outflow since the beginning of October, Philippines Equity Funds experienced net redemptions for the eighth time in the past 10 weeks and Korea Equity Funds chalked up their second largest inflow YTD.

Brazil Equity Funds were the biggest contributor to the headline number for all Latin America Equity Funds as investors redeemed over $100 million for the third time in the past six weeks. Investors remain worried that President Lula da Silva’s desire for greater social spending is at odds with their desire for fiscal discipline and central bank independence.

Among the EMEA Equity Fund universe, those dedicated to Turkey are in the spotlight as the country counts down to a general election in mid-May. The architect of a policy mix that pushed the Turkish inflation rate over 80%, Turkish President Recep Tayyip Erdogan, faces a stiff challenge that could lead to a contested outcome as Erdogan tries to extend his two decades in office. Turkey Equity Funds posted consecutive outflows for the first time since the second week of February.

Developed markets equity funds

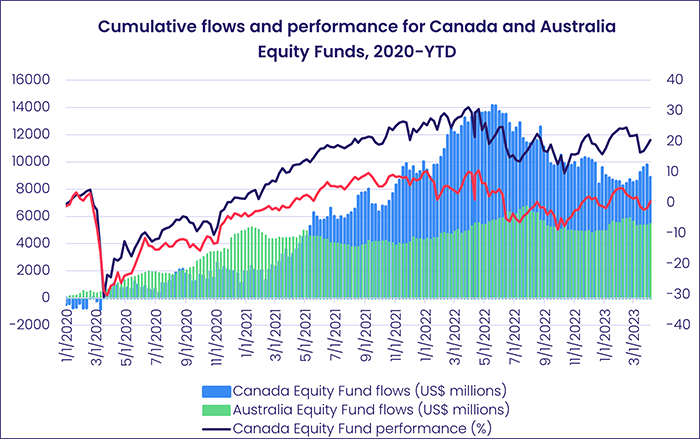

Despite fears that recent job creation and inflation data invites at least one more rate hike from the US Federal Reserve, EPFR-tracked Developed Markets Equity Funds posted their biggest collective inflow since the final week of January. Flows into US Equity Funds climbed to a 10-week high and, in combination with the inflows recorded by Global, Canada and Australia Equity Funds, more than offset the $1 billion that investors pulled out of both Europe and Japan Equity Funds.

With China’s economy tabbed for 5% growth, the Reserve Bank of Australia’s recent decision to pause its tightening cycle has prompted investors to rebuild some of their exposure to this market. Australia Equity Funds have attracted fresh money for three of the past four weeks. Meanwhile, funds dedicated to the other major developed markets resource play, Canada, have posted inflows in five of the past six weeks.

Allocations to Australia and Canada among the diversified Global ex-US Equity Funds peaked in August and October of last year, respectively, and have lost ground since. That group recorded modest inflows, their first in three weeks, while their counterparts with fully global mandates posted their third consecutive inflow.

Japanese stocks were lifted during the week by US investor Warren Buffet’s bullish remarks and the commitment by incoming Bank of Japan Governor Kazuo Uedo to maintain – at least for now — the ultra-accommodative policies championed by his predecessor Haruhiko Kuroda. But Japan Equity Funds recorded their second straight outflow, although flows into foreign domiciled funds hit a 17-week high and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow since the third week of 3Q22.

Europe Equity Funds also saw over $1 billion flow out, with the bulk of those redemptions coming from diversified rather than single market groups. Investors expect the European Central Bank to raise interest rates again at its May meeting and remain fearful of further bank-related shocks, so cashing in recent gains is appealing.

Hopes of a pause in US interest rate hikes were dented by the continued growth – albeit at a slower pace – in non-farm jobs and the fact core inflation is now higher than the headline number. But investors remain confident the end is in sight and that, with Fed policy meetings in May, June and July, rate setters have several chances to act on new data. US Equity Funds took in over $4 billion with Large Cap Blend and Growth Funds absorbing the bulk of the fresh money.

Global sector, industry and precious metals funds

With most eyes focused on a slew of earnings reports from regional, national and international US financial companies, the most striking number in the latest EPFR-tracked Sector Fund flows was delivered by China Technology Sector Funds.

In a week when flows to the 11 major groups ranged from a $1.1 billion inflow to a $2 billion outflow, Technology Sector Funds posted their third largest weekly outflow since EPFR started tracking them in 2000. By far the biggest contributor to that headline number were China Technology Sector Funds which experienced record-setting outflows. “The proposal to break Alibaba into several divisions, the likelihood that developments in artificial intelligence will stoke tensions with the US and Europe, and China’s move to regulate this emerging driver have all hit sentiment towards Chinese technology plays,” noted EPFR’s Research Associate, Kirsten Longbottom.

Among the Technology Sector Fund sub-groups, Semiconductor Funds posted their heaviest outflow since the end of 2Q21 to start April and saw more money flow out during the latest week and Cloud Computing Funds chalked up the biggest redemption since this week last year.

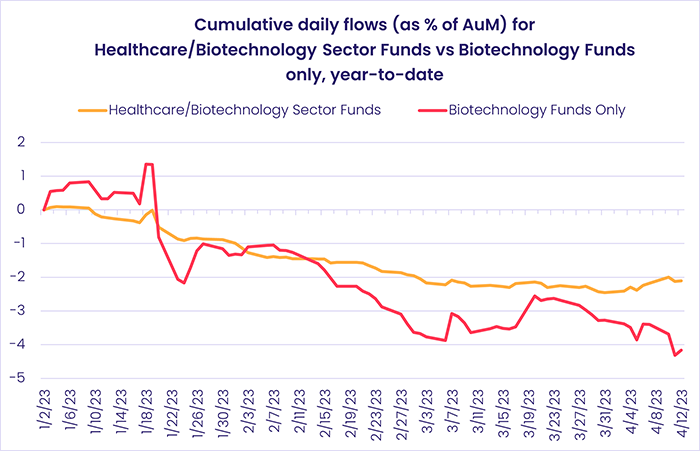

China Healthcare/Biotechnology Sector Funds also posted a weekly flow record. In their case, it was an inflow that extended their streak to 12 weeks and $3.5 billion. Overall, Healthcare/Biotechnology Sector Funds collectively snapped an 11-week run of redemptions with their largest inflow in 19 weeks. Year-to-date, $6.3 billion has flowed out of this group, a trend we have not seen since the second half of 2019. Year-to-date, dedicated Biotechnology Funds have posted outflows equal to 4% of their AUM on January 1 compared to 2% for the larger sector group.

Elsewhere, Telecoms Sector Funds’ six-week run of inflows reached $1.5 billion after nearly $1 billion flowed in this week – the largest since the end of October 2018 – backed almost entirely by a single communication services funds that sits in the US Telecoms Sector Fund group.

Bond and other fixed income funds

The week ending April 12 saw EPFR-tracked Bond Funds post their 13th inflow year-to-date. The total was, however, the third lowest as investors digested mixed data that did not support their hopes the US Federal Reserve will follow Australia’s central bank in pausing its rate hiking cycle when it meets in early May.

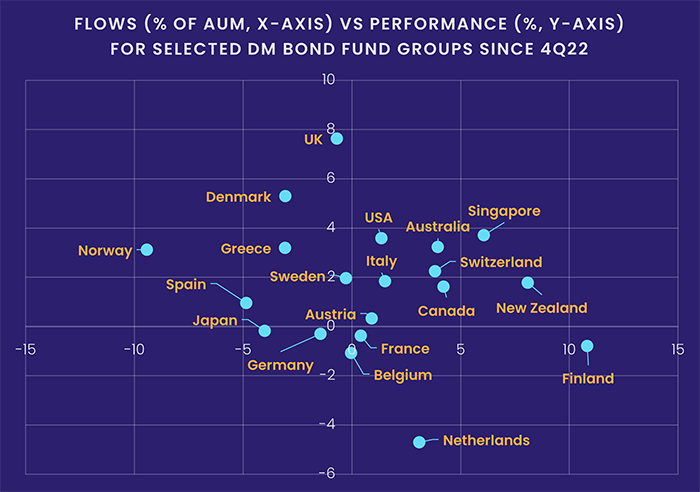

Among the major groups by geographic focus, US, Europe and Canada Bond Funds posted solid inflows while Emerging Markets, Global and Asia Pacific Bond Funds recorded an outflow. At the asset class level, Inflation Protected Bond Funds narrowly extended their longest outflow streak since 2013, High Yield Bond Funds posted their seventh outflow in the past nine weeks and Mortgage-Backed Bond Funds posted their 12th inflow year-to-date.

Flows to Europe Bond Funds were driven by the groups with regional mandates, while most of the country-level groups attracted limited interest. Redemptions from Italy Bond Funds climbed to a seven-week high and UK Bond Funds, which carried a 16-week inflow streak into March, posted their sixth straight outflow despite delivering the best collective performance YTD among major Developed Markets Country Fund groups.

Emerging Markets Bond Funds racked up their eighth straight outflow with Hard Currency EM Funds surrendering over three times the amount that flowed out of their local currency counterparts. At the country level, Korea Bond Funds posted their 19th inflow in the past 21 weeks and China Bond Funds their 49th outflow over the past 12 months.

Investors pulled money out of US Bond Fund retail share classes for the sixth week running and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their third outflow in the past five weeks. But Intermediate Term Mixed and Long Term Sovereign Funds both pulled in over $1 billion.

Global Bond Funds, the largest of the diversified Bond Fund groups, posted their third outflow of the past four weeks. So far this year, funds with fully global mandates have attracted four times the amount of fresh money than their ex-US counterparts have taken in. The US is the biggest single country allocation for Global Funds, accounting for over half of the average portfolio, while Japan, the UK and France take up the biggest shares6 of Global ex-US Fund portfolios.

Did you find this useful? Get our EPFR Insights delivered to your inbox.