Reports that a Chinese company had built and trained an open-source artificial intelligence (AI) model in record time, and at a fraction of the costs incurred by US developers, roiled US equity markets during the final week of January. Investors found themselves revisiting assumptions about the major drivers of US markets such as Nvidia, Alphabet and Meta.

Fund flows during the final week of January suggest that many of those investors kept faith with their previous assumptions about AI. Flows into EPFR-tracked Technology Sector Funds hit a 16-week high, with a 3x leveraged bull fund leading the way.

While DeepSeek’s model dominated the headlines, the latest week was also marked by central bank policy meetings, corporate earnings reports and more executive orders from newly installed US President Donald Trump. Risk appetite remained high, with Bank Loan, High Yield and Emerging Markets Bond Funds all pulling in significant sums, flows into Frontier Markets Equity Funds climbing to a six-week high and Momentum Funds recording their fifth straight inflow and 15th since the beginning of 4Q24.

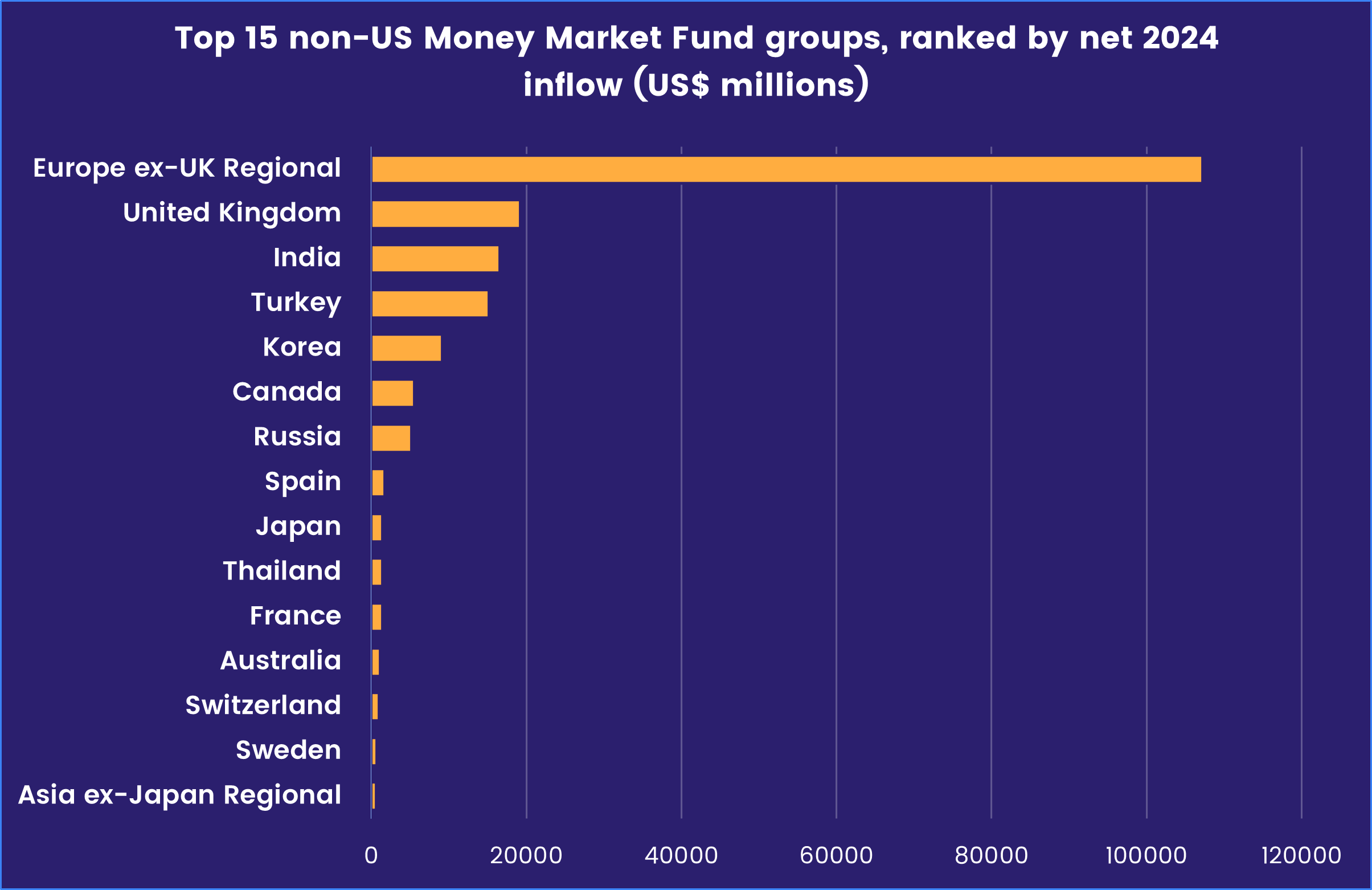

Overall, the week ending Jan. 29 saw a net $23.9 billion flow into EPFR-tracked Equity Funds while Bond Funds took in $17.6 billion and Alternative Funds $251 million. Net redemptions from Balanced and Money Market Funds totaled $624 million and $12.5 billion, respectively, with US-mandated funds accounting for the bulk of the latter’s headline number. Despite US Money Market Funds’ big footprint – they took in over $750 billion last year – appetite for other groups has been growing. Ranked by flows, the next 15 groups attracted a combined $187 billion in 2024.

At the asset class fund level, Dividend Equity Funds recorded their 15th inflow during the past 16 weeks, Physical Gold Funds extended their longest run of inflows since October and flows into Inflation Protected Bond Funds hit a year-to-date high.

Emerging Markets Equity Funds

China’s AI story got an upgrade in late January as DeepSeek’s model shook, at least for a few days, assumptions about US leadership in the field. China Equity Funds took in over $1 billion during the latest week as they posted only their third inflow since the second week of October, lifting the headline number for all EPFR-tracked Emerging Markets Equity Funds into positive territory.

With US President Donald Trump still setting out his protectionist stall, flows outside of China-mandated funds ranged from modest to negative. Retail share classes added to a redemption streak stretching back to mid-July and the diversified Global Emerging Markets (GEM) Equity Funds posted their fifth straight outflow.

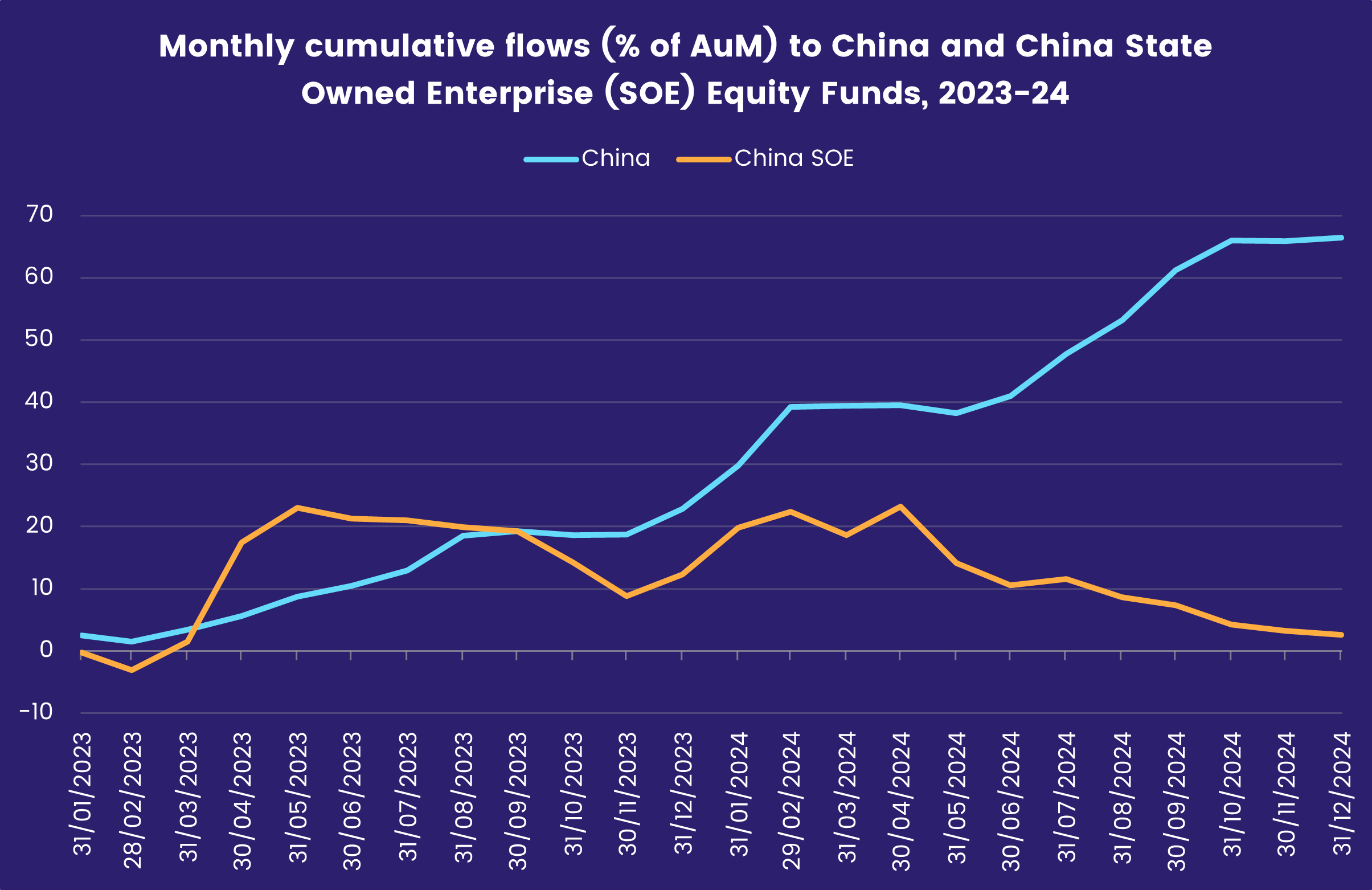

The latest flows into China Equity Funds came ahead of the Lunar New Year holiday, when millions of workers will leave their jobs and travel home – and abroad – to celebrate the transition from the Year of the Dragon to the Year of the Snake. Although China Equity Funds overall are coming off a record-setting year in terms of flows, funds dedicated to state-owned enterprises (SOE) have fallen out of favor since compiling a 14-week inflow streak in 1H23.

Indian citizens will not celebrate a new year until the Diwali holiday in October. Meanwhile, its stock market is giving investors little to cheer about with the benchmark Sensex index down over 10% since its five-year run peaked in late 3Q24. Rich valuations and opportunities elsewhere have also hit India Equity Funds, with the latest week’s outflow the biggest since the Covid-19 pandemic hit in 1Q20.

EMEA Equity Funds continue to benefit from investors’ cautious optimism that the conflicts in Ukraine, Gaza and Syria will reach some form of resolution during 2025. Flows into Emerging Europe Regional Equity Funds jumped to a 21-week high and Saudi Arabia Equity Funds chalked up their fourth consecutive inflow.

Funds dedicated to Latin America are also enjoying a modest thaw, with the current run of inflows the longest since 4Q23. Brazil Equity Funds pulled in over $100 million for the second week running as investors responded to bargain prices and the administration’s assurances that it will respect the independence of Brazil’s central bank.

Developed Markets Equity Funds

Investors saw the DeepSeek-triggered sell-off as an opportunity rather than an off-ramp, steering over $20 billion into US Equity Funds during the week ending Jan. 29. Allied to the flows into Global and Canada Equity Funds, this offset modest redemptions from Europe and Japan Equity Funds and handed all EPFR-tracked Developed Markets Equity Funds their fifth consecutive inflow and 15th over the past 16 weeks.

The latest flows into US Equity Funds included the second collective inflow of 2025 for retail share classes, the sixth inflow for US Dividend Funds since mid-December and the fourth largest flows into US Equity Collective Investment Trusts (CITs) since early 3Q23. Foreign-domiciled US Equity Funds attracted another $6 billion, taking their current run of inflows to 17 weeks and $110 billion.

While US-mandated funds did not pick up any tailwind from the Federal Reserve, America’s central bank did not do what the Bank of Japan did earlier in the month and raise them. Japan Equity Funds ended the month with another outflow, as investors wrestle with the tradeoffs for consumer confidence, input costs, export competitiveness and carry trades that come with tighter Japanese monetary policy.

Analysis by EPFR’s sister division, CEIC, suggests that the BoJ’s latest rate hike was timely. “[Japanese] headline inflation surged to a 3.7% year-on-year pace in December – the steepest increase since early 2023, when global supply chain disruptions were still sending consumer prices soaring around the world,” CEIC pointed out in a recent note to clients. “Japan’s core inflation also rose (though not as sharply as the headline figure), increasing from 2.7% to 3% year-on-year. This suggests that much of the jump was driven by volatile food and energy prices. Inflation in Japan has remained above the central bank’s 2% target for more than three years.”

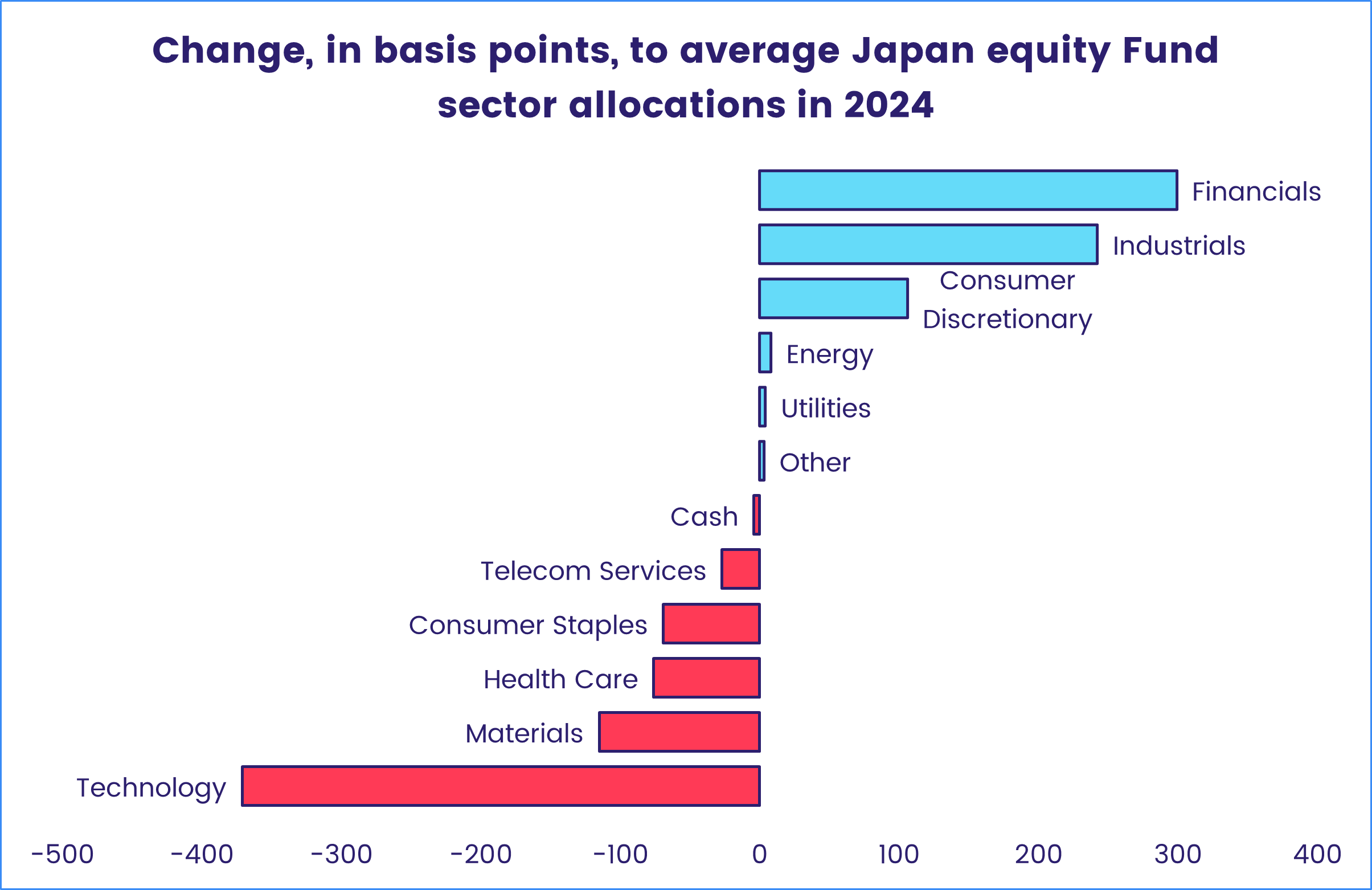

Managers of Japan Equity Funds responded last year to the changing price and interest rate environment by aggressively rotating exposure from technology stocks to financial and industrial plays.

Solid redemptions from UK Equity Funds, which came despite the country’s benchmark index pushing towards a new record high, meant that Europe Equity Funds carried a 17-week run of outflows into February. Among the Country Fund groups dedicated to markets within the EU and Eurozone, Germany Equity Funds posted their biggest outflow year-to-date while flows into Sweden Equity Funds climbed to a 33-week high.

The largest of the diversified Developed Markets Equity Funds groups, Global Equity Funds, absorbed fresh money for the sixth week in a row. More of that money went to funds with fully global rather than ex-US mandates for the fifth week running.

Global sector, Industry and Precious Metals Funds

The final week of January saw a spike in the total trading volume (the absolute value of outflows + inflows) for the 11 EPFR-tracked Sector Funds, which climbed to nearly $13 billion. This was the largest total since mid-January 2022 and the seventh largest since 2000, but $5 billion under the record trading volume experienced in mid-November 2016. Seven of the 11 EPFR-tracked Sector Fund groups posted inflows this week, with Financials and Technology Sector Funds coming out on top.

Against a backdrop colored by the claims of Chinese AI firm DeepSeek for its open-source model, Technology Sector Funds continued their longest run of inflows since mid-3Q24 with a sizable inflow of $6.5 billion this week, nearly two-thirds of which rushed in on a single day – January 27. That was backed by a record-daily inflow for Leveraged Technology Sector Funds of $2.5 billion, after experiencing outflows for eight days straight. Investors committed $1.7 billion to a bullish semiconductor ETF, and another $1.2 billion to a fund seeking to provide 2x the daily performance of Nvidia stocks throughout the reporting period.

Inflows to Consumer Goods Sector Funds hit a six-week high of nearly $500 million. This has been guided by US-dedicated Sector Funds, which posted inflows for a fifth straight week and eighth time over the last 10 weeks. Behind the headline number this week stood a consumer discretionary ETF and another ETF focused on home construction in the US. The top 10 funds with the biggest inflows also included two Leveraged Tesla Funds and spanned themes like retail, premium brands, and alcohol.

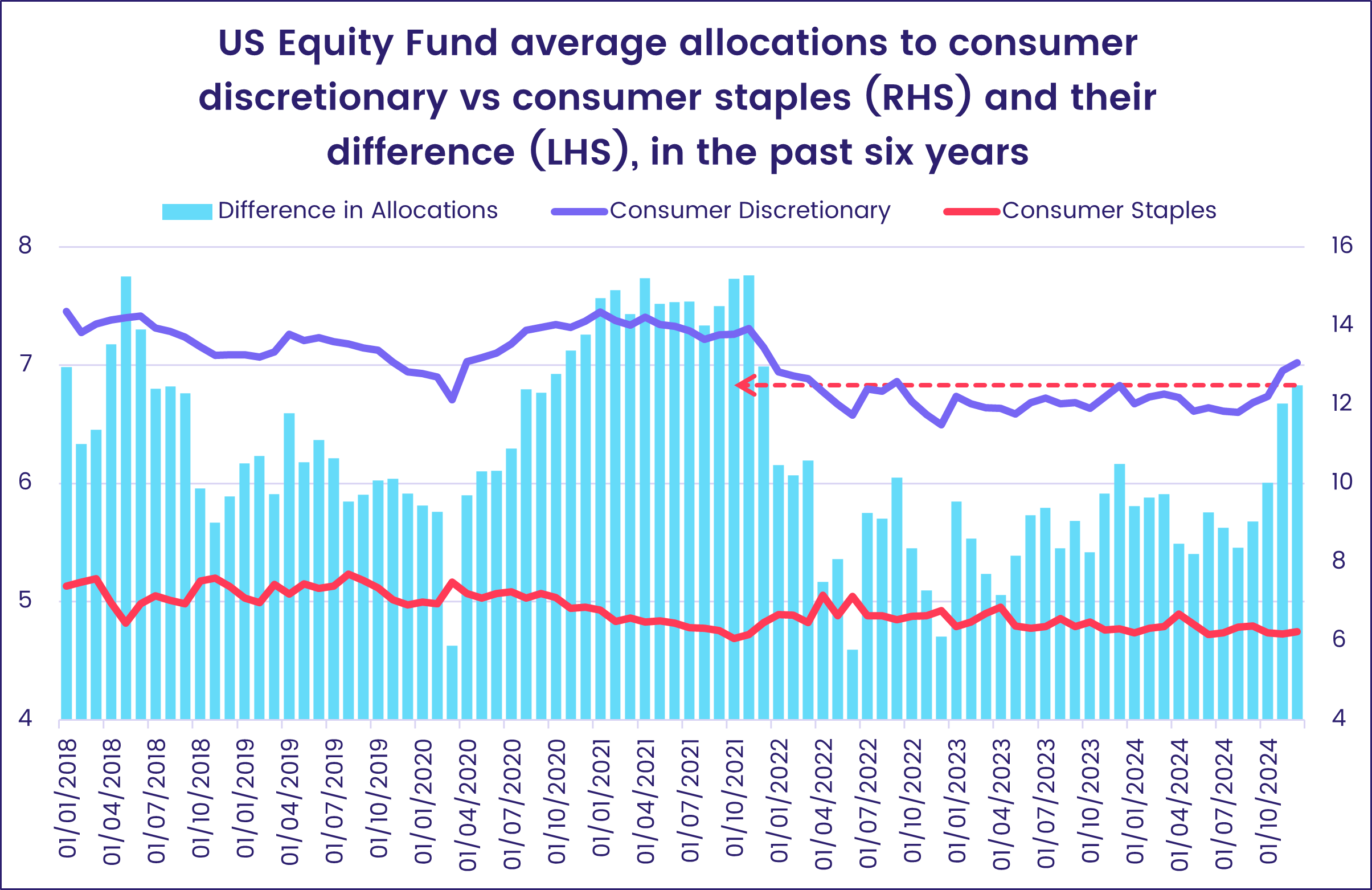

EPFR Sector Allocations data shows a notable shift from US and Global fund managers into Consumer Discretionary and away from Consumer Staples. US Equity Funds’ average allocations to consumer discretionary surpassed 13% for the first time since December 2021, and in the second half of last year increased by 1.2%. The gap between allocations to consumer discretionary vs staples has averaged higher in the past three months to 6.5%, whereas it averaged around 5.5% in the 30 weeks prior, and 6.34% in the full-history dating back to 2009.

Flows into Financials Sector Funds were the biggest since mid-January 2022, reaching above the $2 billion mark for the fourth time over the past three months. Two-thirds of the inflow this week was directed by a single ETF benchmarked to the S&P Financial Select Sector, while three of the remaining top 10 funds with the biggest inflows had “bank” in their name. A niche grouping of Regional Bank Funds posted their biggest inflow in seven weeks, while the broader US Bank Funds posted their sixth consecutive inflow, and 14th of the past 16 weeks.

Bond and other Fixed Income Funds

Fixed income investors went into the final days of January with Eurozone policy rates 0.25% lower, Japan’s 25 basis points higher and America’s on hold while US borrowing requirements ran into a reinstituted debt ceiling. They responded by committing another $16 billion to Europe, Global, US and Canada Bond Funds and, in the emerging markets space, piling into Turkish debt.

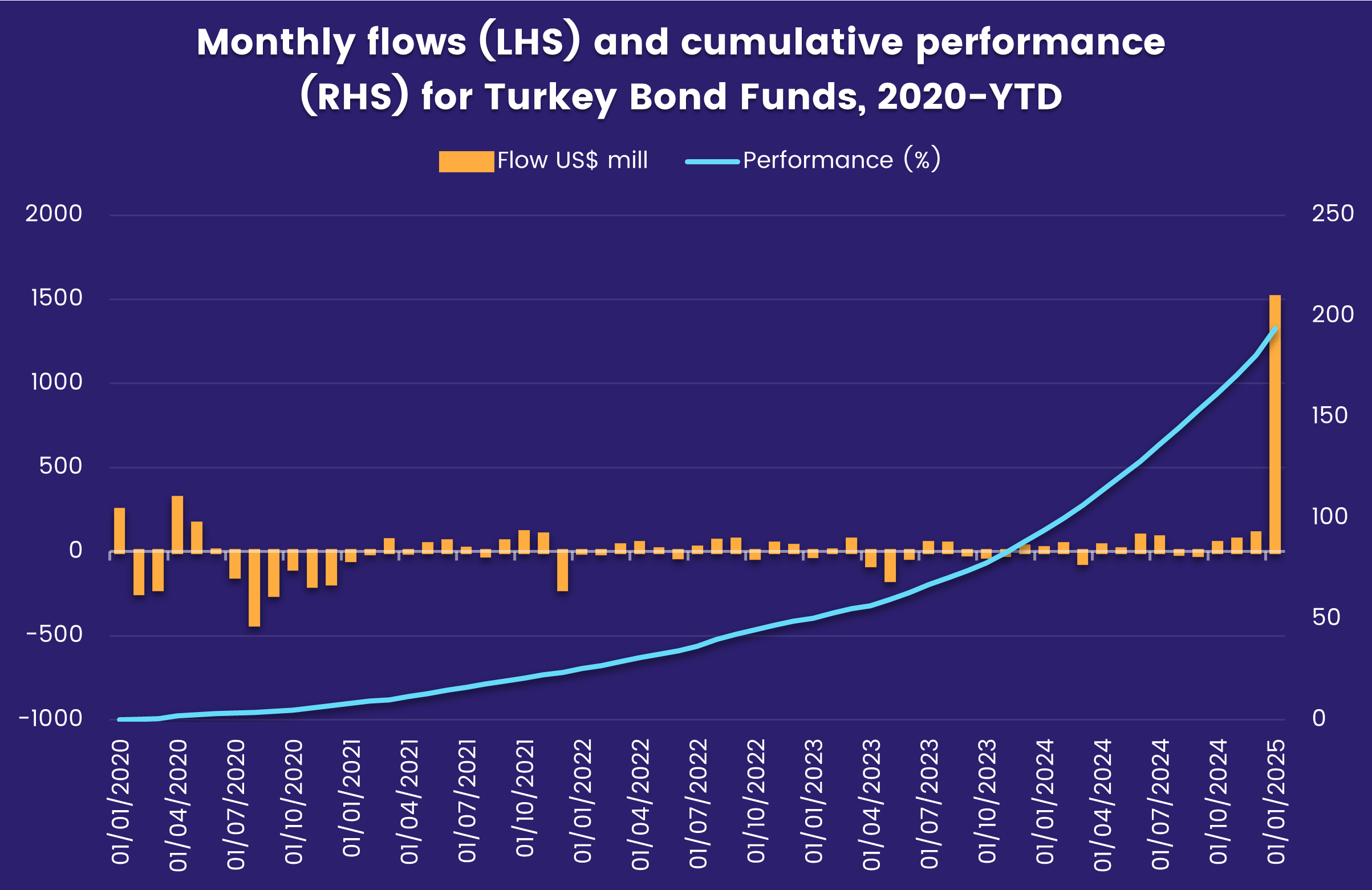

In the case of the latter development, that lifted flows into Turkey Bond Funds to a record high and allowed all EPFR-tracked Emerging Markets Bond Funds to post their biggest collective inflow since 1Q23. Flows to Turkey-mandated funds were broadly distributed, with 20 funds absorbing over $10 million and nine of those posting inflows of $50 million or more, as investors responded to Turkey’s falling inflation and improved policy environment.

Among Europe Bond Fund single country groups, flows into UK, Spain and Austria Bond Funds hit six, seven and 122-week highs, respectively, while Denmark Bond Funds posted their biggest outflow in two months. At the asset class level, Europe Corporate Bond Funds pulled in nearly six times the amount of fresh money claimed by funds dedicated to sovereign debt and Europe Total Return Funds tallied their biggest inflow in over 11 months.

Long Term US Bond Funds were in the duration sweet spot for the first time since early November and Treasury Inflation Protected Securities (TIPS) Funds extended their longest inflow streak since mid-3Q22 as US Federal Reserve policymakers cited concerns about inflation following their decision to keep interest rates on hold.

Flows to Japan Bond Funds took the opposite tack, with over $200 million redeemed, as investors digested the Bank of Japan’s third rate hike in the current tightening cycle.

Did you find this useful? Get our EPFR Insights delivered to your inbox.