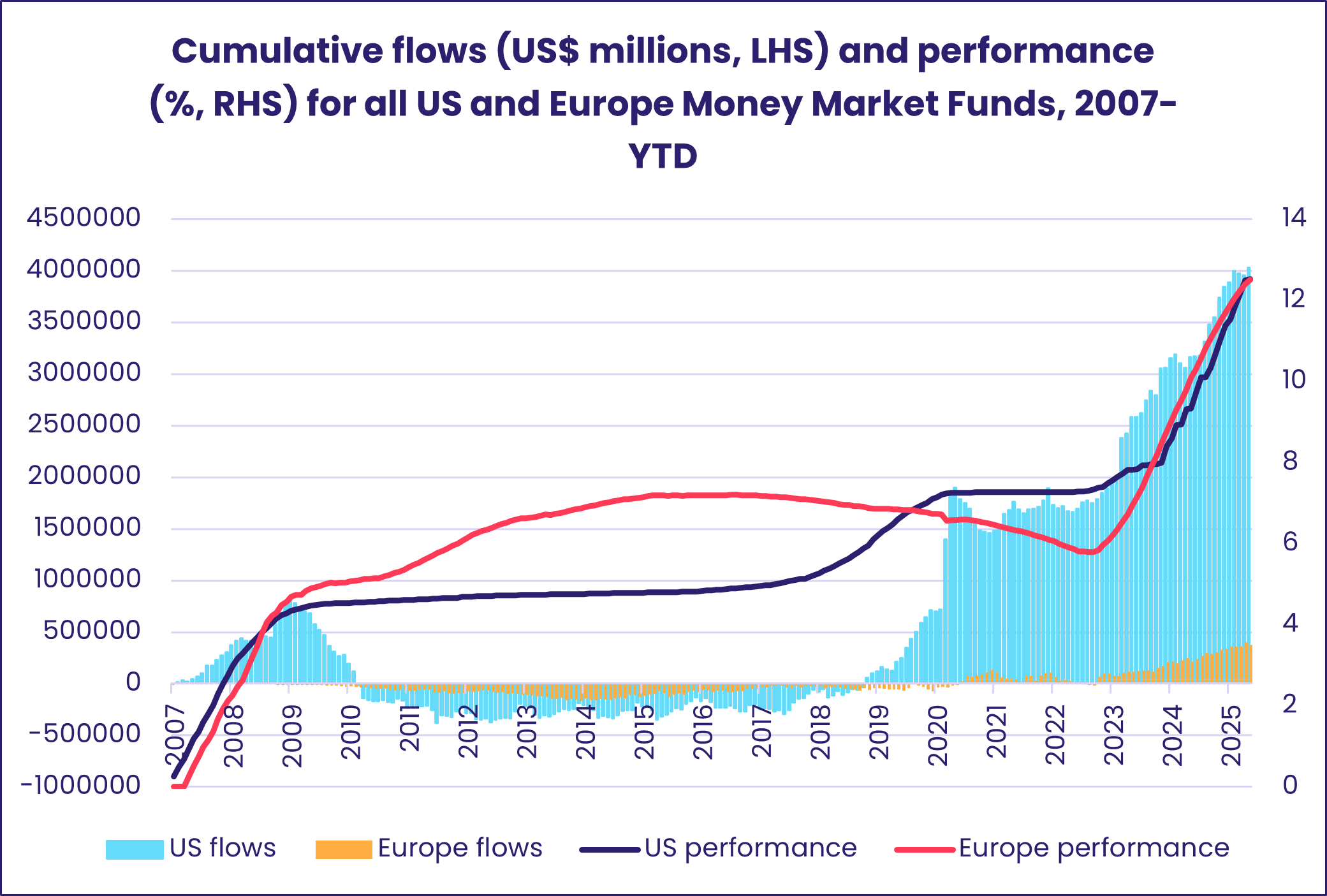

Elsewhere, the week ending June 4 saw US Money Market Funds tally their biggest inflow since late February, Japan Equity Funds recoup over a third of the previous week’s record-setting outflows, Physical Gold Funds take in another $1.4 billion, flows into Intermediate Term Bond Funds climb to a 13-week high and Dividend Equity Funds chalk up their 19th collective inflow year-to-date.

Overall, all Equity Funds started June with an inflow of $5.3 billion while Balanced Funds absorbed $844 million, Alternative Funds $1.6 billion and Bond Funds $15.7 billion. Flows into Money Market Funds totaled $94.8 billion, with the fourth-largest inflow YTD for Europe MM Funds adding to those recorded by US-mandated funds.

At the asset class fund level, Physical Silver Funds recorded their biggest inflow since the third week of 3Q24, Momentum Equity Funds posted their eighth consecutive inflow, Municipal Bond Funds saw a five-week inflow streak come to an end and flows into Convertible Bond funds hit a 16-week high.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds managed to post a collective inflow in early June despite fresh outflows from mainland China-mandated funds. For the second week running, all four of the major regional groups posted inflows that ranged from $2 million for EMEA Equity Funds to $1.5 billion for Asia ex-Japan Equity Funds.

The latest week was marked by the first collective inflow for retail share classes since early 3Q24, flows to EM Dividend Equity Funds hitting an eight-week high and the seventh inflow over the past eight weeks for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates.

The headline number for Asia ex-Japan Equity Funds was underpinned by strong flows into Taiwan (Province of China) Equity Funds and solid flows into Korea Equity Funds. In the case of the former, the inflow was the biggest in exactly a year and was driven by a single domestically focused P-share ETF. Korea Equity Funds, meanwhile, snapped their longest redemption streak since 1Q24 as left-of-center opposition candidate Lee Jae-myung emerged victorious from the country’s snap presidential election on June 3. Foreign-domiciled funds posted a new record weekly inflow, eclipsing the old mark set in 4Q07.

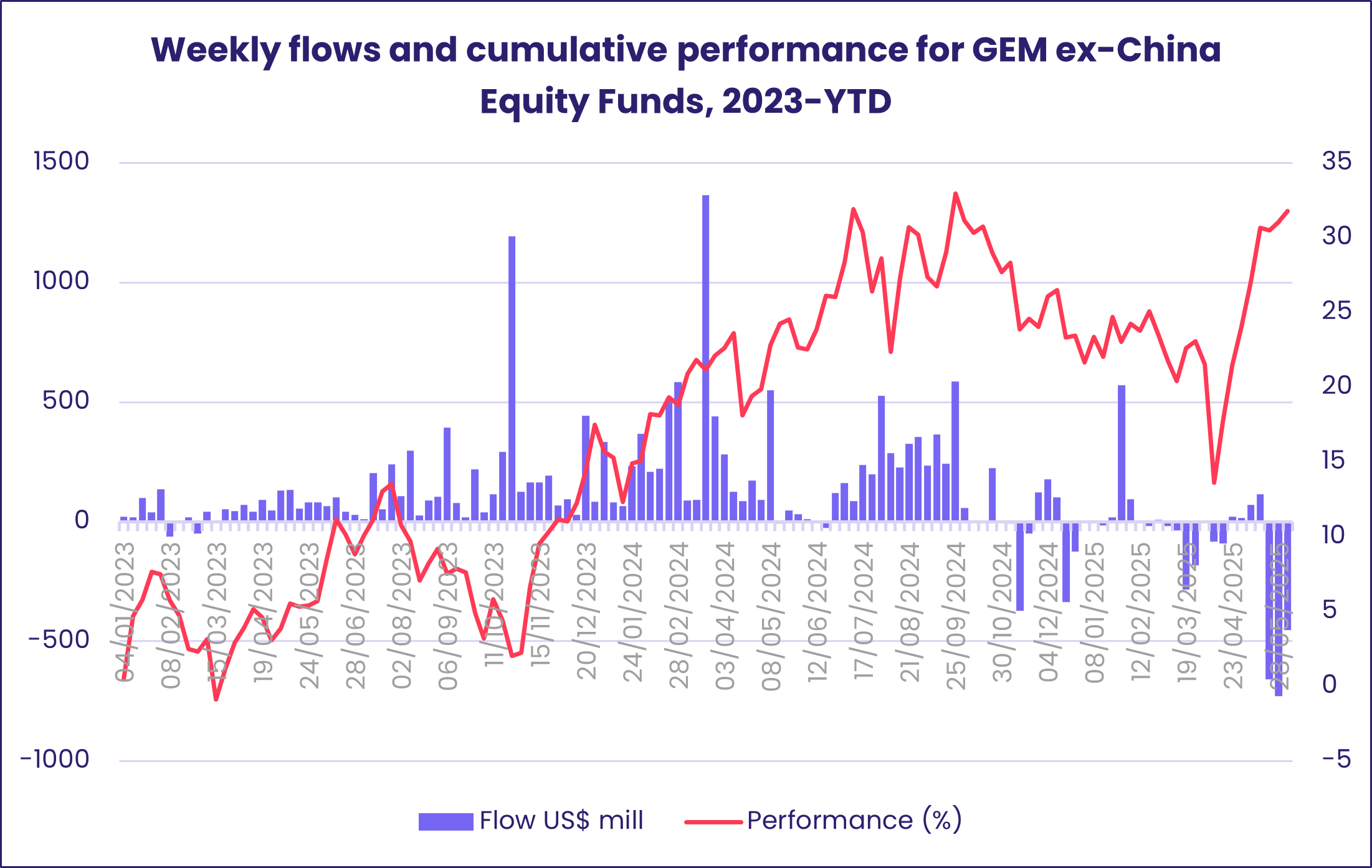

It was the opposite story for overseas domiciled China Equity Funds, which saw over $1 billion redeemed during a week when manufacturing data undershot expectations and the country’s benchmark stock index ended May up 8.6% from its April low. GEM ex-China Equity Funds, meanwhile, posted their third straight week of above average redemptions.

Latin America Equity Funds in general, and Brazil Equity Funds in particular, carried their recent momentum into June. Among funds dedicated to the smaller regional markets, Chile Equity Funds enjoyed strong inflows as investors chase a market that has soared on the back of a slate of well received pension and tax system reforms. Flows to Argentina Equity Funds, which stumbled after the Libra cryptocurrency scandal broke in late February, were in the black for the sixth straight week.

Among the EMEA Country Fund groups, Poland Equity Funds extended their current inflow streak despite populist candidate Karol Nawrocki’s narrow victory in the recent presidential contest and South Africa Equity Funds posted consecutive inflows for the first time since the second week of March. But redemptions from Africa Regional Equity Funds surged to their highest level in over 14 months.

Developed Markets Equity Funds

For investors with a developed market focus, US-exceptionalism has taken on a different, more chaotic character in the second quarter of 2025. It is not one they are comfortable with. During the week ending June 4, they pulled money out of US Equity Funds for the seventh time during the past eight weeks and steered over $2.5 billion apiece into Global, Europe and Japan Equity Funds.

The latest redemptions from US Equity Funds came despite heroic efforts by US companies to prop up their share prices through buybacks and strategic acquisitions. In a recent report, Senior Liquidity Analyst Winston Chua noted that, “Announced corporate buying (new cash takeovers + new stock buybacks) in May totaled $210.3 billion, topping $200 billion for second consecutive month. Buying of this magnitude [over a two-month period] has happened only twice before: April/May 2024 and May/June 2018.”

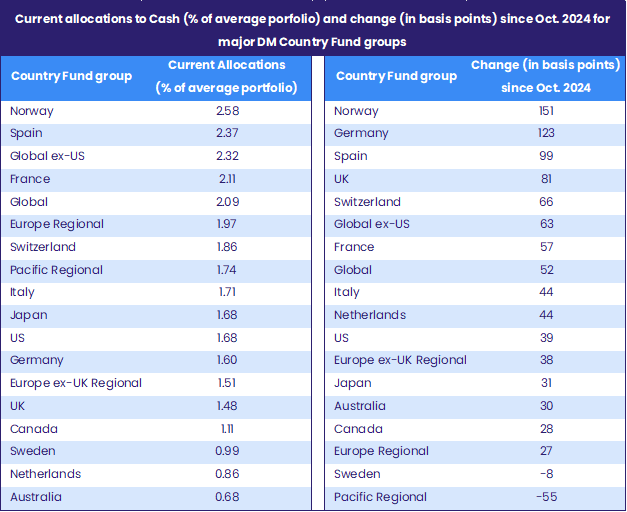

With key US indexes rebounding strongly in May – the S&P 500 was up over 6% and the Nasdaq Composite over 9% – flows to overseas domiciled US Equity Funds turned positive. But the uncertainty surrounding US policymaking has prompted managers of US Equity Funds to increase liquidity, with average cash allocations a third higher than they were before last year’s US presidential election.

Among Europe Country Fund groups, Norway Equity Funds have been the most aggressive over the past seven months when it comes to building up cash buffers. During the latest week, money continued to flow out of UK Equity Funds as the country’s government steps up the pressure on pension funds to invest in UK assets and France Equity Funds recorded their biggest outflow since mid-December. But overall, Europe Equity Funds posted their eighth consecutive inflow and 16th over the past 17 weeks.

After last week’s huge outflows, Japan Equity Funds recouped a decent chunk of that money after Bank of Japan Governor Kazuo Ueda stressed that further interest rate hikes will come only when Japan’s economy is robust enough to cope with them.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, attracted fresh money for the eighth week running. Funds with fully global mandates took in $2 for every dollar committed to their ex-US counterparts. Global funds domiciled in Japan have not posted a collective outflow since late 4Q23.

Global sector, Industry and Precious Metals Funds

The number of EPFR-tracked Sector Fund groups reporting inflows during the week ending June 4 dipped to just four – Infrastructure, Telecom, Consumer Goods and Industrials – as the first quarter earnings season winds down. All four of these groups provide exposure to companies known for offering steady dividend yields.

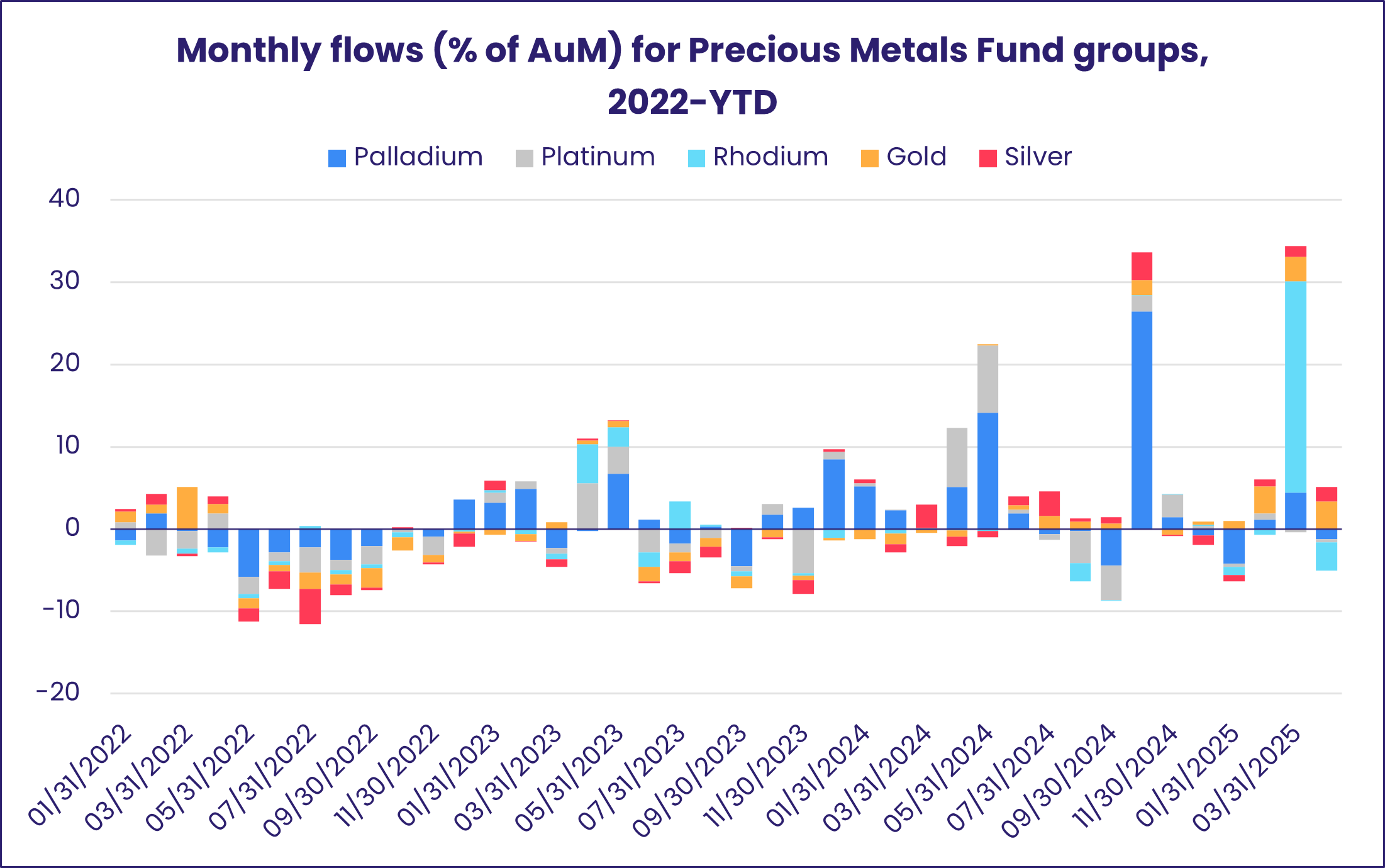

Joining them on the right side of the flow divide were funds dedicated to precious metals, which are riding a wave of investor enthusiasm. Following gold’s rally this year, the price of silver recently surged toward $36 for the first time in over 12 years. Against this backdrop, Physical Silver Funds recorded a fourth consecutive week of inflows – their longest streak since late 3Q24 – and Physical Gold Funds posted their 17th inflow during the past 21 weeks. Platinum & Palladium Funds, meanwhile, attracted their biggest inflow since mid-2Q24 at over $112 million (or 2.5% of assets).

Among the 11 major EPFR-tracked Sector Fund groups, flows into Industrials Sector Funds climbed to a 19-week high. The group has seen inflows of $7.7 billion total this year, half of which has been racked up in the past eight weeks – and close to a net $12 billion since late October.

Healthcare/Biotechnology Sector Funds extended their longest run of outflows since EPFR started tracking these funds in 2003. In just the first five months of the year, the group has experienced over $18 billion in outflows, only $4 billion below last year’s total and $9 billion short of the 2023 record redemption. Widespread layoffs of health care workers, pharmaceuticals caught up in Trump’s tariffs, lowering of Medicaid funding, scrutiny of UnitedHealth, and ongoing vaccine controversies have shaken the sector.

Technology Sector Funds suffered their third outflow of the past five weeks. Consumer Goods Sector Funds saw their first inflow in three weeks and their biggest in 11 weeks.

Bond and other Fixed Income Funds

With five months of 2025 gone, EPFR-tracked Bond Funds have posted net inflows 19 of the 22 weeks year-to-date that, through June 4, total $194 billion. At the same point last year, hover, that total stood at $344 billion.

In 2024, the ratio of inflows for Sovereign versus Corporate Bond Funds was 1-to-1.5 and for every $1 steered into Short Term Bond Funds and every $5 into Long Term Bond Funds, Intermediate Term Bond Funds pulled in a commanding $20. So far this year, the sovereign/corporate inflow ratio is 2-to-1 and Short Term Funds have taken in $6 for every $1 absorbed by Long Term Funds.

During the latest week, all of the major groups by geographic focus recorded inflows that ranged from $230 million for Asia Pacific Bond Funds to $4.7 billion for US Bond Funds. Flows into Europe Bond Funds hit their third-highest weekly total YTD and Emerging Markets Bond Funds extended their longest inflow streak since an 11-week run ended in 2Q21.

At the asset class level, Convertible Bond Funds posted their biggest inflow in over three months, High Yield Bond Funds took in fresh money for the sixth week running and YTD flows into Inflation Protected Bond Funds climbed north of the $6 billion mark. Against a backdrop of major Canadian forest fires and predictions of an above average Atlantic hurricane season, Catastrophe (CAT) Bond Funds chalked up their 20th inflow of the year so far.

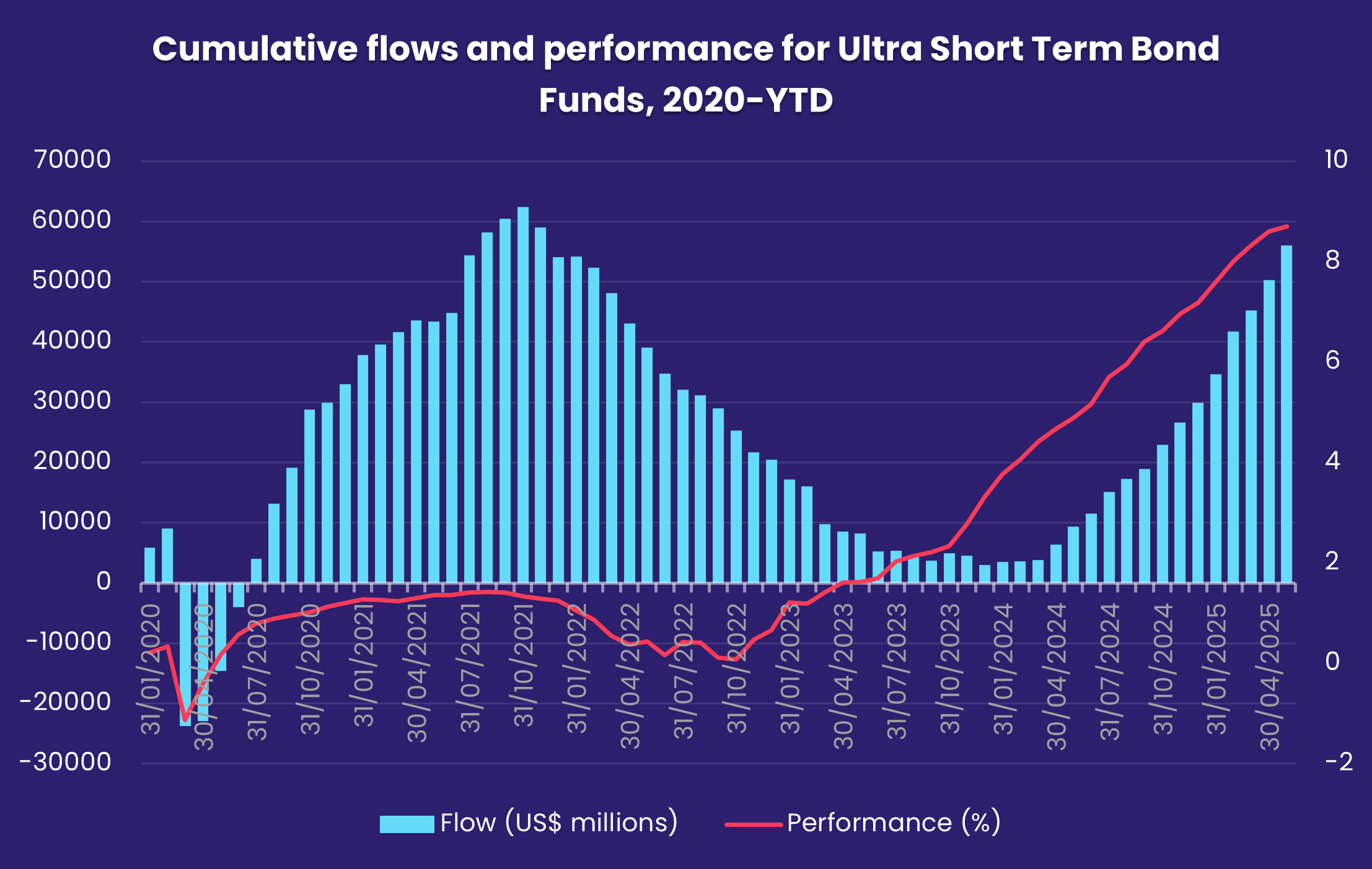

Also seeing strong investor interest are Ultra Short Bond Funds, which typically invest in debt with a maturity of under a year, as investors seek to cut duration risk and increase their liquidity.

Flows to US Bond Funds in early June favored funds offering mixed corporate/sovereign exposure. Intermediate term was the preferred duration. The week did see US Municipal Bond Funds post their first outflow in over a month thanks to concerns about federal funding of local projects under the current administration and uncertainty about future tax policy.

Emerging Markets Bond Funds again benefited from strong investor appetite for dedicated China Bond Funds. The latter’s current inflow streak now stands at 12 weeks and $9.3 billion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.